1B03 Intro to Microeconomics Midterm #1

1/74

Earn XP

Description and Tags

Chapters 1 - 4

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

75 Terms

What does economics study?

The study of human behaviour and choice

Economics asks the questions such as:

What choices do people make?

What factors influence those choices

What are the consequences of those choices for the person making them?

The 3 perspectives of Economics

Consumers

Managers

Government Policymakers

Assumptions about human behaviour

People are rational

People respond to incentives

People use cost-benefit analysis

People are rational (explanation)

People act on self-interest

Make decisions that they believe will make them happy/better off

People respond to incentives (explanation).

When an option becomes more attractive, people are more likely to select it

For example: If a Uni. offers a student a scholarship, they are more likely to select that offer compared to another uni that does not offer a scholarship.

People use cost-benefit analysis (explanation)

People compare marginal benefit (MB) and marginal cost (MC)

Marginal Benefit (MB)

The benefit you receive from making a decision

For example, eating a steak has nutritional value, making it healthy for your body

Marginal Cost (MC)

The cost you must pay for making a decision

For example, that same steak (that is nutritious and healthy) still costs money

Net benefit

Marginal Benefit - Marginal Cost

Consumers will consider the option with a positive net benefit

Positive Net Benefit: MB > MC

Negative Net Benefit: MB < MC

The economic problem

People have unlimited wants, but societies have limited resources

Societies face trade-offs

We must decide how to spend our resources (money, time and materials) to get as much as we can from the stuff we want the most

The 3 main economic questions

What goods/services will be produced?

How will the goods and services be produced?

Who will receive the goods and services produced?

3 Economic models/markets

Market Economy

Centrally-Planned economy (Command)

Mixed Economies

Market Economy Characteristics

Foster innovation and entrepreneurship

People are free to choose, saving them money on taxes that the government would allocate for running the economy

However, it generates a substantial amount of inequality

Resources are not allocated fairly society is underproduced

Country examples: United States, UK and Japan

Centrally-Planned Economy Characteristics

Govn. appointed central planners make decisions for the economy

Rationing reduces inequality.

If there’s an economic emergency, they are able to adjust and coordinate

However, there’s a lack of innovation (no profit motive, so they aren’t striving for innovation)

Production is usally not efficient

Country examples: Cuba and North Korea

Mixed Economy Characteristics

Combines both market economies and central planning

Private sector: Businesses owned by individuals

Government tends to influence and regulate them

Public sector: Government provides goods/services directly

Attempt to obtain the advantages of both free markets and central planning, while avoiding the disadvantages of either type

Country example: Canada and most developing countries

Positive analysis

Facts or logic —> Focused on what “is” and “could be”

More analytical and provides evidence (can be proven true or false)

Normative Analysis

Value judgements that are subjective and based on personal opinions

Cannot be proved true or false

Production Possibilities (PP)

The total quantity of goods/services our economy can produce

Since our resources are limited, need to be strategic with how our resources can be distributed across the production of multiple goods

Economic rational

How we specialize in some sectors, and import other goods

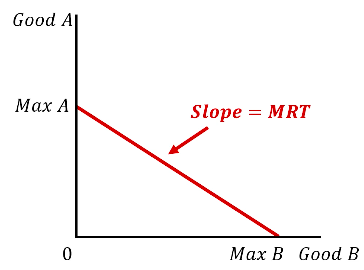

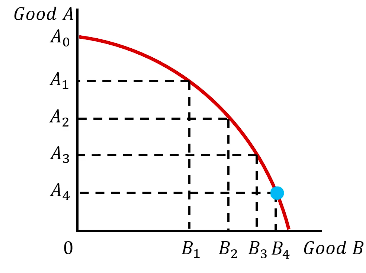

Example of PP graph

Any point beyond the PPF cannot be produced

Unemployment is an example of this as its a waste of resources

Opportunity Set: All combinations of Good A and Good B are possible with current resources

Opportunity Cost

The benefit that could be received from the next best alternative

Example: Spending time with friends on a Friday night in comparison to studying means you'll be less prepared for the test that could've been spent studying

Marginal Rate of Transformation (MRT)

The rate at which we can switch between good a and good b

Diminishing Returns

The more resources devoted to an activity, the less production additional resources become

Could hit a point where adding further resources gives us no additional benefit

The presence of diminishing returns means the ppf becomes bowed instead of linear

Absolute Advantage

When one person, firm or country can produce more in total than another using the same resources

Comparative Advantage

When one person, firm or country has a lower opportunity cost of producing a good

Able to produce the good more efficiently than others

This is the basis of specialization and trade

Types of Markets

Output market

Factor markets

The labour market

The capital market

Output market

Firms produce good/services, which they provide to customers

Can be defined as

Broadly (classes of goods): Such as washing machines and refridgerators

Narrowly (Specific goods): Such as fast food burger places and seafood houses

Operate for profit

Types of customers; B2C, B2B or B2G

Factor Market - The Labour market

Households sell their time and efforts in exchange for salaries/wages

Firms use this time and effort as an input in the production process

Amt. of money earned depends on education level, skill and experience

Factor Market - The Capital Market

Households loan their savings to firms so that firms can purchase PPE

In return, firms pay interest and will repay the loan

Households also loan their savings to:

Other households that need the money to pay for purchases

Governments when they spend more than they collect in tax revenue

Supply and Demand Framework

Prices are determined by the action of action of:

Suppliers: Who offer goods and services

Consumers: Who wish to buy them

Quantitty demanded (QD)

The amt. of a good/service consumers are willing to buy at a given price

Law of Demand

An increase in price —> Reduces QD

A decrease in price —> Increases QD

Indirect relationship

-What effects cause the demand curve to be downward sloping

The substitution effect

The Income effect

Substitution effect:

When the price of one good rises, consumers switch and purchase another similar good

(Vice versa) When the price of one good falls, consumers will switch and buy this good instea

Income effect:

When the price of a good rises, consumers cannot afford to buy as much as before

When the price of a good falls, consumers can afford to buy more

Change in Quantity Demanded

There is movement along the curve due to a change in price

Ceteris Paribus

All else equal

Change that causes demand factors to shift right

Increase income

Increase in the price of a subsitute good

Deccrease in the price of a complementary good

An increased desire for the good

Increase in population

Reduciton in interest rates

Improved expectations about the future

Change that causes demand factors to shift left

Decreased incomes

A decrease in substitute goods

Increase in complementary goods

A decreased desire for the good

Increase in interest rates

Decrease in population

Worsening expectations about the future

Quantitty Supplied

The amount that a producer is willing and able to provide at a given price

Law of Supply

Increase in price —> Increase Qs

Decrease in price —> Decrease in Qs

Direct relationship

Why is the supply curve upward sloping?

As costs rise, firms produce more

Change in Quantity supplied

Whenever there’s a change in price, there’s movement on the curve

Producers will take advantage of this as it means they ar able to gain more profit

Factors that cause supply to shift rightward

Input prices decrease (costs are more affordable)

Production technology improves

Alternative cheaper inputs become avaliable

Interest rates delcine

Number of firms increases (total market supply increases_

Expectations about the future improve

Factors that cause supply to shift leftward

Input prices increases

Interest rates increase

Number of firms decreases

Expecations about the future worsen

Equilibrium price

Intersection of the supply and demand curve

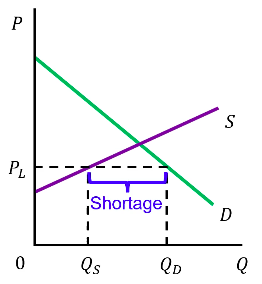

Shortage / Excess demand

When the current market price is too low

QS < QD

Firms will raise prices to expand production until they reach the eq point.

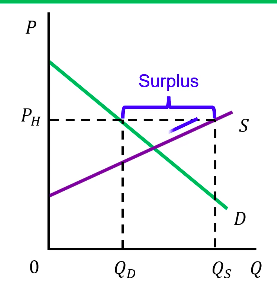

Surplus / Excess Supply

When the current market price is too high

QS > QD

Producers are making more than consumers actually want to buy

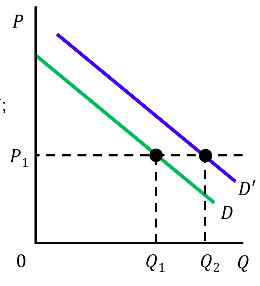

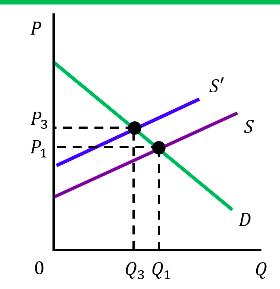

An increase in Demand

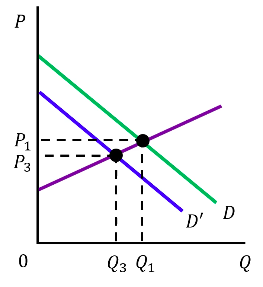

Any factor that causes demand to increase will cause the price to rise and will also cause the quantity sold to rise (for his graph, D is the same as D1 and D' = D2)

Any factor that causes demand to decrease will cause the price to fall and will also cause the quantity sold to fall (for his graph, D is the same as D1 and D' = D2)

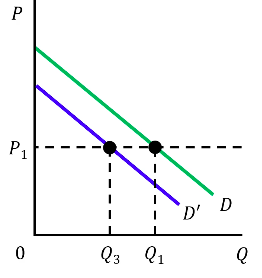

Decrease in Demand

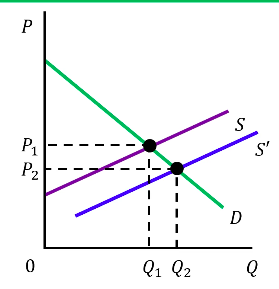

Increase in Supply

Any factor that causes supply to increase will cause the price to fall and will cause the quantity sold to rise (On his graph, S is the same as S1, and S' = S2)

Decrease in Supply

Any factor that causes supply to decrease will cause the price to rise and will cause the quantity sold to fall

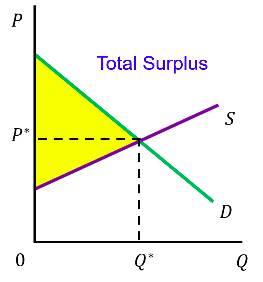

Consumer surplus

The difference between what consumers are willing to pay for a good and the price they actually pay

Perceived value - Price

You might be willing to pay $8 for a burger, but it actually costs $5 —→ The consumer surplus is $3

Where is the Consumer surplus located

Total area between the demand curve and the price line

Beneath demand, above eq

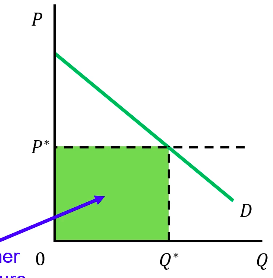

Total consumer expenditure

The amount that consumers pay in total for Q units

Calculated as: Price x Quantity

The green box is the Consumer expenditure

This also becomes producer revenue

Producer Surplus

The difference between the price producers are willing to accept (based on marginal cost) for a good/service compared to what they actually receive

Can be calculated by: Price - Marginal Cost of Producing the unit

Represents the extra money that producers earn above their cost to make units

Where is the producer surplus located?

Total area between the supply curve and the price line

Beneath the eq

Total Surplus

Consumer surplus + Producer surplus

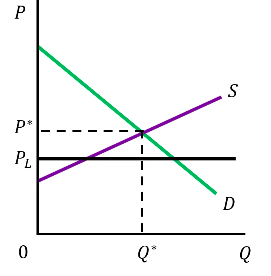

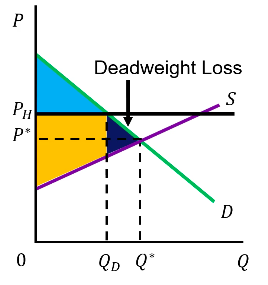

Price Floor

A minimum price set by the government

Allowed to be higher than the price floor, but cannot be less than the price flooor

Benefits producers

Producers surplus is larger and consumer surplus is smaller

Deadweight Loss

Reduction in total surplus

For example, in Ontario, the government imposes minimum prices on alcohol and tobacco products

This is due to the fact that these have serious health concerns, so the government wants you to buy less of these items

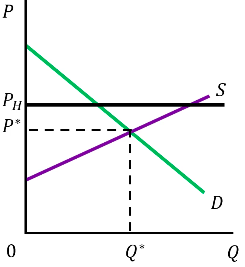

Price ceiling

Maximum price set by the government

Price is allowed to be lower than p.c but cannot be higher

Benefits consumers —> Consumer surplus is larger and producer surplus is smaller

Problems with price ceilings

Advanatge for some consumers, and disadvantage for others

Some consumers take advantage of this low price

For example: Rent Control

The artifically low price generates excess demand (shortage)

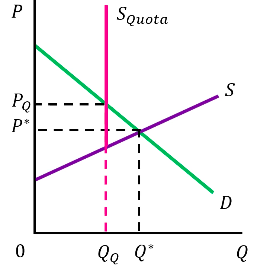

Quota

Maximum quantity set by the government

The amount producer is allowed to be lower than the quota, but cannot be higher than the quota

Benefits produers

Producer surplus is larger and consumer surplus is smaller

Generates a deadweight loss

For example: The government works with both egg farmers and dairy farmers to set quotas for eggs and milk

Even though the policy means higher prices for Canadian consumers, the government believes its worthwhile to ensure that farmers can earn enough money to continue farming

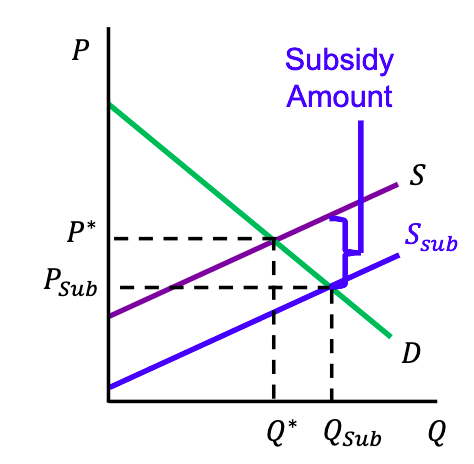

Subsidy

Payment made by the government to firms to cover a portion of the cost of production

Could be in the form of cash payments or tax rebates

Lower costs = increased production

Also lowers the price that consumers must pay

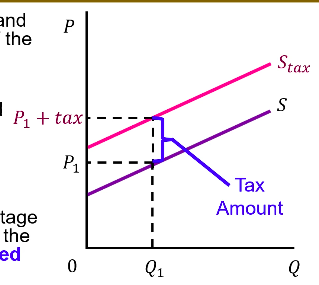

Sales Tax

Added to the price consumers pay

Firms need to cover their production costs

Unit tax

When the amt. of the tax is fixed and does not change with the underlying price

Fuel Taxes: A gasoline tax is a classic example, where a government charges a specific amount (e.g., cents or dollars) for every gallon or liter of fuel sold, regardless of the final price.

Value added tax / Valorem tax

When the amt. of the tax is a percentage of the price, and increases as the price increases

Best example: Harmonized Sales Tax (HST) = 13%

Effect of a tax

Since tax increases the price, consumers buy less

Since suppliers are producing a lower quantity, they charge a lower price

Consumer incidence of the tax

The change in the consumer price

Producer incidence of the tax

The change in the producer price

Tax amount

Consumer incidence + Producer incidence

Firms cut their prices to try and keep some customers

In a way, producers are helping the consumer by covering the tax by lowering the price

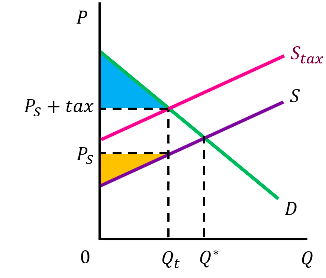

Welfare effect on tax

Tax causes the producer price to decline, and consumer price to rise, and the quantity to fall

Since consumers pay a higher price and buy less, consumer surplus shrinks

Since producers receive a lower price and sell less, producer surplus shrinks

Government tax Revenue

Tax Revenue = Tax x Quantity sold

The government will use the additional income by improving the economy such as improving infrastructure and improving school education systems