ECON 201 - Final Exam (JMU)

1/122

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

123 Terms

economics

the study of how society allocates its scarce resources

absolute advantage

the ability to produce a good using fewer inputs than another producer

opportunity cost

whatever must be given up to obtain some item

comparative advantage

the ability to produce a good at a lower opportunity cost than another producer

market

a group of buyers and sellers of a particular good or service

law of demand

the quantity demanded of a good falls when the price of the good rises

normal good

an increase in income leads to an increase in demand

inferior good

an increase in income leads to a decrease in demand

substitutes

two goods for which an increase in the price of one leads to an increase in the demand for the other

complements

two goods for which an increase in the price of one leads to a decrease in demand for the other

law of supply

the quantity supplied of a good rises when the price of the good rises

determinants of demand

income, price of sub/complements, taste, expectation, # of buyers

determinants of supply

input prices, technology, expectations, number of sellers

where on a graph does the quantity demanded equal the quantity supplied ?

market equilibrium

surplus occurs when ..

market price is above the equilibrium price

shortage occurs when ..

market price is below the equilibrium price

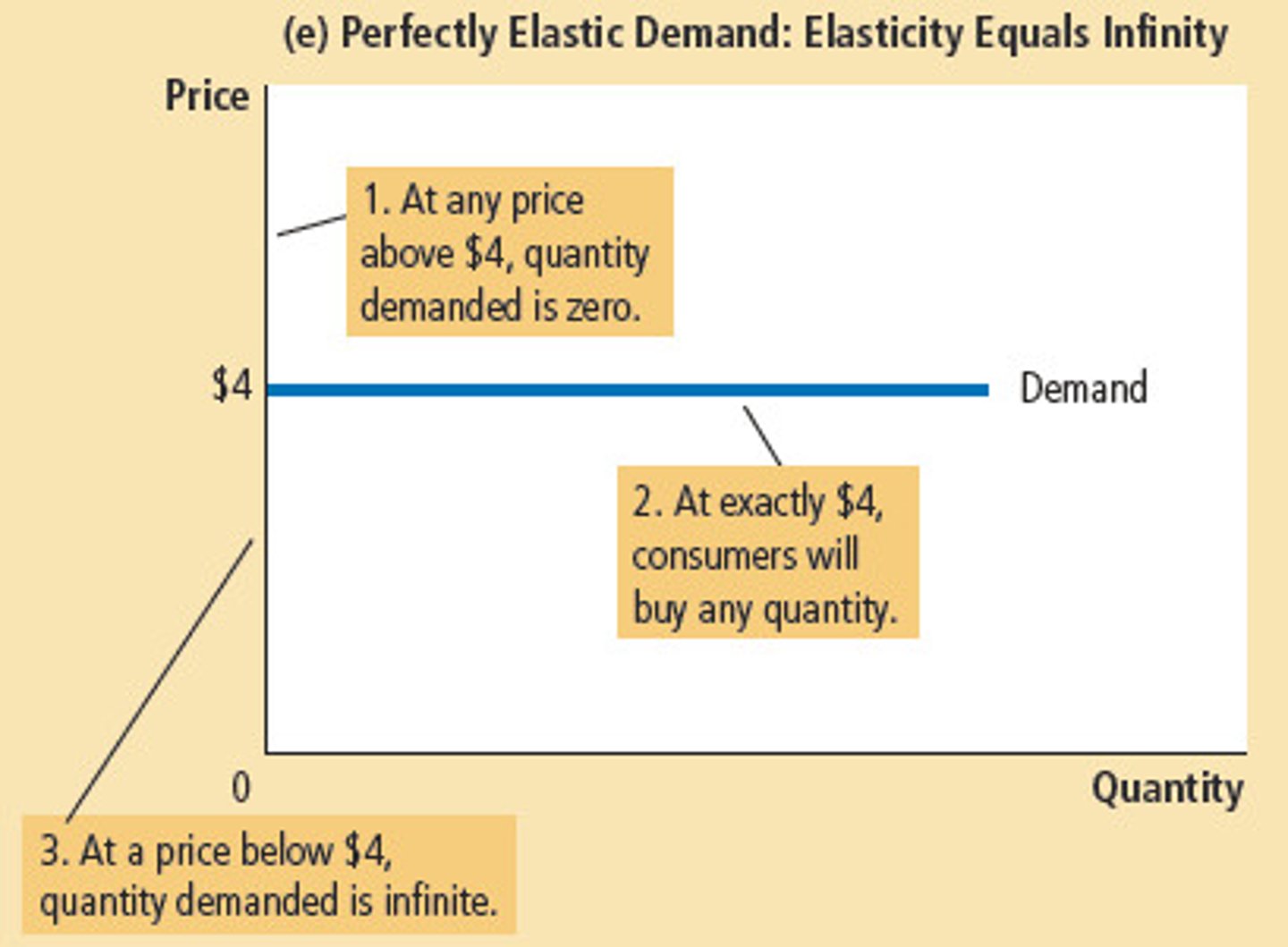

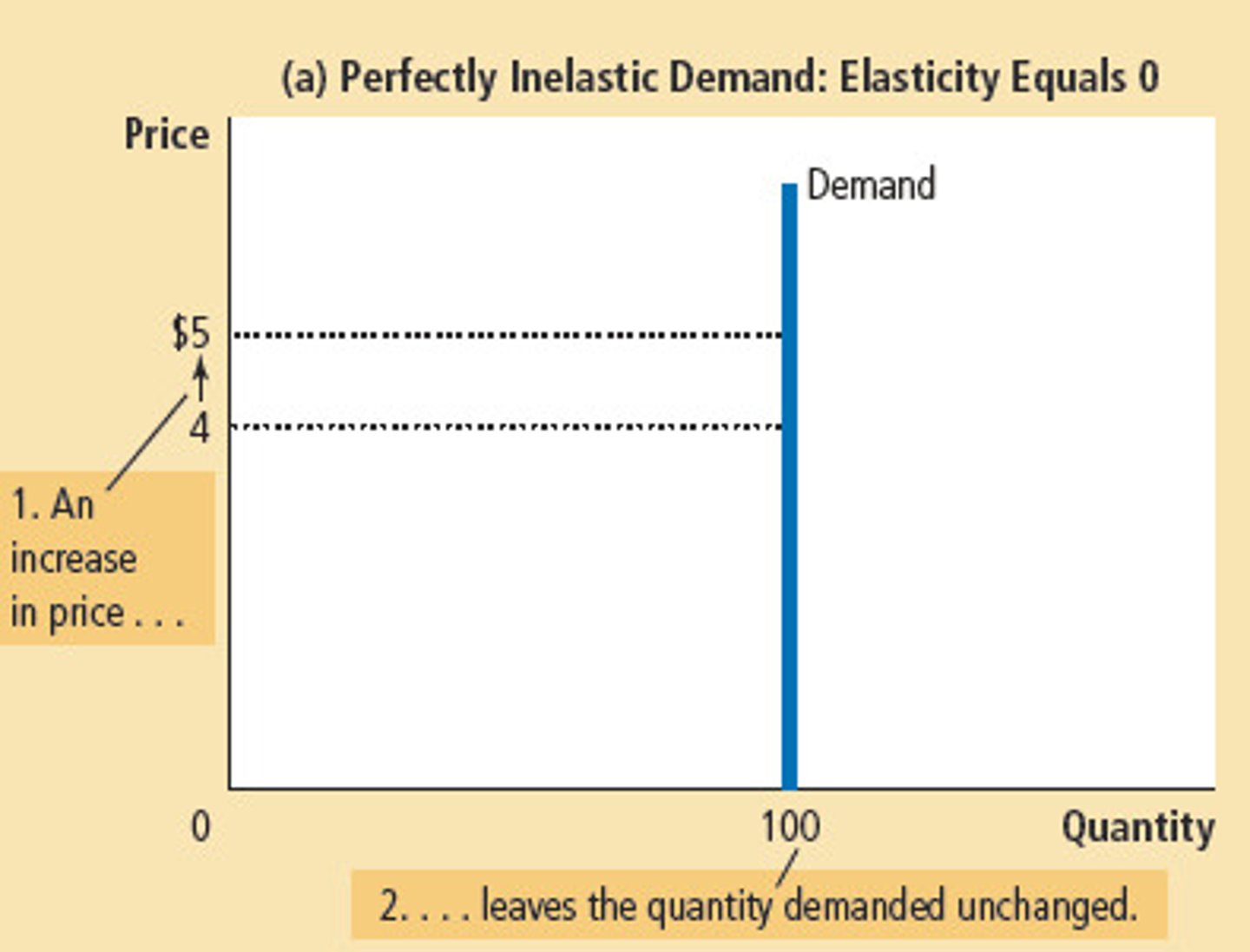

elasticity

measure of the responsiveness of quantity demanded or quantity supplied to a change in one of its determinants

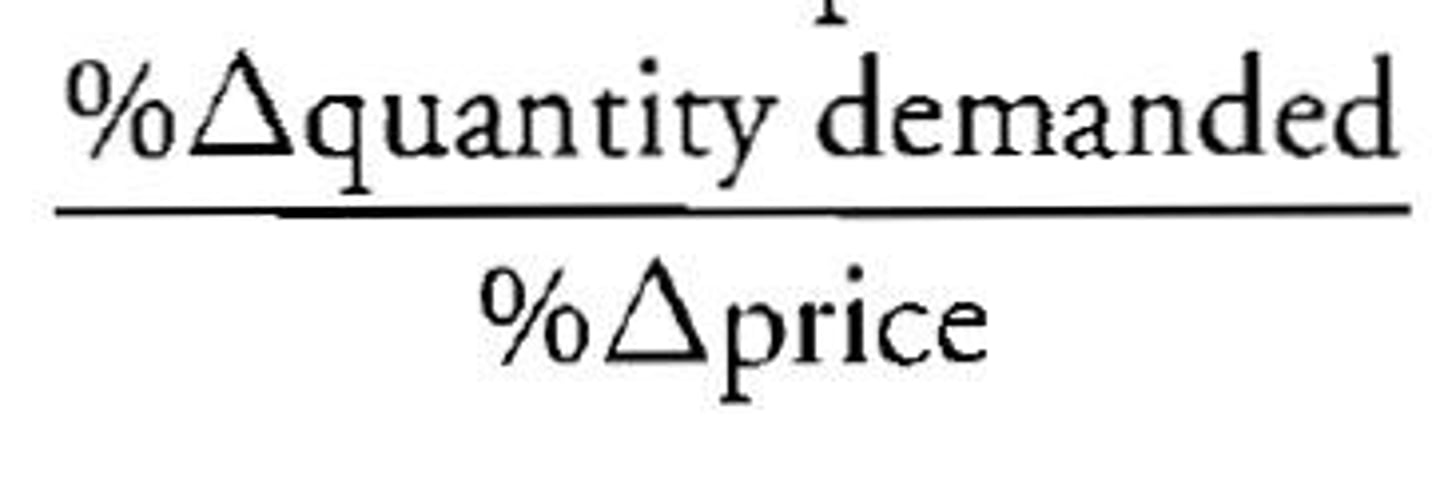

price elasticity of demand equation

computed as the percentage change in quantity demanded divided by the percentage change in price

elastic demand

inelastic demand

total revenue

The amount of money received by firms when they sell a good or service. TR = P x Q.

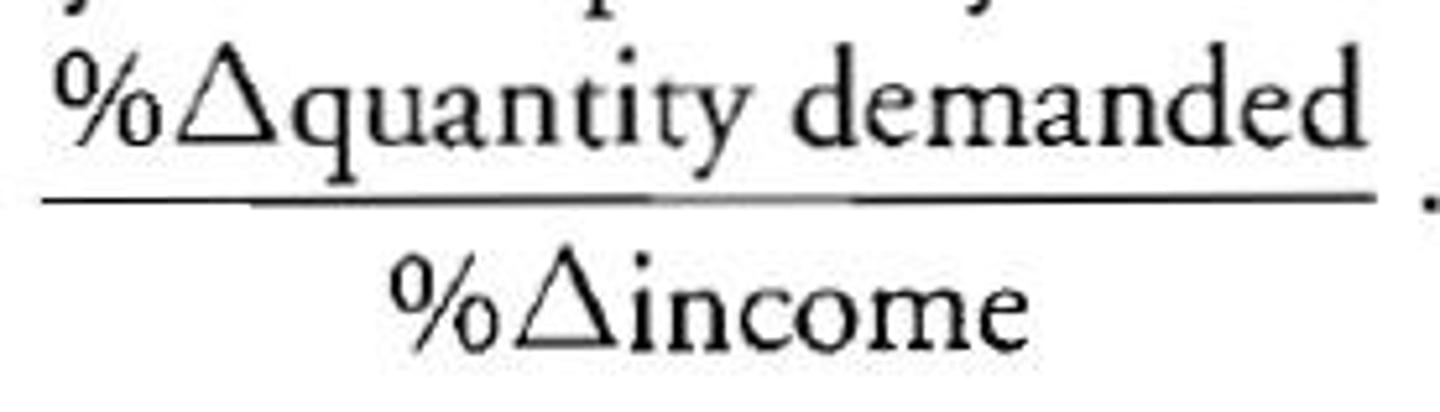

income elasticity of demand

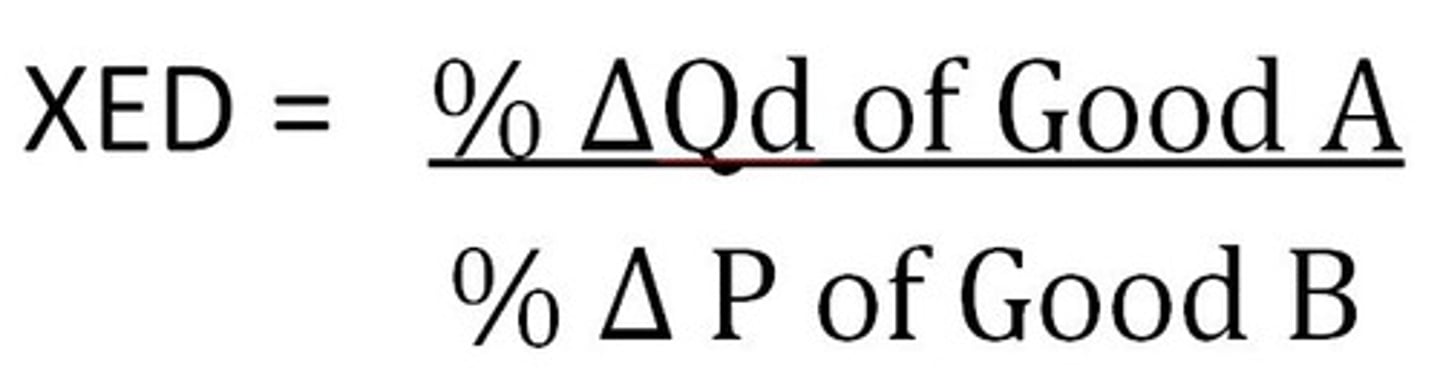

cross-elasticity of demand

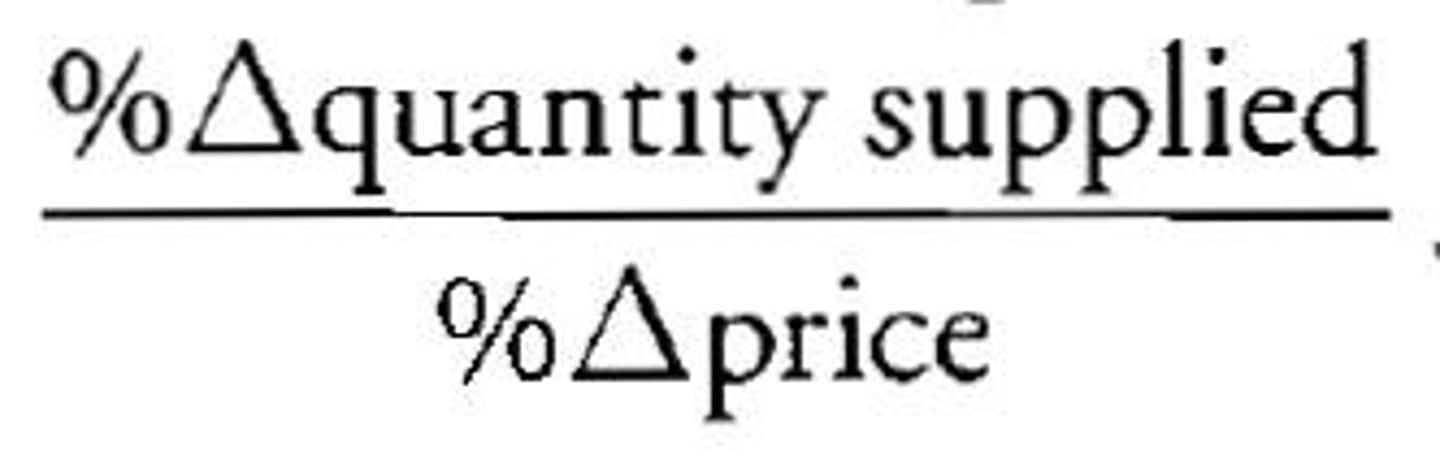

price elasticity of supply

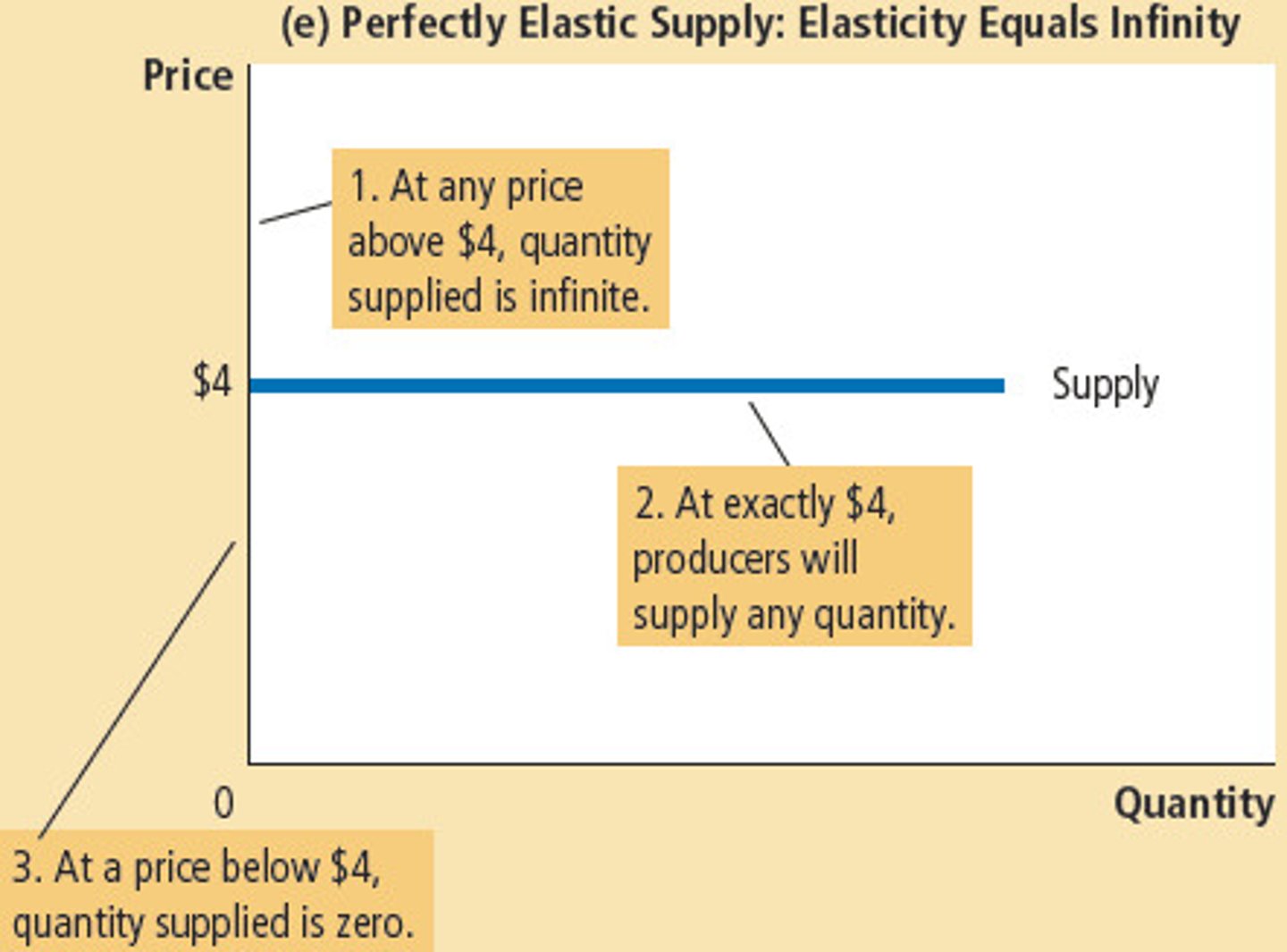

elastic supply

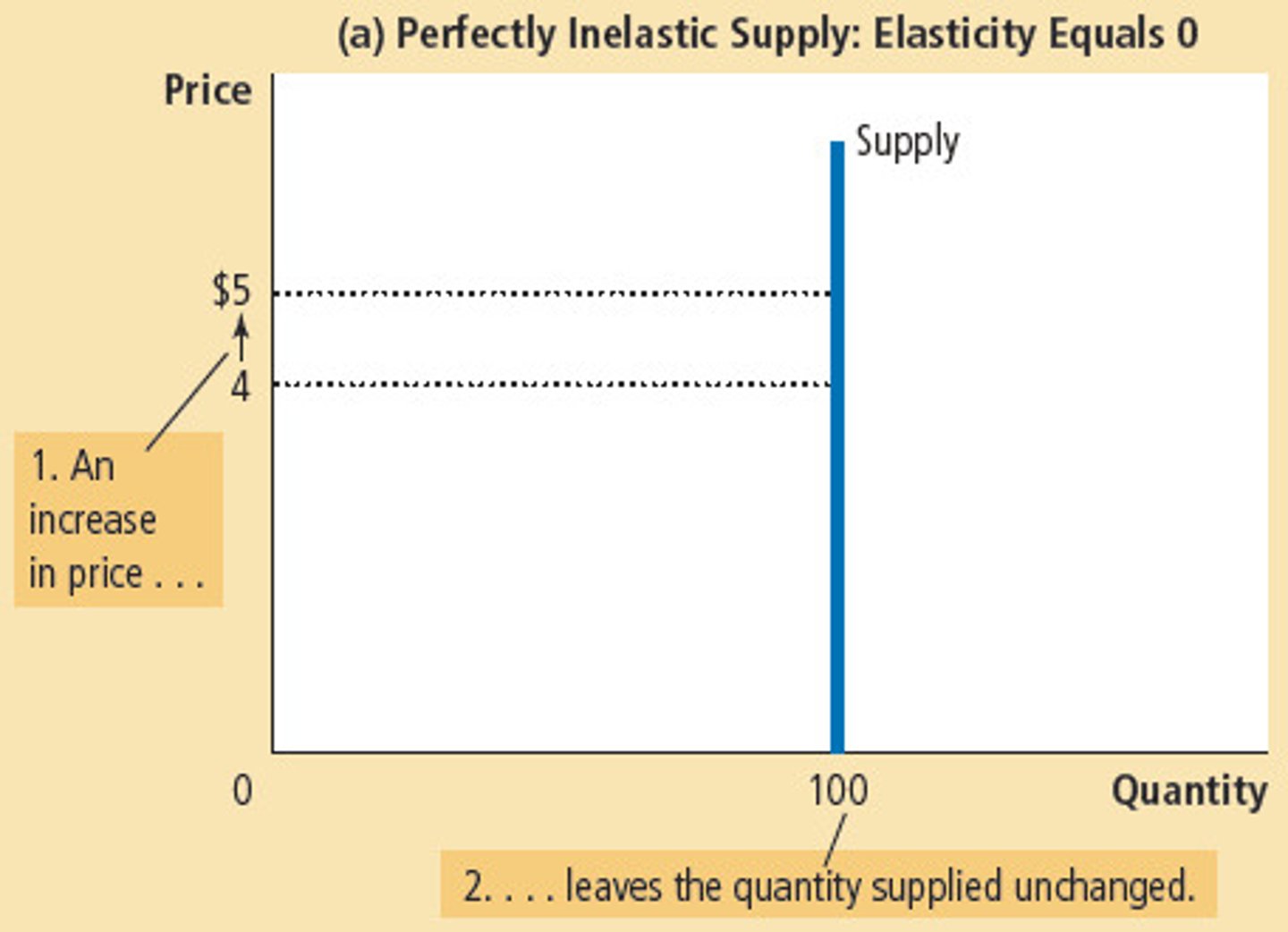

inelastic supply

If close substitutes are available, if the good is a luxury, if the market is narrowly defined.. demand tends to be more ....

elastic

If quantity demanded moves proportional less than the price, adding the elasticity is less than 1.. demand tends to be more ....

inelastic

price ceiling

a legal max on the price at which a good can be sold

price floor

a legal min on the price at which a good can be sold

When a price ceiling is above the equilibrium price..

non-binding price ceiling

When a price ceiling is below the equilibrium price..

binding price ceiling

When a price floor is below the equilibrium price..

non-binding price floor

When a price floor is above the equilibrium price..

binding price floor

tax incidence

the manner in which the burden of a tax is shared among participants in a market

when the government levies a tax on a good...

the equilibrium quantity of the good falls

the incidence falls more on the consumer with a ________ supply and _________ demand

elastic supply ; inelastic demand

the incidence falls more on the producer with a _______ supply and ________ demand

inelastic supply ; elastic demand

consumer surplus

the amount a buyer is willing to pay for a good minus the amount the buyer actually pays for it (area below the demand curve and above the price)

cost

the value of everything a seller must give up to produce a good

producer surplus

the amount a seller is paid for a good minus the sellers cost of providing it (below the price and above the supply curve)

total surplus

value to buyers - cost to sellers

when a tax is levied on buyers, the demand curve shifts ..

downward

when a tax is levied on sellers, the demand curve shifts..

upward

tax on a good causes the size of the market for the good to ..

shrink

deadweight loss

the fall in total surplus that results from a market distortion, such as a tax

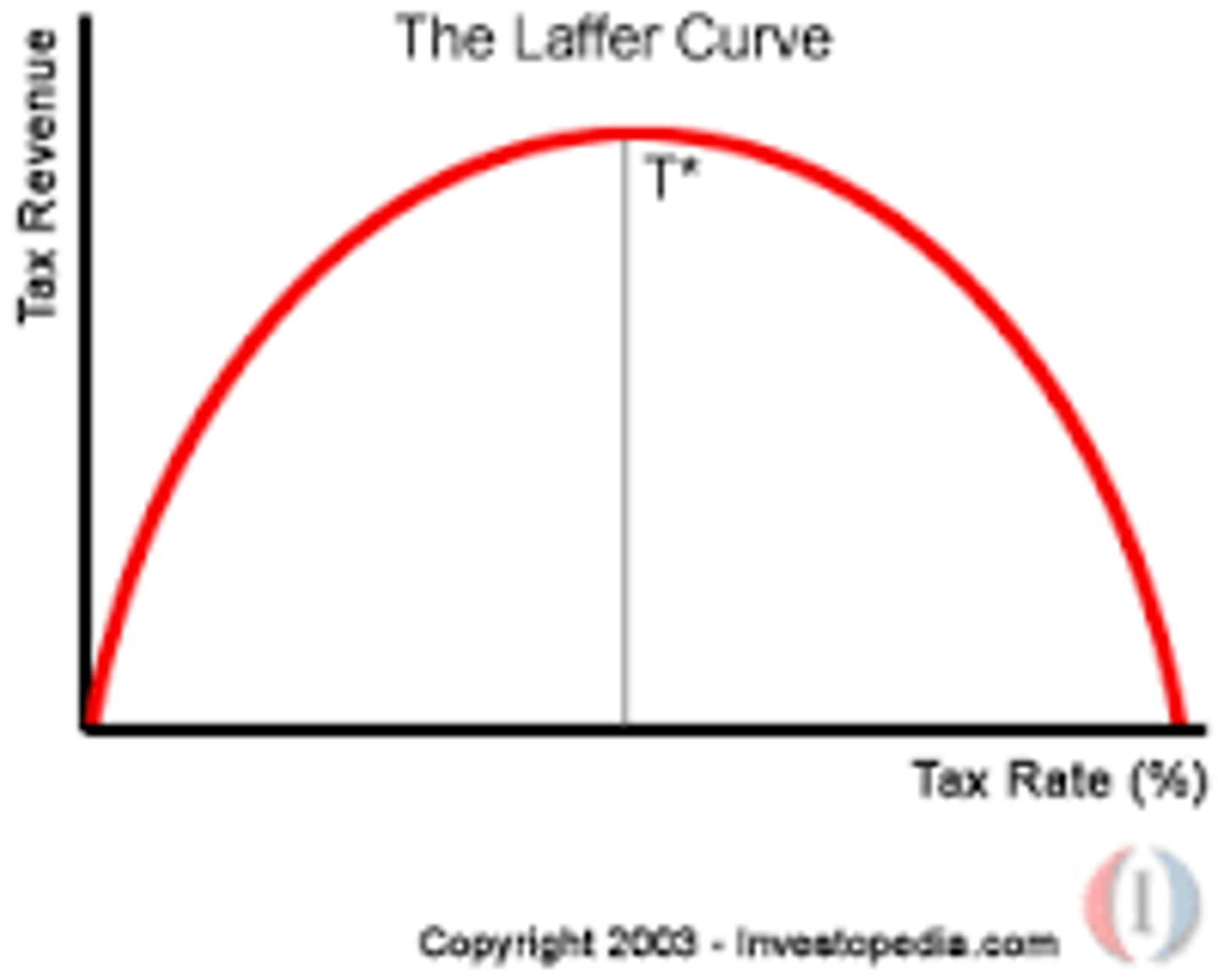

Laffer curve

a graphical representation of the relationship between tax rates and total tax revenues raised by taxation.

T/F: the deadweight loss decreases as the size of the tax increases

False

world price

the price of a good that prevails in the world market for that good

once trade is allowed, the domestic price equals the

world price

tariff

a tax on goods produced abroad and sold domestically

externality

the uncompensated impact of one persons actions on the well-being of a bystander

Coase theorem

the proposition that if private parties can bargain without cost over the allocation of resources, they can solve the problem of externalities on their own

with negative externalities, the socially optimal quantity is ______ than the equilibrium quantity

less

with positive externalities, the socially optimal quantity is _____ than the equilibrium quantity

greater

how will the government react to a negative externality ?

corrective taxes

how will the government react to a positive externality ?

subsidies

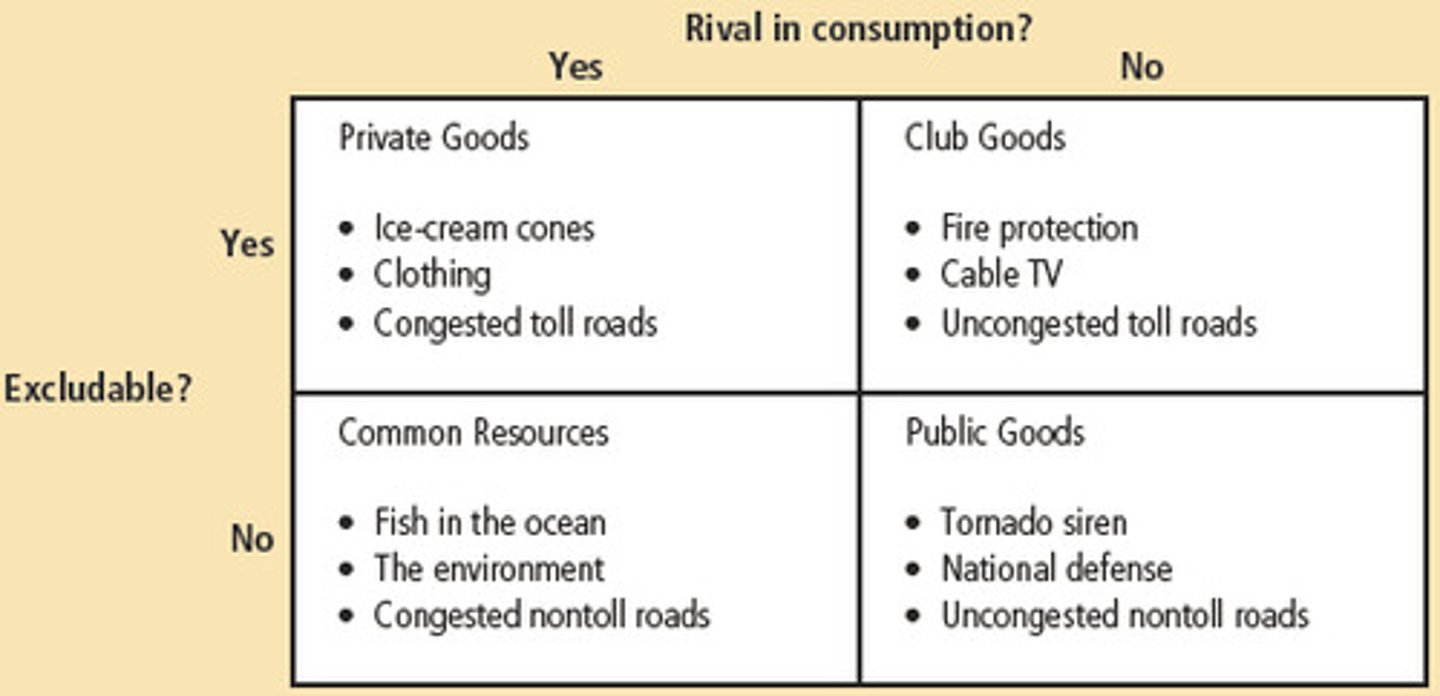

excludability

the property of a good whereby a person can't be prevented from using it

rivalry in consumption

the property of a good whereby one person's use diminishes other people's use

private goods

excludable

rival

public goods

not excludable

not rival

common resources

not excludable

rival

club goods

excludable

not rival

four types of goods

free rider

a person who receives the benefit of a good but avoids paying for it

explicit costs

input costs that require an outlay of money by the firm

implicit costs

input costs that do not require an outlay of money by the firm

economic profit

total revenue - total cost ; includes both implicit and explicit costs

accounting profit

total revenue - total explicit costs

marginal product

the increase in output that arises from an additional unit of input

fixed cost

costs that do not vary with the quantity of output produced

variable costs

costs that vary with the quantity of output produced

average fixed cost

fixed cost divided by the quantity of output

average variable cost

variable cost divided by the quantity of output

marginal cost

the increase in total cost that arises from an extra unit of production

marginal cost equation

Change in total cost / Change in quantity

average total cost equation

Total Cost / Quantity

economies of scale

when the long-run ATC falls as the quantity of output increases

diseconomies of scale

when the long-run ATC rises as the quantity of output increases

the goal of firms

to maximize profit

where does the marginal-cost curve cross the average total cost curve ?

at the minimum of average total cost

many costs are ______ in the short run, but ______ in the long run

fixed; variable

competitive market

a market with many buyers and sellers trading identical products so that each buyer and seller is a price taker

perfectly competitive market characteristics (2)

1. there are many buyers and sellers

2. goods offered by the various sellers are largely the same

average revenue

total revenue divided by the quantity sold

marginal revenue

the change in total revenue from an additional unit sold

shut down

short run decision to not produce anything during a specific period of time b/c of current market conditions

Exit

long run decision to leave the market

T/F: most firms cannot avoid their fixed costs in the short run but can do so in the long run

True

T/F: a firm that shuts down temporarily doesn't have to pay its fixed costs

False

a firm should do what when their TR > VC

shut down

a firm should do what when their P < AVC

shut down

sunk cost

a cost that has already been committed and cannot be recovered

a firm should do what when their TR < TC

exit

a firm should do what when their P > ATC

enter

a firm should do what when their P < ATC

exit

Profit equation

Profit = (P - ATC) x Q

price of the good in a competitive market equals

the firm's average revenue and its marginal revenue

T/F: a competitive firms supply curve is also its marginal-revenue curve

False, marginal -cost *

increase in demand raises prices and leads to ..

profits