Unit 3 Accounting Test, journals, source documents, sales tax, chart of accounts, correcting errors,

1/49

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

50 Terms

Journal

First point of written entry/transaction to keep everything organised

Organises everything before creating the ledger

First 3 Steps in the Accounting Cycle

Transaction occurs

Transaction recorded in journal by date

Accounting entries transferred to ledger accounts

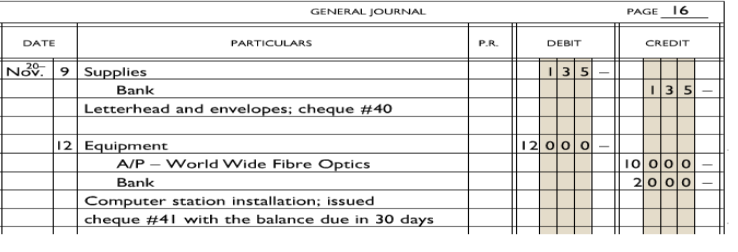

Two Column General Journal

Area to record amount of money

Debit and Credit amounts

Columns for date, particulars (account names and explanations) and P.R. (Posting reference)

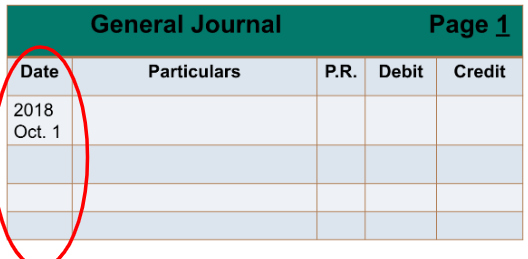

Step 1 in recording Journal Entry

Record date and page no. (year, month, day, page no.)

Year is recorded on page 1 and only recorded again if a new year starts

Each month is recorded every new month and new page

Enter the day for each transaction, if multiple transactions in a day write the day twice (*one transaction could impact multiple accounts in which case only write the date once)

Write the page no. in the top right

Step 2 recording debits

Write the name of the account(s) in particulars column then write the amount without dollar signs in debit column

Step 3 recording credits

Every debit(s) has a credit(s) so on the next line write the name of the accounts to be credited indented and the amounts without $ signs in credit column

Step 4 description (final step)

Brief description of transaction in words in particulars column under the accounts (e.g. bought computer equipment remainder to be paid in 30 days)

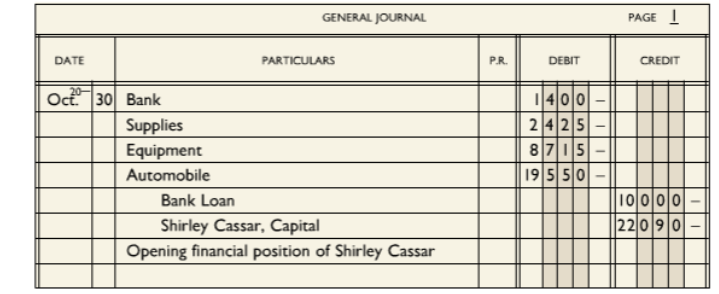

The Opening Entry

First entry in the journal for any business “opens the books”

Assets = debits

Liabilities = credits

Capital = credits

Journal Entry Tips

Debits = credits (complete journal entry debits = credits)

Keep all lines of a single entry on the same page

Compound Entry

3 or more accounts in one journal entry

Source Document and 3 examples

Documents verify business transactions and amount of $$ involved. Original record of transaction

bills from creditor

cheque

receipt

cash register record

credit card slip

cash sales slip

sales invoice/slip

GAAP source document

Objectivity principle - Business accounting must be recorded clearly through source documents. Two different accountants will record same amount, no personal feelings involved

How to use source documents

Recorded in journal entry description so accountants can record information

Cash sales slip

source doc shows goods and services sold to customer for cash

Sales invoice/sales slip

Business who do not deal with the public make most sales on account and not through cash sales

Vendor

In sales transaction (sales invoice) the seller

purchaser

In sales transaction (sales invoice) the buyer

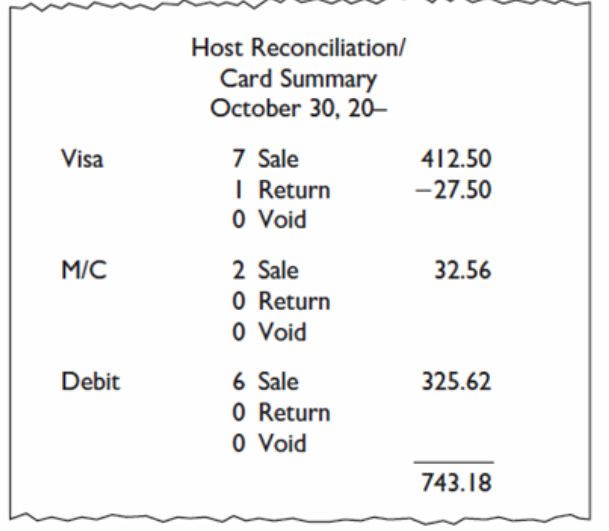

Point of Sale summary

POS terminal is where credit and debit card transactions are processed (e.g. thing where you tap credit card at a store). Summary of transactions is called point of sale summary or transaction log

Transaction log

Different point of sale summary report which has detailed info such as customers name and card no. useful for if purchase is disputed by customer

Journal entry for POS summary’s

Debit and credit card transactions treated as cash receipts by business. Total shown at the bottom represents net cash deposit for transactions that occurred.

Purchase invoice

When businesses purchase from supplier on account they receive a purchase invoice (kinda like acc payable)

Cheque Copies

Document summarizing supporting accounting entry for a payment by cheque. *not all payments by cheque require cheque copies, owner’s drawings for example does not.

Sales tax exempt goods/services

Essentials: home rent & insurance, essential groceries, prescriptions, wages (different tax)

HST

Harmonized sales tax

Includes GST (goods and service tax) federal government

PST (provincial sales tax) provincial government

GST = 5%

PST = 8%

Total HST = 13%

Taxation Principles

Seller collects taxes (record in seperate account)

Buyers are charged taxes for purchases

Taxes belong to government and sent at periodic dates

Seller sends tax $$ to goverment - HST it has paid on its purchases in the same time period (e.g. sales tax on equipment which is resold) companies can claim tax exemptions since they already paid tax

Who pays HST

Businesses with $30 000+ revenue

When a business sells a good/service it is responsible to collect HST on taxable goods

HST payable

Business records it on HST payable account

*Debits = Credits so basically HST payable account + other credit account(s) = debits

HST recoverable

Businesses can recover HST already paid on supplies, expenses etc.

Contra liability account (means recorded as a liability but it is a debit account)

Value Added Taxes (VAT)

Tax dollars from a sale - taxes already paid for purchasing supplies/expenses to make the good. Ex. if a company buys a good for $100 and then sells for $200. They don’t need to pay $26 in taxes from the sale since they’ve already paid $13 from the first sale so they would only need to pay $13 again rather than paying $26 on top of the $13.

Why should a business keep track of HST it pays

Can deduct from HST tax liability and be partially refunded

HST remittance

Businesses must pay government HST they have collected - HST they have already spent. Paid to Canada Revenue Agency (CRA)

Must remit HST regularly (monthly, quarterly or annually)

Tax remittance vs refund

At the end of a fiscal period a businesses HST payable & recoverable accounts must be cleared (=0).

If HST payable is greater than recoverable then pay tax remittance to CRA

If HST recoverable is greater than payable businesses can get a tax refund

Where to record HST payable and recoverable accounts on balance sheet

Both in liabilities section since HST recoverable is a contra liability (has debit balance but still in liabilities). * HST recoverable is subtracted to reduce liabilities even though its considered a liability

Chart of Accounts

Document to organize ledger for identification & reference.

Steps to create chart of accounts

Heading (Who (business), what (chart of accounts)

List Accounts (Assets by liquidity, liabilities (owed first), Owners equity & drawings, revenue (largest to smallest), expenses (largest to smallest)

Account no.’s (assets = 100s, liabilites=200s, capital/drawings = 300s, revenue = 400s, expenses = 500s

First 3 steps in accounting cycle

Identify transactions

journal entries

post ledger entries

Journal vs Ledger

Journal - Transactions recorded by date

Ledger - Debit & credit amounts posted to affected accounts

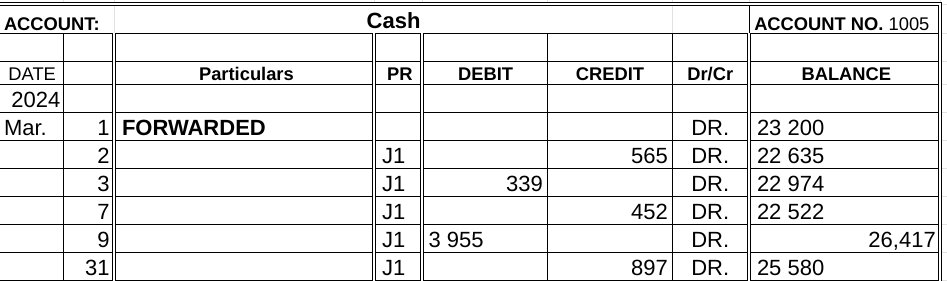

Balance column account/formal ledger

3 money columns that are debit, credit and trial balance

Account no. is based on chart of accounts no. assigned (e.g. cash might be 105)

Posting

transferring info (usually to ledger)

6 step process of posting to the ledger

record date (year then month underneath then date no.’s in all columns below) and account name

record PR (posting reference) basically just the page no. of journal the transaction is from (e.g. J1, J2 etc.)

Record amount in debit or credit column

Write dr or cr in the dr/cr column per transaction depnding on if the total trial balance of the account is positive(debit) or negative (credit)

Write the total account balance in balance column

Write account no. in top right based on chart of accounts

*when u fill in pr column of general journal it guarantees it was posted in the ledger so good for checking for errors (note: pr for journal is different than ledger its basically chart of account no. instead of journal no.)

cross referencing & 3 reasons to do it

write the journal page number in the account and account no. in journal.

1. Entries in the journal can be followed through to the accounts where they have been posted

2. Entries in accounts can easily be trace back to their source in the general journal

3. If the posting process is interrupted, it is easy to tell where to begin again. Journal amounts that have been posted will have the ledger account number entered

Forwarding

continue an account in new balance column by carrying forward date and balance from last transaction (e.g. month to month). occurs when transferring from previous ledger or if theres not enough space. only time when u write in pr column and u write forwarding

Who uses accounting info

Owners, bankers, investors, employees, tax authorities

How to correct accounting errors if they are found immediately

Neatly cross out the mistake with one line and write the correct

ones right above/below

DO NOT erase or whiteout errors cause can cause suspicion of forging or if its online do not just delete errors

How to correct accounting errors if you find them later after the document has been completed

Use a correcting journal entry

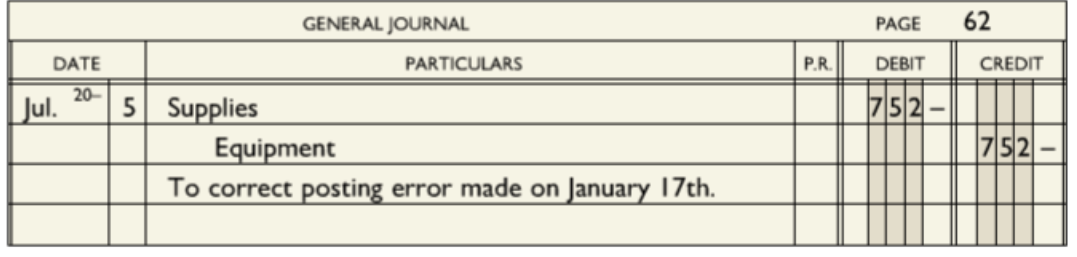

Correcting journal entry

If mistake has been made after ledger has been complete add a separate correcting entry. Description would be “to correct posting error made on “date”. Debit and credit appropriately to balance. So for example if the error was that equipment was debited instead of supplies. The correcting entry would credit equipment and debit supplies.

*must be used whether its on paper or online

5 steps to make sure trial balance & other documents following it are in balance

credit & debit amounts in journal entry are equal

Debit and credit journal amounts are posted to debit and credit columns in ledger accounts

New ledger account balances are calculated each time amounts from the journal are posted

Final balances on ledger are identified as debit/credit then properly put in the trial balance as a debit or credit

Debits=credits on trial balance

why is it important to find mistakes causing unequal trial balance

Other financial documents cannot be prepared until trial balance is balanced to prevent fraud and ensure money is all accounted for

How to detect a single error if trial balance is unequal (4 tests)

First determine the difference b/w debit and credit totals. Then use these 4 tests until you find the error:

If the trial balance difference is a multiple of 10 (40.10, $1, $10 etc.) an addition error probably was made so you must re-add trial balance columns and recalculate the balance of each account on the ledger.

Check ledger & journal to see if the difference in dr/cr in trial balance is equal to an amount entered in the journal or ledger. Ex. if the difference in dr/cr in trial balance is $5 then look for amounts that are $5. If you find an amount that matches with this check to make sure it was done properly.

Divide difference of dr/cr (trial balance) by 2. Look for the divided amount in trial balance & ledger. If an equal amount is found check to make sure it was done properly. *this type of error usually happens during posting

If difference b/w dr/cr (trial balance) is multiple of 9 its a decimal error or transposition error (transposition error is messing up digit order e.g. 56 written as 65). To find the error look at the no. digits of the dr/cr difference. If difference is two digits then probably if its a transposition error then tens digits were switched

How to deal with multiple errors

If single error tests fail there’s probably multiple errors so try and work backwards through the accounting cycle and look for mistakes.