macro lecture 05 (fiscal policy & financial intermediaries)

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Fiscal Policy & Output Intro

Fiscal & Aggregate Economy

Fiscal Policy Diagram (changed in gov spending)

We start at output 𝑌! with the function 𝑃𝐴𝐸(𝐺!) intercepting the 45° line

• In this example, 𝑌! is a contractionary gap because we have a potential output at

𝑌∗

o i.e. PAE is less than 𝑌∗

• To reach 𝑌∗ we increase government expenditure, so 𝐺# > 𝐺! , shifting PAE

upwards

• This gives us a new function 𝑃𝐴𝐸(𝐺#)

o Everything else has remained constant, only government expenditure has

increased

• The new function 𝑃𝐴𝐸(𝐺#) has given us a new equilibrium 𝑌# which is a lot closer

to the potential output 𝑌∗ than 𝑌!

o Note: if we say the increase in government expenditure is by $100,

because of the multiplier eTect, there’s a direct increase in PAE which is

illustrated by the shift upwards

o However, movement towards 𝑌# is by the indirect increase in the induce

part of consumption, increasing output through the multiplier eTect

• We are now closer to potential output

• Because of Okun’s Law, this increase in output/economic activity would lead to

firms hiring more people and decrease the unemployment rate

• With the expansionary fiscal policy, GDP increases and unemployment

decreases

Fiscal Stimulus: Increase G or Decrease T?

Limitations of Fiscal Policy in Demand Management

Empirical Limitations of Fiscal

Fiscal Policy: Automatic Stabalisers

Automatic stabilizers mean that the economy adjusts naturally through built-in fiscal mechanisms, rather than requiring active government intervention. These stabilizers, such as progressive tax systems and transfer payments (e.g., unemployment benefits), automatically respond to economic fluctuations:

During a boom, tax revenues increase while government spending on welfare decreases, slowing down excessive growth.

During a recession, tax revenues decrease while government spending on welfare increases, supporting demand and preventing a deeper downturn.

Since these mechanisms operate automatically without new government policies or discretionary actions, they help stabilize the economy in a predictable way.

Fiscal Policy and Debt

Role of Financial Markets in the Macroeconomy

Financial Intermediaries

Financial Markets

Benefits of Financial Intermediation

Role of Monet

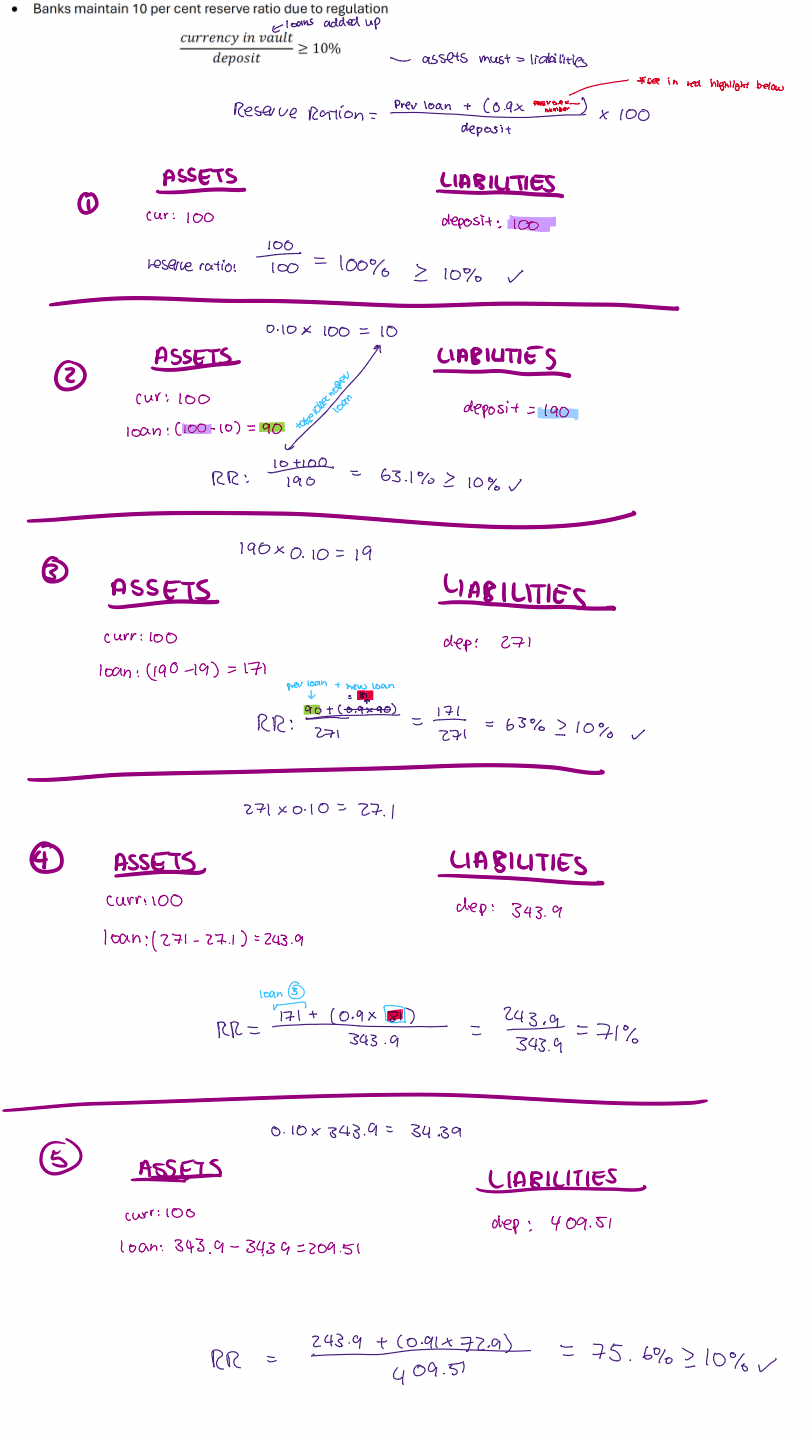

Money Multiplier

Money Multiplier Example

Quantity Theory of Money