ACCTG 211: Chpt. 8- Reporting and Analyzing Receivables- midterm portion

1/18

Earn XP

Description and Tags

* only includes up to what was covered in midterm

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

Accounts Receivable (A/R)

Amounts due to a business from its customers or other entities

Expected to be collected in cash

Frequently classified as Accounts receivable, Notes receivable, other receivables usually in current assets section.

Revenue recognition requires the receivable be recorded when the sale occurs or service is provided.

Journal entry:

DR Accounts receivable $100

CR Sales $100

Receivable is reduced when cash is collected or the product is returned by the customer.

Accounts Receivable Subsidiary Ledger (“sub ledger”)

*not doing these in this course!

Is a group of accounts that share a common characteristic (i.e. they are all receivable accounts)

The subsidiary ledger for accounts receivable provides the details that support the total balance for accounts receivable in the general ledger

The single accounts receivable account in the general ledger is the control account

A/R Terms

Usually has collection policies associated with it (due in 30, 45, or 60 days – usually depends on type of business; other businesses may negotiate longer terms; depending on agreement/arrangement)

Usually listed at Net 30

There are also sales discounts that are used in certain industries – usually listed as 2/10 net 30 or something similar. (interpreted as 2% discount if paid within 10 days, otherwise the full amount is due in 30 days)

Example 1: Company A provides services to Company B. The total is $100 on account (on credit). The terms of credit (accounts receivable) are 1/10 net 45. How is the sale recorded in the books of Company A?

(recorded as if receiving the full amount of money)

DR A/R $100

CR service revenue $100

Example 2: Company A provides services to Company B. The total is $100 on account (on credit). The terms of credit (accounts receivable) are 1/10 net 45. Assume Company B pays on day 45 – how is this receipt recorded in Company A’s books?

DR cash $100

CR A/R $100

Example 3: Company A provides services to Company B. The total is $100 on account (on credit). The terms of credit (accounts receivable) are 1/10 net 45. Ignoring the previous example, Assume Company B pays on day 10 – how is this receipt recorded in Company A’s books?

(1% discount)

DR cash (100-1) $99

CR A/R $100

DR sales discount $1

*remember that there is NO account that’s just “discounts”

Interest Revenue

Some retailers add interest to accounts receivable accounts that are not paid within a specified time period.

Interest revenue is reported as non‐operating income on the income statement.

Journal Entry:

DR Accounts receivable $10

CR Interest revenue (or interest income) $10

Uncollectible Accounts

Some accounts receivable become uncollectible (some people either just don’t pay, file bankruptcy, “disappear”, just don’t pay, etc.)

Losses from these uncollectible accounts are debited to an account called Bad Debts Expense or Credit Losses.

Bad debts expense should be recognized in the same period as the related sales revenue is generated (“matched”)

Bad debts expense is reported as an operating expense.

Dealing with Uncollectible Accounts / Bad Debts: Method 1: DIrect Write-off

NOT TESTED

*doesn’t follow accounting principles

Write off accounts it becomes known that they are uncollectible

Easy

Not GAAP

Violates Matching Principle

Accurate

*does not include an allowance for doubtful accounts

Dealing with Uncollectible Accounts / Bad Debts: Method 2: Allowance Method

WE USE THIS

Set up an allowance for accounts (contra-account) that could possible be uncollectible

Not as easy

Follows GAAP

Matches Expenses with Revenues

Requires Estimation

Estimating the Allowance

Most companies use the percentage of receivables basis to determine the allowance

Estimate what percentage of receivables are likely to be uncollectible

Apply this percentage to total receivables, or

Apply this percentage to receivables classified according to the length of time they have been outstanding (called aging the accounts receivable).

Once the appropriate estimate for uncollectible accounts is determined, an adjusting entry can be recorded.

The amount of the adjusting entry is the difference between the required balance and the existing balance in the allowance account

Methods for Determining Allowance for Doubtful Accounts or Allowance for Expected Credit Losses

percentage of receivables

aging method

^will be given/told these amounts on a exam

Regularly referred to as AFDA (allowance for doubtful accounts)

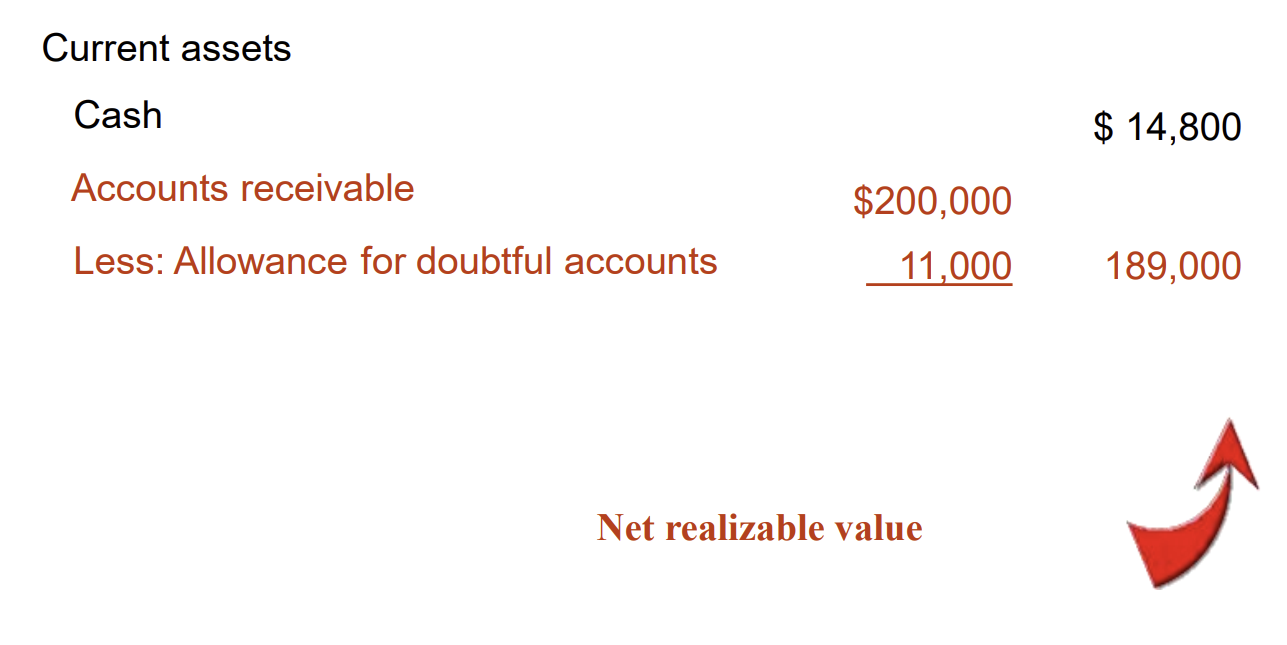

Contra Account to A/R (should be a normal CREDIT balance)

On the balance sheet right after Accounts Receivable (or netted with Accounts Receivable).

Features of Allowance Method (3)

Recording estimated uncollectible accounts

Any increase to the allowance is recorded as bad debts expense

Recording the write-off of an uncollectible account

Actual accounts are written off when they are determined to be uncollectible.

This write-off reduces the allowance.

Recording the recovery of an uncollectible account

If a written-off account is later collected, the writeoff is reversed and the collection recorded.

Example 1: Bad Debt- Company D has Accounts Receivable of $200,000 which remains uncollected. According to the credit manager $11,000 will be uncollectible. AFDA is currently has a $0 credit balance (nothing currently in the account). What is the journal entry that should be recorded?

DR bad debt expense $11,000

CR AFDA $11,000

*note: bad debt expense is only adjusted when adjusting finiancial statements (otherwise don’t touch)

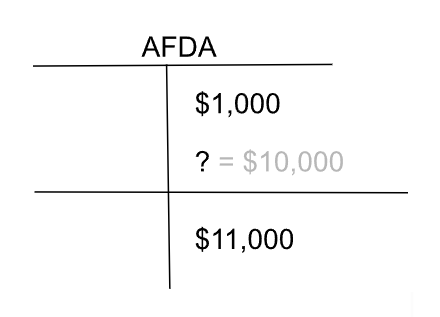

Example 2: Bad Debt- Company D has Accounts Receivable of $200,000 which remains uncollected. According to the credit manager $11,000 will be uncollectible. AFDA is currently has a $1,000 credit balance. What is the journal entry that should be recorded?

DR bad debt expense $10,000

CR AFDA $10,000

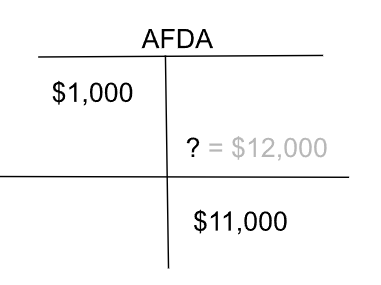

Example 3: Bad Debt- Company D has Accounts Receivable of $200,000 which remains uncollected. According to the credit manager $11,000 will be uncollectible. AFDA is currently has a $1,000 debit balance. What is the journal entry that should be recorded?

DR bad debt expense $12,000

CR AFDA $12,000

Company D Balance Sheet (partial)

Example 4: Bad Debt-

Company D has determined that Company F will not be able to pay their outstanding AR of $650 as they have gone bankrupt. Record this journal entry.

Six (6) months after writing off Company F’s amount a settlement has been received for $300. Record the entry for this deposit of $300.

DR AFDA (write off here) $650

CR A/R $650

DR cash $300

CR AFDA (put back here) $300

When an account is written off (you have determined that it is definitely uncollectible) under the allowance method…

Allowance for Doubtful Accounts is debited

(Bad Debt Expense is only adjusted when you are setting up the year-end accrual amount via AFDA amount, you don’t do it as you go along!)