2.3.4 National income + Injections and withdrawals

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Ways to measure national income

National output

National expenditure

National income

National output (O)

Total value of goods and services produced by firms in an economy (most commonly measured using GDP

National expenditure (E)

Total value of spending by all economic actors (consumers, firms, governments, net exports)

National income (Y)

Total value of income of all producers (wages, owner income, corporate profits)

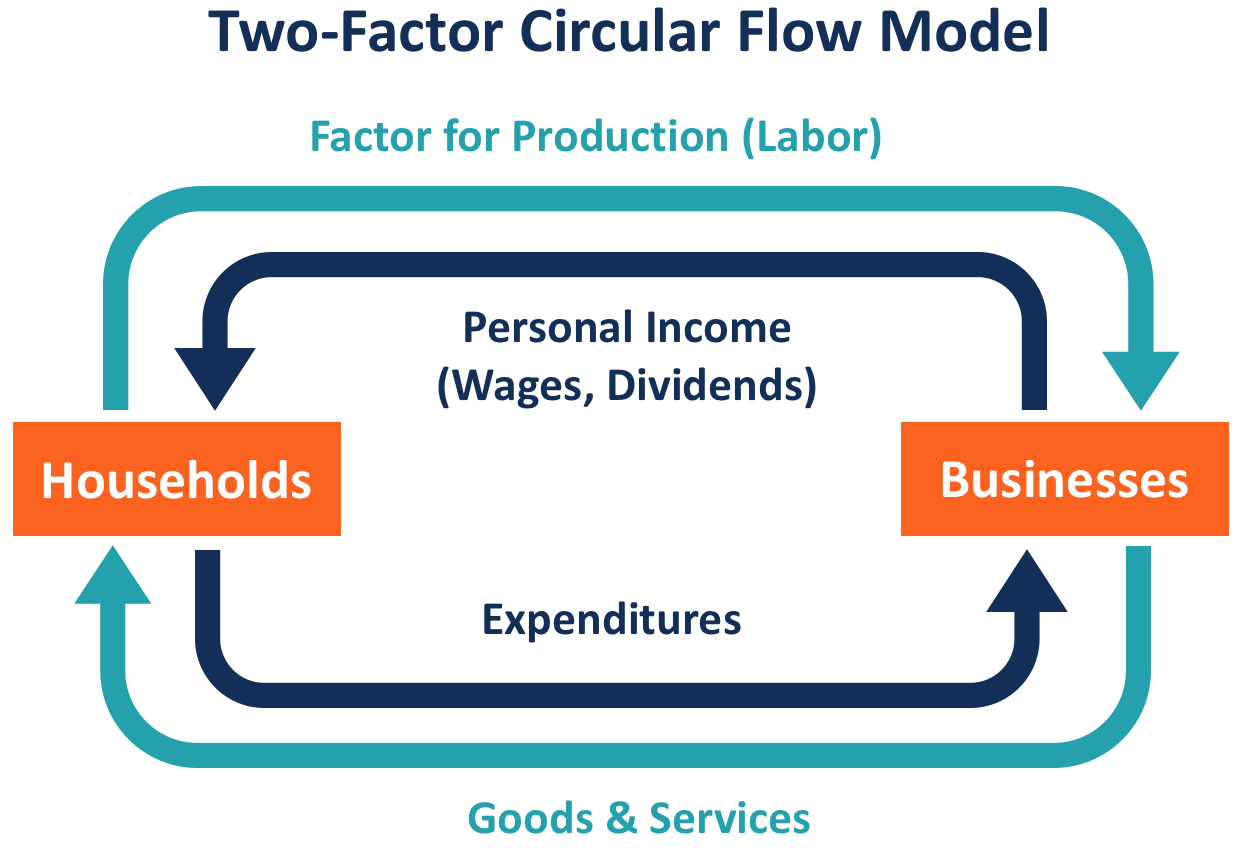

Circular flow of income

Ways of thinking about money flowing around an economy

No foreign trades, closed economy - O = E= Y, no taxation

Households supply firms with factors of production in exchange for rent, wages

Firms supply households with goods and services

Income vs wealth

Income: flow of money received after a period

Wealth: stocks of asset accumulated over time

Injections

Spending not generated by households

Investments by firms (factors/machinery, spending on goods and services used in production)

Government spending (Subsidies, benefits)

Exports - spending by foreigners on goods and services

Withdrawals

Spending that does not flow back to households and firms

Saving by households and firms

Taxes paid to the government by households and firms

Imports - goods and services purchased from abroad by households and firms

Equilibrium

injections = withdrawals

outputs, expenditure and income remain the same

National income rises

Injections > withdrawals

(spending increases)

National income falls

Injections < withdrawals

(spending decreases)

How do classical economists believe RNO is increased

Supply-side policies (shift supply)

Shifts in AD only lead to inflation

How do keynesian economists believe RNO is increased

Demand-side policies (if in recession), followed by shifts in supply

The multiplier effect

Increase in components of AD will lead to greater increase in GDP

Autonomous spending results in induced spending

MPW + Components

Marginal propensity to withdraw:

Change in income that is withdrawn from the circular flow of income

MPS (save)

MPT (tax)

MPM (import)

MPW = MPS + MPT + MPM

Formulas for the multiplier

1 / 1 - MPC

1 / MPW

Formula with MPC and MPW

MPC + MPW = 1

Example evaluations for multiplier effect

Also leads to larger fall in GDP

Time lag

Difficult to measure (size and complexity of economy)

Factors that affect multiplier

Spare capacity

MPM

MPT

MPC