Economics

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

80 Terms

Choice

means to face scarcity

Incentive

to promote goods actions or actions with negative effects. Reward or penalty

Scarcity

Inability to have everything

Microeconomics

Choices of individuals and businesses

Market

Individuals

Government

Business

Macroeconomics

Performance of the national and global economy

Global

National

Goods and services

What?

How?

For whom?

What?

Changes and varieties | Determinantes? ex. what determinates what we produce

How?

Factors of production

For whom?

Consumers

Factors of Production

Labor (workers)

Land

Capital

Entrepeneurship

Labor (workers)

wages

human capital

skills, jobs

Land

rent

natural resources

oil, gas, coal, water

Capital

Interests

tools that help you produce

material goods (may be rented)

Entrepeneurship

profits

the ideal/vision

human resource that organizes labor, land, and capital

Can self-interest promote social interest?

self-interest= best choice available for you

social-interest=efficiency, best for society, fairness

*how can we align both even when it seems not possible

Economic thinking (consumption)

Social Science

Statements:

Normative:

what should be

values

how life or things should be based on values

Positive:

What is

Test

Cause vs. Effect

Models

Economics

the study of choices and its consequences

Efficient Resource Allocation

Economies must decide the best way to allocate their scarce resources to meet the needs and wants of their population

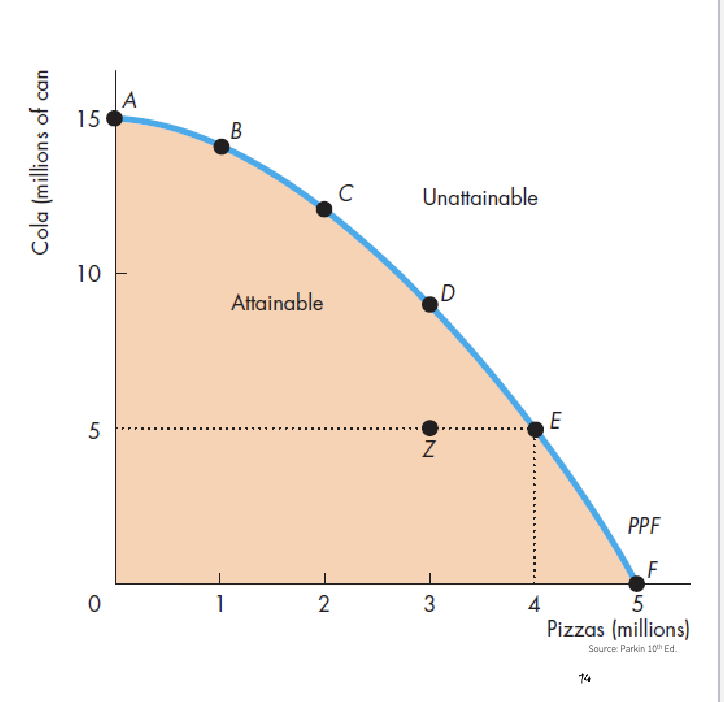

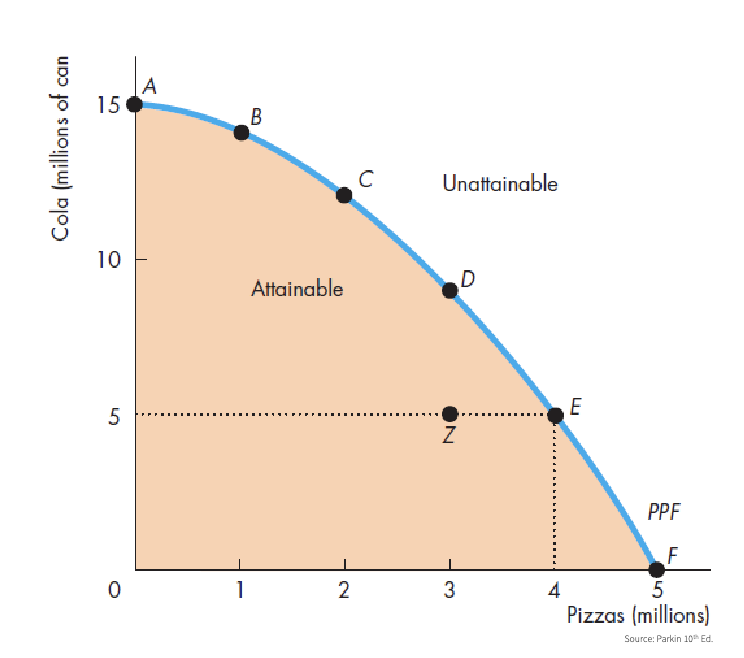

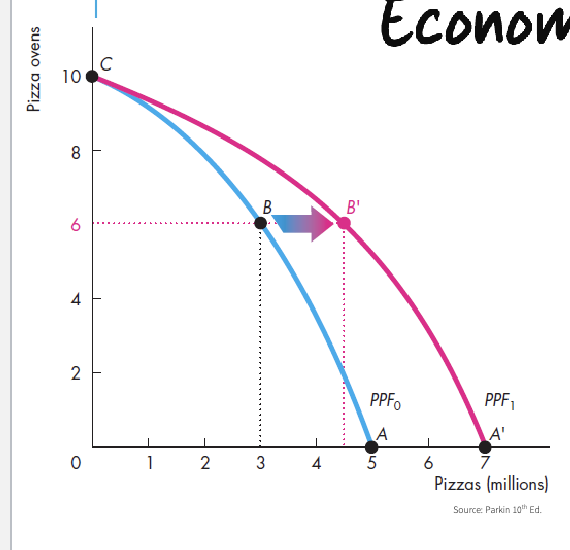

PPF (Production possibilities frontier)

Represents the production boundaries of an economy (scarcity)

2 goods

cetris paribus

Efficiency

PPF efficiency

Misallocated:

not best match

skills

Unused:

Idle

Unemployment

Production efficiency: lowest cost

Inefficient production

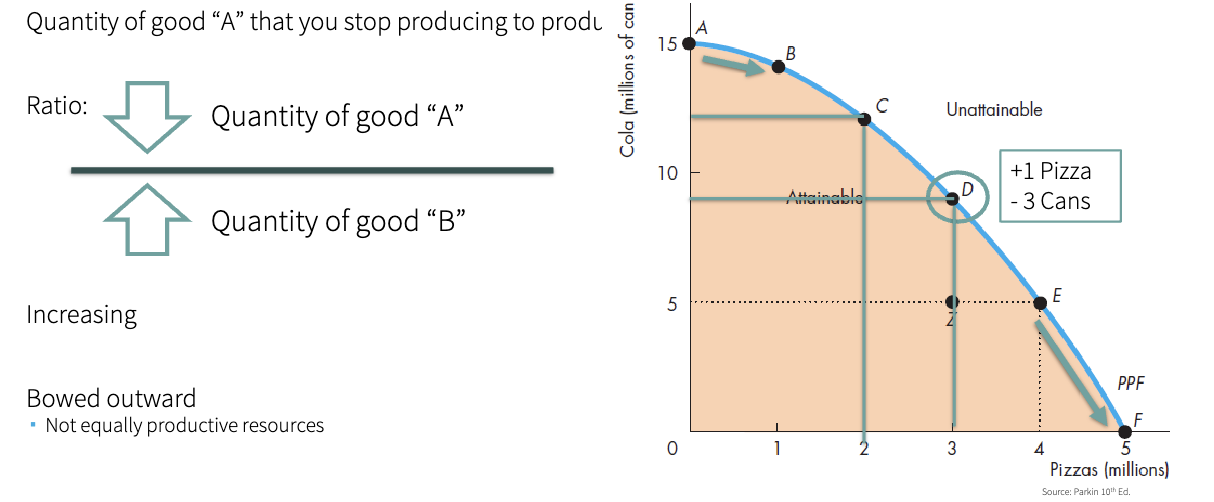

Tradeoffs = opportunity cost

Highest value alternative

Opportunity cost

PPF

which is the most efficient point?

Efficiency

Production: lowest possible cost

Allocative: lowest possible cost, quanitites that provide the most benefit

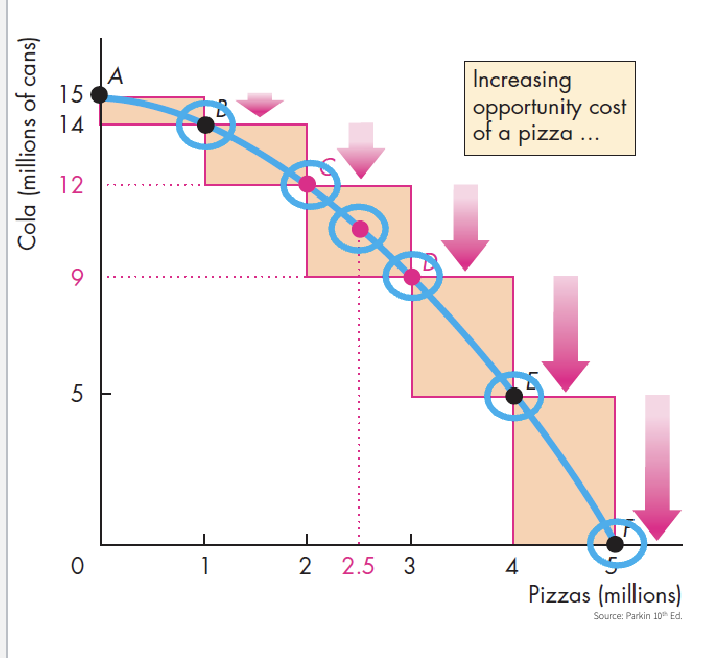

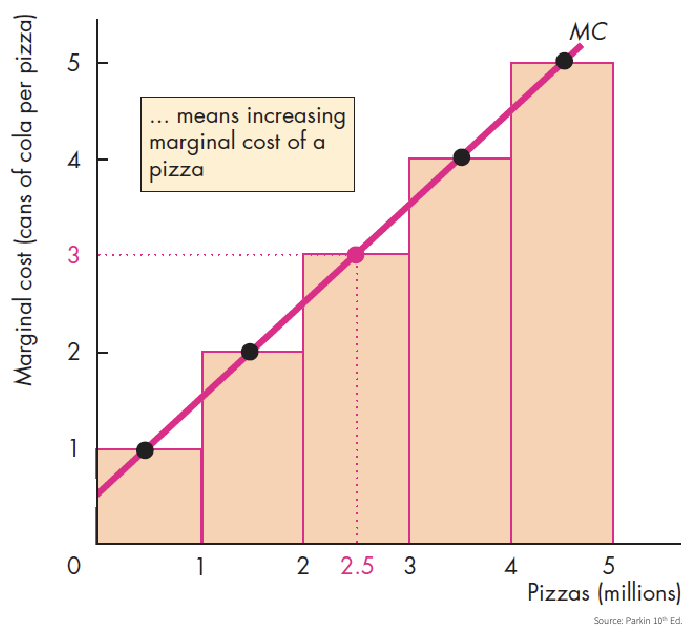

Marginal Cost (MC)

Cost of producing ONE more unit

Refers to how much the cost changes

Opportunity cost is not constant

Is the slope

Marginal Cost Curve - MC

the results of calculating the slope

costo marginal de un bien en cada cantidad a lo largo de la FPP

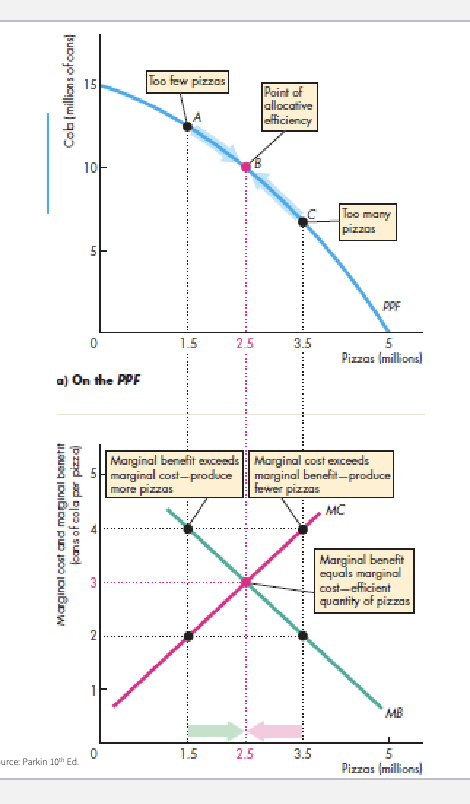

Marginal Benefit

Benefit of consuming ONE more unit

Measure: the most that people are willing to pay for ONE more unit

Quantity: of other services & goods that you give up

Preferences: want -like

Decreasing marginal benefit: why?

Allocative Efficiency

PPF

Any point = tradeoff (intercambio)

Best point: tradeoff of a good that provides a greater benefit

Economic Growth

Expand production possibilities

living standards

Economic Growth & the PPF

If we develop new technologies and accumulate capital:

Increase consumption in the future

Disminuye la producción actual de bienes y servicios

Opportunity cost: decrease in today’s consumption

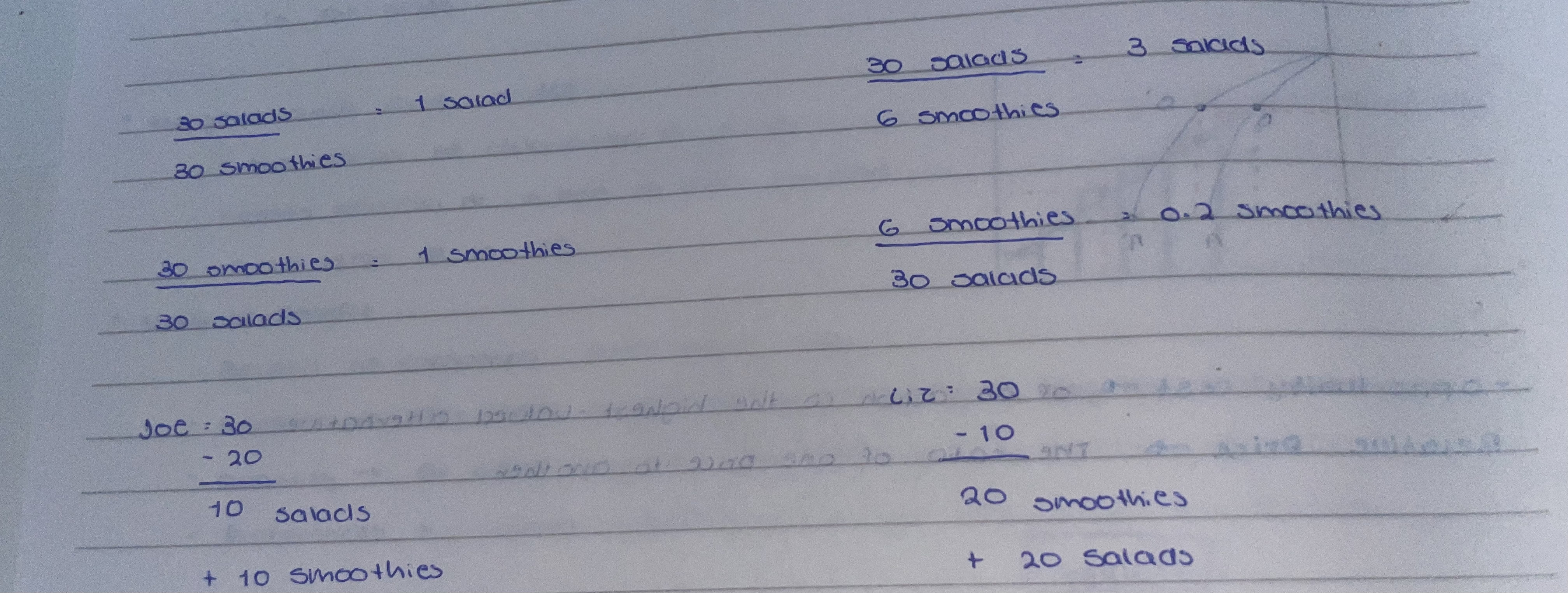

Opportunity cost

of an action is the highest-valued alternative

Advantages:

Comparative:

lowest opportunity cost

abilities and resources

in terms of another good

Absolute

highest productivity

per hour

Relative price

The ratio of one price to another

Liz and Joe example of comparative advantage

Factors that bring changes in demand

the price of related goods

expected future prices

income

expected future income increases

population

preferences

Normal good

demand increases as income increases

Inferior good

demand decreases as income increases

Circular flow diagram

Market: Firms, markets, property rights, money

Sectors: Households, firms, government, rest of the world

Dynamic: Income=expenditure

3= financial, factors of production, goods and services

Needs to work clockwise and counter-clockwise

Sectors

households

firms

government

rest of the world

households

factors of production

consumption expenditure

savings

income=salaries (dividends, interests, rent, transfers)

payments=taxes

no investments

firms

factors of production

expenditure (investments, financial conc.)

inventories

future salas

purschase goods and services

capital increase

FDI = +10% value of the company investment, power of participation gives revenue

government

expenditure

transfers

purschases

income=taxes and loans

can borrow from IMF or the world bank

rest of the world

exports

imports

prices

Money: number of currency that you give in exchange for a good or service

Relative: ratio of one price to another. opportunity cost. the value of a product and what you give up to buy it

supply and demand model

competitive markets:

producers offer goods or services, IF the price covers their opportunity cost

consumers seek cheaper goods or services

alternatives

Determines relative prices

Price = relative price

demand

it represents that you…

want (can we satisfy all our wants?

can afford (scarcity)

plan to buy

effects

Substitution:

goods have substitutes

opportunity cost increase=incentive to switch

Income:

higher prices and same income

can’t afford everything

stop buying those goods that increase the price

quantity demanded

quantity demanded vs quantity bought = not equal

quantity demanded = amount per unit of time

law of demand

“ceteris paribus, the higher the price of a good, the smaller is the quanity demanded. the lower the price of a good, the bigger is the quanity demadned”

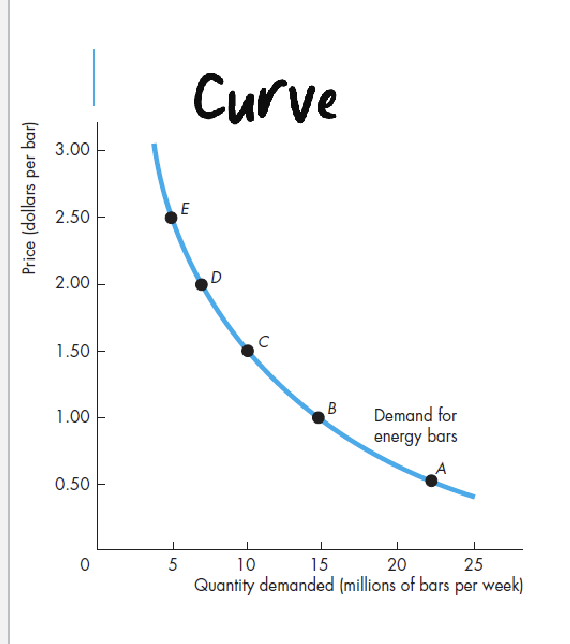

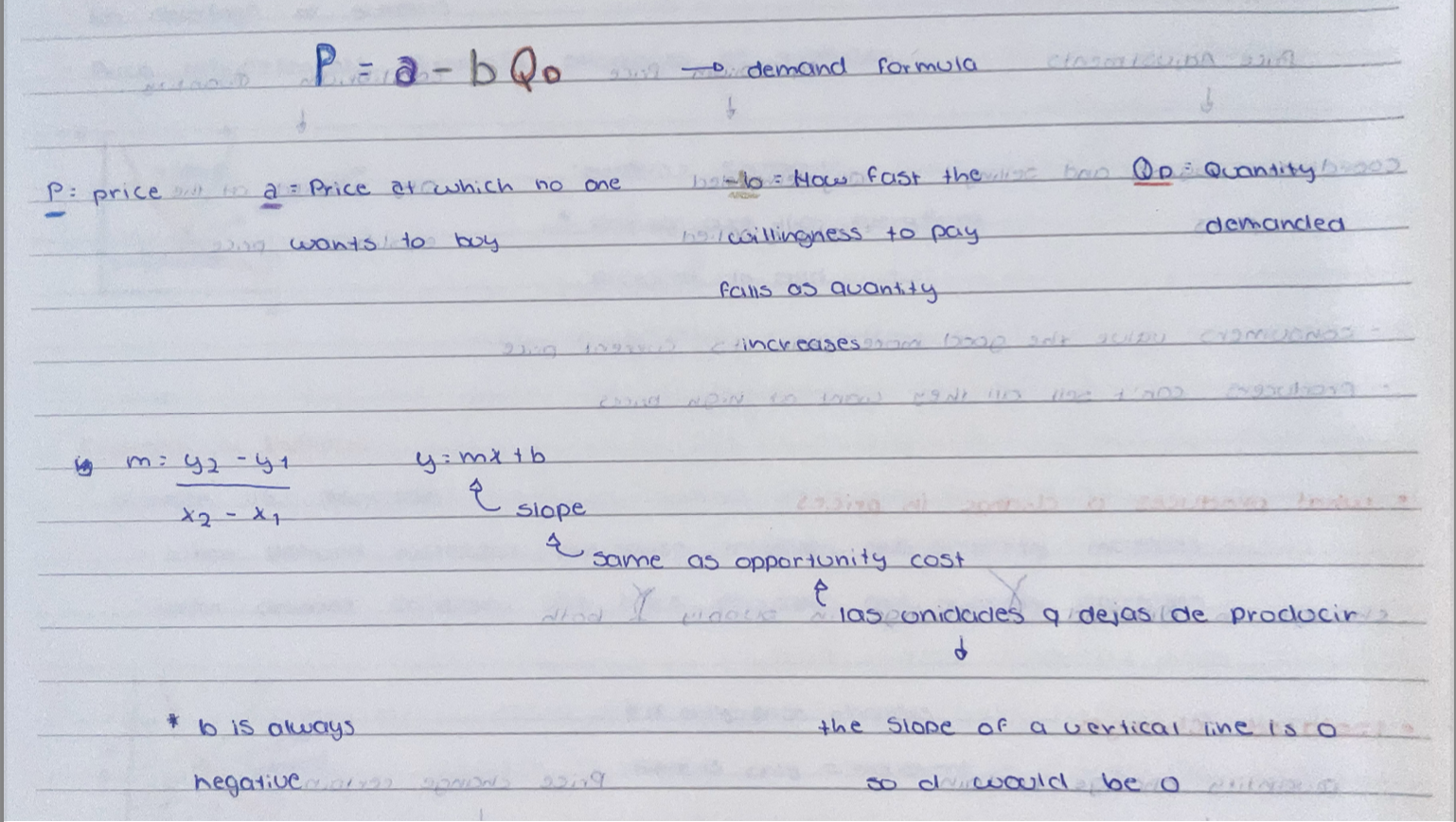

demand curve

Demand

price-quantity relationship

Demand curve

illustration

willingness and ability to pay

Demand schedule

quantities demanded at each price

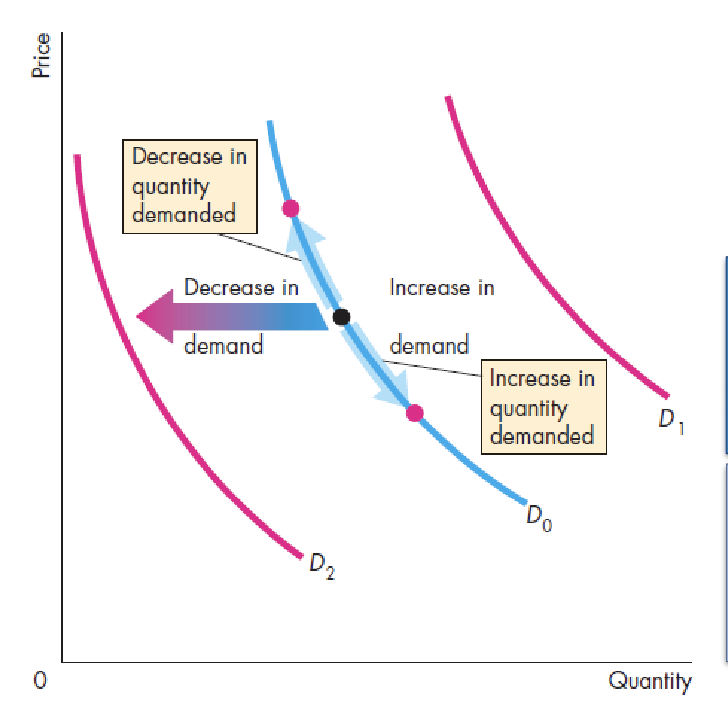

changes in demand

price of related goods

substitutes: can be used in place of another

complement: used with another good

change in quantity: only price change, movement along the curve

change in demand: price remains constant, other factor changes, shift of the curve

changes in demand

any factor that influences buying plans

expected future prices

income

positive relationship

normal good= demand increases with income

inferior good= demand decreases with income

expected future income and credit

easy to get credit

positive relationship

price of related goods

population

size and age structure

preferences

determine the value of a good

influenced by: weather, information, fashion

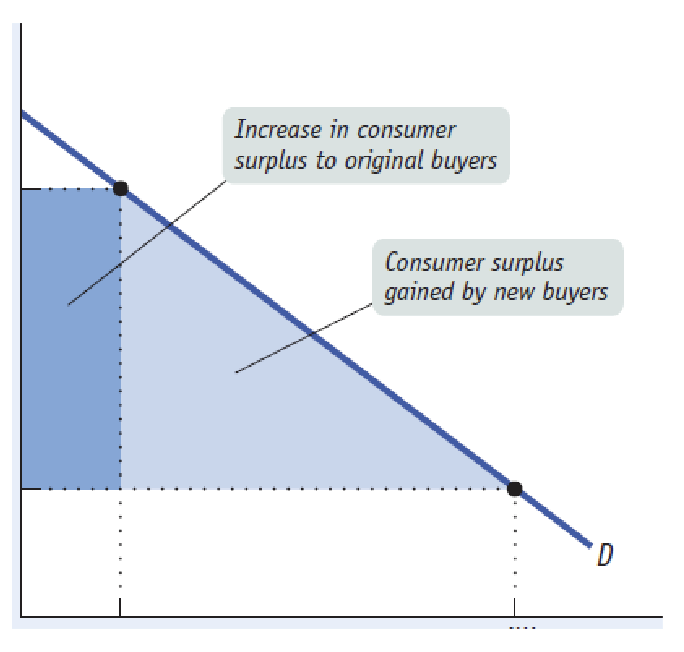

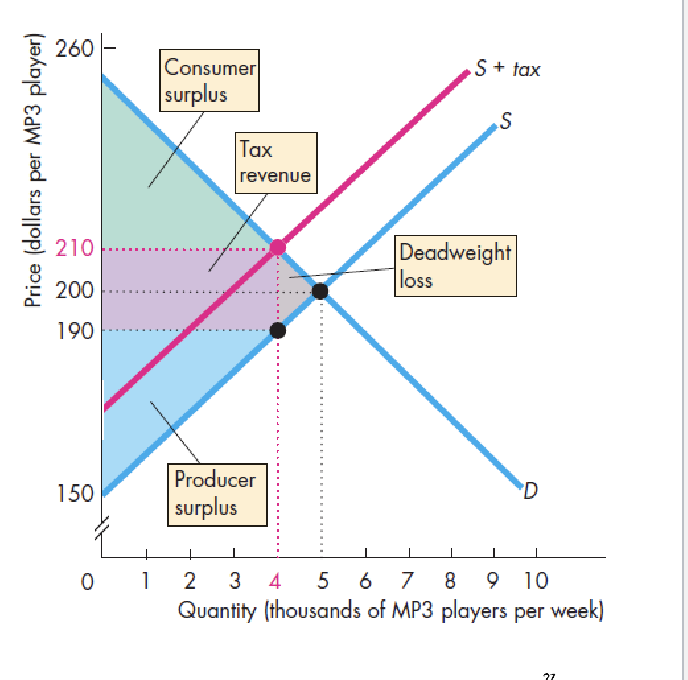

consumer surplus

the difference between the willingness to pay and the price payed

sum of individual surpluses=total consumer surplus

usually consumers pay less than their willingness to pay

price effects

supply

quantity supplied vs quantity sold

not equal

quantity supplied = amount per unit of time

supply represents

it represents that firms:

plan to produce it (what are the constraints?)

can profit (resources and technology

have resources and technology

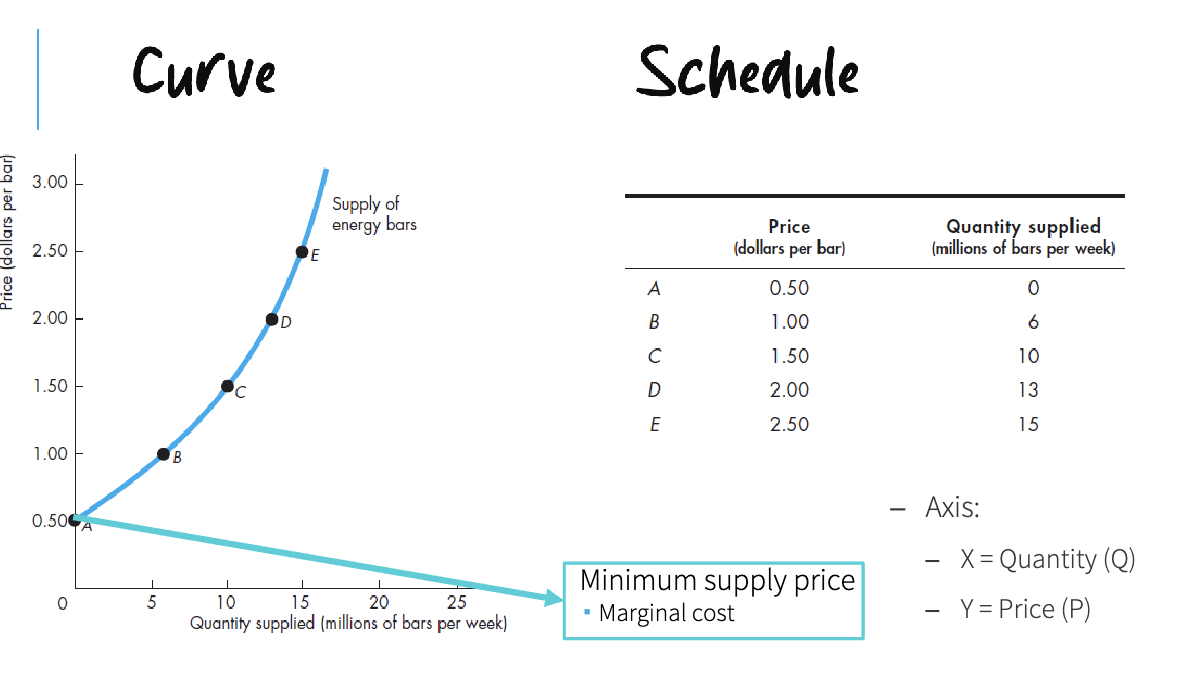

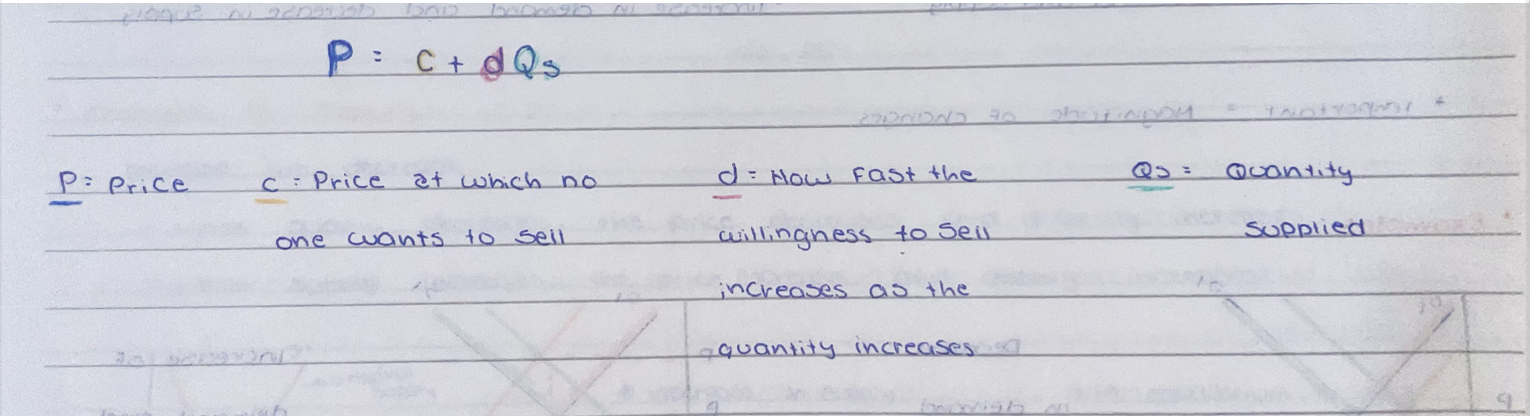

supply curve

supply

price-quantity relationship

supply curve

illustration

supply schedule

quanitities supplied at each price

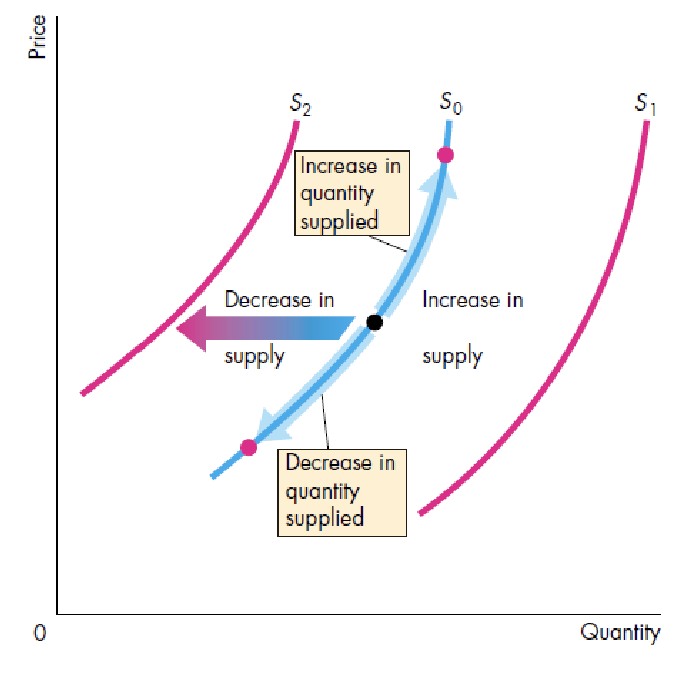

changes in supply

change in quanity:

only price change

movement along the curve

change in demand:

price remains constant

other factor changes

shift of the curve

causes of changes in supply

any factor that influences selling plans

price of related goods

substitutes=goods that can be produced with the same resources

expected future prices

remaining of sales (now vs.future)

price of factors of production

lowest price willing to accept changes

number of suppliers

positive relationship

technology

ways that factors of production are used to produce

nature

natural forces that influence production

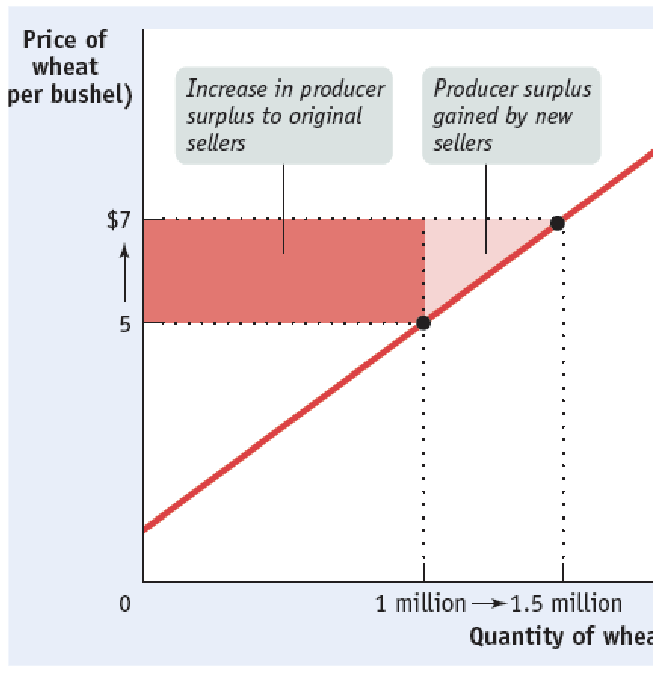

Producer surplus

the difference between the producer’s min. price (cost) and the price received

sum of individual surpluses = total producer surplus

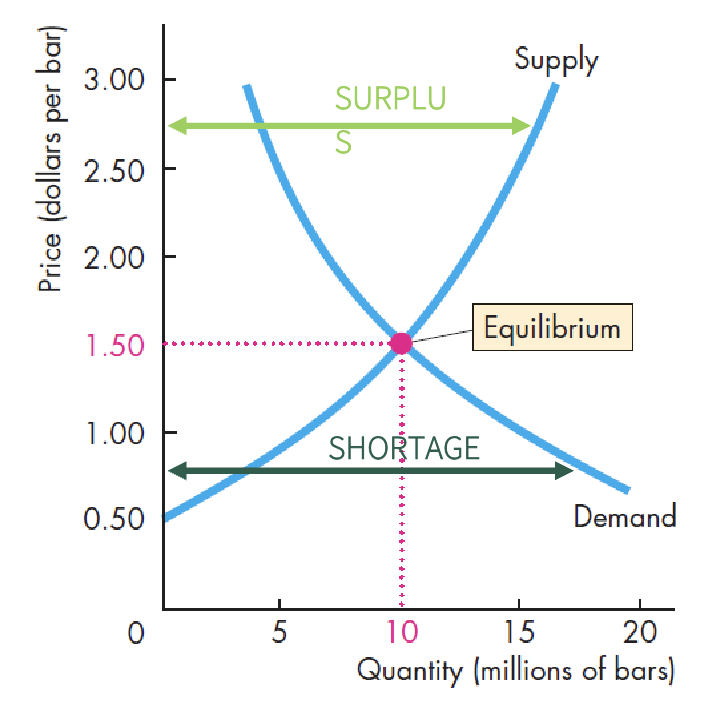

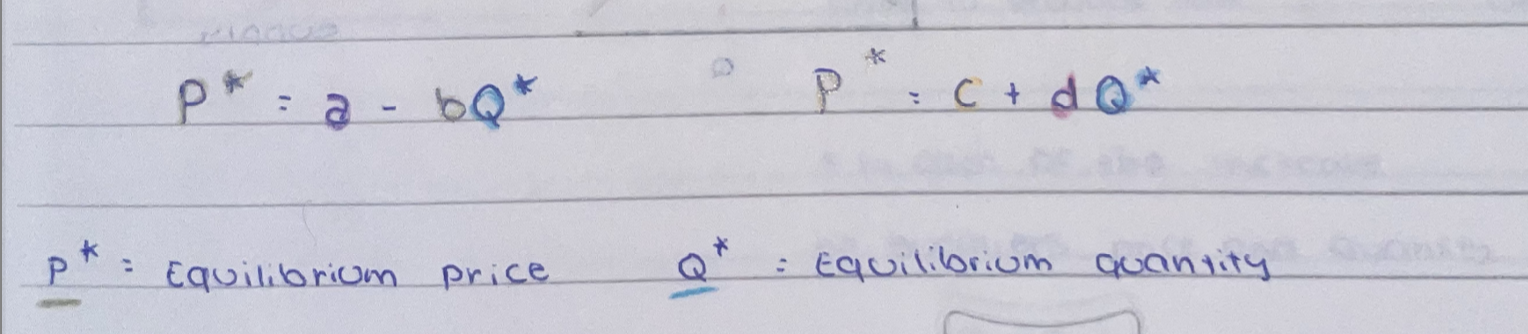

market equilibrium

no shortages or surplus

price adjustments eliminate shortages or surpluses

surplus = excedente

making sure that everything produced is sold

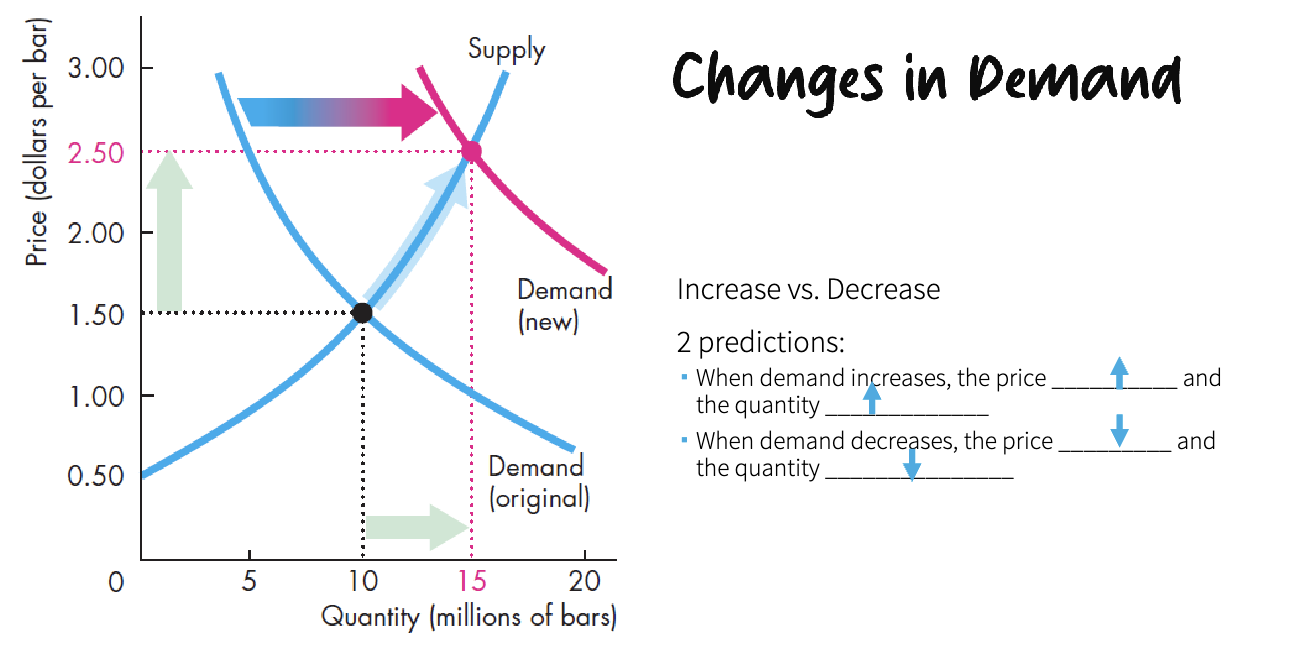

Changes in demand

increase vs. decrease

if only price changes there is only a movement

expected price increase might decrease the demand

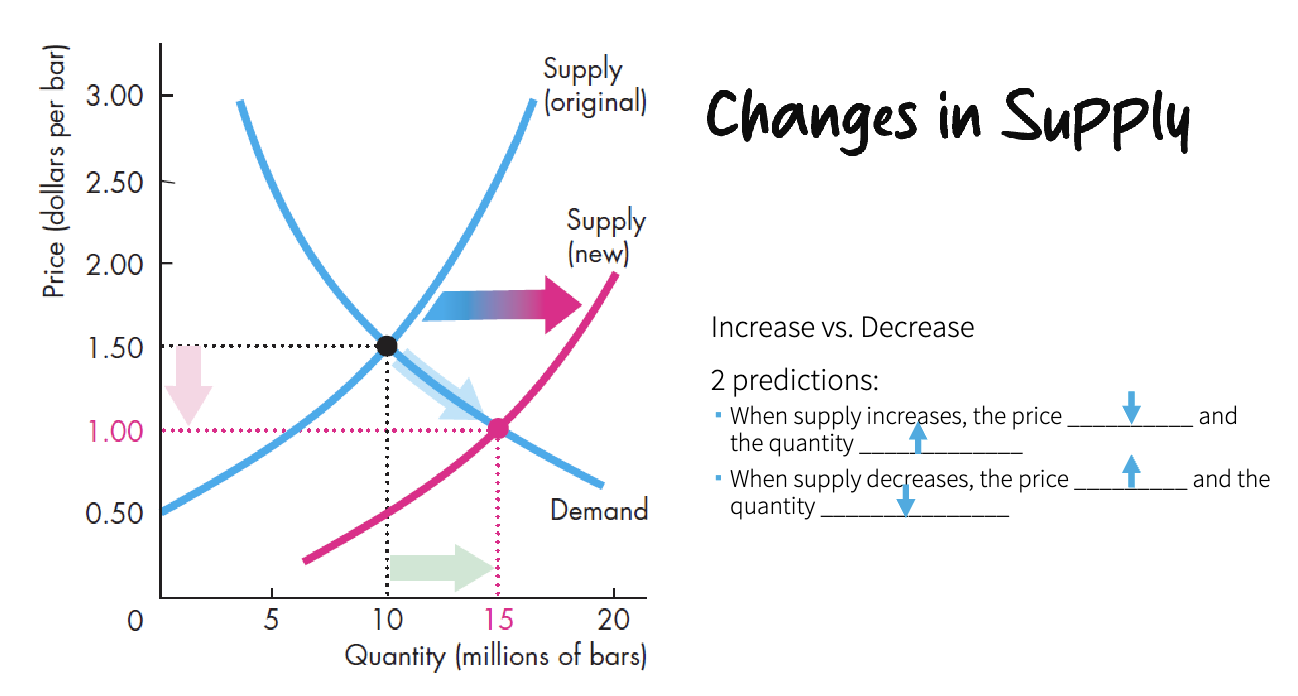

changes in supply

decrease in supply, we have a higher price to produce less

in case of the increase of suppliers price and quantity decrease

in equilibrium a price change will always end up in shortage or surplus

Equilibrium

price adjustments: coordinate buying and selling plans

equilibrium price: qty demanded= qty supplied

equilibrium quanity: qty supplied at equilibrium price

consumers value the good more than its current price

producers can’t sell all they want at high prices

produces a change in prices

isolated changes

quantity change certain

increase in demand and supply

decrease in demand and supply

price change certain

decrease in demand and increase in supply

increase in demand and decrease in supply

important: magnitude of changes

demand curve

supply curve

market equilibrium

quantity equilibrium

price equilibrium

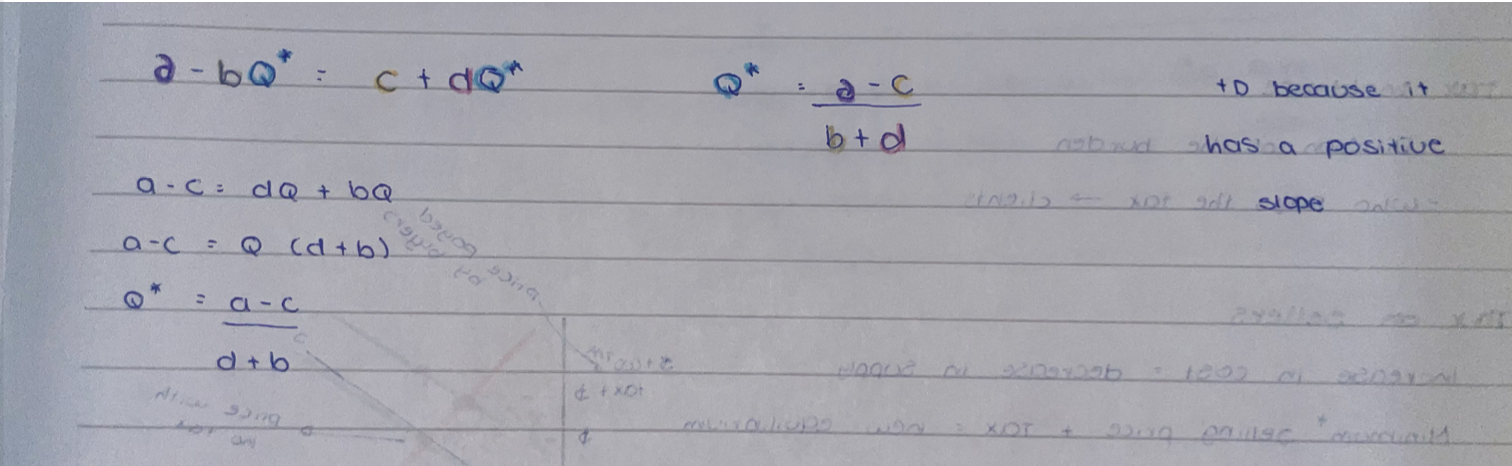

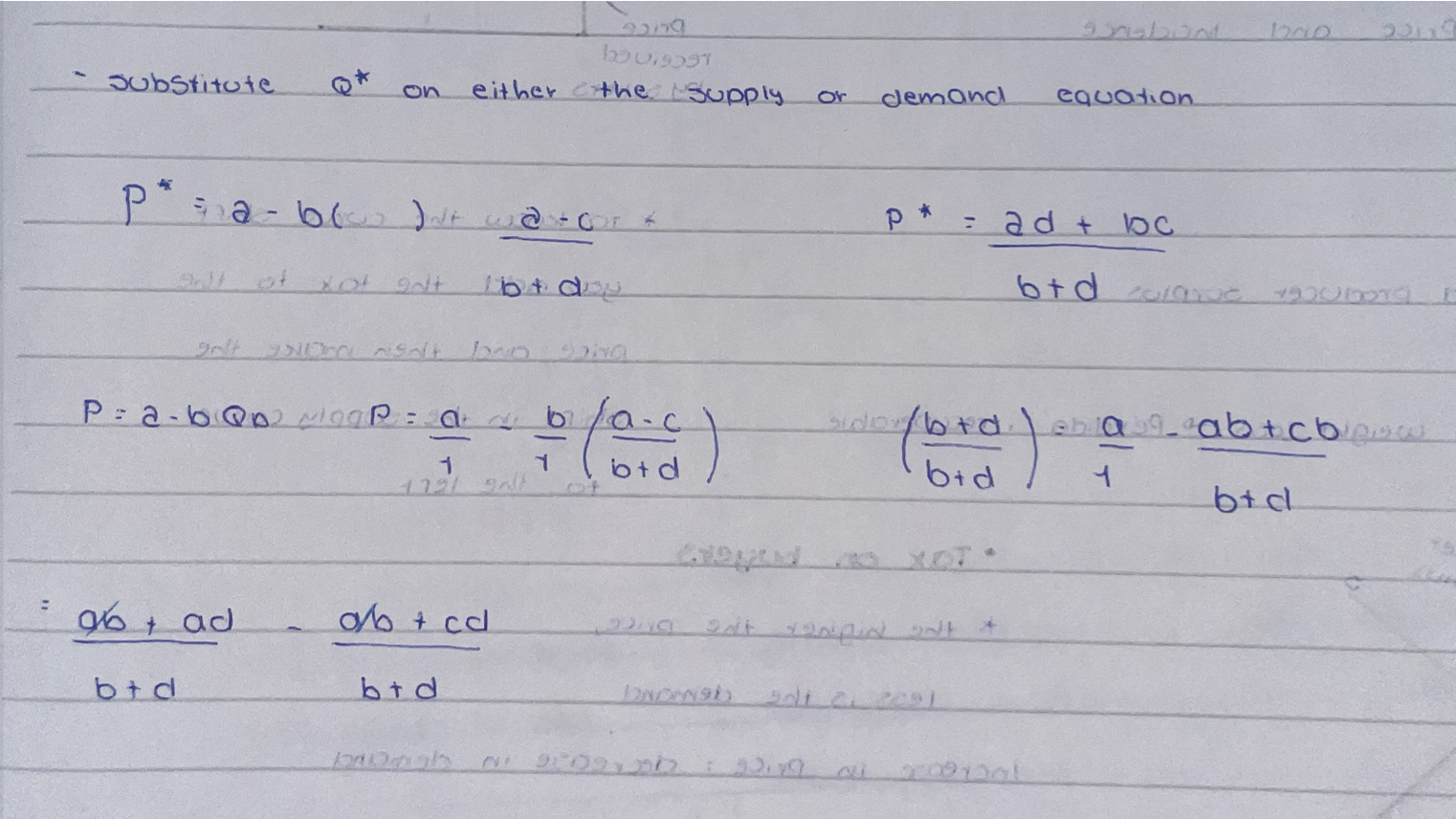

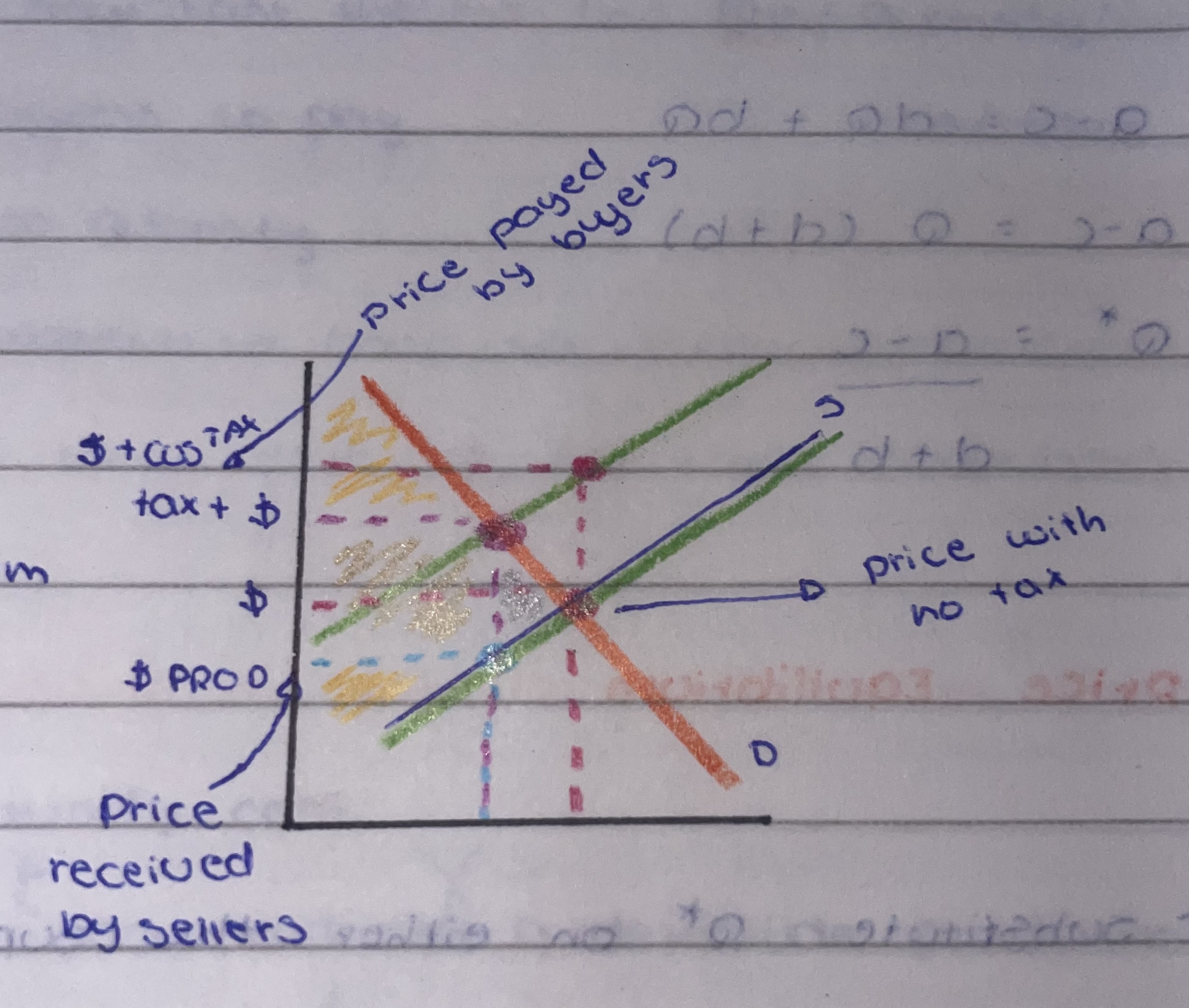

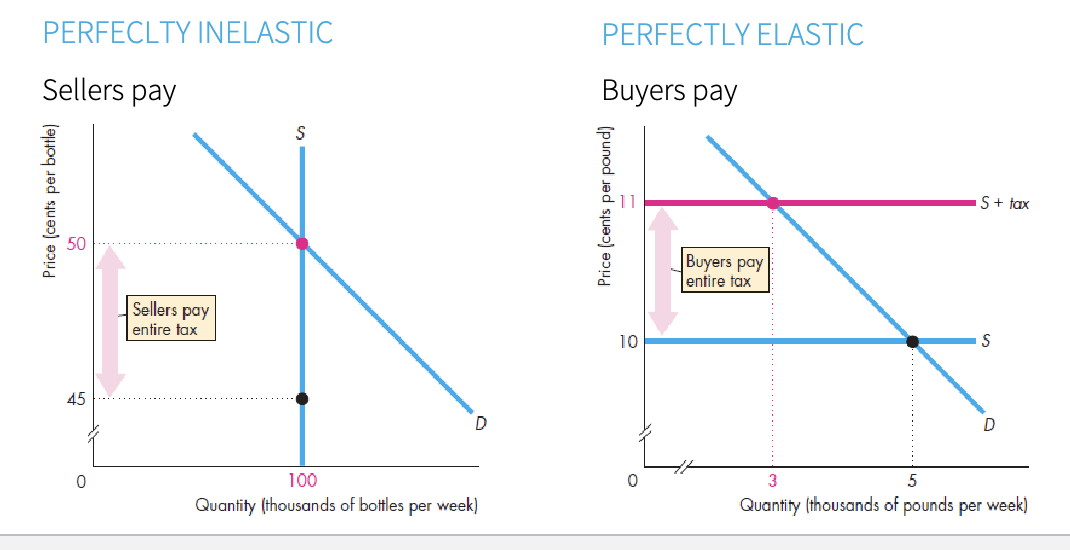

Tax incidence

division of the burden

who really pays the tax

tax on sellers

increase in cost= decrease in supply

min. selling price + tax = new equilibrium

new= price and incidence

to know the curve shift you add the tax to the price and then make the shift in the supply curve to the left

tax on buyers

the higher the price, less is the demand

increase in price= decrease in demand

$ Tax - price that producers get

$ cons - represent what consumers will pay

taxes and efficiency

wedge between buying and selling prices

underproduction

shift of consumer and producer surplus to tax revenue

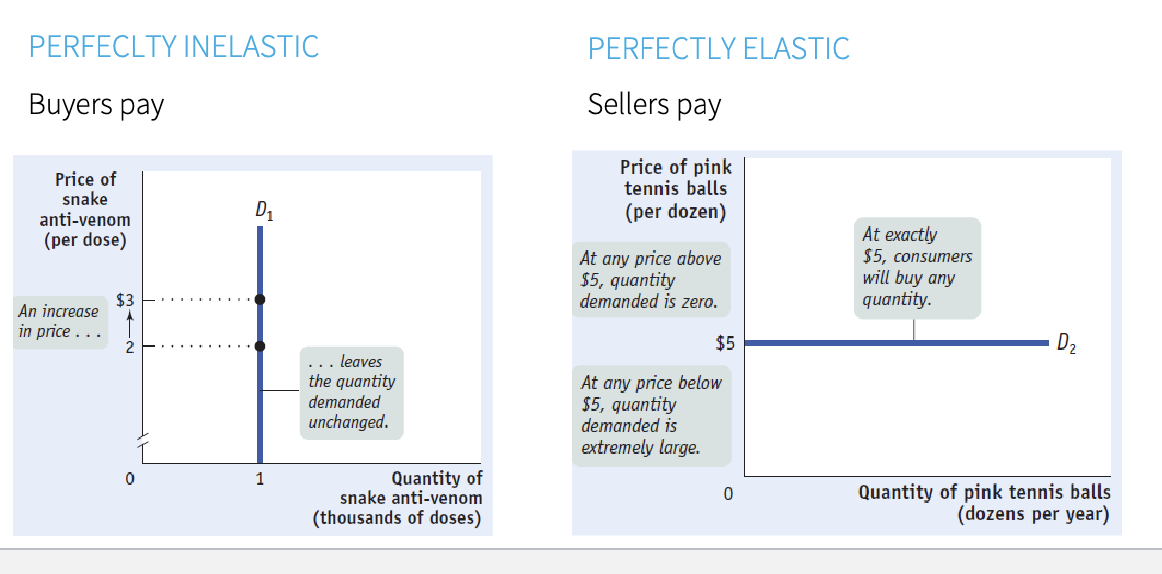

taxes and elasticities - demand

taxes and elasticities - supply

taxes and fairness

benefits

pay taxes= benefits received

ability to pay

how easily can the burden be covered

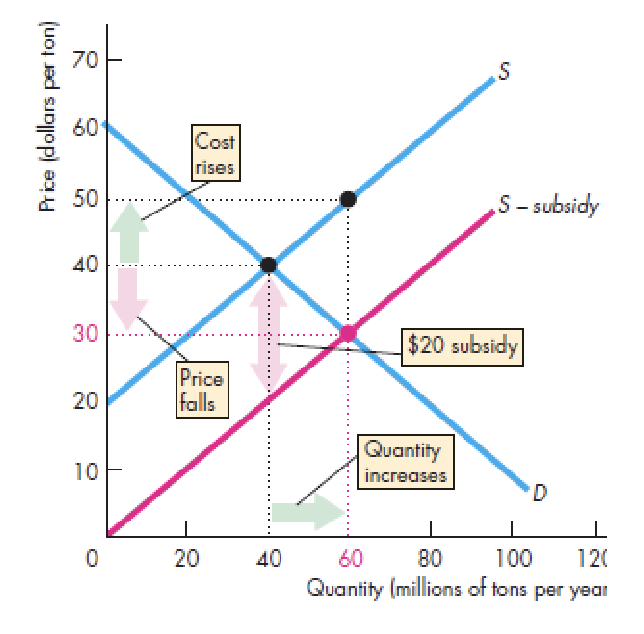

subsidies

payment from the government to a producer

effects:

supply increase

price decrease

qty produced increase

MC increase

inefficient over-production

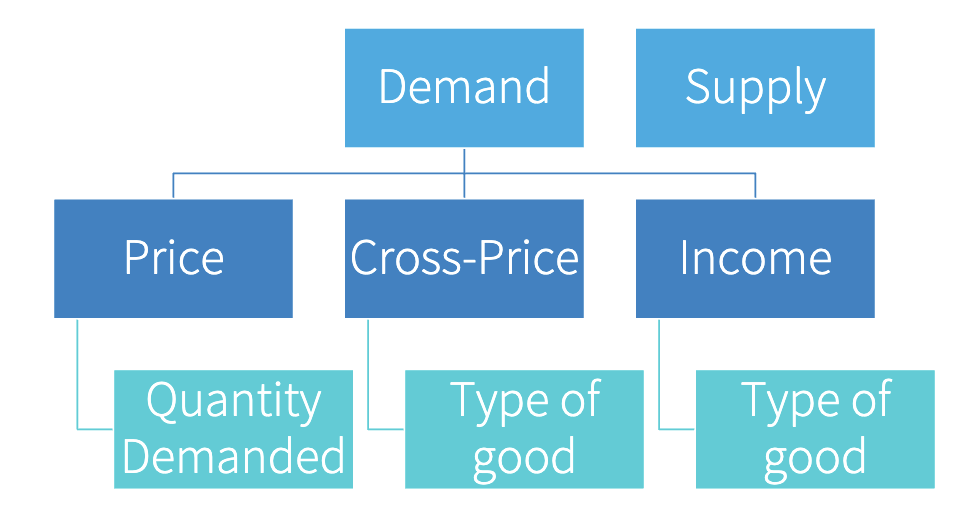

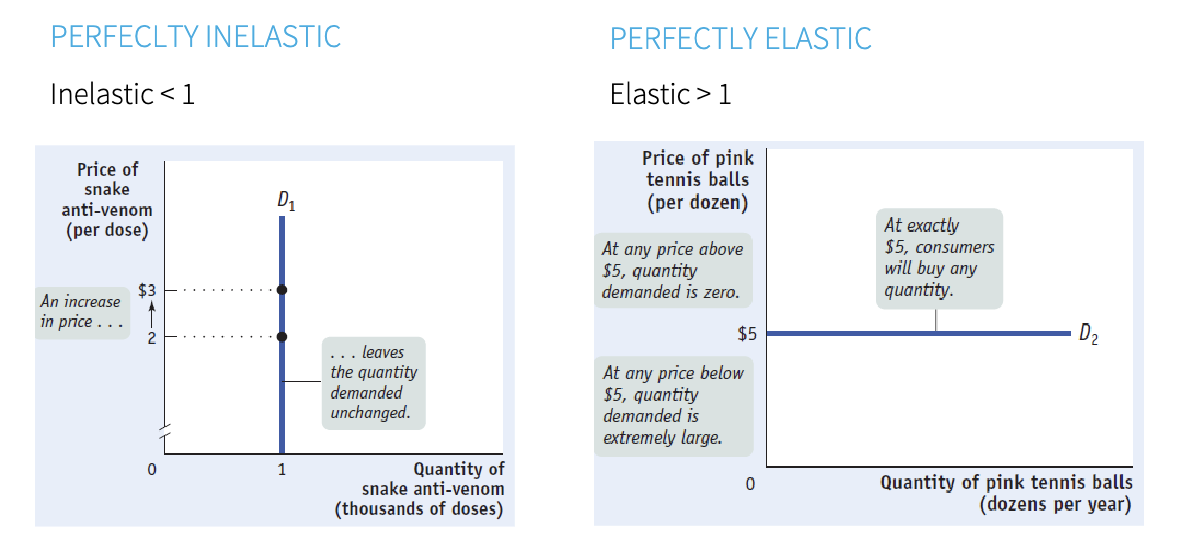

elasticity

change in the quantity for a specific change in price

interpreting elasticity

predictions

effect on TOTAL revenue

price effect

quantity effect

unit-elastic: nochange

inelastic: revenue increase

elastic: revenue decrease