ACC3200

1/133

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

134 Terms

What are the financial investment measurements?

Return on Investment

Residual Income

Economic Value Added

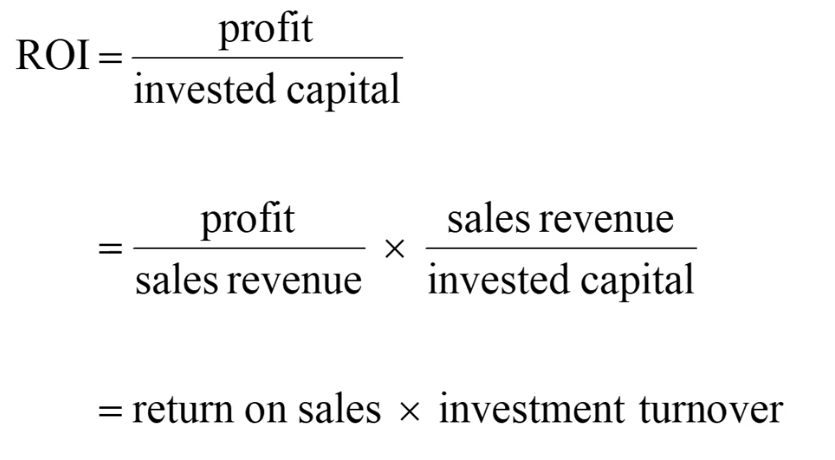

What is ROI?

Use to evaluate the financial performance of investment centres

Profit/ investment capital

% or a ratio

How to improve ROI?

Increase return on sales through increase selling price or sales revenue or decrease expense

Increase investment turnover through increase sales revenue or reduce invested capital

What are the advantages and limitations of ROI?

Advantages:

Focus on both the profit and the assets required to generate those profits

Can be used to evaluate the relative performance of investment centres

Limitations:

May encourage managers to focus on improving short term financial performance = may impact future competitiveness - use multiple measures

May encourage managers to defer assets replacement to maintain high ROI - consider alternative ways of measuring invested capital

Prevent goal congruence

Discourage managers to take on other projects

How to minimise behavioural problems of ROI?

Use multiple performance measurements

Consider different ways to measure invested capital

What is RI?

Profit - (invested capital * imputed interest rate)

Required rate of return = imputed interest rate charge

$ amount

What are the advantages and limitations of RI?

Advantages:

More likely to promote goal congruence compared to ROI

Takes into account of the organisation's measurement of required rate of return on performance/ investments

Encourages investment in projects that yield a positive RI to the organisation

Limitations:

Cannot use to compare performance of businesses that are different sizes

Formula is biased in larger businesses

Can encourage short orientation

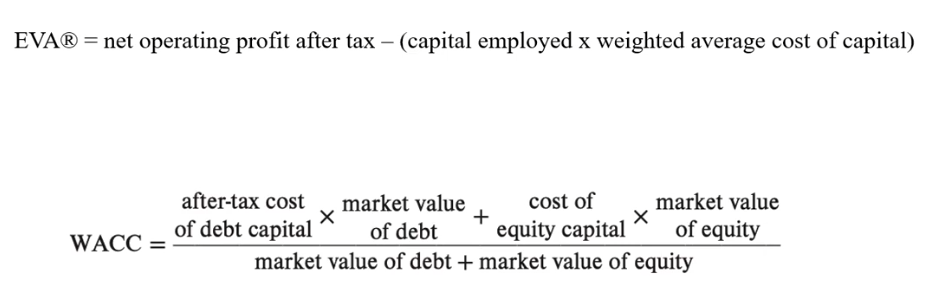

What is EVA?

Measures the value added over an accounting period

The spread between the return generated by business activities and the cost of capital

How can EVA be improved?

Increase profitability without employing additional capital

Borrowing additional funds

Pay off debt by selling assets

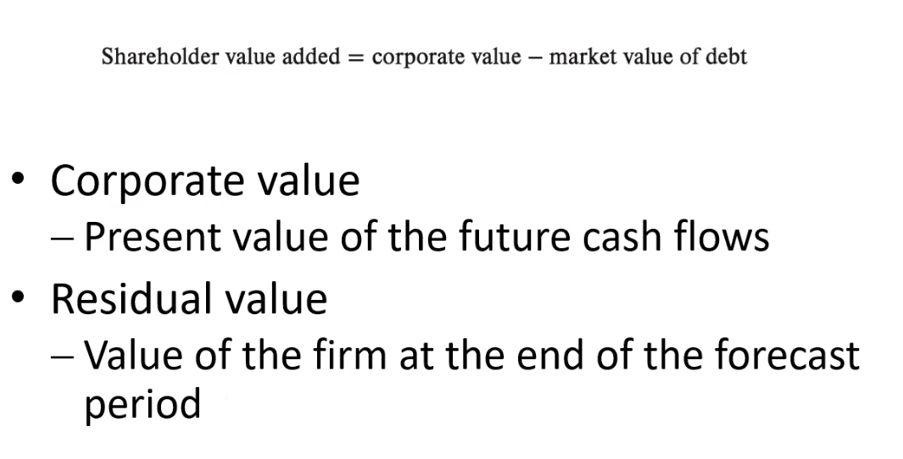

What is Shareholder value added (SVA)?

The worth of the business from a shareholder's perspective

What is Invested Capital?

Total assets

Total productive assets

Total assets less current liabilities

What is Value-based management?

Framework for making key business decisions that add economic value to the business

Strategies or decisions that achieve a return on capital greater than the cost of capital

What is incentive scheme?

Process, practices and systems that are used to provide levels of pay and benefits to employees

High incentives can strive high performances

Goal congruence

What is Intrinsic motivation?

Derives from the interest and enjoyment of work

What is Extrinsic motivation?

Derives sources outside the individual

What are the Performance-related pay systems?

Individual incentive plans

Profit sharing plans

Employee share plans

Gainsharing

Team based incentive scheme

What are the disadvantages of using financial performance measures?

Focuses on the results rather the causes

Only showing one perspective of performance

Limited guidance for future actions

Some actions does not take into account of shareholder and customer value

List some non-financial measures

Customer satisfaction

Defect measures

Quality

Stock status

Accident report

Multi-skilling

Machine downtime

Delivery on time

What are the advantages of non financial measures?

May emphasise strategy

Can be a drivers of future financial performance

Easier to investigate

May be more timely

More understandable and easier to relate to

What are the limitations of non financial measures?

Inclusion of non-financial measures can be ad hoc and undirected

Trade-off can occur

Lack integrity

May not easily translate into financial outcomes

What is a balanced scorecard?

Performance measurement system

Identifies and reports on performance measures of the organisation

Translates an organisation's mission, objectives and strategies into performance measures for each key strategic area of the business

It is used to implement strategy and to monitor and manage organisational performance

May form part of an organisation's planning cycle

What are the perspectives of BSC?

Financial perspective = perspective of the shareholders

Customer perspective = achieving customer's value

Internal business process = focusing specific and critical porcess

Learning and growth = capabilities of the organisation to achieve internal business process

Define lag indicator

Measures that help managers monitor progress towards objectives

Measurements of past performance

Results of the past

Define lead indicator

Focus on factors that drive outcomes and provide actionable information

Relate to business process and activities

Predictors of future success

Improvements in these measures should, overtime, improve lag indicators

What is a strategy map?

A visual representation explaining the cause and effect relationships linking the objectives of the perspectives of the BSC and the objectives of the organisation

It communicates to managers the components of strategy and processes and systems that will help achieve it

What are the types of benchmarking?

Internal benchmarking;

Business units within the same company

Competitive benchmarking:

Identify weaknesses and strengths of competitors

Industry benchmarking:

Company with similar interests and technologies

Best in class or process benchmarking:

Best practices in an industry

Businesses may try to normalise the measures to make them comparable

Define corporate sustainability

Requires organisation to consider interrelated impacts of their activities on the economy, environment and society

What is sustainability report and what does it highlights?

Measure and communicate the economic environmental and social (ESG) impacts

Triple bottom line reports

Corporate social responsibility reports

Social audits

Social and environmental reports

What is global reporting initiative (GRI) framework?

recognised + regarded as global standards

it is the representation of the best practice

required for all reports published after 1/07/2018

Provides guidance to organisations on performance measures and methods that they can use to measure and report on sustainability-related impacts and performances

What is the SASB standards?

IFRS Sustainability disclosure standards

IFRS S1 = General requirements for sustainability related disclosures

IFRS S2 = Climate related disclosure

What is international integrated report framework (IIRF)?

Broader focus than sustainability reports

Aims to explain how an organisation creates value overtime

Integrated report: six kinds of capital (financial, manufactured, intellectual, human, social and relationship, natural)

What are the benefits of reporting sustainable performance?

Identify environmental and social changes that impact the organisation and its stakeholders

Develop a strategy to manage risk and opportunities

Create innovative new products and services

Engage in actions to grow their market share

Define natural capital

Stock of capital derived from natural resources

Issues of materiality and valutation

What is environmental management system (EMS)?

Manage environmental performance

Report and capture environmental impact of an organisation's activities

Environmental performances to be measured against policies, objectives and targets

Define environmental cost and list them.

Incurred to prevent, monitor and report environmental impacts and costs of non-compliance with regulations

Conventional costs

Direct costs associated with capital expenditure, raw materials and other operating and maintenance costs

Hidden costs

Activities such as monitoring and reporting of environmental activities and emissions, cost of searching for environmentally responsible suppliers and ongoing cost of cleaning up contaminated land

Contingent costs

Arising from failure to clean up contaminated sites, and fines and penalties for non-compliance with regulations

Relationship and image costs

Less tangible costs and benefits that relate to consumer perceptions, and employee and community relations

Societal costs

Impose on others

The environment and society

What is supply chain management?

Life cycle analysis = associated impacts on the product

May lead to adoption of innovative product and process environment in each stage

Suppliers = environmentally responsible supplier cost analysis

Customers = work with to reduce the adverse environmental and social impact of products

what is International standard organisation (ISO) 14031 environmental performance evaluation?

Provides advice on how to measure environmental performance

Eco- intensity and eco-efficiency measures

Operational performance indicators

Management performance indicators

Environmental condition indicators

What is capital expenditure analysis?

Inclusion of environmental costs and benefits may affect the attractiveness of a project

Some capital expenditures driven by need to be environmentally and socially responsible

Define responsibility accounting.

A system that is built around a framework of responsibility centres

A manager is held accountable for their own responsible centre

What is strategic planning?

Long-term planning usually undertaken by senior managers

Involves decision about corporate strategy and business strategy

Might happen every 3 to 5 years

Formulated in broad terms

Directly influences the formulation of budgets

What is a budget?

Detailed plan of future operating activities

Acts as financial model of future operations

Core component of an organisation's planning and control system

Critical way of providing information to managers

Short-term plan, covering year by year

What is the purpose of budgeting?

Planning = expresses a plan of action in financial terms

Facilitating communication and coordination between all managers

Allocating resources

Controlling profit and operations = serves as a benchmark for comparing actual results

Evaluating performance and providing incentives

What is included in an operating budget?

sales budget

cost budget for manufacturing business

What does sale budget do?

Detailed summary of estimated sales units and revenues

Estimating which products will be sold and in what quantities = can be done through market research

Internal and external factors should be considered

What does cost budget for manufacturing do?

Production budget shows number of units to be manufactured

Budgets for direct materials, direct labour and overheads

Budget for selling and administrative expenses

What does cost budget for retail and wholesale business consist of?

Purchases budget to determine the quantity and costs of goods to be purchased for resale

Budgets for selling and administrative expenses

What does cost budget for service firm consist of?

Budgets for costs incurred to provide services

Overhead budget

What is included in financial budget?

Cash budget:

Expected cash receipts and planned cash payments for the budget period

Timing of all cash movements

Allows businesses to plan financial resources

Budgeted income statement:

Shows expected revenue and planned expenses

Budgeted balance sheet:

Shows expected assets and liabilities at the end of the budget period

Capital expenditure budget:

A plan for the acquisition of long-term assets

May involve cash flows over many years

What is budgeting like for not-for-profit organisations and government agencies?

No sales budget if services are provided for no charge

Other revenue sources may be estimated, including government grants, donations and sponsorships

Services levels drive the resources that are needed and form the budget cost

Define administration

Formal processes are typically used to collect data and prepare the budget

The process is often the responsibility of the senior accounting manager

A budget committee consists of key senior executives who advise the accountant during the preparation of the budget

What is a budget manual?

Who is responsible for providing information

When the information is required

What form it will take

What are the main issues for budgeting?

participative budgeting

Budgetary slack

Budget difficulty

Define participative budgeting and its benefits and costs

Develop initial budget estimates for own area of operations

Negotiation and revisions of budget estimates

Managers at all levels have input

Top-down budgeting = senior managers impose budget targets

Bottom-up budgeting = lower managerial and operations levels active in setting own budgets

Benefits:

Encourage coordination and communication between managers and wider organisation

More accurate budget estimates

Individuals identify more closely with budget targets

Employee empowerment due to higher degrees of authority and independence

Costs:

Expensive and time consuming

Can cause delays and indecisiveness

May aggravated differences and disagreements

Provides opportunities for padding budgets

Define budgetary slack and what reduce opportunities for budgetary slack?

Managers may intentionally underestimate revenues or overestimate costs

Refers to the difference between the revenue or cost projection and a realistic estimate of revenue or cost

Reduce opportunities for budgetary slacks:

Use benchmarking

Senior managers regularly involve themselves in the tasks of subordinates

Promoting and fostering values and norms unfavourable to budgtary slack

Linking rewards to predictive accuracy

Using stretch targets

What is budget padding and reasons for it?

If manager performance evaluations depend on budgetary benchmarks being achieved, managers may try to "beat the budget", manage uncertainty or compete for resources

Incentives to underestimate revenue or overestimate costs

Deploy tactics to influence budget negotiations, such as witholding information, promising performance improvements, emphasising the role of business conditions, or appealing to decision maker's emotions

There are three primary reasons for padding the budget:

Some managers believe their performance looks better when they exceed their budget

It is a way of coping with uncertainty

To guard against initial budget requests being cut back by senior management

When does budget difficulty occur?

Goal congruence occurs when the organisation's goals coincide with an individual's goals

When is budget acceptance occur?

Budget acceptance is more likely when:

Developed participatively

Considered achievable

There is frequent feedback on performance

Employees are held responsible for activities within their control

Achievement is accompanied by rewards

What is zero based budgeting?

The process where all activities in the organisation are initially set to zero

Managers must justify each activity in order to receive an allocation of resources

Can be time consuming and expensive to implement

Not useful to identify areas of waste, redundant activities or ways to improve performance

Can be too introspective

What is program budgeting?

Budgets are prepared for individual programs and program objectives as opposed to line item budgeting

Control is achieved through quantitative and qualitative performance measures

It is often associated with budgeting in government departments

Focus on outputs and outcomes

What is rolling budgeting?

Continually updated

Add a new time period

Drop the period just completed

Identify any gaps between what it is expected

What is flexible budgeting?

Detailed budget prepared for a range of levels if activity = compared to a static budget which relates to one specific planned level of activity

Allows us to select the most appropriate benchmark for cost control

A valid basis for comparing actual and expected costs to budget, for the actual level of activity

What does a control system consist of?

Predetermined performance level

Measure of actual performance

Comparison between standard performance and actual performance

What is standard cost?

Serves as a benchmark

Part of the control system

Important for planning and control

Estimated costs that is going into making a unit of product

Budgeted costs, based on estimates of the cost of material, labour and overhead resources

Actual cost is compared to standard cost to determine variance cost

Define standard cost variance

Used to evaluate actual performance and control costs

Define Setting standards

Analysis of historical data

Engineering methods

Combined approach

What is service organisation?

May be non-repetitive

Firms may develop standard quantities to capture the time taken for key activities and processes

What are the types of standards?

perfect or ideal standard

practical standard

Benchmarking cost standard

Define ideal or perfect standard

Peak efficiency

Lowest material and labour prices

Use of the best quality materials

No production disruptions

Motivation to achieve the lowest cost = can cause employee to feel discourage as standards are not possible to achieve

May sacrifice product quality

Define pratical standard

Minimum attainable costs under normal operating conditions

Allowances made for downtime and wastage

May encourage more positive attitudes towards targets as it is more achievable and realistic

May encourage inefficiency and wastage

Define benchmarking cost standard

Identify the company that has the best cost performance

Identifies areas need to improve cost performance

Cost standards may be formulated to achieve external performance standards

More difficult to benchmark against competitors = but will create a competitive advantage once succeed

What is static-budget variance?

The difference between the actual result and the corresponding static budget (master budget) amount

What are the cost and benefits of investigation?

Cost:

time spent investigating

disruption to the production process

cost of implementing corrective actions

Benefits:

Reduce future cost if the cause of the variance is eliminated

Improve work practice

What is standard costing system?

can be used for product costing

all inventories recorded at standard cost

variances are closed off at the end of the period

Limitation of variance analysis

variances are too aggregated

variances focused on the consequences rather than the causes of the problems

variances report may be too late to be useful

tendency to focus on cost minimisation

takes departmental rather than a process perspective

What is the purpose of performance measurement?

Communicate business' strategy and plans, align employee's goals

Track management performance against targets

Evaluate and reward subordinate's performances

Guide future development of strategies and operations

Compare actual results with what's on targets

Allows for goal congruence

What is an effective performance measurement system?

Links to strategies and goals

Recognises controllability

Embraces participations and empowerment

Simple and understandable measures

Emphasises the positives

Reported in a timely manner --> to take corrective actions

Includes benchmarking

Limited number of measures

Links rewards

What is decentalisation?

Dividing the organisation into smaller units

Each unit assigned particular operational and decision making responsibilities

Goal congruence = ensuring goals throughout the units are aligned with organisational goals

Managers assigned responsibility to run units

Managers accountable for performance of their units

What are the benefits for managers in decentralisation?

More accurate and complete local information about markets and operations

Training for future higher level managers

Greater motivations and job satisfaction

Corporate managers have more time for strategic issues

Delegation allows quicker responses to opportunities and problems as they arise

What are the cost of decentralisation?

Narrow focus on own unit's goals

Unnecessary duplication

Behavioural challenge

What is shared services?

Concentration of support services formed into a separate unit to service multiple internal customers

Aim to reduce cost and improve quality of service

High level of autonomy and incentives

Often set up as profit centres with the aim to break even

What is team based structure?

Move towards flatter organisational structures

Self managed work teams

Members of team will be multiskilled

Promote employee satisfaction

Improved customer satisfaction and improved productivity

What is financial performance reports?

Show key financial results appropriate for the type of responsibility centre

Contribution margin format

Distinguish between profit margin controllable by manager and profit margin attributable to unit

What is transfer pricing?

Internal selling used when goods and services are transferred within a decentralised organisation

The transfer price is the revenue for the supply unit and cost for the buying unit

Result in profits that are reliable and accurate

Preserve and encourage autonomy

Encourage goal congruent behaviour

Who set transfer price?

Managers of profit centres and investment centres may have considerable autonomy

Direct intervention by corporate management is contrary to decentralisation philosophy

Corporate management may develop general policies to govern transfer pricing practices

What are transfer pricing method?

Market based prices = used if there are competitive external markets

Cost plus prices = no reliable external market prices, such as intermediate products

Negotiated prices = profit and/or investment managers negotiated transfer prices

What is the general transfer pricing rule?

Provide guidance on the appropriate transfer price

Represents a minimum transfer price

What happen when An external market and spare capacity in the supplying unit?

Additional profit for supply unit

Negotiation may occur to provide incentives for the buying unit

What happen when An external market and no spare capacity in the supplying unit?

Take into account of opportunity cost of lost profits

What happen when there is no external market and spare capacity in the supplying unit?

No opportunity cost

May be based on cost plus

What happen when there is no external market and no spare capacity in the supplying unit?

Account for opportunity cost on lost sales

What is quality?

The degree to which a product meets customers' needs and expectations

Total features and characteristics of a product or service made or performed according to specifications to satisfy customer at the same time

What are the layers of quality?

Quality of design:

Degree to which a product's design specifications meet customers' expectation

Quality of performance:

Degree to which a product meet its design specification

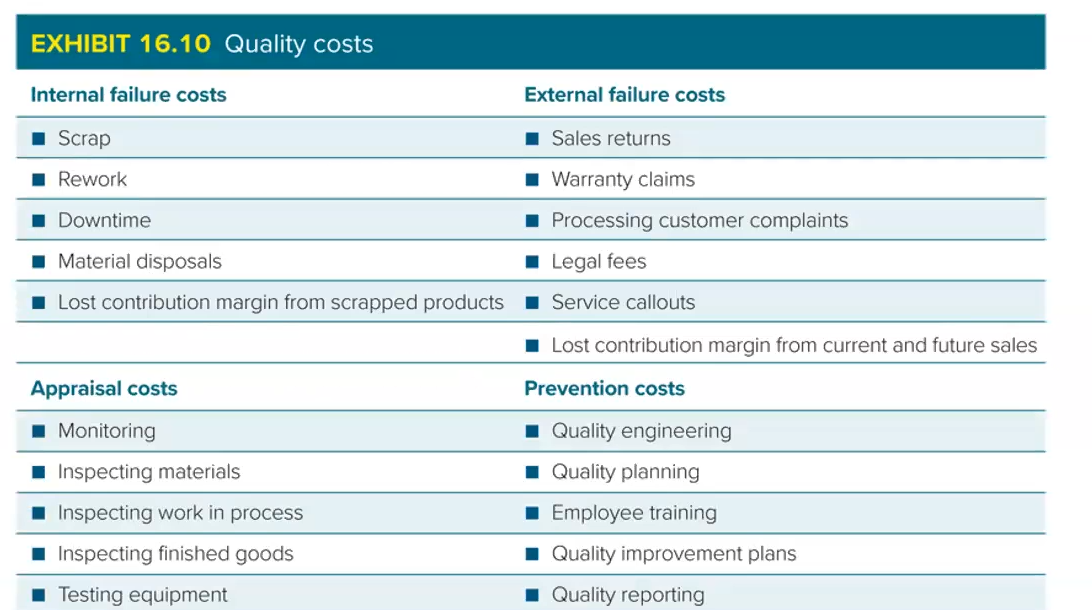

What are the types of quality cost?

Internal failure costs:

Detective products or services are detected before leaving the business

External failure costs:

Defective products or services provided to customers

Appraisal costs:

Determine whether defects exist

Prevention costs:

Prevent internal or external failures and minimise appraisal activities

What is cost of quality report?

Places a dollar figure on the costs of poor quality to quantify them

Looks at trends over time

Classifies costs as fixed or variable

Considers interactions between the four categories

What is total quality management and what does it consist of?

Structured approach to achieving continuous improvement in process to meet customer expectations

Organisation-wide

Infiltrates all aspects of the business and involve employees

Customer driven

Define by the needs and expectation of the customers

Involves empowerment

Want employees to manage their own quality inspections and correct problems

Process perspective

Focus on the smooth flow across the organisation

Quality management system

Supported by documented quality procedures and practices to keep the TQM process under control

Continuous improvement

What is six sigma?

Approach to manage quality

Business improvement methodology that focuses on identifying and eliminating defects

Structured approach and rigorous data analysis

Company can achieve quality accreditation - ISO 9000

What is supply chain management?

Interlinked organisations involved in creation, distribution and sales of goods and services

The management of key business processes that extend across the supply chain (original supplier to the final customers)

What kind of technology involves supply chain management?

E-commerce (Business transactions through electronics = allow customers to access interactive websites and initiate and complete transactions over the internet)

Business-to-business (B2B)

Electronic data interchange (EDI) (linking a company's computer system to suppliers or customers to exchange information in a timely manner)

Business and its non-business customers (B2C)

Enterprise resource planning (ERP)

Cloud computing

Internet of things

How are customers be managed?

Customer relationship management (CRM) = collecting and analysing of customer data to understand customers' behaviour patterns and needs

Seeks to develop strong customer relationships

Tailored products to customers' expectation and needs

Lead to improvements in customer service, customer retention, new customers, more effective and efficient marketing

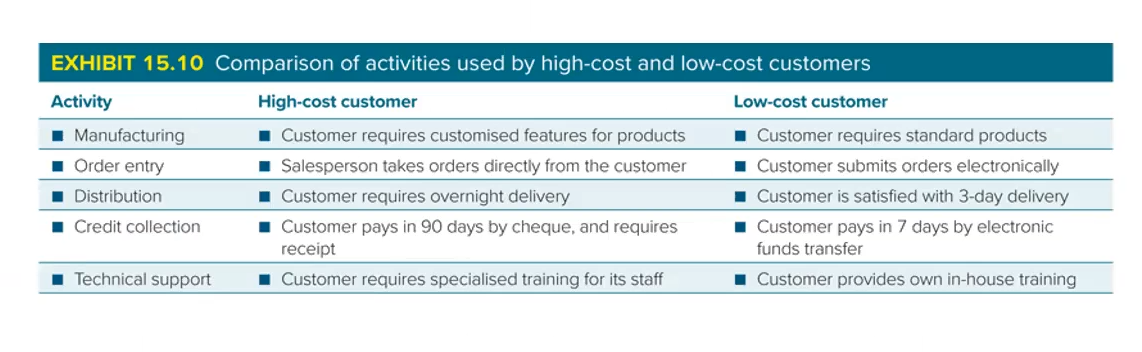

What are the types of customer profitability analysis?

Customer cost analysis = the analysis of the cost of products purchased by customers plus customer driven activities

Customer driven costs = include marketing and selling, packaging, order entry and after sales services

Activity based costing analysis may be used to determine the relative profitability