6 - Money, Banking & the Macroeconomy

1/65

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

66 Terms

primary function of banking system

intermediate between borrowers and lenders

adding to model

distinction between interest rates

money market - interbank market, market for gov bonds

balance sheet of banks - solvency & liquidity problems, role of equity

inflation-targeting CB - scarce reserves regime and ample reserves regime

3 interest rates considered

lending rate

desired lending rate

money market rate

policy rate

lending rate

actual rate charged to borrowers by commercial banks

determines current output by the IS curve, set by market conditions

treated as the real interest rate

denoted r

markup over rp

desired lending rate

the rate commercial banks want to lend at, based on risk, funding costs & strategy

denoted rs

money market rate

the short-term rate at which banks lend to each other

i.e. LIBOR

determines the cost of borrowing of the banks, set by market conditions

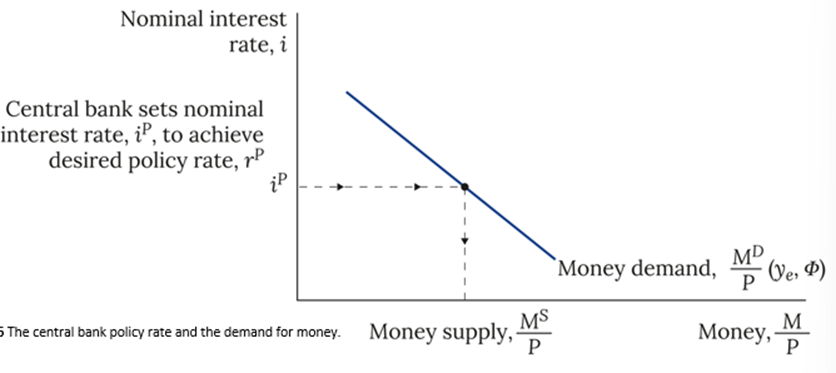

policy rate

the CB’s benchmark rate

treated as the nominal interest rate

due to arbitrage, money market rate and policy rate are assumed to be the same

only consider policy & lending rates in model

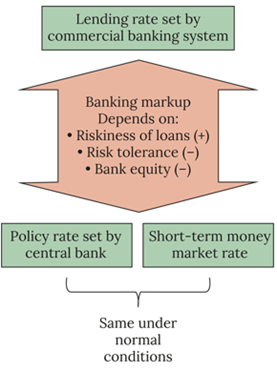

banking markup

difference between desired lending interest rate (rs) and policy rate (rp)

rs - rp

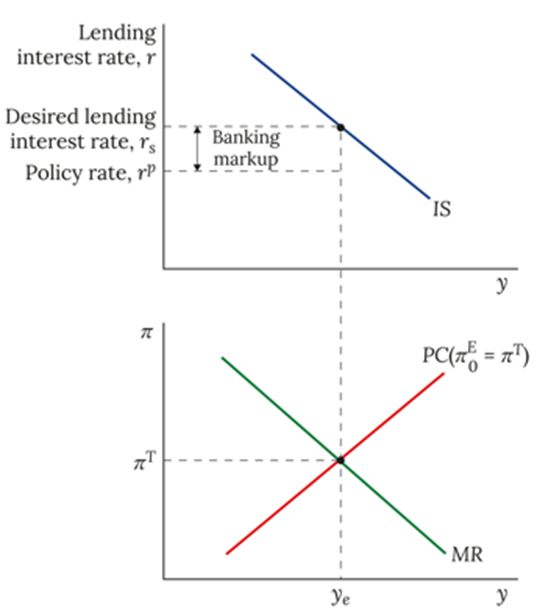

3-equation model - policy & lending interest rates

after CB chooses optimal output gap, it finds the desired lending interest rate rs from IS

given its knowledge of the banking system (banking markup) it then sets rp to achieve this

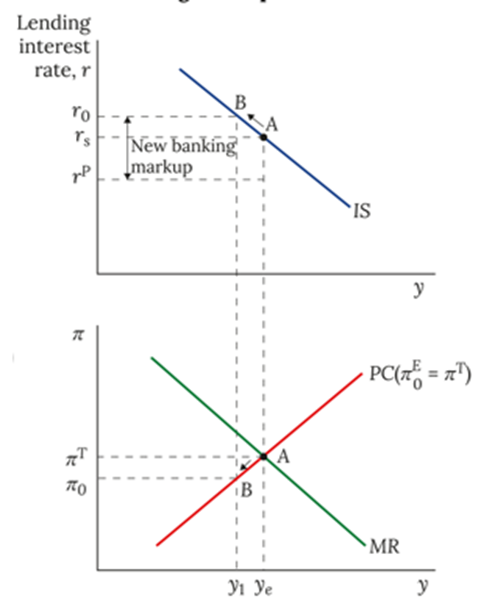

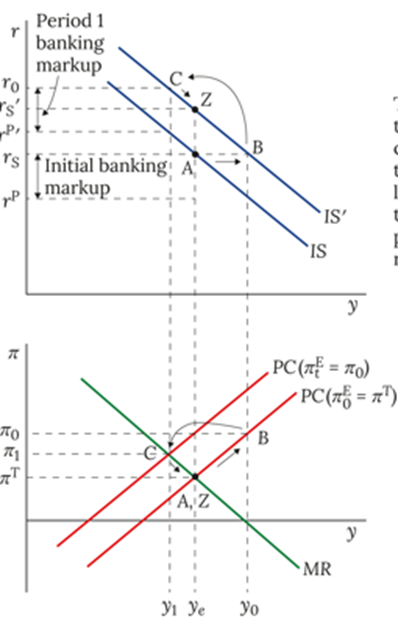

shock to 3-equation model

banks view loans as being riskier → increase markup

unanticipated by CB so rp stays fixed → AD falls

output falls to y1 and inflation falls to pie0 (B)

same process under inflation targeting CB

adjustment process as before

CB finds desired output gap using the intersection of PC and MR

CB finds lending rate on IS to generate this output

CB lowers rp to achieve this lending rate

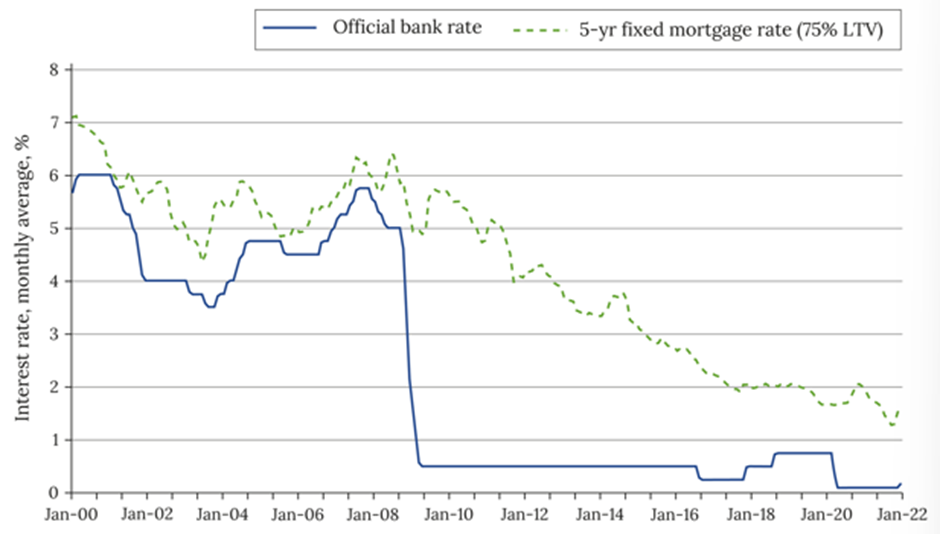

Fischer equation

with constant inflation expectations, changing i is the same as changing r

hence can use a real rate rp to represent policy rate

relax this assumption when dealing with ZLB

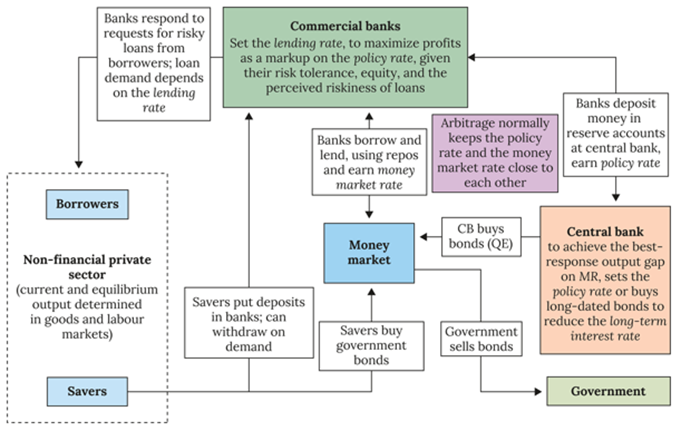

financial system - key players & markets

non-financial private sector

commercial banks

central bank

money market

non-financial private sector

comprises of households & firms

set current and equilibrium output → determines stabilising interest rate rs

commercial banks

profit-maximising - lend to private sector

create deposits, hold borrow and lend reserves

central bank

keeps commercial banks’ reserves

set policy rate to achieve desired lending rate to minimise their loss function

money market

where interbank transaction activities occur

any gap between the money market rate (LIBOR) and the policy rate creates arbitrage opportunities

definitions - collateral

an asset that the lender will receive should the borrower default

secured borrowing - borrowing with collateral (housing market)

bonds

a financial instrument sold by an institution wishing to borrow to an investor wishing to lend

initial buyer can sell bond to another investor in the market

repos

repurchase agreement - banks borrow by selling a bond in the repo and promising to buy it back the next day (or 14 days later) at a slightly higher price

main way banks borrow and lend to each other in money market

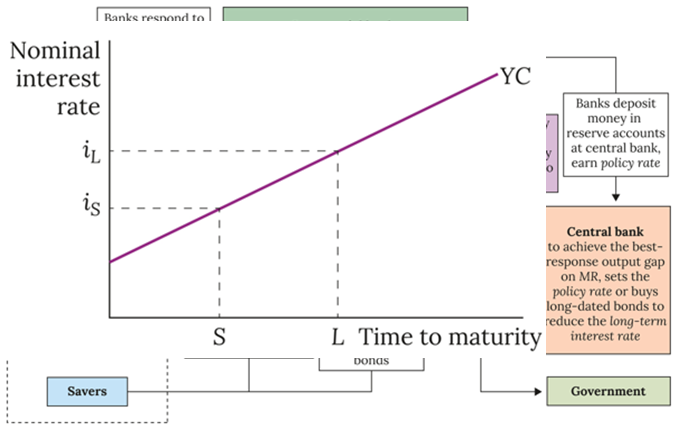

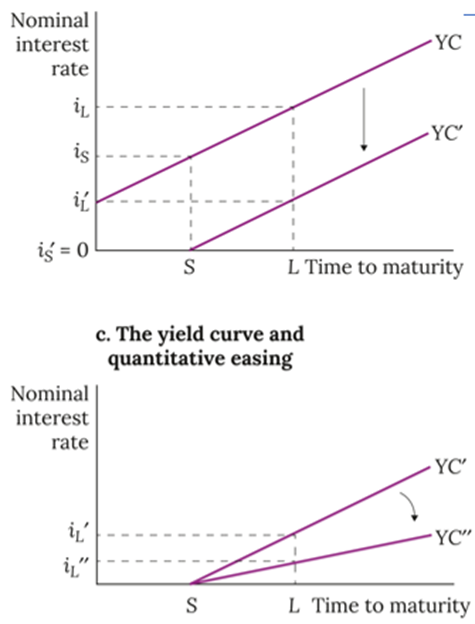

yield curve

yield (interest rate of a bond) changes inversely with its price

yet yield increases with time to maturity, creating an upward sloping yield curve

investors demand a higher return to hold long-term bonds

more uncertainty in the long-term due to interest rate fluctuations, recessions…

conventional monetary policy - negative demand shock

fall in policy rate by CB → fall in money market rate due to arbitrage → fall in lending rate by commercial banks

as CB lowers policy rate to 0, yield curve shifts down

as the short-term nominal rate cannot fall below 0, the long-term rate cannot fall below iL’

given a large negative demand shock, this may be insufficient

CB applies QE (purchases large quantities of long-term gov bonds)

increase in price of gov bonds causes yield to fall

pivots, lowering long term nominal rates

yield curve inversion

in reality, the yield curve may not have a monotonic relationship with time to maturity

short-term rates are high but investors could expect a recession in the near future → suggests interest rates will be cut soon to stimulate growth

investors may then be happy to lock in a lower yield on long-term debt than short-term debt as they know that the relatively high short-term yields will not last long

extended 3-equation model - permanent investment boom

economy moves to B with rightward shift of IS

increase in investment causes an increase in output and inflation

CB chooses point C and targets r0

given that CB cannot set lending rate directly the CB uses its knowledge about markup and sets the policy rate as rp’

increase in policy rate by CB causes increase in money market due to arbitrage → increases lending rate by commercial banks

increases cost of borrowing for firms & households → fall in investment → fall in output & inflation

economy reaches C

in subsequent periods, CB then gradually reduces the policy rate until the lending rate reaches its new stabilising rate at rs’ and inflation has returned to target

money supply

doesnt include money held by banks

difference between narrow & broad money

narrow money

banknotes of the non-bank public + demand deposits

indicator of spending in the economy

broad money

also includes term deposits

indicator of future spending and of the transmission mechanism of MP

money creation - base vs bank money

base money - created by CB

banknotes + commercial banks’ reserves

used by commercial banks to cover withdrawals from customers and transactions with other banks

bank money - created by commercial banks when they make loans

money demand

increases with output - income increases → transactions increase → hold more money

decreases with interest rate: increase in interest rate → bonds more attractive → increased opportunity cost of holding money → hold less money

factors that shift money demand

unanticipated inflation changes

structural changes in financial sector (phi) - confidence, innovations in payment technology

money market equilibrium

changes in the money supply are the outcome of changes in money demand

changes in MS are entirely reactive and dont lead to further impacts on the wider economy

demand & supply of reserves has consequences instead

markup - factors that affect the lending rate

banks choose the markup and set the lending rate based on:

riskiness of loans - higher credit risk increases markup

risk tolerance - lower risk tolerance increases markup

bank equity - lower equity means lower ability to bear credit risk which increases markup

uncompetitive banking sector - higher market power means higher markup

lending rate

markup (u^B) increases with risk and decreases with risk tolerance and bank equity

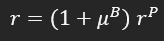

r and rp shown on graph

UK official bank rates (rp) and 5-year fixed mortgage rates r

75% loan to value mortgage - borrower has borrowed up to 75% of the value of the house, with the remainder coming from a deposit

stable relationship between rp and r that was disrupted by the financial crisis

key transmission mechanism of MP broke down in post-crisis world

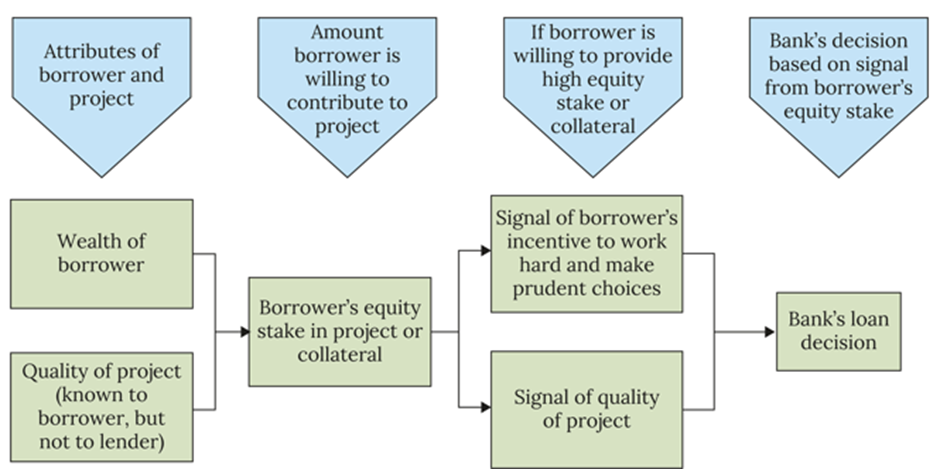

credit rationing

banks adjust markups in response to credit risk, and impose credit rationing

affects households credit constraints → increases multiplier and decreases slope of IS curve

information asymmetries contribute to credit rationing:

moral hazard

adverse selection

moral hazard

efforts exerted by borrowers in their projects are unobserved by the bank

adverse selection

individuals with stronger prospects will self-select away from higher interest loan agreements → only weaker applicants remain → banks ration credit

i.e. banks charge a higher interest rate as households’ expected future earnings are unknown to them → households cannot borrow when needed

role of borrower wealth

given information problems, borrower’s wealth in terms of equity stakes or collateral, is important for signalling credibility to lenders and aligning incentives

a borrower with a good project but no wealth will be denied credit

inefficient and unfair outcome

fractional reserve banking system

banks only hold a fraction of deposits in liquid form in their reserve accounts at the CB

role of banks

maturity transformation - transforming liquid savings into long-term borrowing, but a maturity mismatch poses liquidity risk

aggregation - aggregating small savings to make large loans

risk pooling - banks can better withstand defaults so offer limited risk to savers

dangers that banks face

liquidity risk

solvency risk

liquidity risk

inadequate reserves to meet depositor’s demand to withdraw money from their accounts

i.e. banking panic - incentive to be the first to withdraw as if everyone withdraws there is a run on the bank

CB acts as LOLR to provide emergency liquidity while the gov insures deposits to reduce the likelihood of a bank run

solvency risk

the value of assets is less than that of debts or liabilities

lead to bankruptcy if not bailed out by the government

insolvency is another danger

interconnectedness in banking sector

fire sale - an illiquid bank sells assets at discounted prices → asset prices drop → other banks face reductions in their assets’ values (housing) → forced to sell their assets

it is a solvency problem for a small number of banks → banks unsure about safety in lending to one another can cause widespread liquidity problems (credit crunch)

shows how insolvency has direct negative effects on bank depositors, creditors, shareholders & bondholders

balance sheet identity

Net worth (equity) = Asset - liabilities

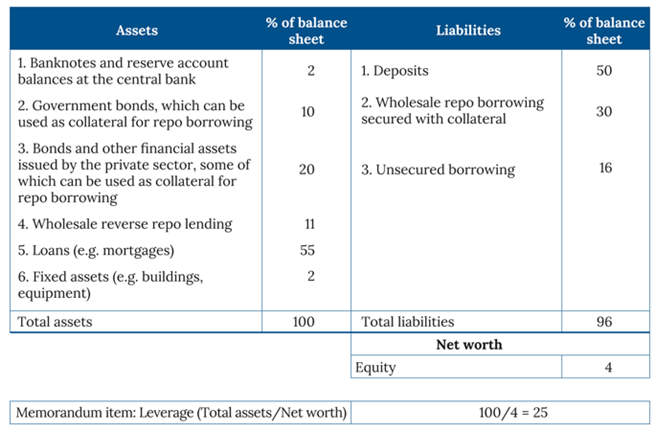

balance sheet

shows balance sheet of a typical commercial bank before the financial crisis

all items expressed as a % of total assets

useful to evaluate liquidity and solvency

if a bank has negative equity, it is insolvent

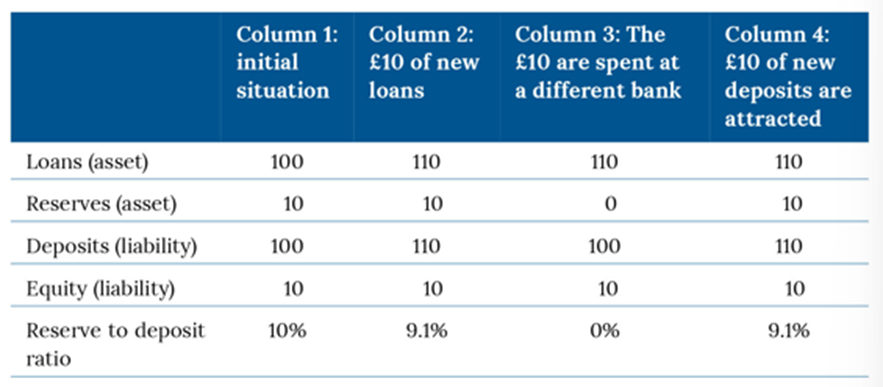

example - making loans

Banks seek to attract new deposits when making loans:

Column 1: initially bank A has reserves that can cover 10% of its deposits.

Column 2: Bank A makes a £10 loan. Loan on the asset side and deposit on the liability side each increase by 10.

Column 3: the borrower spends the money at a business that uses Bank B.

Bank A transfers £10 of deposits and reserves to Bank B.

Now Bank A has no reserves and cannot meet liquidity requirements.

2 options

borrow reserves at money market rate - expensive

attract new deposits from customers

when new deposits come in, bank gains corresponding reserves as shown in column 4

therefore can make loans without impacting its reserves even if its borrower spends the money elsewhere

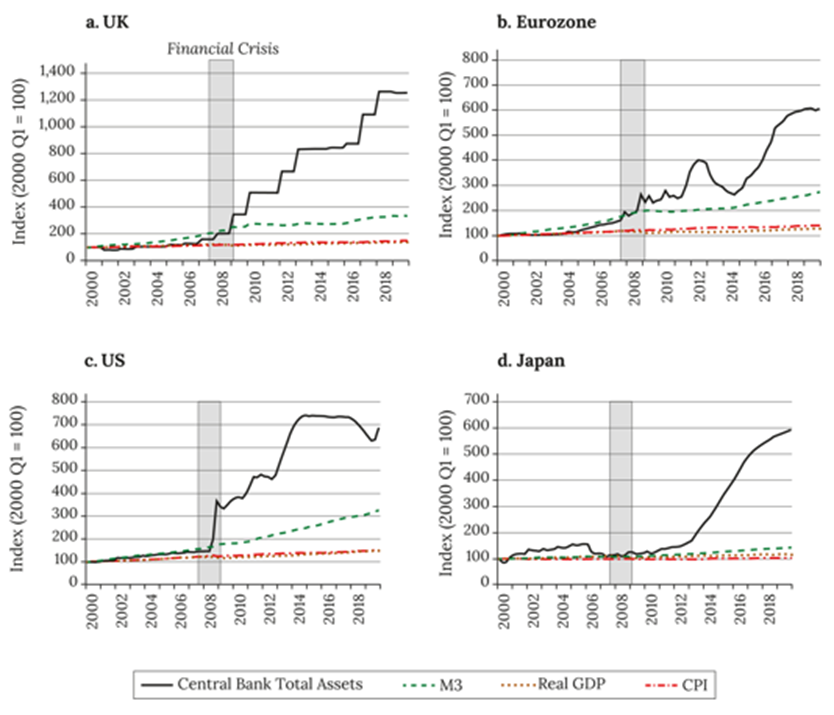

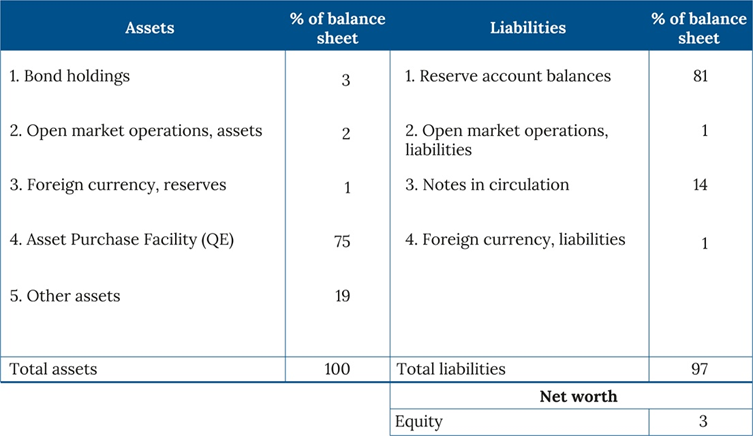

central bank balance sheet

come to public attention under QE because the purchase of assets has grown rapidly

growth in CB assets has significantly outstripped growth in either eal GDP, CPI or money supply

suggests it has not been driven purely by economic fundamentals

example CB balance sheet

liability - reserve account balances

demand deposits of commercial banks at CB which help settle transactions

total quantity of reserves remain fixed by CB

asset - asset purchase facility (APF)

assets acquired through QE

difference between open market operations (OMO) and QE

OMO - used to adjust quantity of reserves to target an ideal policy rate

QE - used to try to influence long-term interest rate by purchasing assets

BoE weekly report

Note: APF is included under other assets.

Pre-crisis: stable balance sheet, reflecting the success of inflation targeting through the setting of the policy rate (scarce reserves framework).

Post-crisis: huge growth in “other assets” driven by QE (ample reserves framework).

Excess reserves – money in reserve accounts that are over and above any reserves held for prudential reasons.

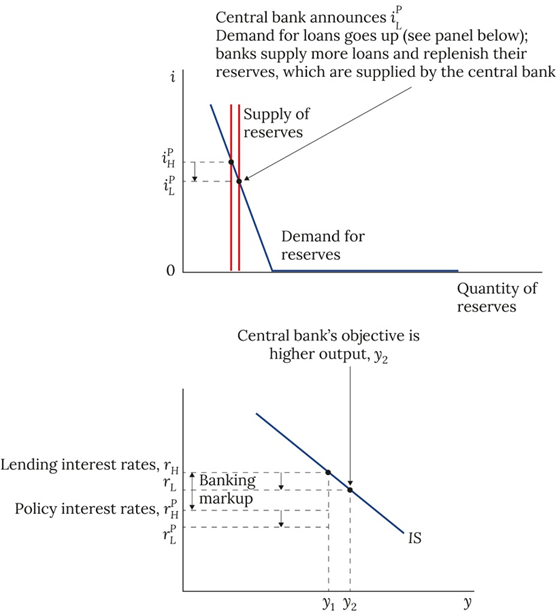

MP operations - scarce reserves regime

CB implements a cut in the policy rate (i.e. raising output target from y1 to y2)

IS - CB targets rL by announcing policy rate rPL

fall in lending rate after announcement → increase in demand for loans → increase in deposits → increase in commercial banks’ demand for reserves (liquidity purposes)

increase in CB supplied reserves by combination of OMO & repos (performing repo lending on a larger scale)

hence a fall of policy rate is associated with an increase in reserves supply

features of market for reserves

demand for reserves - very inelastic, hence fluctuations in the supply of reserves will be modest

flat when we hit ZLB - no opportunity cost of holding reserves

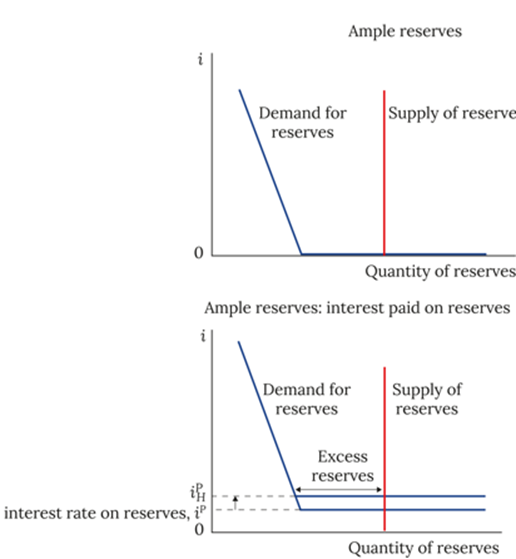

MP operations - ample reserves regime

under ample reserves regime & zero interest → CB can only tighten MP by unwinding QE policy

as on a large scale → disruption in financial market expected

CB chooses to pay interest on reserves under ample reserves:

interest provides a floor to the willingness to accept price → demand curve is horizontal at this rate (no opportunity cost)

how does CB tighten MP in ample reserves regime?

raising interest rate of reserves

QT

raising interest rate on reserves

increased interest rate on reserves → increase in money market rate

→ increases lending rate → lowering demand for loans from private sector

QT

CB sells some of the bonds purchased during QE to primary dealers

dealers’ banks settle transactions by decreasing dealers’ deposits and transferring reserves to CB of the same amount

→ supply of reserves to shrink

raising interest rate on reserves doesnt causes supply of reserves to change, yet under QT it must fall

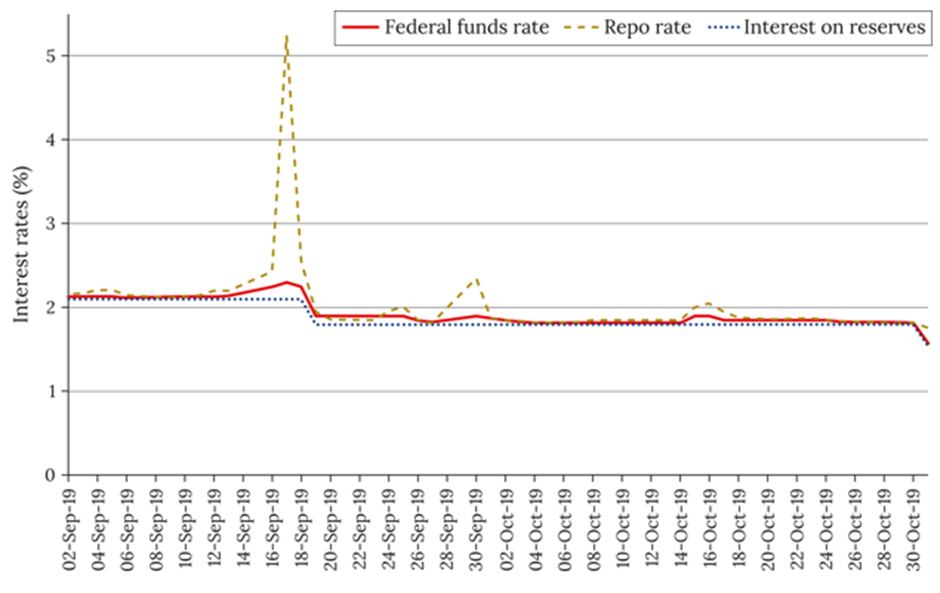

US interest rates sept & oct 2019

due to uncertainty over the shape of the demand curve for reserves, QT should be applied gradually

→ avoid moving too rapidly into scarce reserves territory and losing control of the interest rate

summary - functions of financial system

facilitates economic transactions

allows maturity transformation

enables inflation-targeting MP

summary - importance of BS

provide information on liabilities & assets of banks

reflect liquidity and solvency of banks

help illuminate the relationship between CB & commercial banks

summary - 3-equation model with banking system

lending rate - markup over the policy rate, chosen by profit-maximising banks

banking markup (r over r^P) if influenced by loan riskiness, risk tolerance, bank’s capital cushion

summary - response of CB

CB reacts to economic shocks in a similar way as before

now sets the policy rate to target the lending rate that achieves the ideal output gap

application of QE changes MP framework from a scarce to an ample reserves regime

interest rate on reserves - now the policy rate