FIn Modeling Final

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

100 Terms

Excel is important to the Corporate Finance function because (select the best answer):

It enables financial modeling, data analysis, and decision support (e.g., budgeting, forecasting, valuation).

Named ranges and data validation are commonly used to add which Excel feature that makes reports more dynamic (select the best answer)?

Drop-down lists

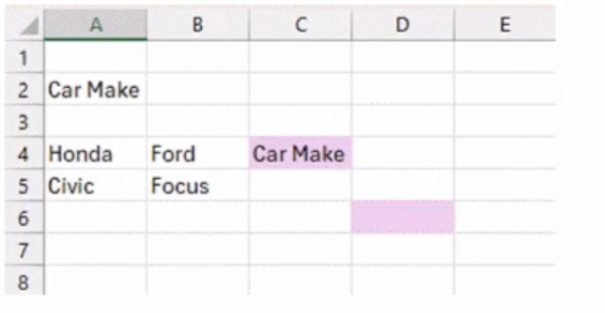

Using the provided view, what is the expected result of copying and pasting the formula in C4 to D6? The formula in C4 is = $A2.

Honda

Reports can be built using only relative cell references, but this approach has major drawbacks. Which option best describes those limitations?

All of the above are correct.

=MATCH("Tulsa",$C$2:$C$10,0)

is looking for the term "Tulsa" in (select the most appropriate response):

A series of rows

Which option best describes Excel-based dynamic reporting as discussed in class (select the most appropriate response):

User-friendly and designed to be easy to build, update, and refresh with new data

When using Excel’s INDEX function, which set of inputs does Excel require (select the most appropriate response)?

The array (range), the row number, and optionally the column number

Which statement best explains how variance analysis works with dynamic reporting (select the most appropriate response)?

All of the above statements are correct.

or income statement variance calculations, the standard approach is:

Variance = Current (Actual/Latest) − Prior Forecast or Budget

A. True

Variance analysis typically involves which of the following (select the most appropriate response)?

All of the above statements are appropriate

The MATCH function can only be used to return the row position in an array.

B. False

XLOOKUP in Excel, while useful, is considered outdated compared to the flexibility of INDEX + MATCH + MATCH.

B. False

For the cell reference =$X34, which option best describes the reference type (select the most appropriate response)?

Relative row and absolute column

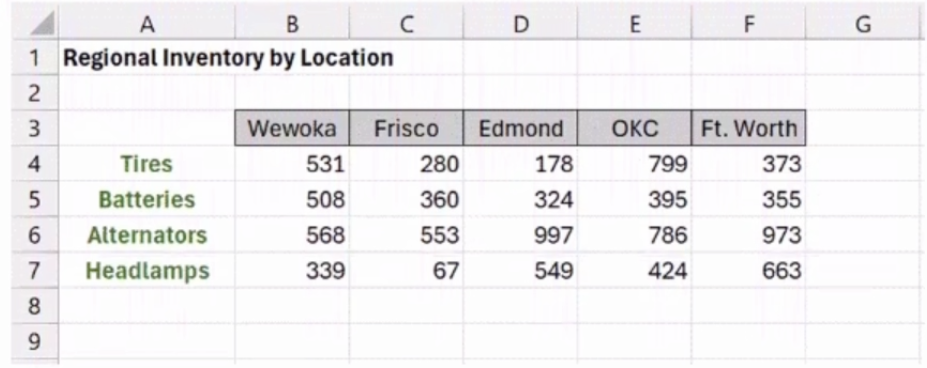

Using the provided view, what value would the Excel function =INDEX(C4:F7,2,3) return?

395

Using the provided view, what value would the Excel function =MATCH("OKC",$D$3:51$3,0) return?

2

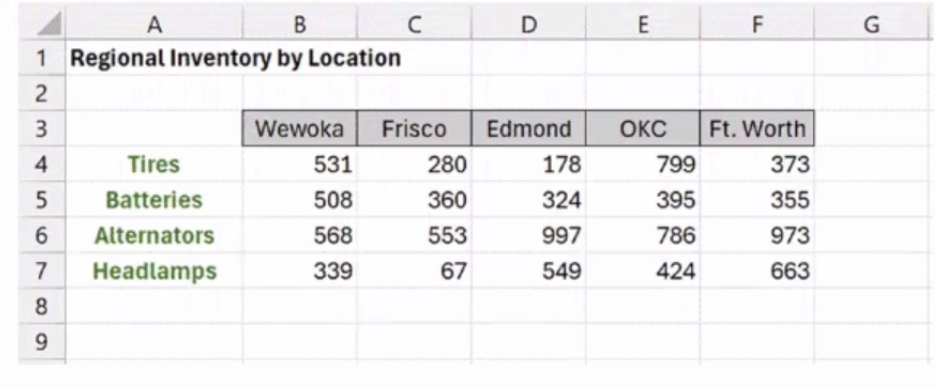

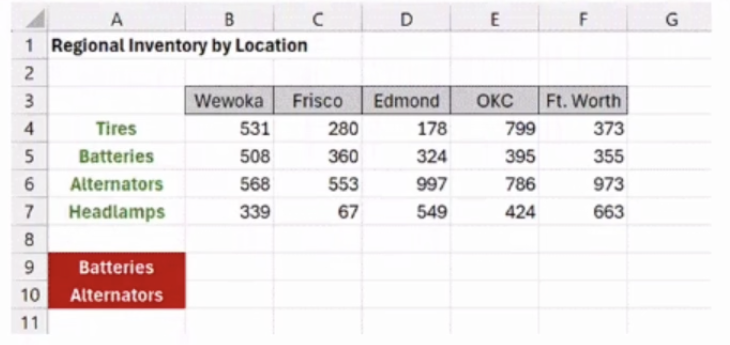

Using the provided view, what value would the Excel function =INDEX$B$4:$F$7,MATCH(A10,$A$4:$A$7,0),3) return?

997

Using the provided view, what would be the lookup value in cell C6 to search the rows of our Global Media data set (select the most appropriate response)?

A2&"," SA6

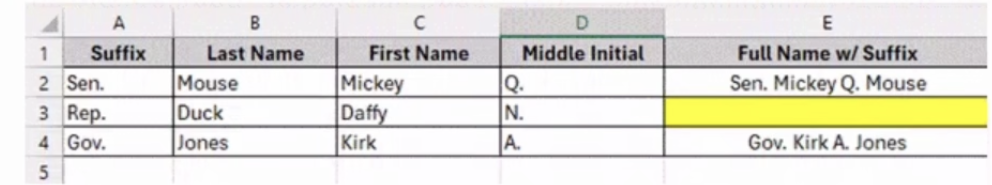

Using the provided view, what is the most appropriate formula to generate Rep. Daffy N. Duck in cell E3?

=A3&””&C3&””&D3&””&B3

Which statement is most accurate regarding Excel and its value in the workplace (select the best answer)?

Finance professionals with strong Excel skills often have a competitive advantage over finance professionals without those skills.

When using Excel’s XLOOKUP function, which set of inputs does Excel need to perform the lookup (select the most appropriate response)?

Lookup value, lookup array, return array

Which option best explains why understanding relative vs. absolute cell references is valuable when building dynamic Excel reports (select the most appropriate response)?

It allows formulas to be copied and filled across a report quickly while keeping the correct references.

n a dynamic report, data dimensions are commonly represented using which of the following (select the most appropriate response)?

All of the above

Excel reports can be created without using named ranges.

A. True

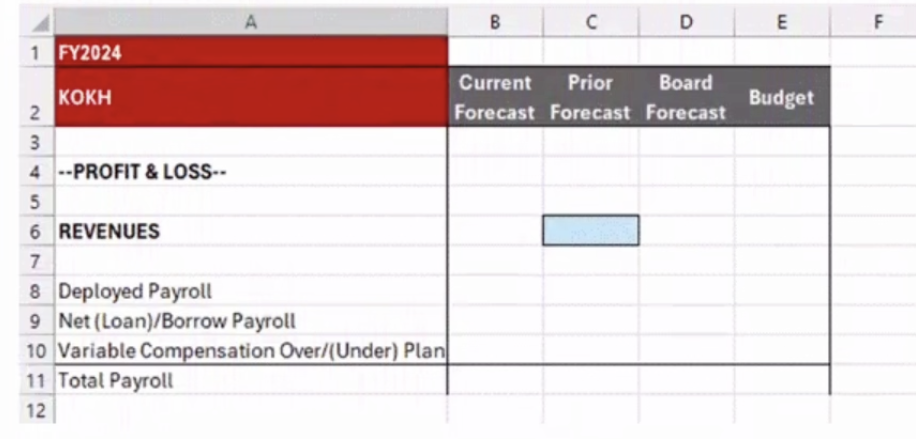

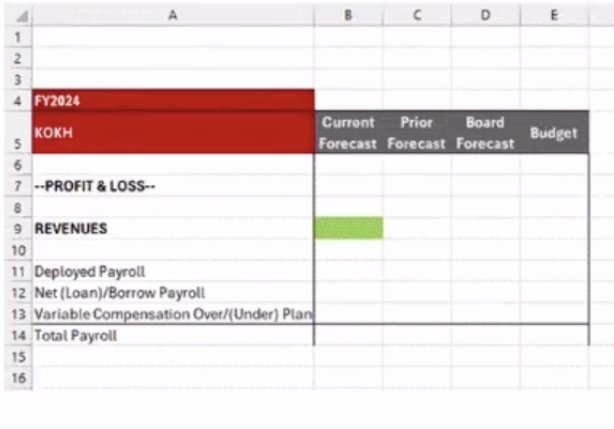

For the dynamic reports we built and reviewed in class, where did the variance analysis typically appear (select the most appropriate response)?

As additional columns/cells placed next to (adjacent to) the report output

Thinking about the data set for Global Media that we have used in class lecture and looking at the provided view, which of the following formulas is best suited to quickly populate the report with simple copy and paste actions (assume all formulas are in cell B9):

=INDEX(GMC_ data,MATCH(SA$5&" SSA9",Division_PLLine,0),MATCH(B$58,"SAS4Version_Period",0"' SAS4Version_Period.0))

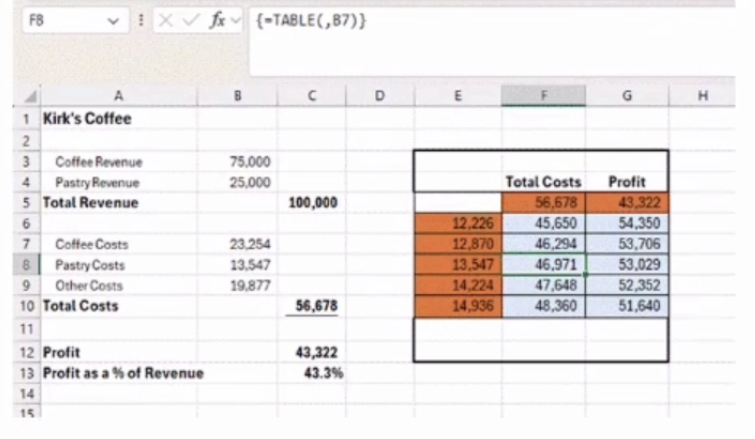

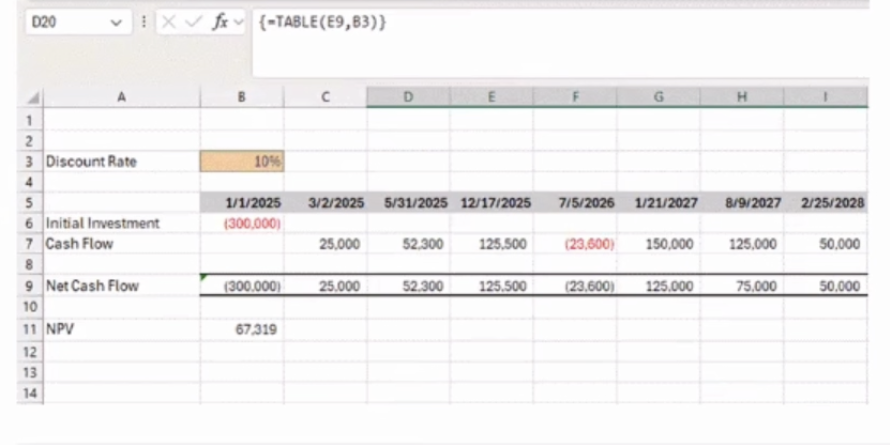

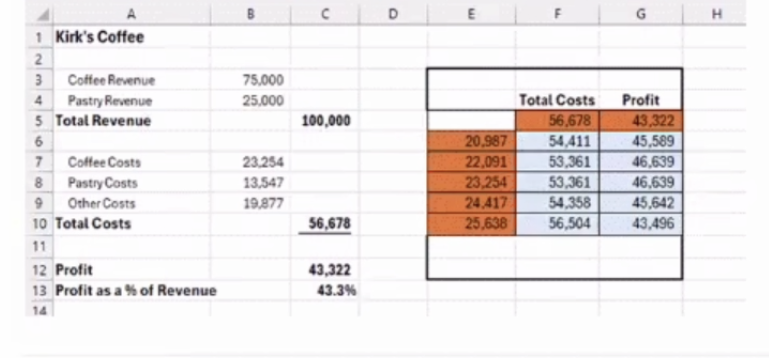

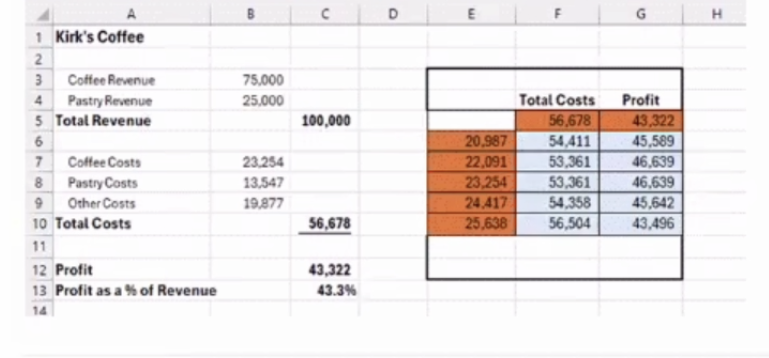

Using the provided view, what is the input variable for the data table (select the most appropriate response)

Coffee costs

Using the provided view, which of the following statements best describe the implied data table. Note the data table is not visible in the view (select the most appropriate response):

Two input variables, single output variable

Based on time value of money concepts, which statement is most accurate (select the best answer)?

A dollar received today is worth more than a dollar received in the future.

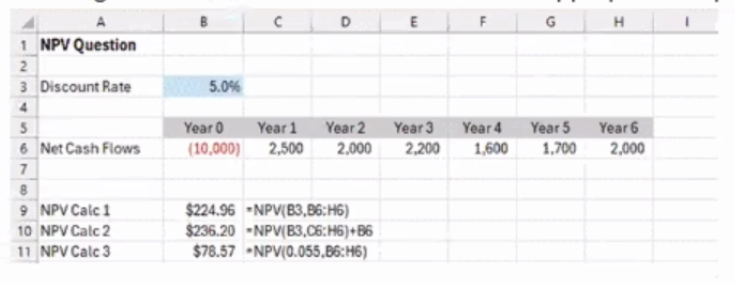

Which statement best explains the common “glitch” (common pitfall) with Excel’s NPV function (select the most appropriate response)?

It assumes the first cash flow in the NPV range occurs at the end of period 1, not at time 0.

Capital budgeting is best defined as (select the most appropriate response):

The process a business uses to evaluate and decide on major long-term projects or investments

In which scenario would a future value (FV) calculation be most appropriate (select the best answer)?

Calculating what $4,000 will grow to in 6 years at an interest rate of 5.5%

All else equal, if the interest rate used in a future value calculation decreases, what happens to the future value (select the best answer)?

Future value decreases

When calculating the future value of a payment stream, it matters whether payments occur at the beginning or end of each period.

A. True

All else equal, a project will pay $10,000 exactly 5 years from today. If the discount rate used to value that cash flow drops (e.g., from 8% to 6%), what happens to the present value today?

Present value increases

A core feature of discounted cash flow (DCF) analysis is that it (select the most appropriate response):

Values an investment by forecasting its future cash flows and discounting them back to today

In discounted cash flow (DCF) analysis, cash flows are typically assumed to be the same amount every period in most real-world cases.

B. False

Net present value (NPV) analysis is only useful when all future cash flows (after the initial investment) are positive.

B. False

In a discounted cash flow (DCF) analysis, changing the discount rate does not affect the internal rate of return (IRR) of a set of cash flows.

A. True

In theory, if a project’s net present value (NPV) is negative, the recommended decision is to (select the most appropriate response):

Reject the project because it is expected to destroy value at the chosen discount rate

Which statement best describes the internal rate of return (IRR) (select the most appropriate response)?

IRR is the discount rate that makes the NPV of the project’s cash flows equal to zero

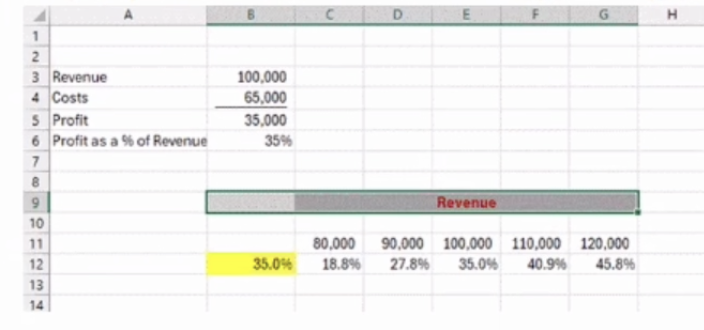

Using the provided view, which of the following data ranges was used to set up the data table?

B11:G12

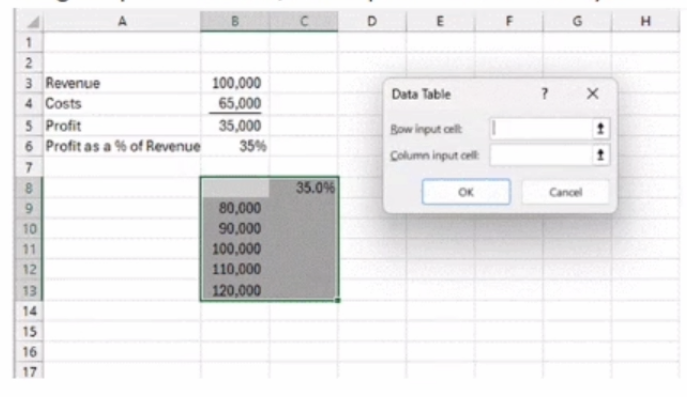

Using the provided view, to complete the data table you would do which of the following (select the most appropriate option)?

Populate the column input cell

Using the provided view, what statement best describes the data table (select the most appropriate):

Vertical/column data table with single input variable with multiple outputs

Using the provided view, what is the number of times the model will run to populate the data table (select the most appropriate response):

5 times

In Excel, a two-input Data Table (What-If Analysis) is designed to evaluate combinations of two inputs. When set up in the standard way, what is the maximum number of distinct output results that a single two-input data table can return?

One

One key advantage of Excel’s XNPV function is that it (select the most appropriate response):

Correctly values cash flows that occur on irregular dates/intervals (not evenly spaced periods)

Using the provided view, which cell contains the appropriate NPV calculation. Note the formula for each NPV calculation is shown to the right of the NPV results. Select the most appropriate response.

B10

Excel’s XIRR function has an advantage over IRR because it can handle cash flows occurring at regular (evenly spaced) intervals.

B. False

A one-input (single variable) Excel data table can be set up to return seven different output results at the same time.

A. True

If the discount rate used in an NPV analysis for a project increases, which statement is most accurate (select the best answer)?

The project’s IRR does not change

Which option best defines free cash flow to the firm (FCFF) (select the most appropriate response)?

All of the above are appropriate

Which of the following is least directly associated with the primary uses of Free Cash Flow to the Firm (FCFF) analysis (select the most appropriate response)?

Calculating the company’s overall internal rate of return (IRR) as a standard FCFF output metric

When calculating Free Cash Flow to the Firm (FCFF), you subtract depreciation from net income.

B. False

In calculating Free Cash Flow to the Firm (FCFF), why do we add back increases in current liabilities (select the most appropriate response)?

Because an increase in current liabilities (e.g., accounts payable) is a source of cash (you’re effectively financing operations by delaying cash payments)

When we built Free Cash Flow to the Firm (FCFF) in class starting from net income, we grouped the calculation into which primary sections (select the most appropriate response)?

Operations, Fixed Capital Investments, and After-Tax Interest

To compute the after-tax cash flow effect of interest expense (i.e., the interest tax shield), which inputs are strictly necessary (select the most appropriate response)?

The tax rate and interest expense

A company’s weighted average cost of capital (WACC) can be used as the discount rate when performing an NPV/DCF valuation of the enterprise (assuming the cash flows match the firm-level risk).

A. True

In discounted cash flow (DCF) analysis, terminal value typically represents the present value of cash flows beyond the explicit forecast period (the “continuing value”).

B. False

Which of the following is not a standard input in the WACC formula (select the most appropriate response)?

Net income (or operating income)

Which option is a standard, commonly used terminal value method in DCF valuation (select the most appropriate response)?

Exit multiple method

The exit multiple terminal value method assumes the company’s cash flows grow at a constant rate forever.

B. False

We can apply the net present value (NPV) concept to estimate a company’s enterprise value by discounting expected future free cash flows.

A. True

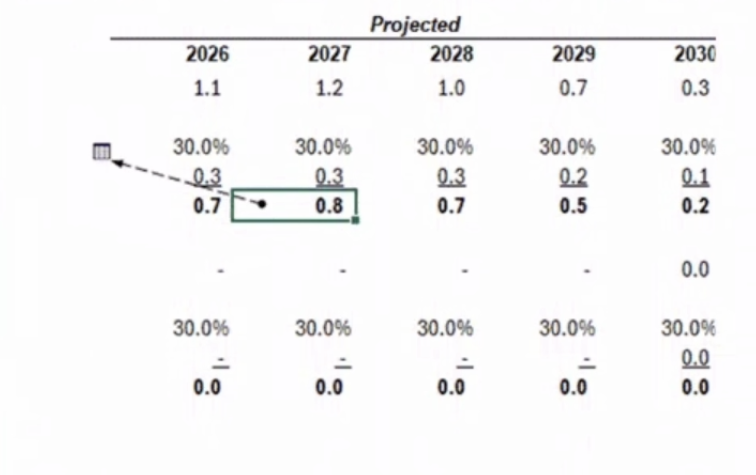

Using the provided view, which Excel feature is being used on the spreadsheet (select the most appropriate response):

Trace Dependent

In the perpetual growth (Gordon Growth) approach to terminal value, terminal value is based on the final forecast-period FCFF, a long-run growth rate, and an appropriate discount rate (typically WACC). Which input below is not required as a standalone component of that terminal value formula (select the most appropriate response)?

Cost of equity

The Capital Asset Pricing Model (CAPM) is most commonly used to estimate which input in the WACC calculation (select the most appropriate response)?

Cost of equity

Which of the following is not an input required to calculate the Cost of Equity using CAPM (select the most appropriate response)?

The discount rate / WACC

In the CAPM framework, which choice best represents the risk-free rate (Rf) used in the calculation (select the most appropriate response)?

The yield on a U.S. Treasury security that matches the relevant time horizon

All else equal, if a company’s WACC increases, what is the most likely effect on its enterprise value in a DCF framework (select the most appropriate response)?

Enterprise value decreases because future cash flows are discounted more heavily

Liquidity ratios primarily evaluate a company’s ability to meet short-term obligations. Which balance sheet categories are most directly used in liquidity ratio calculations (select the most appropriate response)?

Current assets and current liabilities

Leverage (solvency) ratios are commonly used to evaluate how a company uses debt and its ability to meet long-term obligations.

A. True

You buy a house for $100,000 using a $25,000 mortgage and $75,000 cash (no other assets or liabilities). What is your debt-to-assets ratio (select the most appropriate response)?

25% ( $25,000 ÷ $100,000 )

Based on our class approach to building financial ratios in Excel, which goal is most appropriate (select the best answer)?

Organize, format, and document the ratio calculations so users can clearly understand the key drivers behind the ratios

When building dynamic reports in Excel, using Form Controls (e.g., scroll bars, drop-downs, option buttons) typically requires several linked cells (often ~4–6) to store the control value and support lookup logic

A. True

In Excel, if a cell contains a formula, which method(s) can help you identify where the formula’s inputs come from (select the most appropriate response)?

All of the above

What is the most important reason to include a What-If / sensitivity section in an Excel model that calculates financial ratios (select the most appropriate response)?

To help users understand the key ratio drivers by showing how changes in inputs affect the ratios

According to the FMI videos and materials, the depreciation schedule is most commonly placed in which part of a financial model (choose the best answer)?

The Calculations/Engine section

Which item below would NOT typically be classified as a capital expenditure (CapEx) under standard accounting treatment (choose the best answer)?

Accrued wages

Not every capital expenditure is depreciated (choose the best answer).

A. True

Which of the following would NOT typically be classified as a capital expenditure (CapEx) for a coffee shop (choose the best answer)?

Milk, sugar, and artificial sweeteners

Depreciation is most accurately described as which of the following (choose the best answer)?

An accounting method

Depreciation expense is recorded on which financial statement(s) (choose the best answer)?

Income Statement

A common “shortcut” in modeling is to solve for operating costs by assuming a target profit margin and backing into expenses. Why is this approach potentially misleading when used to forecast operating costs (choose the best answer)?

It implicitly treats all operating costs as variable with revenue

A corporation’s taxes paid in a given year are simply equal to accounting EBT × the tax rate.

B. False

When presenting financial results to tax authorities, corporations generally have an incentive for their reported results to (choose the best answer):

Look as unfavorable as possible from a profit standpoint

Deferred taxes are best described as which of the following (choose the best answer)?

The difference between book (accounting) taxes and tax (government) taxes in a given year

A deferred tax liability occurs when a company pays taxes in advance.

B. False

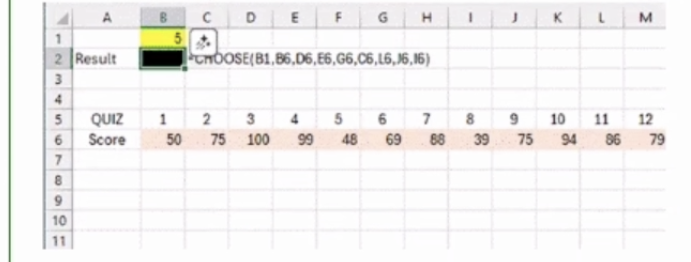

Using the provided view, what would be the result in cell B2 based on the CHOOSE function in B2. The formula used in B2 is visible to the right of the call via the formulatext function (select the most appropriate response):

75

Which statement best reflects a correct understanding of capital structure in financial modeling (choose the best answer)?

Most firms use some form of debt, but all firms have equity (even if book equity is negative).

Which stakeholder group is generally least reliant on GAAP-audited financial statements for its primary decisions (choose the best answer)?

Government / taxing authorities

According to the FMI materials, what is the most typical approach for projecting the individual working-capital line items into future periods (choose the best answer)?

Use “days” assumptions (e.g., DSO/DIO/DPO) to compute the related account balances

Which of the following would NOT be classified as a current asset (choose the best answer)?

Accrued wages

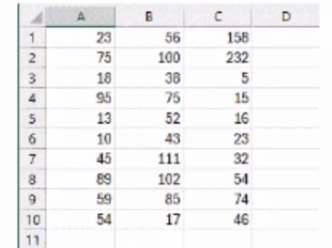

Using the provided view, what result will the Excel formula = MAX(A3:B10,109,75,C3:C6) return (select the most appropriate

response)?

111

According to FMI’s modeling standards, a well-built debt schedule should capture which of the following (choose the best answer)?

Both debt and cash (so the model can track net debt and interest implications)

Items that appear as depreciation expense on the income statement (choose the best answer):

Are tied to items that were previously capitalized on the balance sheet

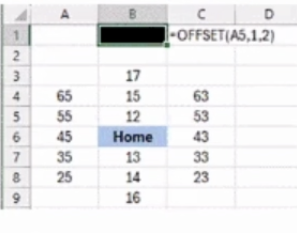

Using the provided view, what result will be returned in cell B1 based on the OFFSET function. The formula in B1 is visible in cell

C1 (select the most appropriate response):

43

According to the FMI materials, when designing a model to capture changes in balance sheet accounts, the structure should show (choose the best answer):

Beginning balances, the change during the period, and ending balances

Why is forecasting revenue using a price × volume build typically preferred over applying a single top-line growth rate (choose the best answer)?

It allows you to better explain and defend the key drivers behind the forecast

According to the FMI content and materials, including a revolver (credit facility) schedule in a model is optional.

B. False

According to the FMI materials, setting “Days In” assumptions (e.g., DSO/DIO/DPO) for future periods is typically best described as (choose the best answer):

The modeler’s judgment based on historical performance and forward-looking expectations

Which method is generally the best practice for centering a title across the width of a worksheet without creating merge-related issues (choose the best answer)?

Use Center Across Selection (Format Cells → Alignment)