OCR GCSE Economics - Paper 1

1/112

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

113 Terms

consumer

a person or organisation that consumers/buys a good or service

producer

a person, company or country that makes, grows or supplies goods or services

government

a political authority that decides how a country is run, manages operations and allocates recourses

goods

tangible products - can be touched or seen

services

intangible product - can not be touched or seen

production

the total output of goods and services produced by a firm in a given time period

factors of production

the resources in an economy that can be used to make goods or services: CELL

Capital

the fop that relates to all human and man made aid to production e.g. machines, tools

Enterprise

the fop that takes a risk in organising the three other fops e.g. a business tycoon

Land

refers to the use of natural resources in the production process (free gifts of nature)

can be above or below land and from the sea

Labour

refers any human effort or resources into the production process

can be physical or intellectual e.g. workers, engineers

what is the role of the government?

to set laws, tax and to spend money on infrastructure and in an economy

basic economic problem

how to best allocate scarce resources to satisfy unlimited wants

need

something you have to have to survive

needs are limited

e.g. water, food, shelter, air

want

something you would like to have but not needed to survive

scarce resources

an insufficient amount of a resource to satisfy all wants

opportunity cost

the next best alternative given up when making a choice

economic choice

an option for the use of selected scarce resources

economic sustainability

the best use of resources in order to create responsible growth and development, now and into the future

social sustainability

the impact of development or growth that promotes an improvement in the quality of life for all, now and into the future

environmental sustainability

the impact of development or growth where the effect on the environment is small and possible to manage, now and into the future

market

a way of bringing together buyers and sells to buy and sell goods or services

market economy

an economy in which scarce resources are allocated by the forces of supply and demand

product market

a market in which finished goods and services are offered to consumers, producers and the public sector

factor market

a market in which the factors of production are bought and sold

primary sector

the direct use of natural resources, such as the extraction of basic materials from the land and sea

secondary sector

all activities in an economy that are concerned in manufacturing, assembling and construction (other 3 fops added to land)

tertiary sector

all activities in an economy that involve the idea of a service

examples of primary sector

fishing, mining, agriculture, fracking, foresty

example of secondary sector

packaging, building a car, constructing a table

examples of tertiary sector

hairdressing, babysitting, taxi service, receptionist

specialisation

The process by which individuals, firms, regions and whole economies concentrate on producing those products that they are best at producing

benefits and costs of specialisation on producers

benefits: more efficient, larger output, higher productivity, bigger market, EoS

costs: movement of workers (they get bored), dependancy on all parts of production working, possible failure of exchange can slow down process

benefits and costs of specialisation on workers

benefits: increased skill leads to higher pay, can do what they are best at

costs: may get bored, not able to easily change jobs

benefits and costs of specialisation for regions

benefits: jobs for residents, use of local resources, infrastructure development

costs: resource exhaustion, risk of fall in demand could lead to the economy collapsing, loss of advantage (causes job loss)

benefits and costs of specialisation for countries

benefits: economies of scale, more jobs, more international trade, greater tax revenue

costs: over exploitation of resources, dependancy on a particular product, unemployment (industries failing fire people)

demand

the willingness and ability to buy goods or services at a given time at a given price

utility

the level of satisfaction we get from a good or service

law of demand

as price increases, quantity demanded decreases

(inverse relationship)

substitutes

goods and services that can be used in place of one another

e.g coke and pepsi

compliments

goods or services that are usually bought together

e.g. salt and pepper

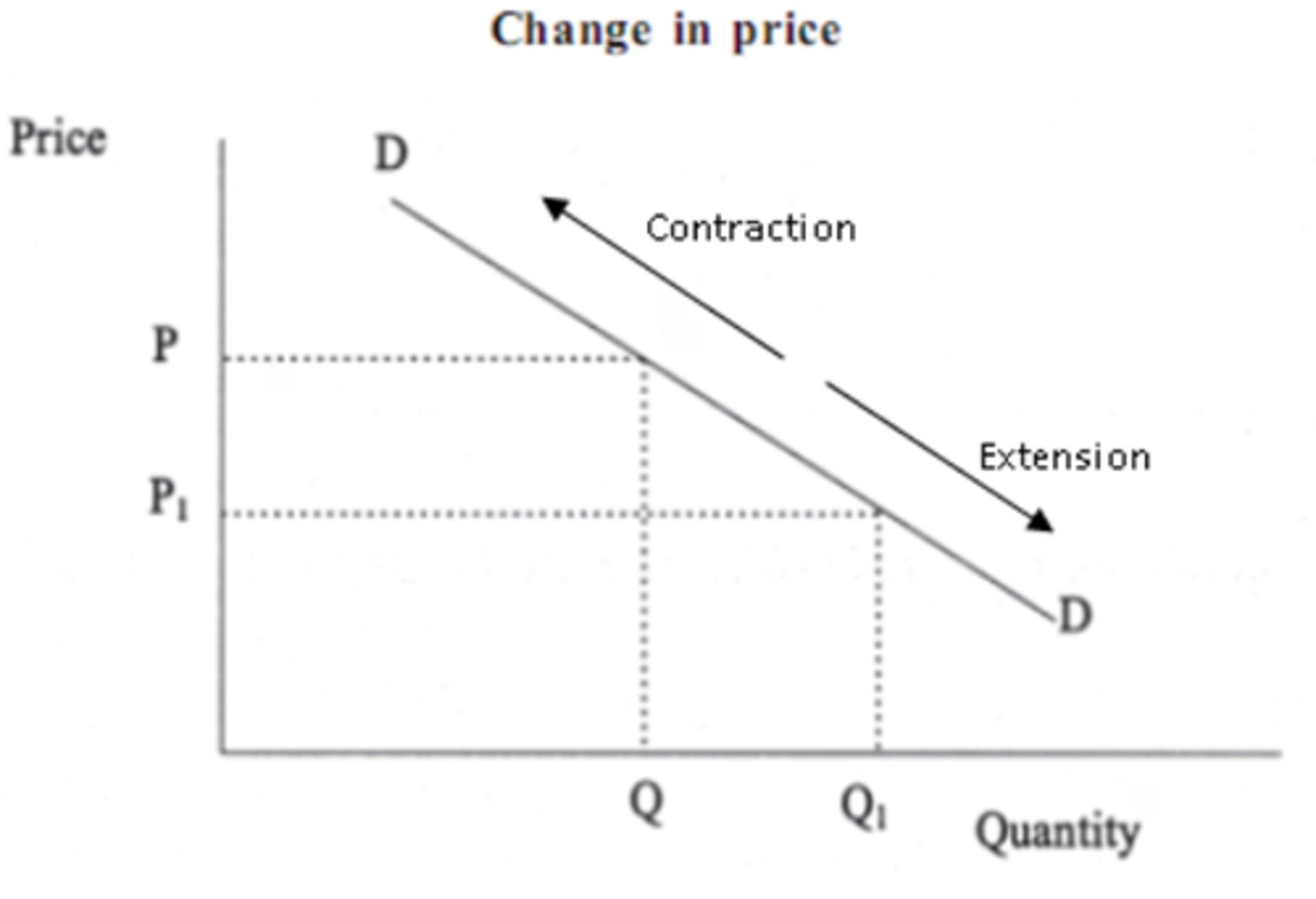

expansion and contraction of demand

expansion - more demand

contraction - less demand

reasons for shifts in demand

Shift in demand (changes in)

Population

Related products

Income

Tastes and fashion

Economic expectations

PED

the responsiveness of the quantity demanded to a change in price

Elastic demand

when the percentage change of quantity demanded is greater than the percentage change in price

inelastic demand

when the percentage change in quantity demanded is less than the percentage change in price

examples of goods with elastic demand

takeaway pizza, chocolate bar, luxury items

examples of good with inelastic demand

cigarettes, petrol, gas, water

PED equation

% change in quantity demanded /

% change in price

What factors determine PED?

Significance / brand loyalty

Percentage of income

Luxury

Addictive or habit forming

Time taken to find an alternative

Substitutes

inelastic and elastic PED values

inelastic = above -1

e.g. -0.5

elastic = below -1

e.g -2.5

always negative and unitary is -1

importance of PED for producers

HAD

helps maximise revenue

allows them guess results after a change in price

decision impact about supply

importance of PED for consumers

allows them to make choices if substitutes are available

if the product is inelastic there may be high tax and price rises

consumers PED depends on factors like season/weather

supply

the willingness and ability of a producer to produce/supply a good or service at a given price at a given time

individual supply

the supply of a product from an individual producer at each price

market supply

the total supply of a good or service (all the individual producers' supply)

law of supply

as price increases, supply will also increase

(direct/positive relationship)

reasons for shift in supply

Productivity

Indirect tax

Number of firms

Technology

Subsidies

Weather and climate

Cost of production

price elasticity of supply

the responsiveness of quantity supplied as a result of a change in price

elastic supply

when the percentage change in quantity supplied is greater than the percentage change in price

inelastic supply

when the percentage change in quantity supplied is less then the percentage change in price

what determines PES?

Capacity spare

Level of stock

Ability to relocate resources (factor substitution)

Production time

PES values

inelastic PES = less than 1

e.g. 0.5

unitary PES = -1

elastic PES = more than 1

e.g 2.5

importance of PES for producers

prefer elastic supply - want to respond to price change

very inelastic supply means price depends on demand

importance of PES for consumers

if the product is inelastic prices are likely to be higher and the item harder to get

elastic supply allows consumers to buy more (more stock)

price

the sum of money you have to pay for a good or service

determined by the interaction of supply and demand

allocation of resources

how scarce resources are distributed among producers and how scarce goods and services are distributed among consumers

market forces

factors the determine the price level and availability of goods and services in an economy without the intervention from the government

competition

where different firms are trying to sell a similar product to consumers

perfect competition

when all consumers and producers have the same influence in the market - one is not more powerful than the other

e.g commodity markets as they can only compete on price

monopoly

a sole producer of a good or service

they have complete market control

e.g royal mail

oligopoly

where a small number of firms have the large majority of market share

(top five control over 50%)

e.g supermarkets

examples of non-price competition

quality, customer service, delivery, marketing, brand name, research (R&D) and sales services like BOGOF

impacts of competition on price

price will decrease as they want customers

supply would increase (shift out) as they want to make back the lost sales

depends on PED of product

Prices may rise as marketing costs need to be payed and new technology is expensive

If a producer is first in a market they can set the price

impacts of competition on consumers

pros:

lower price of goods, higher quality, more choice in the market, consumer sovereignty, higher standard of living

cons:

may buy things they don't need, get addicted, hidden costs (cheap airlines), harmful items may be used to speed up production like pesticides which could harm consumers

impacts of competition on producers

pros:

cost cutting, higher profit, increased efficiency, more innovative ideas

cons:

may loose customers/profit due to the competition from other firms, short term investments, replace workers with technology as they are more efficient but it costs money

profit

the money a producer is left with after all costs are paid

total revenue - total cost

productivity

one measure of the degree of efficiency of the factors of production in the production process

output / input

role of individuals as producers

producers of non-market services like cleaning or babysitting (part time)

self-employed producers that do enter the market like plumbers or electricians (keep profit)

role of firms as producers

may be small businesses or MNCs (private sector)

just want to make a profit

may sell locally or globally

small firms have competition, larger ones may be monopolies or oligopolies

role of government as producers

supply defence/police - couldn't be supplied by private sector as not everyone would want to pay as they don't directly consume it (payed via tax)

education/health - wants everyone to have access to these services, but you can pay to go private

railways / resources / telecoms - better to be run by the state, but can also be provided privately

benefits of high productivity

lower average costs, greater profits, increasing economies of scale, more money for investments, more growth

costs of high productivity

could cause unemployment as workers are replaced with machines to be more efficient, greater international competitiveness could lead GDP to fall, diseconomies of scale if cost rises, loss of market share, environmental problems

total cost

all the costs, both fixed and variable added together

average cost

the cost of producing one unit

total cost / quantity

total revenue

the total income of a firm from the sale of all its goods and services

average revenue

the revenue per unit sold

total revenue / quantity

economies of scale

the cost advantages a firm can gain when increasing production scale, leading to a fall in average cost

examples of internal economies of scale

bulk-buying - large quantities can offer discounts

managerial - more specialised workers = efficient

technical - better equipment = more efficient

division of labour - smaller specialised areas leads to greater efficiency

financial - borrow money with less interest

risk-bearing - offer a wide range of products

marketing - promote products with big budget

R & D - own research and development departments

examples of external economies of scale

concentration of firms - suppliers of parts may be near the main producers (quicker production time)

education - local unis may offer courses which suit the needs of the firm

location - good reputation = more firms

transport - better and more efficient will lower costs

labour market

Where workers sell their labour and employers buy the labour: it consists of households supply of labour and firms demand for labour.

labour demand

how many workers an employer is willing and able to hire at the given wage rate at a given time period

labour supply

the number of hours people are will to work at a given wage rate at a given time

factors effecting labour demand

state of economy

increased demand

wage rates

real wages

productivity of labour

profitability of firms

factors effecting labour supply

wage rates, other payments (like over-time), size of working population, barriers to entry (qualifications), education and non-monetary factors (working conditions or promotions)

gross pay

the amount of money that an employee earns before any deductions are made

net pay

the amount of money an employee is left with after any deductions from gross pay

income tax

a tax levied on personal income

national insurance

a contribution payed by workers/employers towards the cost of state benefits

pension

a fixed amount payed to at regular intervals to a person (usually retired) or to their surviving dependants