Banking Vocabulary/ Fees

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

44 Terms

Balance

The amount of money you have in your bank account

Check

A written order to the bank that tells it to take a stated amount of money from your account and pay it to another

Endorse

To sign the back of a check made out to you so it can be cashed or deposited

Payee

The person to whom the check is made payable

Outstanding check

A check that has been written but not yet deducted from the person's bank account

Outstanding deposit

A deposit that has been made but not yet added to the person's bank account

Overdraw

To write a check or make a withdrawal when there isn't enough money in the account to pay for it

Post-date

To write a future date on a check

Voided check

A check with "VOID" written across it that makes it non-negotiable

Reconcile

To "balance" your checking account with your monthly statement from the bank

Check register

A record that allows you to keep track of checks you have written, ATM/debit card transactions, as well as deposits and withdrawals

Deposit

A sum of money put INTO an account

Deposit slip

A form you fill out to credit money to your account when you make a deposit

Direct deposit

Your employer automatically deposits your paycheck into your account

Withdrawal

A sum of money deducted from your account

Debit card

A card that enables you to do ATM transactions and to make purchases instead of using cash or writing a check

PIN

Personal Identification Number needed to use an ATM card

Interest

A fee paid to you for keeping your money in the account or a fee charged to you for a loan or credit card

ATM

Automatic Teller Machine; allows a customer to get out physical currency from their account

Statement

The monthly record of your account transactions sent to you by your bank

Credit card

A card that allows the holder to make purchases without cash by borrowing money

Person to person payment

An online process that allows you to send money directly from your checking account to a friend via email or cell phone

Check cashing store

A business that cashes checks, giving the customer cash in exchange for a fee for the service

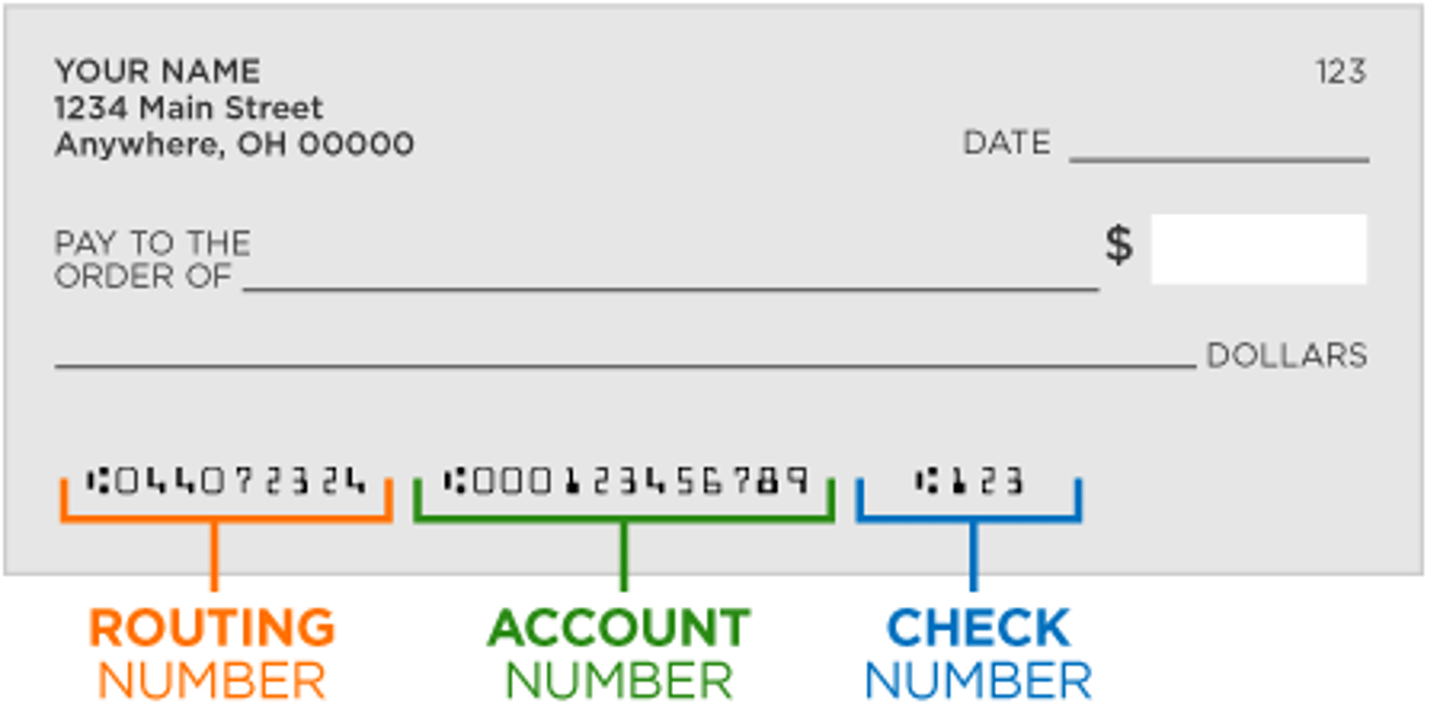

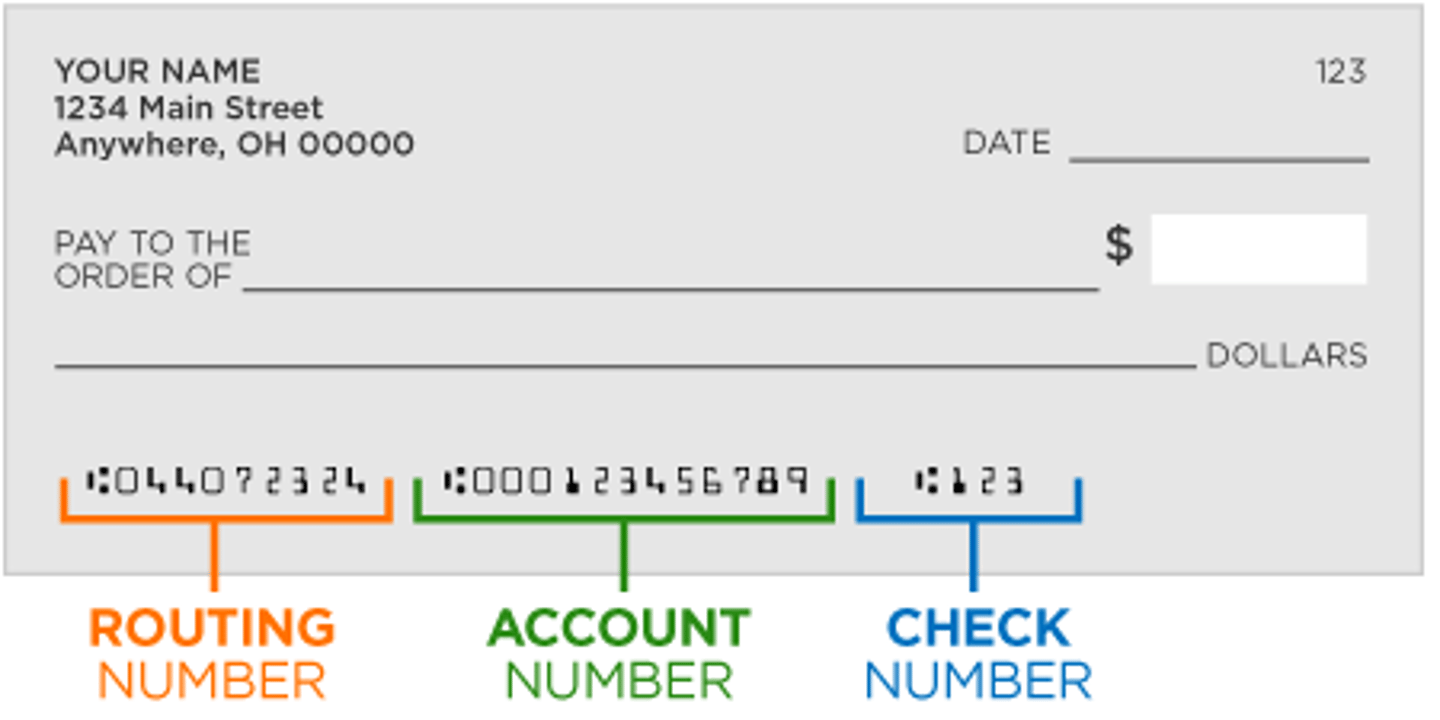

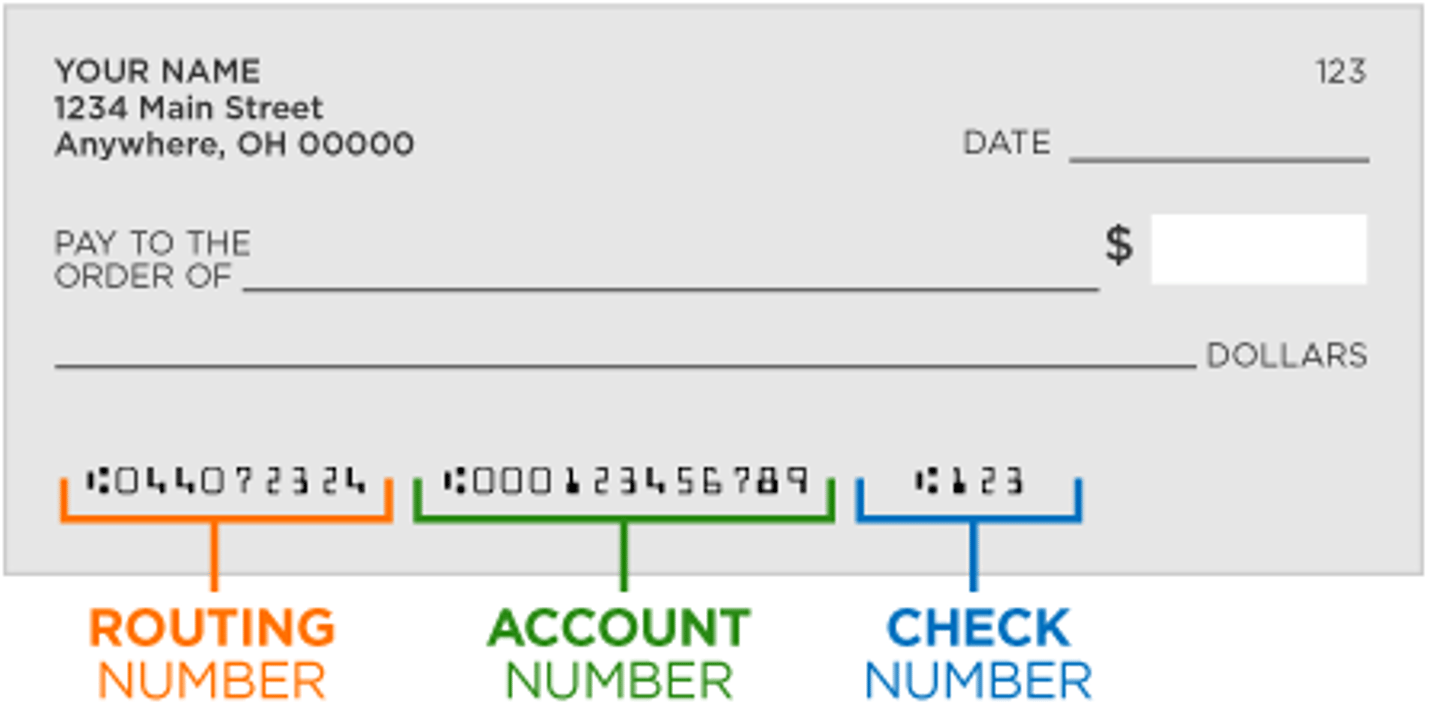

Routing number

9- digit number to identify bank on a check

Account number

Identifies a specific account within the bank on a check

Check number

Identifies a specific check from an individual

Minimum Balance Fee

Fee for not maintaining a minimum balance

Monthly Account Maintenance Fee

Monthly fee to have an account in the bank

ATM Fees

Fee for using an ATM outside the bank's network; you can get charged by the ATM for not being in their network and charged by the bank for going out of network

Additional Checks Fee

You have to pay for checkbooks after the first one is done; prevent this by buying your checkbooks outside of the bank (e.g. Walmart)

Paper Statement Fee

Charged for printing bank statements; prevent it by going "paperless" in the beginning itself and then just printing statements from your own computer if needed

Cashier's Check Fee

Fee to get a certified cashier's check from the bank

Overdraft/ Nonsufficient Funds Charge

Fee for an attempt to take more money out of your account than you have

Overdraft Protection Fee

Fee for a service that links your checkings account to your savings account so you don't overdraft

Lost Card Fee

Fee to replace a lost debit card

Foreign Transaction Fee

Fee charged for using your credit card in a foreign country; prevent this by having a travel plan with your bank, having a travel-friendly credit card, or exchanging currency beforehand

Wire Transfer Fee

Fee for outgoing wire transfers and sometimes for incoming wire transfers too

Savings Withdrawal Fee

Fee if you withdraw more than 6 times from your savings account per year; why does this fee exist -> banks are using your savings money for their investments so they need to know it will stay there

Inactivity Fees

10 dollar fee for not using your account for a certain amount of time (changes per bank)

Return Deposit Fee

Fee for depositing a check that bounces

Account Closing Fee

Fee for closing your account within a short amount of time of creating the account

Basic Savings Account

Type of savings account that provides quick but restricted access to your cash; earns 0.01% to 0.06% interest; limited to 6 withdrawal/ transfers per month

Money Market Account

Savings account with high minimum balance requirement; good for emergency savings; earns 1.8% to 2% interest; may charge low balance fees

Certificates of Deposit

Savings account with limited access to money for a locked in time period; good for long-term savings; highest interest rates; penalties for withdrawing before time period is over