ib econ- 4.5: exchange rates

1/33

Earn XP

Description and Tags

credits https://www.econinja.net/global-economy/4-5-exchange-rates

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

what is an exchange rate?

the value of one currency in terms of another

what is a floating exchange rate?

a situation where the value of a currency is determined by the free market (supply of and demand for the currency)

what does it mean when a currency appreciates or depreciates?

appreciation: when a currency’s value increases compared to another country

depreciation: when a currency’s value decreases compared to another currency

in an exchange rate diagram, what does the supply and demand of currencies refer to?

the supply and demand of a currency that is ready for trading, as opposed to all of it

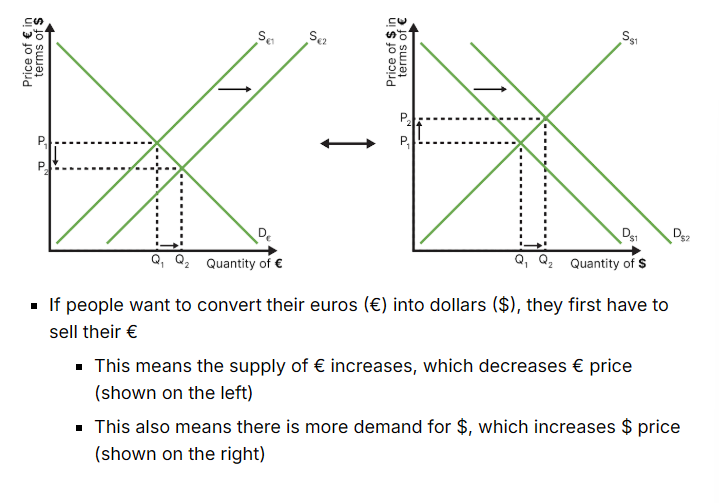

draw a change in supply of a currency (and its subsequent impact on demand)

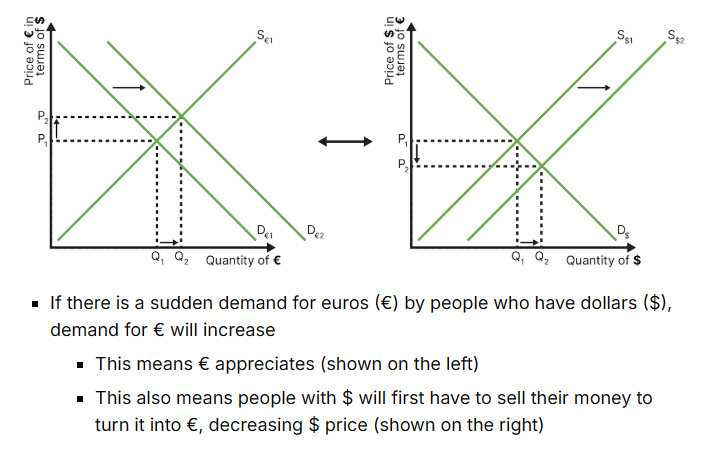

draw a change in demand for a currency (and its impact on supply)

what happens to the supply and value of a currency if you sell it?

sell = increase supply = depreciation

what happens to the demand and value of a currency if you buy it?

buy = demand increases = appreciation

how does foreign demand for exports, or domestic demand for imports affect the supply and demand for a currency?

when consumers from your country want to buy products from another, they first have to sell your country’s currency in exchange for the other country’s currency before they can buy it.

this means demand for the other currency increases, and that the supply of your currency increases, causing depreciation of your currency, and appreciation of the other one

how does foreign direct investment (fdi) affect the supply and demand for a currency?

fdi refers to international firms investing abroad, usually into factories to decrease costs of production

inward fdi means a firm invests into your economy (injection of money) increasing the demand for the domestic currency and causing an appreciation in the currency

outward fdi means a domestic firm invests in another economy (leakage of money) this increases the supply of domestic currency and causes a depreciation

how does portfolio investment effect the supply and demand for a currency?

some people/firms/governments may purchase financial investments from abroad. this includes stocks, bonds and options.

inward investment means someone from abroad wants to purchase investments in your country (money comes in), creating more demand for domestic currency and causing an appreciation in domestic currency

outward investment means someone from your country wants to purchase investments abroad (money goes out). this creates more supply of domestic currency, and causes a depreciation in domestic currency

how do remittances affect supply and demand of currencies?

money sent from people working abroad sending their money back to their home country

more demand for the home currency, while more supply of the original currency. (appreciation in home, depreciation in original)

how does speculation affect demand and supply of a currency?

here, speculation refers to the purchasing of a currency in hope that its value will increase

more demand for investment currency, whilst more supply of the original currency (appreciation of investment currency, depreciation of original currency)

how do relative inflation rates affect the supply and demand for a currency?

high inflation rates makes a countries exports less competitive, reducing exports, in turn reducing demand for the country’s currency (depreciation)

additionally, if inflation is hurting a currency, investors may sell this currency in exchange for a more stable one

more demand for the stable currency (appreciation), more supply of the inflationary currency (appreciation)

how do relative interest rates affect the supply and demand for a currency?

if a country’s bank offers high interest rate deposits, investors may be mor incentivised to put money in these bank accounts, in the form of local currency, as their relative reward for saving increases.

this leads to more demand in the high interest rate currency (appreciation) and more supply of the original currency (depreciation)

what are the two different scenarios that relatively high growth rates can have on supply and demand of a currency?

scenario 1a: high economic growth leads to an increase in the rates of inflation, which causes the central bank to increase interest rates. hence, investors see high returns on bank deposits and more money is put into local banks.

scenario 1b: high economic growth creates more confidence in the economy, which leads to more investment from other countries.

these both show that high economic growth creates more demand for the highly growing country’s currency, (appreciation), while there is more supply of an original currency (depreciation)

scenario 2: high economic growth leads to more net imports from other countries as domestic demand outweighs supply - this creates more demand for other foreign currencies, and more supply of the high growth economy’s currency.

how does depreciation affect the inflation rate and economic growth?

if a currency depreciates, exports become relatively cheaper for other countries, causing an increase in exports

at the same time, imports become domestically relatively more expensive, decreasing imports

this causes an increase in net exports (x - m)

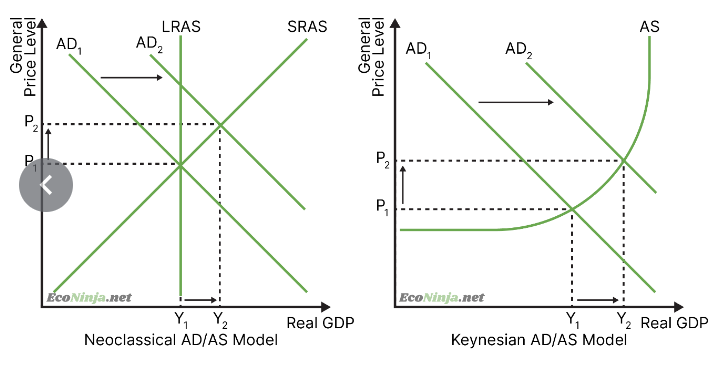

this increases ad - creating growth, but also demand pull inflation and raising the general price level

draw the diagram for how a depreciation affects growth and inflation

how does appreciation affect inflation rate and economic growth?

an appreciated currency makes exports relatively more expensive for other countries, so they are less likely to buy them.

at the same time, imports become relatively cheaper for domestic consumers, so they increase

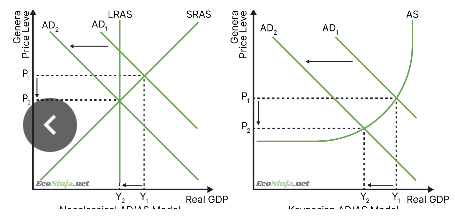

this causes net exports to decrease, thus causing ad to decrease (recession)

this causes a fall in the general price level (deflation)

draw the diagram for the impact of appreciation on inflation and growth

how does currency appreciation and depreciation affect unemployment rates?

currency depreciation makes exports cheaper to other countries, increasing their demand. this means more employment is needed.

currency appreciation will make exports more expensive for other countries, decreasing their demand. this will mean less employment is needed, increasing unemployment rates.

how does currency appreciation and depreciation affect current account balance?

a current account balance is how much net money is flowing into the economy

with depreciated currencies, exports will increase and imports will decrease, this means that the current account becomes more positive (and vice versa for appreciated currencies)

how do appreciating or depreciating currencies affect living standards?

on one hand, many countries rely on imports for necessities such as food and machinery - hence, when their country depreciates, these goods become more expensive and this can decrease living standards

on the other hand, an appreciating currencies makes exports more expensive for other countries, meaning that domestic firms will earn less revenue, reducing economic growth (which can lead to unemployment and a decrease in standards of living)

what is a fixed exchange rate?

one where a central bank ensures its currency stays at a constant rate, buy buying and selling both its own and foreign currencies. instead of being determined by a market mechanism, fixed exchange rates are decided by the central bank authority.

what is the devaluation of a fixed exchange rate?

the deliberate fall in the value of a fixed exchange rate. done to improve international competitiveness, as exports will look cheaper to other countries.

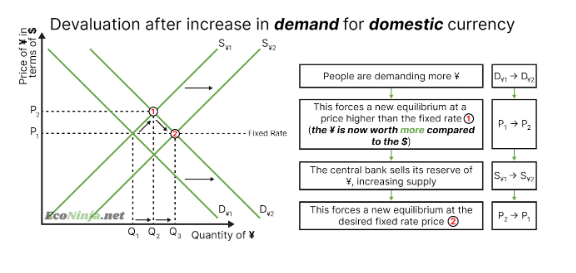

draw the diagram for/and explain a devaluation after increase in demand for domestic currency

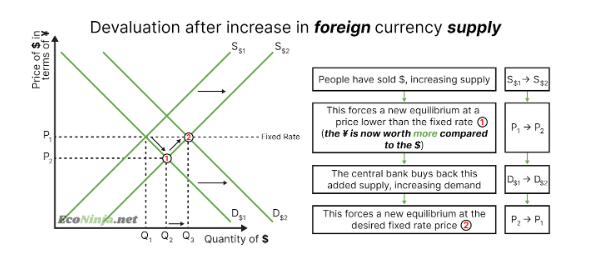

draw the diagram for/and explain a devaluation after increase in foreign currency supply

what is a revaluation of a currency?

the deliberate rise in the value of a fixed exchange rate currency. done to make imports cheaper, as you need less of your money to buy their money.

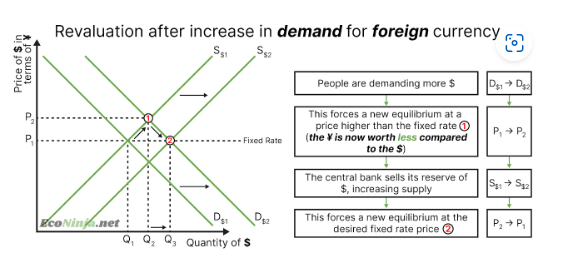

draw the diagram for/explain a revaluation after an increase in demand for a foreign currency

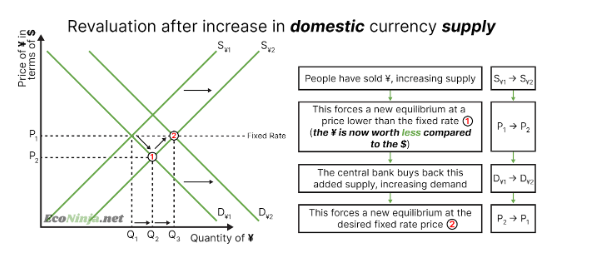

draw the diagram for/explain revaluation after an increase in domestic currency supply

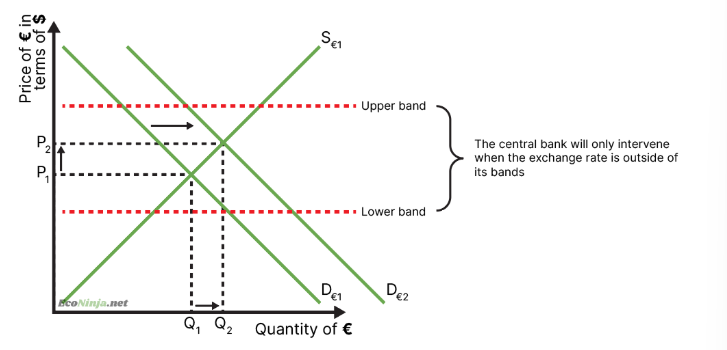

what is a managed exchange rate?

one where the central bank periodically intervenes to influence its currency’s exchange rate. they might have a target range they want the equilibrium to be within.

draw the diagram for a managed exchange rate

what is an overvalued currency?

when the value of a currency is above its equilibrium value in the long run

occurs when the central bank consistently intervenes to keep the value above

this means that imported goods are cheaper than they should be, whilst exports are more expensive - reduces inflationary pressures but also domestic firm revenue

what is an undervalued currency?

a currency is undervalued when its value is below equilibrium value in the long run

this occurs when the central bank consistently intervenes to keep the value below.

this means imported goods are more expensive than what they should be, whilst exported goods become cheaper. this will improve domestic producer revenue, but may cause inflation due to all the excess demand.