International Trade Chapter 6 Vocabulary

1/47

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

48 Terms

Differentiated goods

Products that are distinct from each other, not substitutes

Imperfect competiton

A form of competition in which firms can influence the price they charge

Monopolistic competition

Imperfect competition with two key features

Goods produced by different firms are differentiated

Because no perf competition, they do not have to accept the market price

Increasing returns to scale

Increasing returns to scale

The average costs for a firm fall as more output is produced

Free-trade agreements

An agreement of free trade between a group of countries

CUSFTA 1989

Canada - US free trade agreement

NAFTA 1994

North American free trade agreement

USMCA 2018

US - Mexico - Canada agreement, a renegotiation of NAFTA

Intra-industry trade

Imports and exports in the same industry

What model explains intra-industry trade

Monopolistic competition

Gravity equation

Implication that large countries (as measured by their GDP) trade the most

Duopoly

2 firms are selling a product

Marginal revenue

The extra revenue (sales) earned by a firm from selling one more unit of output

Marginal cost (MC)

The extra cost of production associated with one more unit of output

Monopoly equilibrium

MC = MR

Duopoly

Market structure in which 2 firms are selling a product

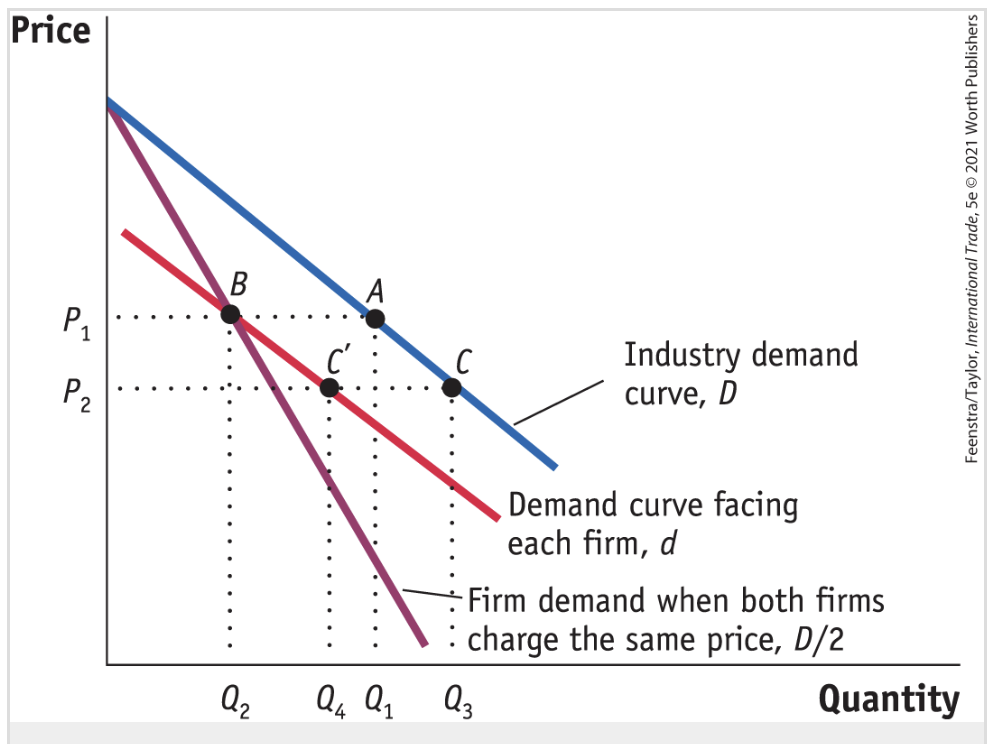

If both firms charged the price P1, then each firm’s demand is at a point on the curve

D/2

Duopoly graph

Trade under monopolistic competition assumptions

Each firm produces a good that is similar to but differentiated from the goods that other firms in the industry produce

There are many firms in the industry

Firms produce using a technology with increasing returns to scale

Because firms can enter and exit the industry freely, monopoly profits are 0 in the long run

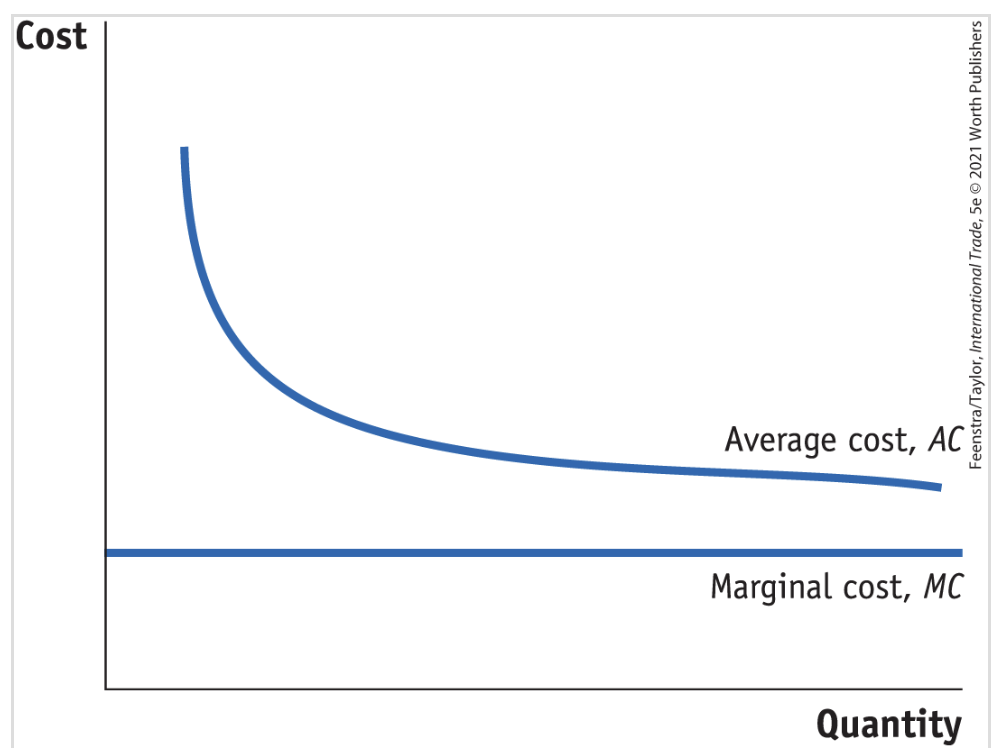

Increasing returns to scale for technology

The average costs of production fall as the quantity produced increases

Relationship between AC and MC. If MC is lower than AC, then AC must be

Decreasing to meet MC

Monopoly profit occurs when

The price charged is above average cost

In short-run equilibrium, each firm maximizes profits by producing

Qo, the quantity at which marginal revenue equals marginal cost

In a monopolistically competitive market, new firms contintue to enter the industry as long as

They can earn monopoly profits

When new firms enter and there are more product varieties available to consumers, the do curves faced by each firm becomes more

elastic or flatter; because each product is similar to the others, the number of close substitutes increases, and consumers become more price sensitive

When is a monopolistic competition industry at long-run equilibrium

When monopoly profit is zero

Under the Ricardian model, countries with identical technology would or would not trade. Why?

Would not trade because their relative prices would be equal

Under monopolistic competition, countries with identical technology would or would not trade. Why?

They would because two identical countries will still engage in trade because increasing returns to scale

Ricardian model

What is the demand during free trade?

D / (N^A), with N^A representing the number of firms in the absence of trade

Free trade causes the number of firm and profuct varieties to

Double

CUSFTA

Free trade agreement between Canada and USA in 1994

CUSFTA effects in Canada

Short-term loss of jobs (100k jobs) but long-run gianed more jobs that offset the loss

Productivity rose 18% over 8 years

Manufacturing productivity rose 6%

Fall in proces for consumers

NAFTA

Free trade agreement between Canada, Mexico, and USA

NAFTA effects in Mexico

Mexican tariffs on US goods declined from 14% to 1% and US lowered tariffs on Mexican goods

Because Mexico went through a financial crisis right after NAFTA signing, can only see benefits after a few years

Took a while for some things to actually take effect. EX. Mexican trucks not allowed to deliver goods in US until 2011

Productivity effects of NAFTA in Mexico (maquiladora plants vs non)

For maquiladora plants, productivity rose 45% from 1994 to 2003

For non-maquiladora plants, productivity rose 25%

Mexico financial crisis

Large devaluation of the peso

1994 Mexico switched to a flexible exchange rate policy, leading to the devaluation

Workers had to pay higher prices for imported goods, a decline in real wages for workers

Higher-income workers fared better than low-skilled workers in the maquiladora sector and better than workers in the rest of mexico

What is the maquiladora sector?

Factories in Mexico owned my a foreign corporation that assemble products and export them back to the US and other countries

Trade adjustment assistance (TAA)

A program that offers assistance to workers in manufacturing who lose their jobs because of import competition. Gives an idea of unemployment caused by NAFTA

Displacement of workers in USA after NAFTA

1999-2001 4 million workers were displaced, about 1/3 in manufacturing

2015-2017 laid off workers lost 93k a year for $5.4 billion total lost wages

Rules of origin specifies

The amount of each product that must be made in North America in order for the product to be shipped tariff-free between NAFTA countries

Changes from USMCA to NAFTA

Total American content of an automobile must be 75%, increasing from 62.5%

30% of an automobiles content must be produced in N American plants where labor earns at least 16$ an hour

Mexico passed new labor laws making it easier to form unions. Law gave workers the rights to vote on unions and on labor contracts under secret ballots

US produced have access to ~3.6% of Canada’s dairy market

USMCA limits the liability the internet platforms such as Facebook and Twitter face in Mexico or Canada for 3rd part content that is hosted on their sites

The provisioins of the agreement will remain in effect for 16 years, unless the three countries agree after 6 years to extend that time

Trans-Pacific Partnership (TPP)

Agreement among 12 countries in 2016, including the US, that was negotiated under Obama. Would have allowed US access to 3.25% of the Canadian dairy market. Trump pulled out shortly after being elected

The index of intra-industry trade tells us

What proportion of trade in each product involved both imports and exports, with 100% indicating an equal amount and 0% indicating the good is either imported or exported not both

Formula for index of intra-industry trade

Minimum of imports and exports (you choose the smallest of the two)

½ (imports + exports)

Gravity equation

Countries with larger GDPs, or that are closer to each other, have more trade between them

Gravity equation

B x [(GDP1 x GDP2)/ dist^n]