Theme 3D - market failure

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Describe direct provision

Government supplies goods directly to consumers (so they become the producer)

Ensures certainty of producing good at the socially optimal quantity since government objective is the maximise society’s welfare

Describe free direction provision (what, impact)

Why free market fail to provide public goods:

Non-excludable -> lack of effective demand in free market -> no private firm want to produce are there is no profit -> missing market and significant welfare loss to society

Non-rivalrous -> MC of providing for additional user = 0 -> price = 0 to maximise society’s welfare

What:

As the government is not profit-oriented, it does not need to earn revenue to cover the cost of production

Direct provision of the goods and services can be financed through the taxes the government collects -> public goods can be free to consumers -> allocative efficiency achieved

The government would decide on the quantity of goods to produce to maximise society’s welfare

Impact:

Government incur opportunity costs as government funds used for public goods could have been spent on other areas

Government lack the profit incentive to minimise cost -> productive inefficiency

Lack of perfect information may however result in the government under or overproducing the good

Describe outsourcing production

Government provide funding and outsource production and maintenance of goods to private producers by awarding them contracts

Private producers have more efficient in minimizing costs as costs have direct effect on their profitability

This eliminates the productive inefficiency associated with direct provision

Describe direct provision of merit goods and its impacts

Governments take over production of goods with significant positive externalities (Eg. Education and healthcare – normally produced by private sector)

Provide the good to consumers for free or at a very low price

Impact:

Governments lack incentive to minimise cost as their aim to meet the output level targets -> productive inefficiency

Compared to private firms which are profit-motivated and want to lower marginal cost

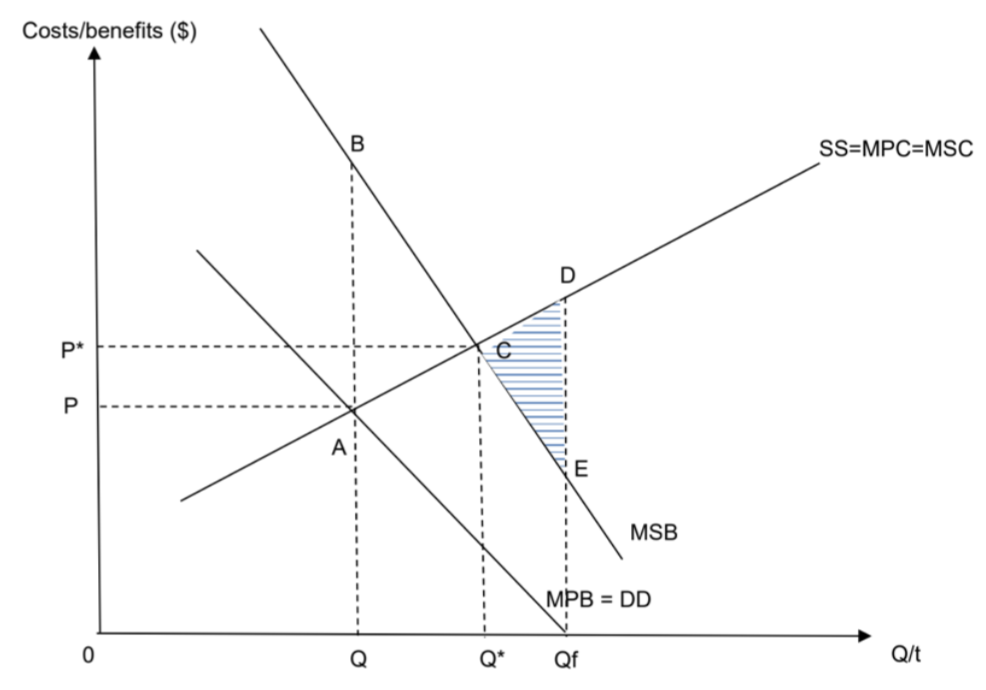

Draw graph of direct provision of merit goods

Market output at Qf -> welfare loss = CDE

Market output at Q -> welfare loss = ABC

Market equilibrium output when P = 0 is at Qf

Qf is closer to the socially optimal level of output, Q* than Q and a smaller welfare loss is incurred

Qf > Q* -> overconsumption -> welfare loss when good is provided for free

MEB not large enough to warrant free provision -> welfare loss from overconsumption is greater than initial welfare loss -> smaller welfare loss -> should provide subsidy = MEB at Q* to achieve socially optimal level

*Compare welfare loss when there is underconsumption (when government does not intervene) and overconsumption (when good provided free) -> choose smaller area

Describe joint provision

Private and public sectors produce a particular good or service together

Eg. Private and public hospitals -> address the demerits of the government taking over production completely -> private sector creates competition for the government enterprise and improves productive efficiency

State the 5 types of regulations to tackle externalities

Imposition of standards to limit negative externalities generated

Laws that command the use of particular methods to reduce the negative externalities

Limit sale / use of certain goods at certain times or at certain places

Total ban

Quota

Describe Imposition of standards to limit negative externalities generated and Laws that command the use of particular methods to reduce the negative externalities and Limit sale / use of certain goods at certain times or at certain places to tackle externalities

Imposition of standards to limit negative externalities generated

Eg. Emissions standards on automobile and factories that emit polluting gases, restrictions on lead and benzene content in petrol

Laws that command the use of particular methods to reduce the negative externalities

Eg. Make compulsory the installation of catalytic converters to reduce pollution from vehicle exhaust

Limit sale / use of certain goods at certain times or at certain places

Eg. Restriction on alcohol availability based on retail sale hours

Eg. In Singapore, there are designated control zones for drinking of alcohol

Eg. In some countries, cars are only allowed on the streets on certain days to reduce congestion

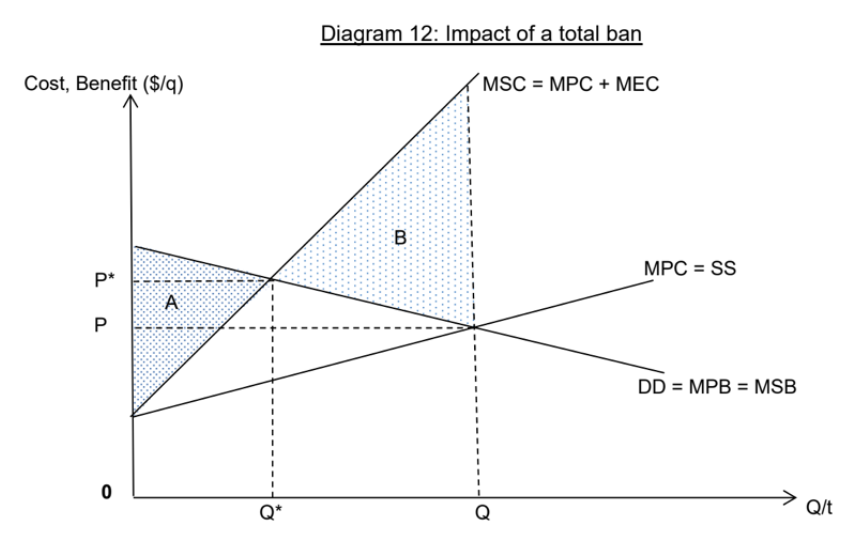

Describe total ban and possible scenarios

Bans are used when it is very difficult to use other policies to limit the amount of the externalities generated or when the damage caused is very severe

Whether this improves or worsens society’s welfare would depend on the magnitude of the MEC (higher MEC -> improvement in society’s welfare)

The socially optimal level of output is Q* where MSB = MSC

At output of Q*, the net total social benefit (societal welfare) = area A

Under the free market, the equilibrium output is Q where DD = SS

The negative externality causes a deadweight welfare loss to society of area B

If the government chooses to eliminate the externality by banning production, output will drop from Q to 0

Society will no longer incur the welfare loss of area B, but it will also lose the net total social benefit of area A from consuming/producing Q*

Net total social benefit = 0

If MEC was high such that the divergence between MPC and MSC was large, resulting in area B > area A (diagram), a total ban will improve society’s welfare, even though it does not cause output to be at the socially optimal level

If area A > area B, it will be better to leave the market alone and let it produce at Q

Draw graph of total ban

Describe quota

Limit the number of goods and services available for sale, usually in terms of restrictions to imports (to protect domestic producers) or exports (to ensure self-sufficiency)

Are legally established maximum quantities defined by the government.

To address negative externalities

Government issuing a fixed number of licenses to producers who will then have the right to sell the goods

Can impose laws to make consumption compulsory (Eg. Primary school) -> DD rises -> new quantity consumed rises to socially optimal level -> welfare loss eliminated

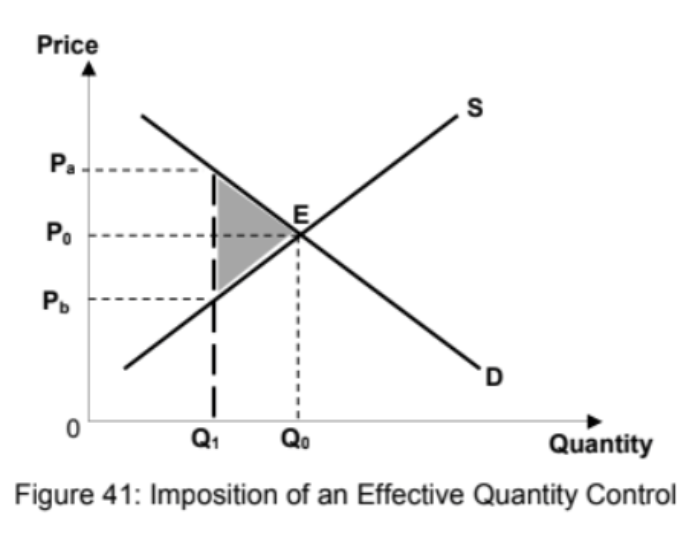

Explain how quota works

In the absence of government intervention, free market equilibrium is at E with equilibrium price Po and quantity Q0

The equilibrium quantity Q0 may be deemed to be higher than desirable

Hence, the government may decide to impose a quantity control at Q1 which is lower than the free market equilibrium of Q0

At the quantity of Q1, consumers are willing and able to pay a higher price of Pa to obtain the good while producers are willing to produce at the price of Pb

To maximise profit, the price charged by a producer would be at Pa

Draw graph of how quota works

Describe impact of quota

The impact of quotas on producers’ TR and consumers’ TE depends on PED :

If PED>1: Rise in price → more than proportionate fall in qty demanded → TR and TE falls

If PED<1: Rise in price → less than proportionate fall in qty demanded → TR and TE rises

Describe feasibility and effectiveness and addressing root cause of quotas

Feasibility |

|

Effectiveness and addressing root cause |

|

Describe side effects and time lag of quotas

Side effects |

|

Time Lag |

|

Describe regulations to address adverse selection

Cause of problem: lack of information

Laws that regulate the quality that producers have to meet or laws that force sellers to replace defective goods

Eg. In Singapore, the Consumers Association of Singapore (CASE) can use laws to prohibit fraudulent misrepresentations in the sale of defective consumer products or set minimum safety standards for consumer products

‘Lemon law’ : forces sellers to replace or repair defective goods and allows buyers the right to a discount or refund if the repairs or replacements of the defective products are not possible or not provided within a reasonable time

Sellers are forced to be honest about product quality -> buyers more willing to pay higher prices as there is greater assurance of product quality -> reducing the problem of adverse selection as buyers and sellers of good quality products can engage in mutually advantageous trade based on an agreeable price

Describe regulations that address market dominance problem

Governments can regulate pricing by imposing price regulations on firms and introduce anti-trust laws

(Covered in JC2)

Describe public education

Government provide information to educate consumers on the true marginal private benefits of consuming these goods -> reduce extent of information failure in the market by educating on true MPB -> encourages consumers to consume more/less of a good as they improve individual decision-making

Governments carry out national campaigns to encourage health checks or discourage gambling -> showing statistics or highlighting the potential benefits/harms in the campaign messaging

Eg. In many countries, cigarette packs are also labelled with health warning messages to inform smokers about the damage that smoking does to their body

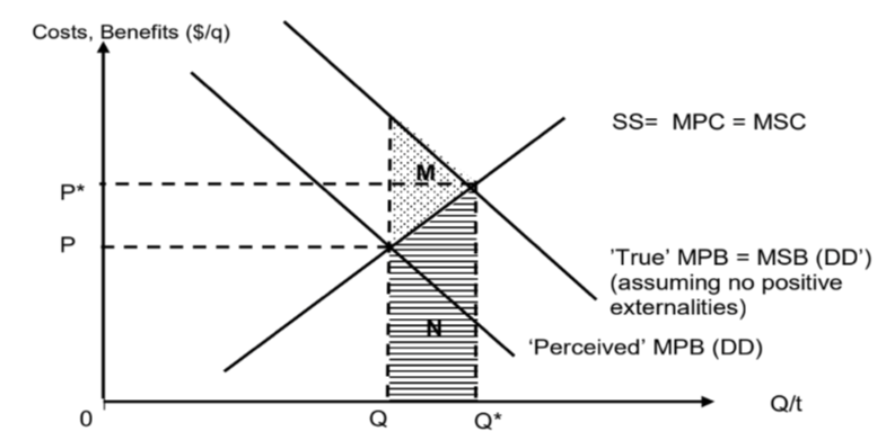

Explain public education solves consumer ignorance and draw graph

With public education, consumers are aware of the true marginal private benefits of being vaccinated

Consumers’ willingness to be vaccinated increases -> demand for vaccination to increase to the true MPB curve (DD’)

The new market equilibrium quantity matches the socially optimal quantity to be consumed at Q* -> resolving the allocative inefficiency problem