TERMS Unit 3: Finance and accounts Chapter 16: Final accounts

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

final accounts

the end of year financial accounts produced by a business

creditors

suppliers to a business who have not yet been paid

window dressing

presenting the accounts of a business in the best possible, or most flattering, way which could potentially mislead users of accounts

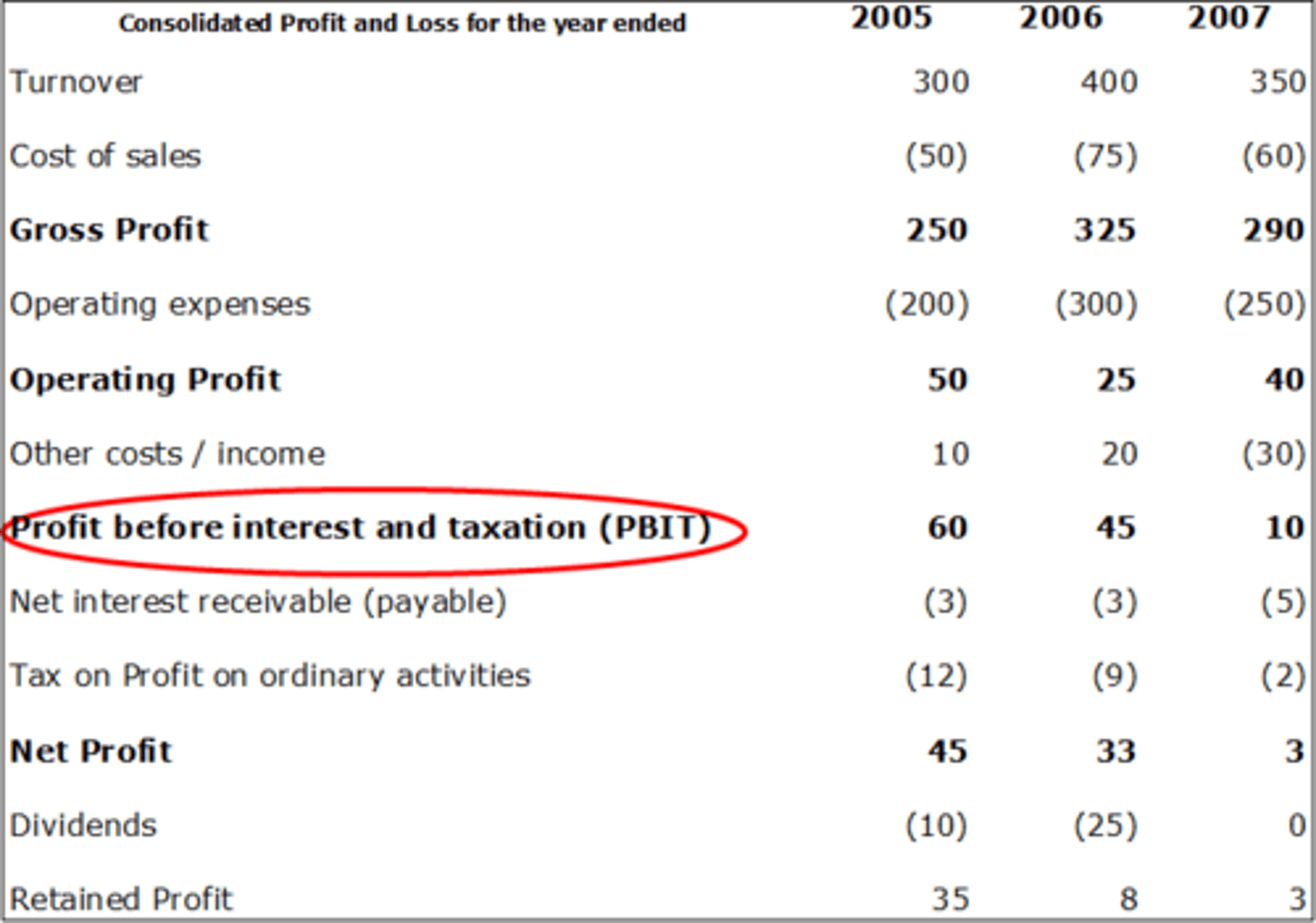

profits and loss accounts

records the revenue, costs and profit (or loss) of a business over a given period of time

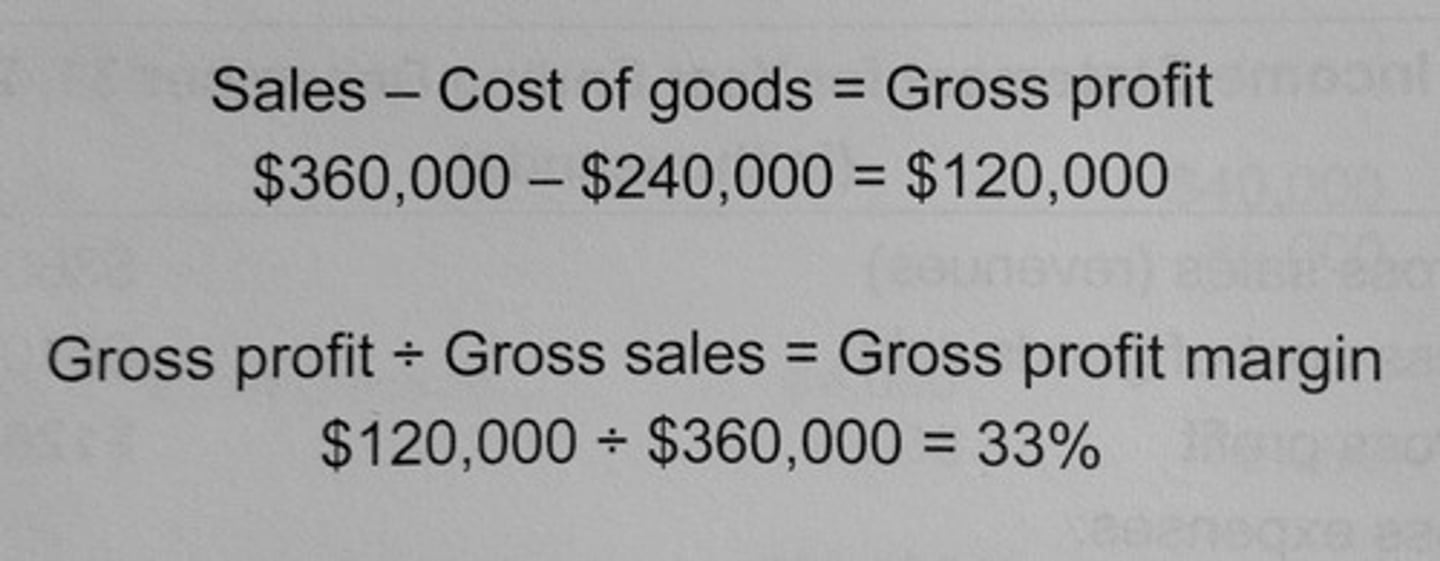

gross profit

equal to sales revenue minus cost of sales

profit before interest and taxation

gross profit minus overhead expenses

profit after tax

profit made after corporation tax has been deduced

dividends

the share of the profits paid to shareholders as a return for investing in the company

retained profit

the profit left after all deductions, including dividends, have been made; this is 'ploughed back' into the company as a source of finance

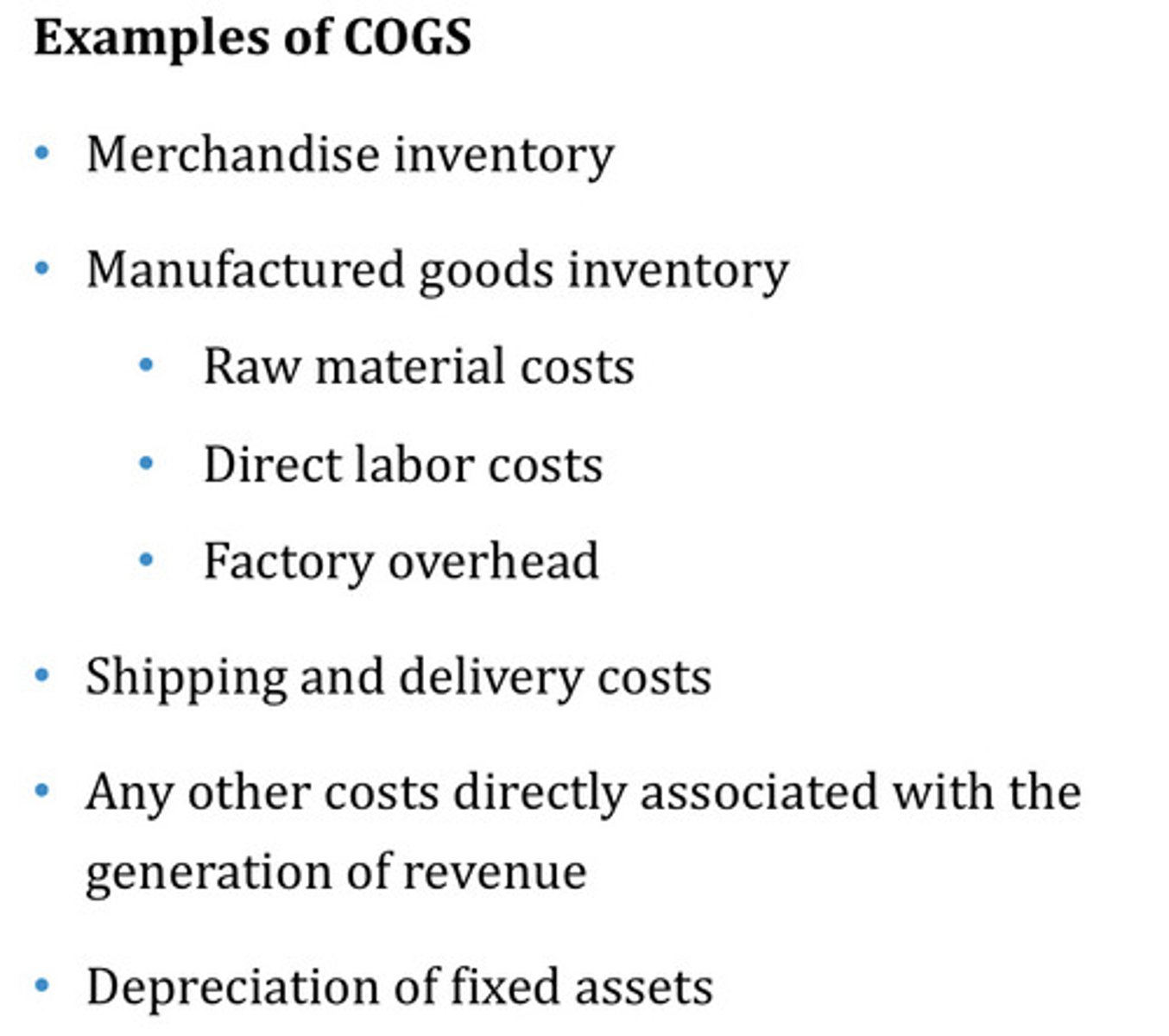

cost of sales (or cost of goods sold) COS or COGS

this is the direct cost of purchasing the goods that were sold during the financial year

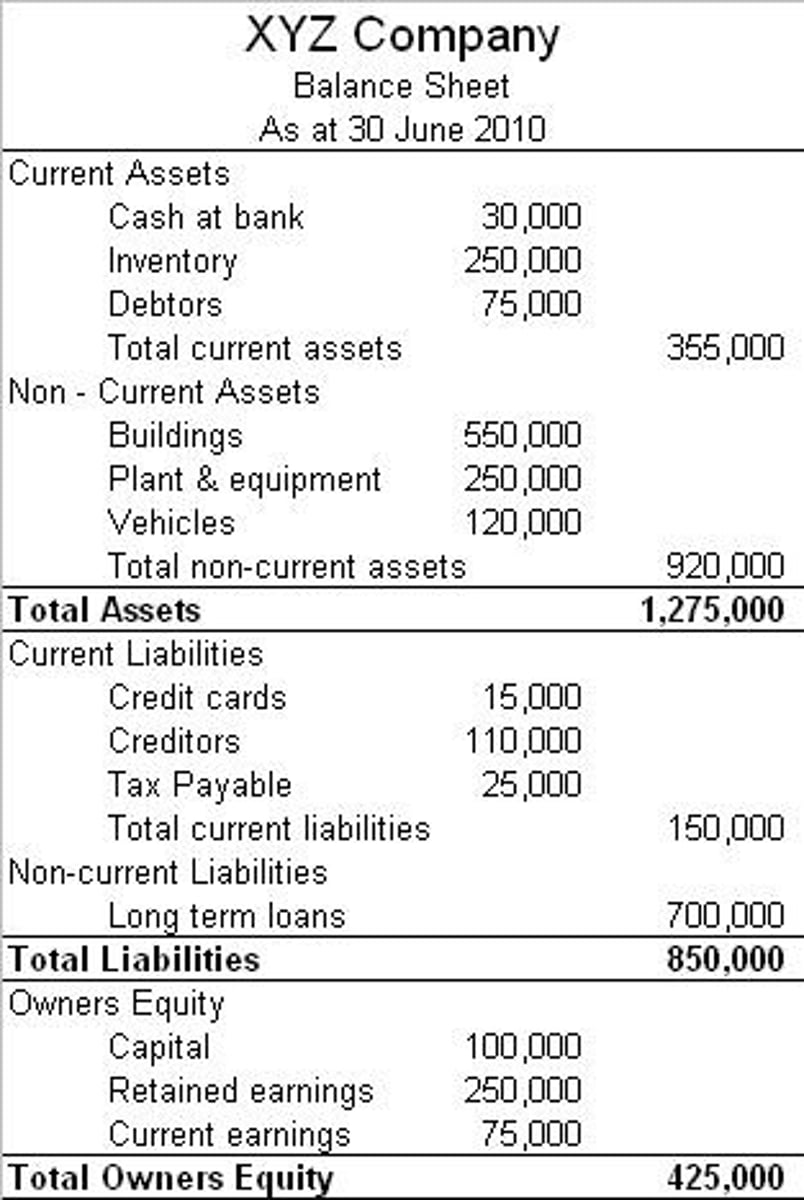

balance sheet (statement of financial position)

an accounting statement that records the values of a business's assets, liabilities and shareholders' equity at one point in time

shareholders' equity

total value of capital invested in the business by shareholders either in the form of share capital or retained profit; shareholders' funds

shareholders' equity

total value of assets - total value of liabilities

current liabilities

debts of the business that will usually have to be paid within one year; e.g. creditors, bank overdraft, unpaid dividends and unpaid tax

share capital

the total value of capital raised from shareholders by the issue of shares

debtors

customers who have brought products on credit and will pay cash at an agreed date in the future

current assets

the value of all assets that could reasonably be expected to be converted into cash within a year; e.g. inventories (stock), accounts playable and cash/bank balance

intangible assets

an identifiable non-money asset without physical substance

goodwill

arises when a business is valued at or sold for more than the balance sheet value of its assets

intellectual property

an intangible asset that has been developed from human ideas and knowledge

market value

the estimated total value of a company if it were taken over

straight-line depreciation

a constant amount of depreciation is substracted from the value of the asset each year

units of production method

depreciating an asset on the basis of its usage

net book value

the current balance sheet value of a non-current asset = original cost - accumulated depreciation

annual depreciation charge =

(historic cost of asset - residual value) / useful life of asset (year)

depreciation per unit =

(cost of asset - residual value) / total units of production