topic 8 - reporting and analyzing current liabilities

1/4

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

5 Terms

what’s the journal entry for sales tax?

debit: cash

credit: sales revenue

credit: taxes payable

what is a contingent liability?

an uncertain future event that has been caused by previous actions. they will not always be recorded

when are contingent liabilities recorded?

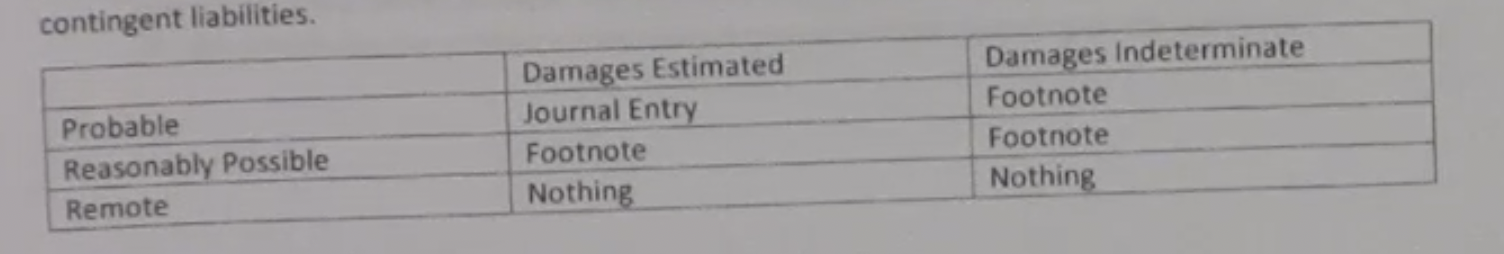

if it will cause probable damage that can be estimated, there will be a journal entry

if it is reasonably possible that it will cause damage that can be estimate, there will be a footnote

if it’s probable/reasonably possible but the damage cannot be determined, it is a footnote

if theres only a remote chance of damages (estimated or not), you do nothing

what are 2 examples of contingent liabilities?

product warranties - usually based on historical data so damages are easy to estimate; therefore, usually a journal entry

environmental cleanup costs - often likely to occur, but difficult to estimate, so you should make a footnote

what are the journal entries for product warranties

estimate

debit: product warranty expense

credit: estimated warranty liability

warranty exercised by customer

debit: estimated warranty liability

credit: cash/supplies