AP MACRO UNIT 5

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

demand-pull economics

occurs when increased demand for goods and services outstrips the economy's ability to produce them, leading to higher prices and a general increase in the cost of living.

Goal of fiscal and monetary policy

change AD to achieve full employment output

fiscal policy

change gov spending, influence consumer spending by changing tax rates

monetary policy

change interest rates to influence interest sensitive spending

why cant fiscal policy fix staglfation

because increasing AD increases inflation

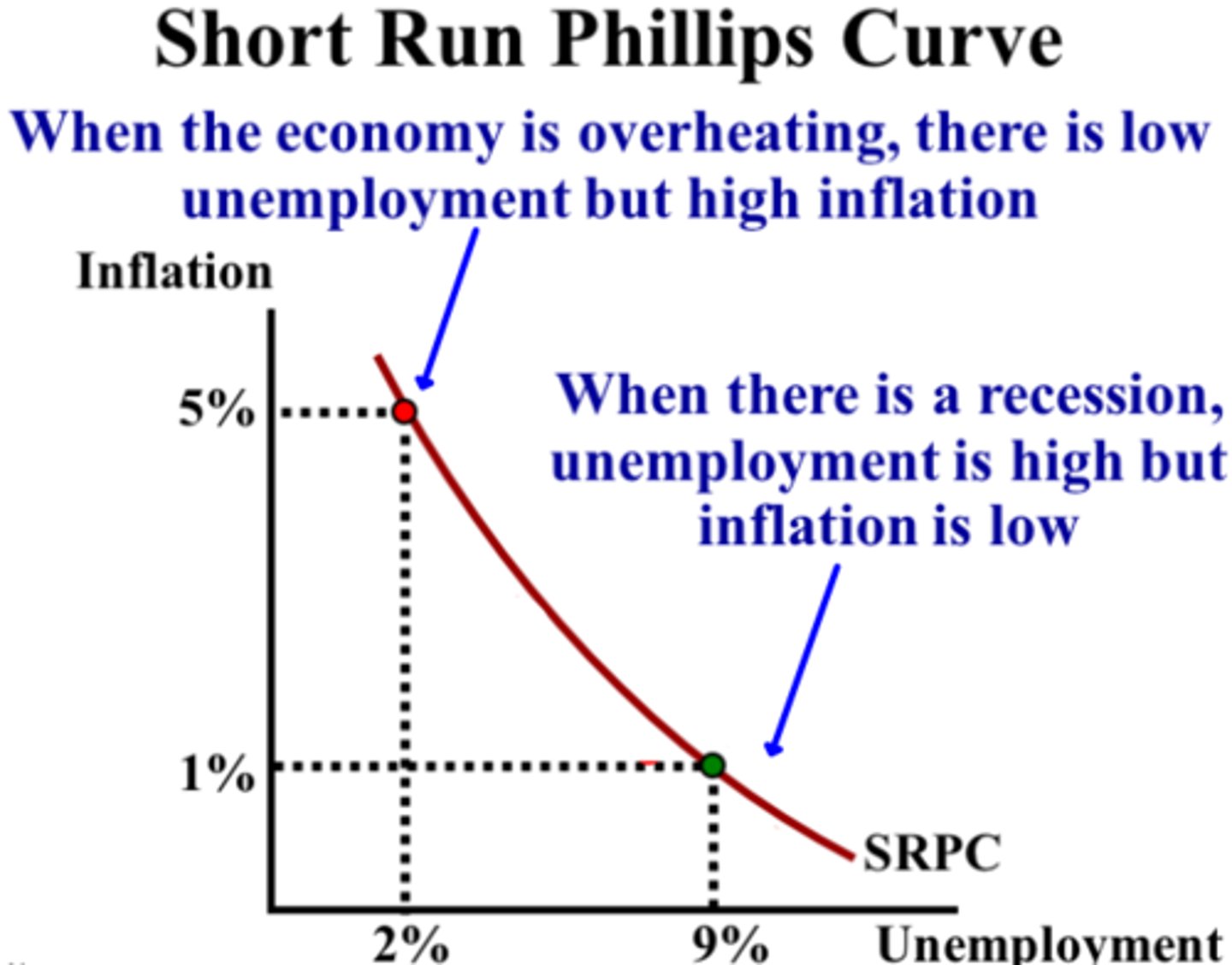

SRPC

shows the inverse relationship between inflation and unemployment

stagflation

-if there is stagflation, unemployment is up and inflation is up

-causes SRPC to shift right

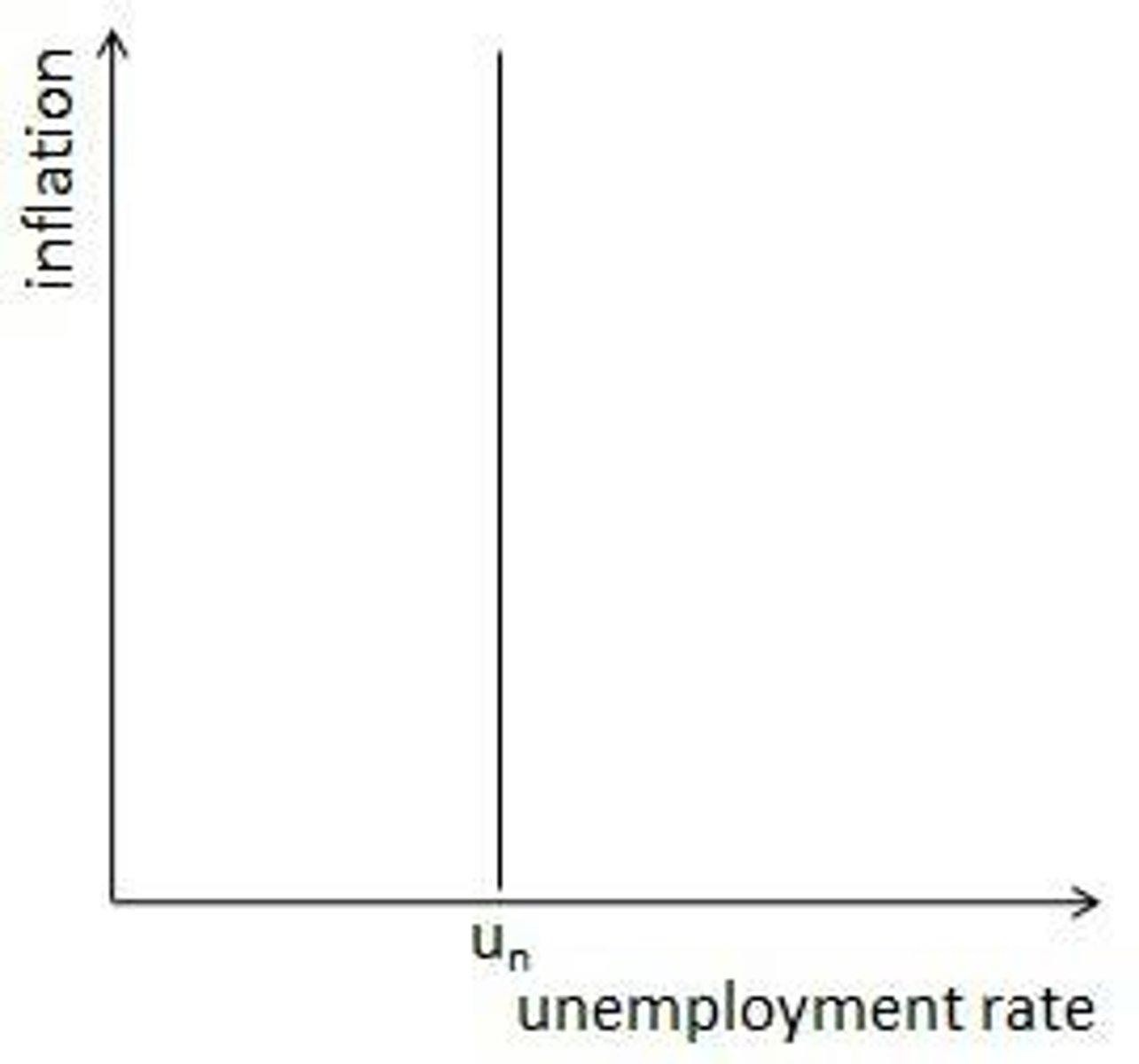

LRPC

shows there is no tradeoff between inflation and unemployment

in the long run...

1. AS increases as workers accept lower wages and production costs fall

2. PL decreases, Y returns to full employment output

how does a change in AD affect the phillips curve

increased AD leading to higher inflation and lower unemployment, and vice versa. increase PL

a change in AD causes a ____ along the SRPC

movement

how does a change in AS affect the phillips curve

If aggregate supply increases, then the Phillips curve shifts to the left. If it decreases, it shifts to the right.

inflationary expectations

there is a direct and constant relationship between the expected rate of inflation and the nominal IR

if inflation is expected

interest rates will rise and decrease SRAS, causing stagflation

if we expect deflation

monetary is ineffective because nominal IR are zero bound which causes a liquidity trap. banks will not lend if nominal IR are below 0%

what does inflation result from

increasing the MS too quickly for a sustained period of time

when the economy is at full employment...

changes in MS have no effect on RGDP in the wrong run... only changes PL

monetarism theory

steady growth of the MS causes steady growth in GDP

Quantity Theory of Money Equation

M x V = P x Y

M- money supply

V- velocity

P- PL

Y-output

... so in the LR the growth rate of M determines the growth rate of P

another way to write quantity theory of money equation

V= (P x Y)/M

P x Y- real gdp

why are budget deficits a "necessary evil"

forcing a balanced budget would not allow congress to stimulate the economy

budget balance =

tax revenues - (gov spending + gov transfers)

budget surplus

tax revenue is greater than gov spending and transfers in a year

budget deficit

tax revenue is less than gov spending and transfers in a year

the accumulation of annual budget deficits

the national debt

the government must pay interest on its debt, which...

-accelerates debt growth

-prevents using those funds for other things

-can lead to crowding out

-increases IR for citizens on loans

crowding out

a decrease in investment that results from government borrowing

-Government usually starts borrowing a budget deficit. (This increases money demand and therefore, the interest rate which then decreases private investment.) ● May cause a lower rate of physical capital accumulation & less economic growth in the long-run

when governments borrow to finance deficit spending...

1. the demand for loanable funds increases

2. the IR rises

3. I decreases

4. the increase in gov spending may be offset by the decrease in investment

crowding out in the SR and LR

-SR: leads to decreased interest sensitive spending

-LR: leads to a lower rate of physical capital accumulation and less economic growth

expansionary fiscal policy

increases IR, but expansionary monetary policy decrease IR

-increases AD curve in SR (fixes recessionary gap & creates a budget deficit).

why might the government increase spending?

They may be trying to use fiscal policy to close arecessionary gap by shifting AD to the right

economic growth

measured as the growth rate in RGDP per capita over time

RGDP per capita =

RGDP/population

-also measures labor productivity

-increase in LP increase RGDP

-both measure economic growth

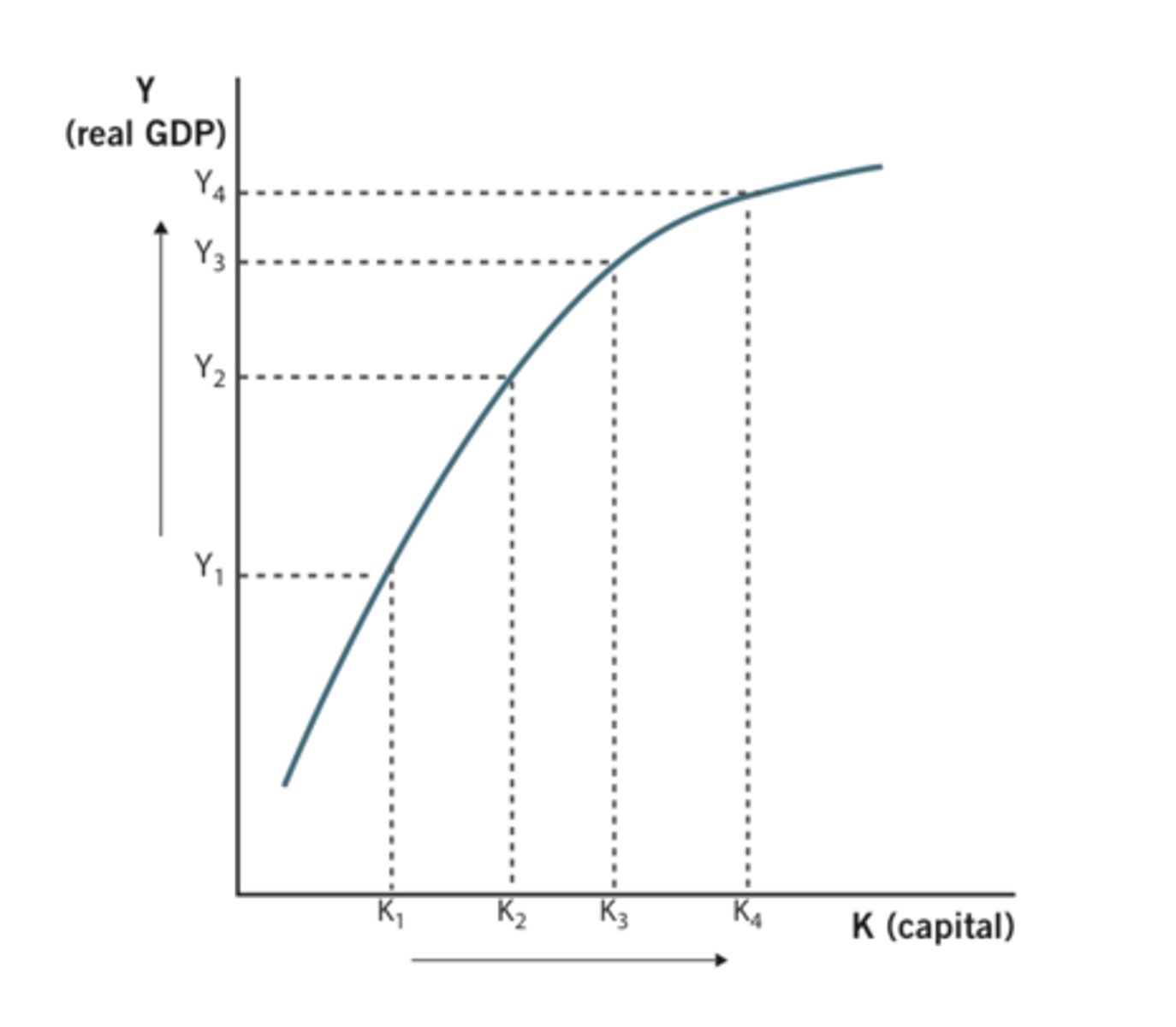

the aggregate production function

a hypothetical function that shows how productivity (real GDP per worker) depends on the quantities of physical capital per worker and human capital per worker as well as the state of technology

-aggregate employment and aggregate output are directly related

productivity is determined by the...

1. lvl of tech

2. stock of physical capital\

3. human capital

if investment increases, what happens in the short run and long run?

In the short run, increased investment boosts aggregate demand, leading to higher output and potentially inflation. Long-run effects include increased capital stock, shifting the long-run aggregate supply curve to the right, and potentially higher long-term economic growth

what shows economic growth

a right shift of LRAS, increase potential GDP/output, and outward shift of PPC

-ONLY INVESTMENT IN PRODUCER RESOURCES LEADS TO LR ECONOMIC GROWTH!!!!!

the role of the gov in promoting economic growth

1. Adding to Physical Capital

• Increase and improve infrastructure

• Encourage high rates of private saving and investment

2. Adding to Human Capital

• Increase and improve education

• Increase the labor force participation rate (LFPR)

3. Adding to Technology

• Government research and development programs

supply side fiscal policy

discretionary fiscal policy to promote economic grwoth that affects AD, SRAS, LRAS, and potential output

in the private market, the gov should provide incentives for households and business to

1. work (increases output)

2. save (increases investment)

3. invest (increases productivity)

...decreasing income tax rates, offering investment tax crdits, and reducing regulation

in the public market, gov spending should include

education and infrastructure

contractionary fiscal policy

decreases AD curve in short-run (fixes expansionary gap & creates a budget surplus

expansionary monetary policy

increases AD (helps fix recessionary gaps

contractionary monetary policy

decreases AD (helps fixes expansionary gap

in the short run, gov deficits can...

cause an inflationary gap and raise interest rates which can delay economic growth.

government deficits

Occur when governments spend more than they receive in tax revenues

how does expansionary monetary policy cause inflation

it stimulates spending and demand, potentially outpacing the economy's ability to produce goods and services, thus driving up prices.

supply-side fiscal policy

When producers focus on employing contractionary fiscal policies to foster increased production

● Affects AD, SRAS, & potential output in the short-run