Intro to Economic Final

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

Impact of negative/positive demand shocks on aggregate output and price (which line shifts)

AD curve shifts left (negative) or right (poitive)

What happens to SRAS if there is a positive of negative shock on production cost

Shifts left or right

Impacts of fiscal policy in AS-AD framework

fiscal policy = government spending. Affects AD curve

Impacts of monetary policy in AS-AD framework (first money supply then affect on as-ad)

manages supply of money or interest rates (demand)

distinguish short run and long run effects. How does economy move back to long run level

adjust SRAS (eg lowering wages)

basics of labor market statistics - labor force, employed, unemployed, and out of labor force

labor force - population over 16 employed or looking for work

employed - percent of labor force with job

unemployed - percent without jobs

out of labor force - not looking for jobs

why has female labor market participation increased over the last several decades

• Education

• Technology

• Structural change

• International trade

• Tax allowance

• Contraceptive pills

why is unemployment under-reported

discouraged workers - would work but are too discouraged to look

marginally attached workers - would like to have a job but are not currently looking

underemployed - are employed but would work more if given the opportunity

why does unemployment exist (perspective of labor demand and supply)

Unemployment = Demand for jobs (positions) < Supply for jobs (workers)

structural - mismatch between the jobs that are available and the people looking for work (Globalization, Technology progress)

cyclical - short run fluctuations (covid)

frictional - transition between jobs

Costs and benefits of minimum wage, unemployment benefits, and unions

minimum wage - can cause unemployment, higher quantity of labor supplied

unemployment benefits - reduces hardship of unemployment, increases frictional unemployment

unions - Inefficient allocation of workers, Inequitable compensation across workers, Necessary antidote to the market power of the firms that hire workers, Keep a happy and productive workforce

inflation

a sustained increase in the general price level of goods and services in an economy, leading to a decrease in the purchasing power of money

how does monetary policy influence inflation rate

adjusting the money supply and interest rates to influence economic activity and ultimately control the pace of price increases (AD rises → price rises)

real interest rate formula

Real interest rate = nominal interest rate - inflation rate (CPI or GDP deflator)

hyperinflation (why, how to prevent, why is central bank independent)

more than 50% inflation per month

Austria, Hungary, Germany, and Poland in 1920s

Prices rise when the government prints too much money

short run and long run phillips curve using AS-AD framework (demand shock → price and output change → unemployment rate)

inflation and unemployment. inflation is Y axis of money supply

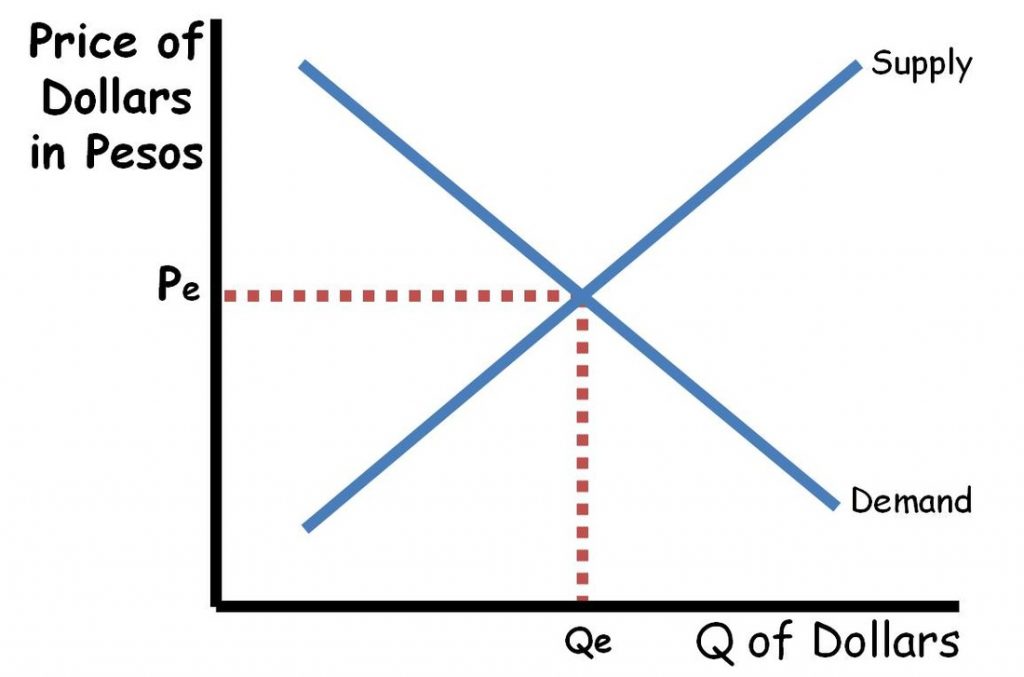

exchange rate

the price of one currency expressed in terms of another

Law of one price

identical goods should have the same price in different markets

purchasing power parity

a theory that compares the prices of goods and services in different countries, allowing for a more accurate comparison of their economies and living standards

big mac index (currency under or overvalued)

compares the prices of a McDonald's Big Mac in various countries to gauge the relative value of their currencies (PPP)

foreign exchange market using demand-supply framework

supply and demand of currency

what does currency appreciation/depreciation mean

Currency appreciation - a currency increases in value relative to other currencies

currency depreciation - a currency decreases in value relative to other currencies

how does monetary policy affect exchange rate

interest rate changes, currency is either more or less demanded

Expansionary monetary policy (increasing the money supply) generally leads to a depreciation of the domestic currency, while contractionary policy (decreasing the money supply) can cause it to appreciate.