tax accting

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

45 Terms

What are the characteristics of a tax?

Required to pay, imposed by governmental agency, and not tied to the benefit of an individual

What are the components of the tax calculation?

Tax base x tax rate = amt of tax

Understand progressive, regressive, and proportional tax rate structures

income increase = tax increases

understand regressive tax rate structures

stopping or going back

understand proportional tax rate structures

flat tax on corporations

Know how to calculate federal tax liability based on taxable income.

Filing status income bracket

Know how to calculate marginal tax rate, average tax rate for what’s going to happen to their marginal tax rate if we add 50,000

figure out two taxes based on inceome of each one then Change in tax/change in income

what is this couple’s current marginal rate

you find what bracket they are on the tax bracket

What are the criteria for federal taxation when it comes to sufficiency

generate needed rev

What are the criteria for federal taxation when it comes to equity

All the taxes need to be fair to everyone

What are the criteria for federal taxation when it comes to certainly

when and where the taxes are due

What are the criteria for federal taxation when it comes to convenience

the fact that your job sends in the withholding

what are the criteria for federal taxation when it comes to economy

tax situation is part of the economy and try not to spend a lot of money collecting the taxes

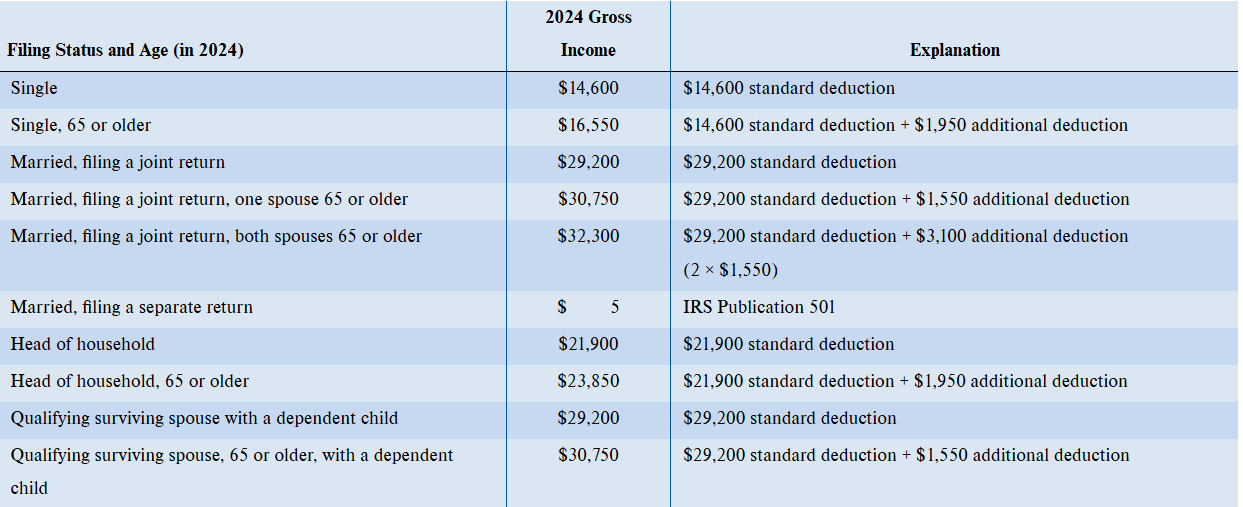

Understand filing minimum requirements.

Depend on filing status, age, and gross income

list all the standard deductions

What are the rules for the statute of limitations on tax returns

Typical is 3 years and is begins the later of the filing date or original due date

if you underestimate your gross income by 25% then your statute of limitations extends to

6 Years

what if you neglect to include a large portion of your self-employed taxes then how long do you have to file your tax

indefinitely

What are the three types of IRS examinations?

Correspondence, Office, & Field

what is the irs Correspondence examination

letters or notices that the irs sends to you about your federal tax (most common and easy)

what is the irs correspondence examination - Office

come into the irs office and send you a list of things you need to bring in

what is the irs examination - Field

they visit someone’s house

What are some of the tools that the IRS uses for selecting returns for audits?

Document Perfect program, Information, & DIF discrimination

Document Perfect program

a program under which all tax returns are checked for mathematical and tax calculation errors.

What can help a tax preparer avoid IRS penalty on a tax return position?

As long as you have a substantial authority, you’ll be fine (One of the main authorities)

Information

a program that compares the taxpayer’s tax return to information submitted to the IRS from other taxpayers (e.g., banks, employers, mutual funds, brokerage companies, mortgage companies). Information matched includes items such as wages

DIF discrimination

looks at returns of similar income levels to set up a norm for that level

What are “for” AGI deductions?

any deduction that went above the line on a 1040 that went above adjusted gross income

EX: property taxes on a real estate

what are the “from” AGI deductions?

below the line (from AGI deductions or deductions subtracted from AGI to calculate taxable income.

EX: standard deduction

What is the first different character of income?

Ordinary income

ordinary income

earned through wages and taxed on the tax tables

what is the second different character form of income

Capital income

Capital income

gain on loss when sales of investments of assets and qualified dividends

what are the four requirements a qualifying child must meet

relationship test, Age test, Residency, Support, and the tie breaker is agi for claiming child

what are the four requirements a qualifying relative must meet

Relative – relationship

Support – more than 6 months if realitive and more than yr if child

Gross income – less than 5,500

Support for qualifying child must meet

provide more than half than what the child supports for themselves

Residency for qualifying child must meet

same principal residence as tax filer for more than HALF the year

age test for qualifying child must meet

under 19 or under 24 as a full-time student

relationship test for qualifying child must meet

Child, nieces’ nephews, adopted children, grandchild

what are the three requirements a qualifying relative must meet

A qualifying relative is a person who is not a qualifying child and satisfies (1) a relationship test, (2) a support test, and (3) a gross income test

relationship test for qualifying relative must meet

related to you

support test for qualifying relative must meet

more than 6 months if relative and more than yr. if a member of the household

Gross income test for qualifying relative must meet

less than 5,500

What is the treatment of long term and short-term gains and losses?

Gains can be offset by loss and deduct 3,000

EX: 6000 in gains and 10,000 in loss so net out the 6000 of loss and add 3000 to make 9000 in loss and then carry the 1000 for next year

Understand the requirements for each of the filing statuses.

Single

Head of house

Married filing joint

Married filing sep

Qualified widower