Chapter 7: Flexible Budgets, Direct-Cost Variances, and Management Control

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

29 Terms

Predetermined manufacturing overhead rate

budgeted manufacturing overhead/ budgeted allocation base

Flexible Budget formula

AO x SP x SQ

Actual Budget formula

AQ X AP

Middle column formula

AQ x SP

standard costing

targets or standards are established for direct material and direct labor. the standard costs are recorded in the accounting system. actual price and usage amounts are compared to the standard and variances are recorded.

- apply costs on the standard units, not actual

standard costing formula

actual output x standard quantity (of the input) x standard cost.

what we think it should cost!

static (master) budget

based on the output planned at the start of the budget period

variance

difference between an actual and an expected (budgeted) amountma

management by exception

the practice of focusing attention on areas not operating as expected (budgeted)

static budget variances

the difference between the actual result and the corresponding amount in the static budget

static budget formula

budgeted output x SP

favorable variance

increases operating income

unfavorable variance

decreases operating income

flexible budget

budget that is adjusted (flexed) to recognize the actual output level

- proportionately increase variable costs, keep fixed costs the same

- prepared at the end of the period

- it is what we would have prepared if we had known the actual output

budgeted contribution margin per unit

budgeted selling price - budgeted fixed cost per unit. "fixed" from budgeted amount to actual amount

1. identify actual output

2. calculate flexible budget for revenue based on budgeted selling price and actual quantity

3. calculate flexible budget for costs based on budgeted variable cost per unit, actual quantity, and budgeted fixed costs

sales-volume variance

difference between flexible budget and static budget amounts

flexible budget variance

difference between actual and flexible budget amount. much better measure than static budget variance

selling price variance

(actual selling - budgeted) x actual units

variance for variable costs

(actual variable costs/unit - budgeted) x actual units

price variance formula

(actual price of input - budgeted price of input) x actual quantity of input

efficiency variance formula

(actual quantity of input used - budgeted quantity of input allowed for actual output) x budgeted price of input

WIP

we cost at standard cost. allocation will always be SP x SQ x AO (standard cost x actual output)

- we will need to record variances from standard using variance accounts (otherwise JEs won't balance)

- variance accounts are generally closed into cost of goods sold at the end of the period, if material

- useful to report variances on COGS statement (for internal use)

JE to record purchase of materials

DR direct materials

CR accounts payable

DR/CR DM price variance

JE to record use of materials

DR work in process

CR direct materials

DR/CR DM efficiency variance

JE to record direct labor

DR work in process

CR wages payable

DR/CR DL price variance

DR/CR DL efficiency variance

JE to write off variances to COGS

DR/CR COGS

DR/CR DM price variance

DR/CR DM efficiency variance

DR/CR DL price variance

DR/CR FL efficiency variance

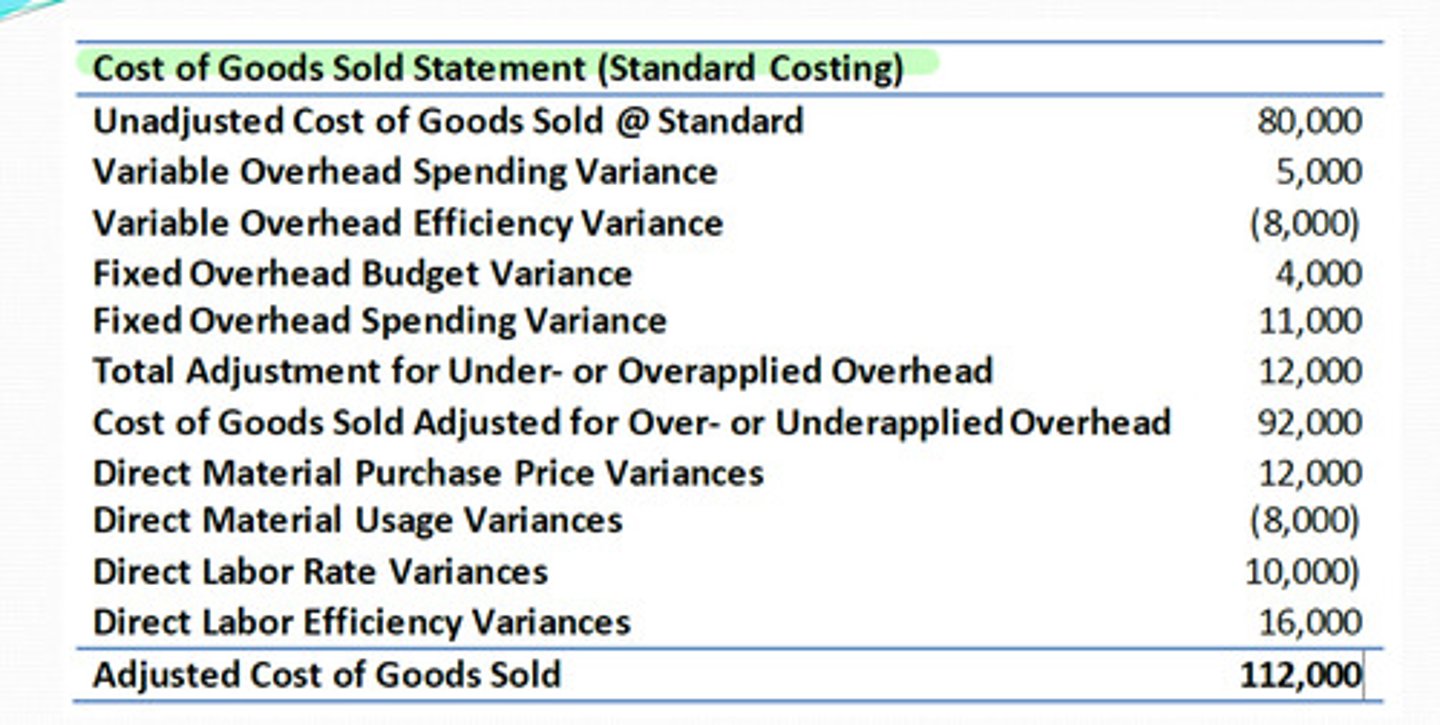

cost of goods sold statement

variances

- price and efficiency variances provide feedback to initiate corrective actions (management by exception)

- standards are used to control costs

- part of a continuous improvement program

important note on variances

it is important to note that a favorable variance is not necessarily a good thing, do not assume favorable = good!