13.1 Fiscal Policy

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

What does fiscal policy involve

The manipulation of government spending, taxation, and the budget balance to influence the economy

What are the two main fiscal policy instruments

Government spending and taxation

What is the macroeconomic function of fiscal policy

To stimulate economic growth and stabilise the economy

What is the microeconomic function of fiscal policy

Targeted spending/taxation to influence specific sectors or address market failures

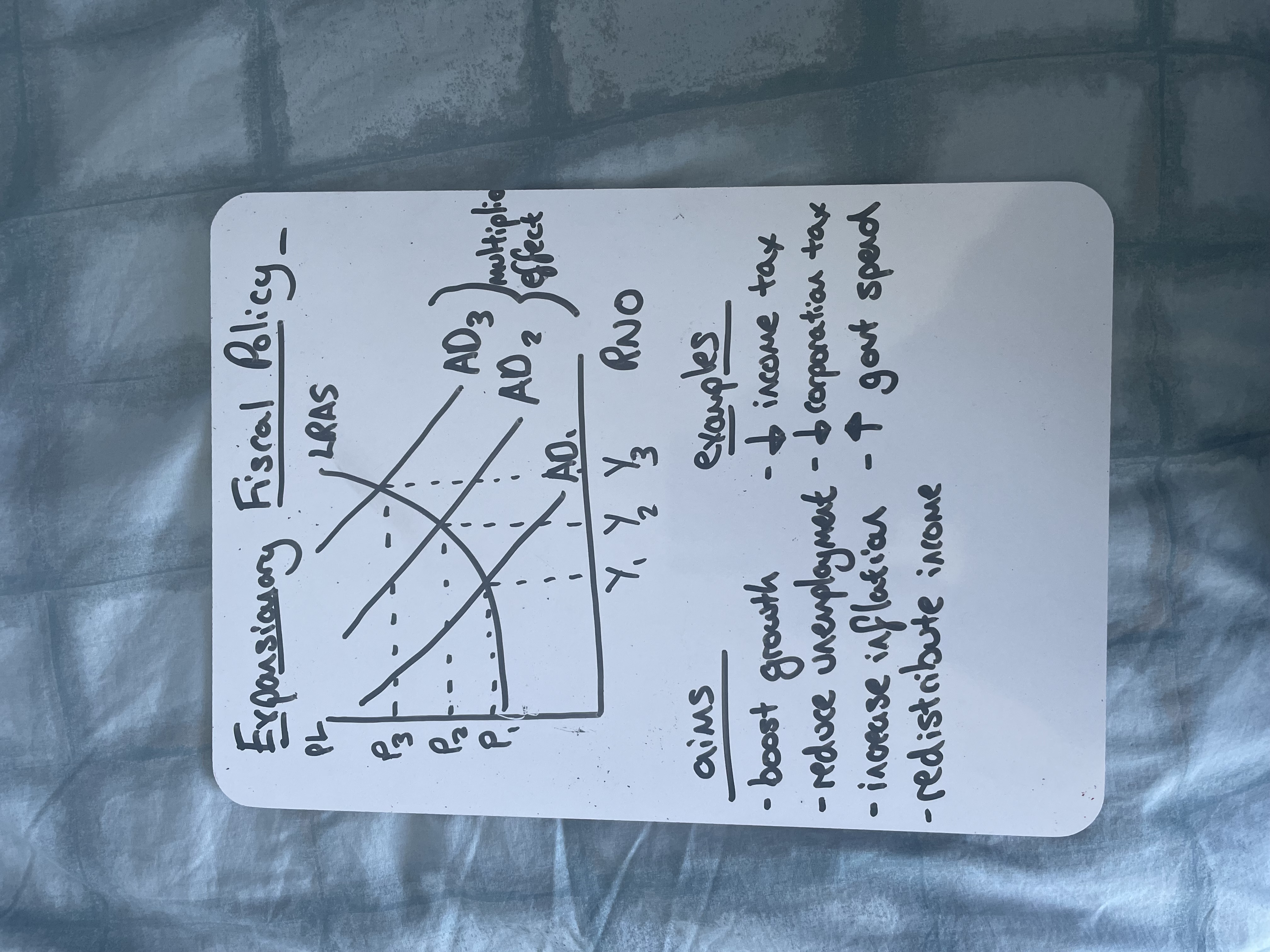

What is expansionary fiscal policy

Policy to increase AD by raising government spending or reducing taxes

Draw expansionary fiscal policy

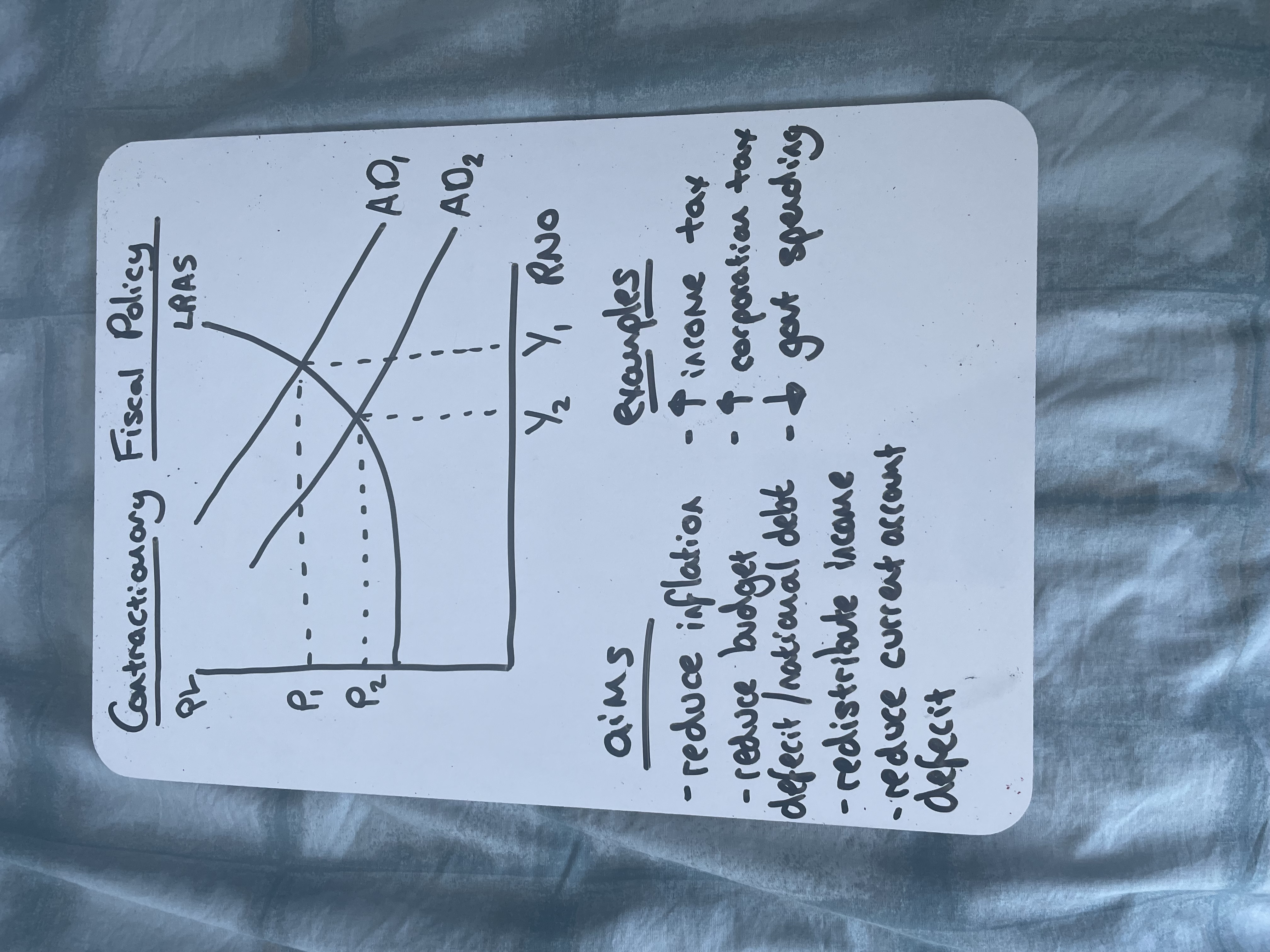

What is contractionary fiscal policy

Policy to reduce AD by cutting spending and increasing taxes

Draw contractionary fiscal policy

Disadvantages of expansionary fiscal policy

Worsen budget deficit - increases national debt

Higher interest rates

Can lead to high inflation

Time lag

Disadvantages of contractionary fiscal policy

Can reduce economic growth - leads to unemployment

Worsen inequality

Could lead to a recession

Time lag

Harms business and consumer confidence

How can fiscal policy improve AS

By reducing taxes, subsidising training, increasing education, healthcare and infrastructure spending

How do subsidies for training affect AS

They lower firm costs and increase labour productivity

How can government spending influence the circular flow of icome

By injecting demand into sectors needing stimulation

Which areas receive most UK government spending

Pensions, welfare, health and education

What is capital expenditure

Spending on long-term assets like roads and schools

What is current expenditure

Recurring spending on short-lived goods/services like NHS drugs

What are transfer payments

Welfare payments with no exchange of goods/services (e.g. state pensions)

Why do government engage in public expenditure

To ensure minimum living standards, promote equality and simulate growth

What are the main reasons for taxation

To raise revenue, redistribute income, influence behaviour, correct markets failures

What are direct taxes

Taxes on income or profits paid directly by the individual or firm

What are indirect taxes

Taxes on expenditure (e.g. VAT), usually included in the price of goods

What is progressive tax

A tax where the average rate increases as income increases

What is proportional tax

A tax with a constant rate regardless of income

What is a regressive tax

A tax where lower-income individuals pay a higher proportion of their income (e.g. VAT)

What are Adam Smith’s four canons of taxation

Low collection cost, certainty, convenience, equity

What is the UK’s main source of tax revenue

Income Tax

What is the difference between the budget defecit and national debt

The deficit is the annual gap between spending and revenue; debt is the accumulation of past deficits

What is a cyclical deficit

A temporary deficit caused by economic downturns

What is structural deficit

A persistent imbalance not related to the economic cycle

What is crowding out

Government borrowing reduces private sector investment due to higher interest rates

Why might high national debt be problematic

It can raise borrowing costs and lead to higher taxes or spending cuts

How can national debt affect investor confidence

Excessive debt may require higher interest rates to attract investment

What does the Office for Budget Responsibility (OBR) do

Analyses UK public finances, provide economic forecasts, assesses govt targets

What fiscal targets does the OBR monitor

Balancing the budget in 5 years and reducing net public sector debt