Monetary Policy: The Fed's Response to Economic Crises

1/94

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

95 Terms

Monetary Policy

The actions the Federal Reserve takes to manage the money supply and interest rates to pursue macroeconomic policy objectives.

Federal Reserve

The central banking system of the United States, created in 1913, with responsibilities including preventing bank runs and promoting maximum employment, stable prices, and moderate long-term interest rates.

The Goals of Monetary Policy

- price stability

- high employment

- stability of financial markets and institutions

- economic growth

Price Stability

A goal of monetary policy aimed at maintaining the purchasing power of money by controlling inflation.

High Employment

- A goal of monetary policy focused on achieving a low level of unemployment in the economy

- The goal to foster conditions for useful employment, as stated in the Employment Act of 1946.

Stability of Financial Markets and Institutions

- A goal of monetary policy that seeks to ensure the health and functioning of financial markets and institutions

- Fed makes funds available to banks in times of crisis, ensuring confidence in those banks

Economic Growth

- A goal of monetary policy aimed at fostering an increase in the production of goods and services in the economy

- Stable economic growth encourages long-run investment necessary for growth.

Covid-19 Pandemic

- The disease outbreak in 2020-2021 that pushed the U.S. economy into a recession, the first since the 1918 influenza pandemic

- leading the Fed to cut its target for the federal funds rate to zero.

Paul Volcker

The Fed Chair who used monetary policy in the 1970s to control high inflation.

Three Monetary Policy Tools

- open market operations

- discount policy

- reserve requirements

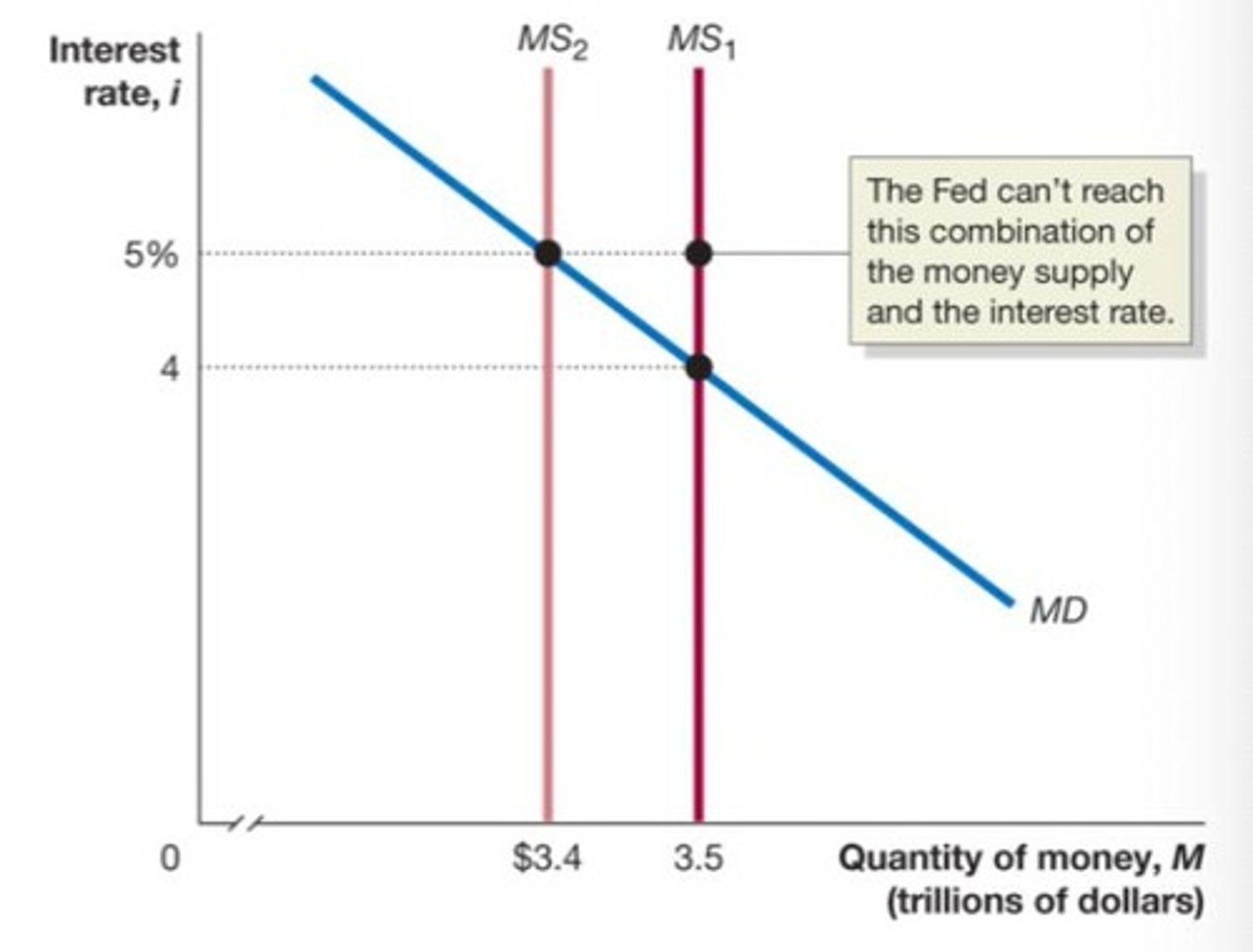

Monetary Policy Targets

- the money supply

- the interest rate (primary monetary policy target of the Fed)

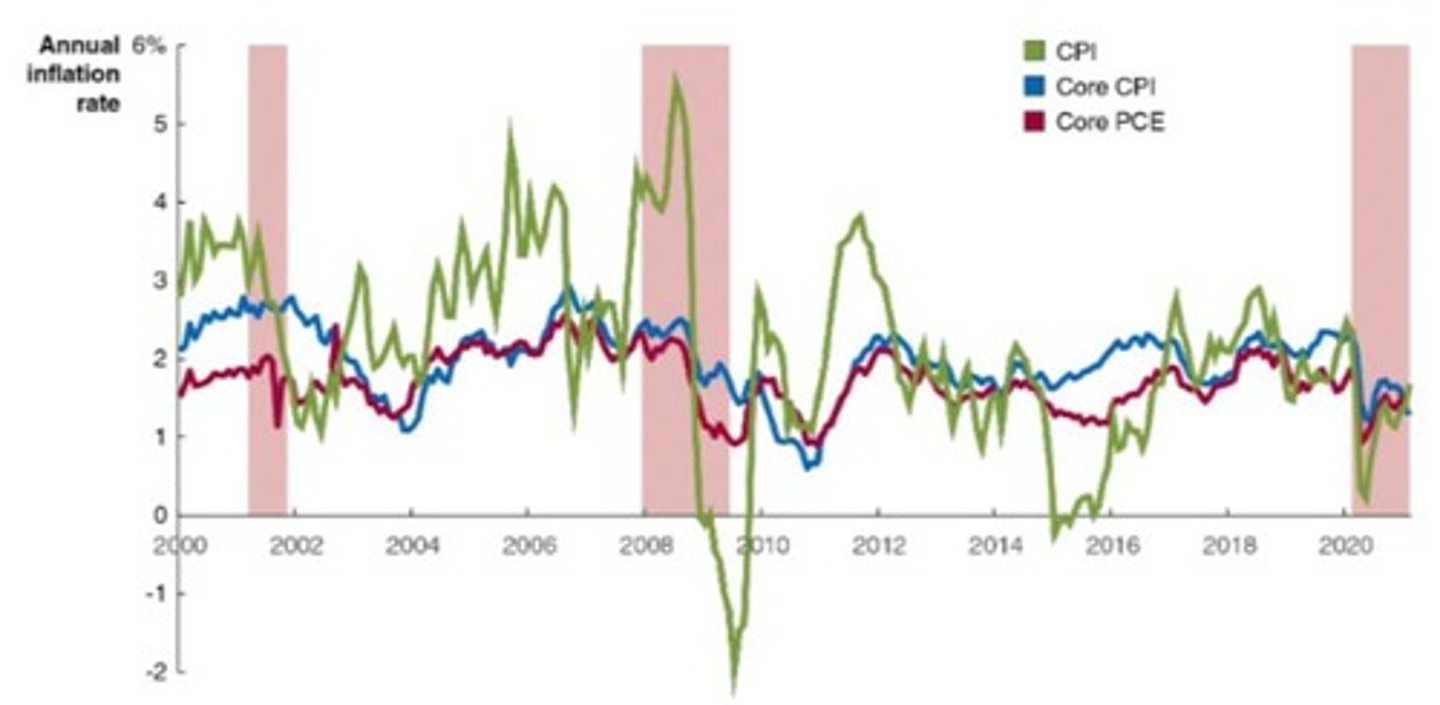

CPI Inflation

A measure of inflation that shows the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Inflation Rate

The percentage increase in the price level of goods and services over a period of time.

Moderate Long-Term Interest Rates

Interest rates that are stable and not excessively high or low over a long period, contributing to economic stability.

Bank Runs

A situation where a large number of customers withdraw their deposits simultaneously due to fears that the bank will become insolvent.

Great Depression

A severe worldwide economic depression that took place during the 1930s, leading to significant changes in monetary policy.

Financial System

The system that enables the transfer of money between savers and borrowers, including banks, stock markets, and other financial institutions.

Dual Mandate

The combination of price stability and high employment as goals of the Fed.

Discount Loans

Funds made available by the Fed to banks during crises to ensure confidence.

Liquidity Problems

Issues faced by banks when they do not have enough liquid assets to meet short-term obligations.

Open Market Operations

The buying and selling of government securities by the Fed to influence the money supply.

Discount Policy

The interest rate charged by the Fed to banks for short-term loans.

Opportunity Cost

The cost of holding money is higher when the interest rate is high.

Money Demand Curve Shift

A change in the need to hold money, influenced by higher real GDP or higher price levels

- if more transactions (higher real GDP) or more money is needed for each transaction (higher price level), the demand for money will be higher

- decreases in real GDP or the price level decreases the money demand

Increasing Money Supply

The Fed increases the money supply by buying securities, leading to more money being loaned out

- open market operations

- when the Fed increases the money supply, the short-term interest rate must fall until it reaches a level where households and firms are willing to hold the additional money.

Decreasing Money Supply

The Fed decreases the money supply by selling securities

- now firms and households (who bought the securities with money) hold less money than they want, relative to other financial assets

- to retain depositors, banks are forced to offer a higher interest rate on interest-bearing accounts

Money Supply Curve

- Assumed to be a vertical line, indicating it does not depend on the interest rate

Equilibrium in Money Market

Occurs where the money supply curve and money demand curve intersect.

Loanable Funds Model

- Concerned with the long-term real rate of interest, relevant for long-term investors

Money Market Model

Concerned with the short-term nominal rate of interest, relevant for the Fed

- changes in money supply directly affect this interest rate

Federal Funds Rate

The interest rate banks charge each other for overnight loans, targeted by the Fed

- Fed can control it quite well:

- the Fed pushes the federal funds rate down during recessions to encourage high employment and up during expansions to encourage price stability

Interest on Reserves

The Fed pays banks interest on their reserve holdings, setting a floor on the federal funds rate

Repurchase agreements

Temporary transactions where the Fed buys a security from a financial firm, which promises to buy it back the next day.

Reverse repurchase agreement

A transaction where the Fed borrows money from a financial firm overnight

- by raising the interest rate the Fed pays on these loans, it reduces the willingness of the firms to lend at a lower rate

Target range for federal funds rate

The range set by the Fed for the federal funds rate, which was 2.25%-2.50% in late 2018.

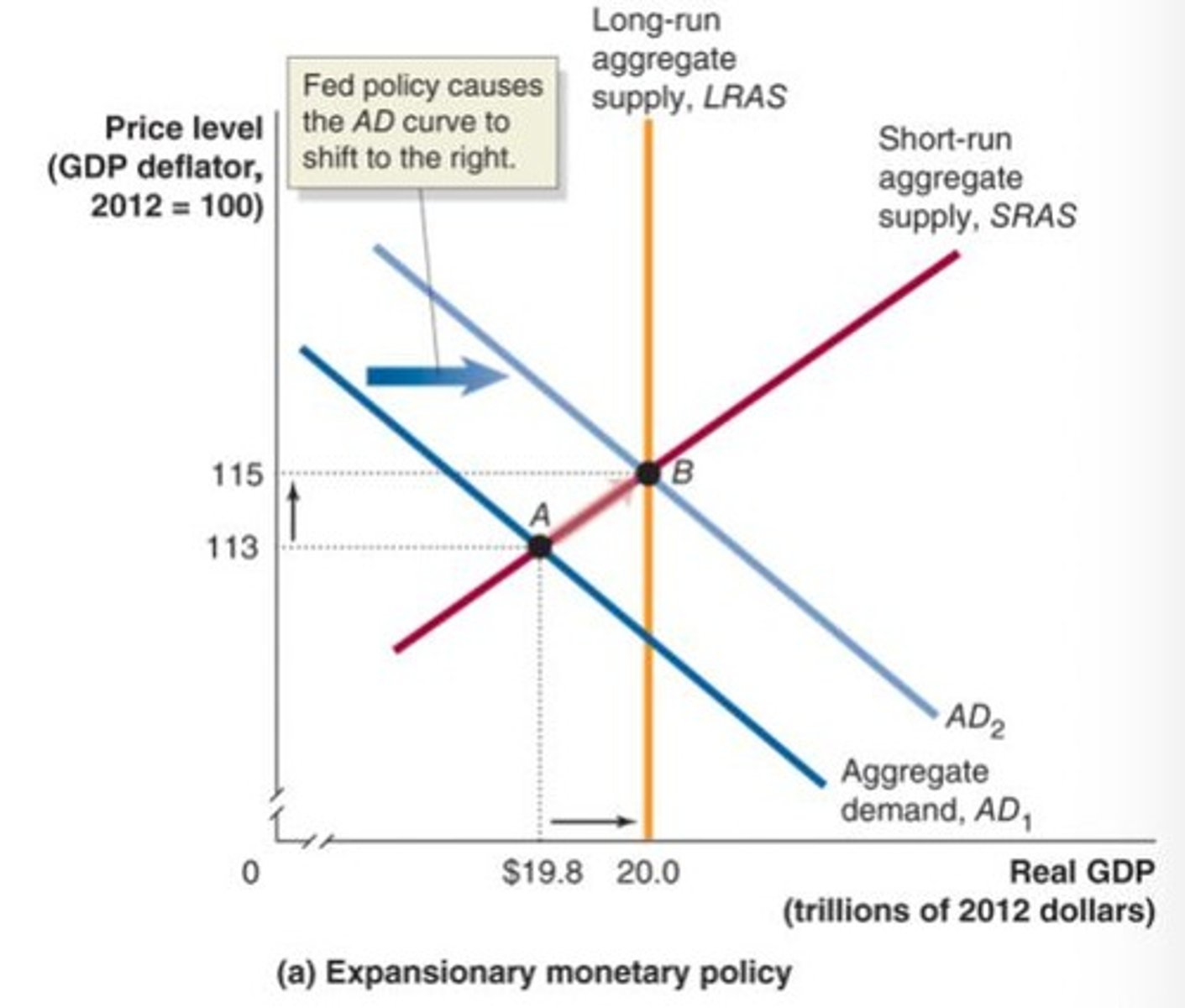

Aggregate demand

The total demand for goods and services within an economy at a given overall price level and in a given time period.

Aggregate supply

The total supply of goods and services that firms in an economy plan on selling during a specific time period.

Consumption

Lower interest rates encourage buying on credit, affecting the sale of durables and discouraging saving.

Investment

Lower interest rates encourage capital investment by firms, making borrowing cheaper and stocks more attractive to purchase; also encourage new residential investments

Net exports

High U.S. interest rates attract foreign funds, raising the $US exchange rate and causing net exports to fall.

Expansionary monetary policy

Actions taken by the Fed to decrease interest rates to increase real GDP

- works because decreases in interest rates raise consumption, investment, and net exports

- Used by the Fed to increase aggregate demand when short-run equilibrium falls below potential GDP

- increase in aggregate demand encourages increased employment

- real GDP at its potential and a higher level of inflation than would otherwise have occurred

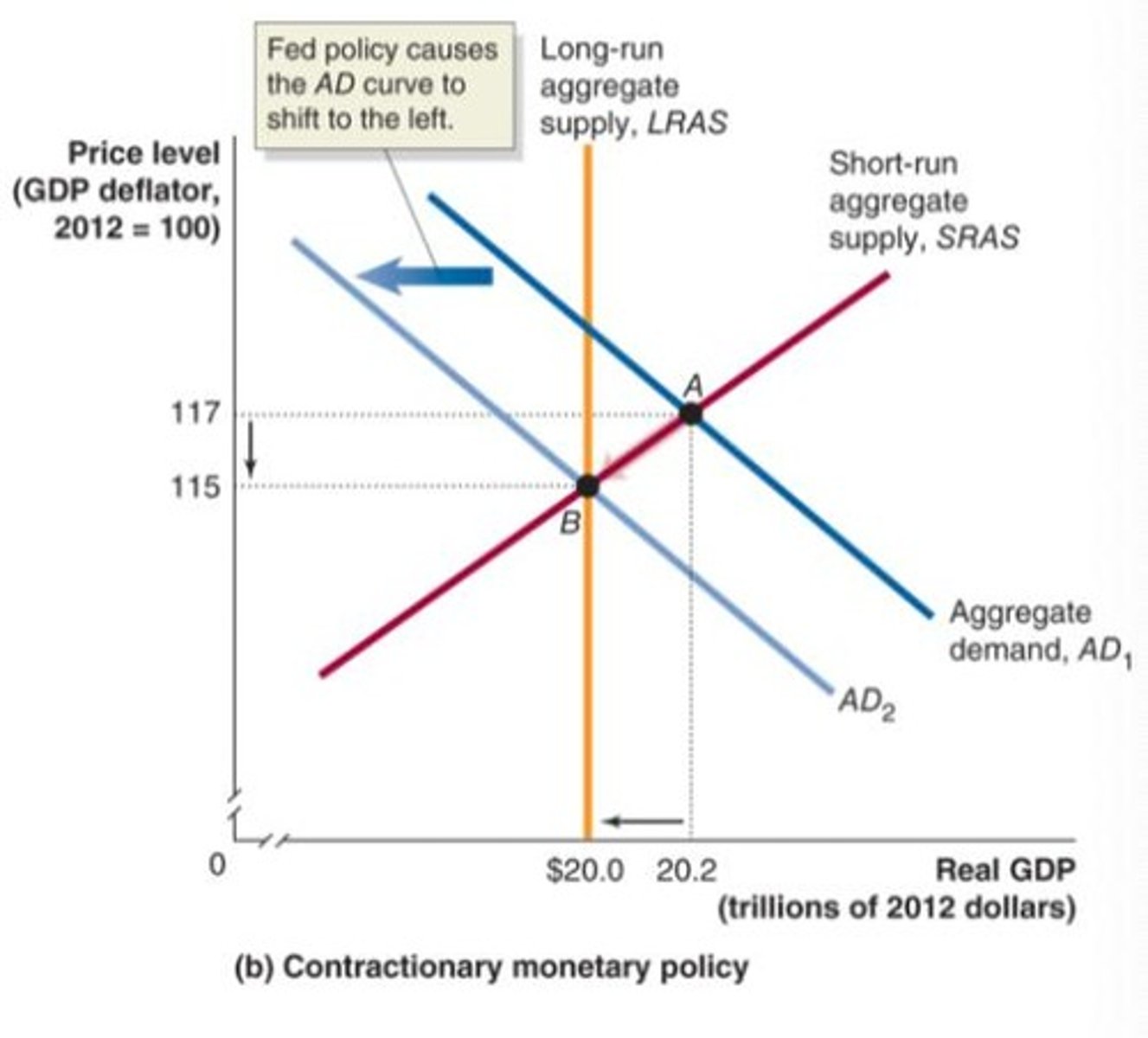

Contractionary monetary policy

Actions taken by the Fed to increase interest rates to reduce inflation

- intentionally reduce real GDP when concerned with long-run growth; if it determines that inflation is a danger to long-run growth, then they can contact the money supply in order to discourage inflation (encouraging price stability)

- lower GDP and less inflation in 2006 than would otherwise have occurred

Liquidity trap

A situation where banks refuse to lend out reserves despite the federal funds rate being maintained at zero.

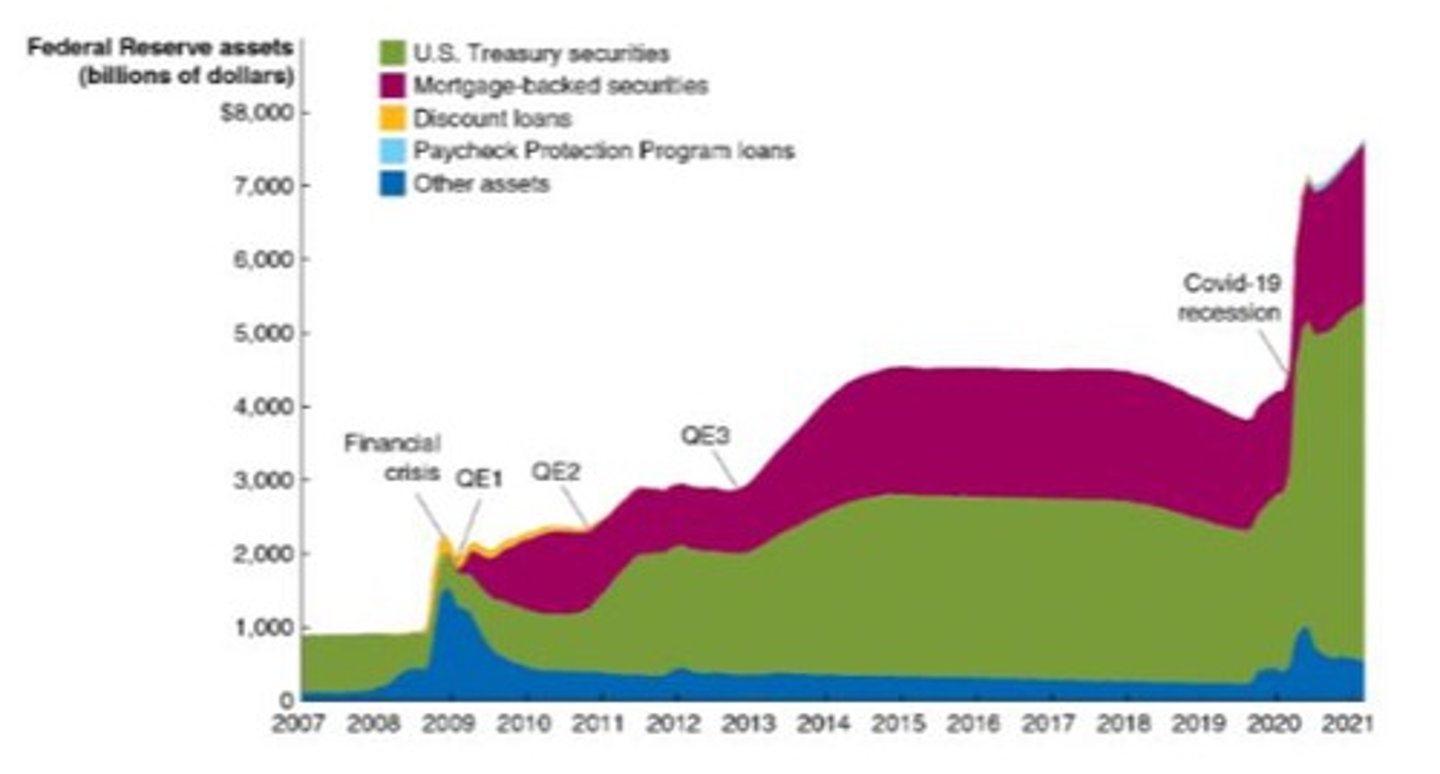

Quantitative easing

A monetary policy used by the Fed to stimulate the economy by increasing the money supply

- buying securities beyond the normal short-tern Treasury securities, including 10-year Treasury notes and mortgage-backed securities

- historically low interest rates (at or below zero)

Long-term growth

The sustained upward trend in the economy's output over time.

Short-run equilibrium real GDP

The level of real GDP where aggregate demand equals aggregate supply in the short run.

Fed's Balance Sheet

A financial statement that summarizes the assets, liabilities, and equity of the Federal Reserve.

Nominal Interest Rates

The stated interest rate on a loan or financial product, not adjusted for inflation.

Aggregate Demand

The total demand for goods and services within a particular market.

Lag in Economic Variables

The delay in the availability of current economic data, often only allowing for retrospective analysis.

Real GDP

The inflation-adjusted value of all goods and services produced in a country.

Forecast Growth Rate

The predicted rate at which the economy is expected to grow in the future

- good policy requires accurate forecasts

NBER

National Bureau of Economic Research, an organization that determines the timing of recessions.

Potential GDP

The level of real GDP that the economy can sustain over the long term without increasing inflation.

Monetary growth rule

A rule advocated by Milton Friedman to increase the money supply at the long-run rate of real GDP growth.

Monetarism

An economic theory that emphasizes the role of governments in controlling the amount of money in circulation.

Money demand curve

Illustrates the relationship between the quantity of money demanded and the interest rate.

Taylor rule

- A rule developed by John Taylor that links the Fed's target for the federal funds rate to economic variables

- federal funds target rate = current inflation rate + equilibrium real federal funds rate + [1/2 x inflation gap] + [1/2 x output gap]

Countercyclical monetary policy

A policy aimed at reducing the severity of economic fluctuations.

Economic stability

A condition where an economy experiences minimal fluctuations in inflation and output.

Excessive inflation

A situation where the inflation rate rises significantly above the target level.

Equilibrium real federal funds rate

The estimate of the inflation-adjusted federal funds rate that would be consistent with maintaining real GDP at its potential level in the long run.

Inflation gap

The difference between current inflation and the Fed's target rate of inflation (could be positive or negative).

Output gap

The difference between current real GDP and potential GDP (could be positive or negative).

Inflation targeting

A framework for conducting monetary policy that involves the central bank announcing its target level of inflation

Arguments for and against inflation targeting

for:

- makes it clear that the Fed cannot affect real GDP in the long run

- easier for firms and households to form expectations about future inflation, improving their planning

- promotes Fed account-ability

against:

- reduces the Fed's flexibility to address, and accountability for, other policy goals

- assumes the Fed can correctly forecast inflation rates

- increased focus on inflation rate may result in Fed being less likely to address other beneficial goals

Core PCE

The PCE without food and energy prices; it is more stable and the Fed believes it estimates true long-run inflation better

Nominal GDP targeting

A policy where the Fed targets nominal GDP growth; for example, if the Fed expected 3% annual real GDP growth and wanted 2% inflation, it would target 5% nominal real GDP growth

- if real GDP growth slowed, the policy would be expansionary

- if real GDP growth was faster than expected, the policy would be contractionary

Bubble in a Market

refers to a situation in which prices are too high relative to the underlying value of the asset

- can form due to herding behavior and speculation

- ex) stock prices of Internet-related companies were "optimistically" high in the late 1990s, before the "dot-com bubble" burst, starting in March 2000

Credit crunch

A situation where banks become less willing to lend, further depressing the housing market.

Herding behavior

Failing to correctly evaluate the value of the asset and instead relying on other people's apparent evaluations.

Speculation

Believing that prices will rise even higher and buying the asset intending to sell it before prices fall.

Subprime loans

Loans made to borrowers with poor credit histories.

Alt-A loans

Loans made without evidence of income.

Adjustable-rate mortgages

Mortgages that start with low interest rates.

Illiquid market

A market where few people or firms are willing to buy securities, leading to a rapid fall in prices.

Federal National Mortgage Association (Fannie Mae) and Federal Home Loan Mortgage Corporation (Freddie Mac)

A government-sponsored enterprise that sells bonds to investors and uses the funds to purchase mortgages from banks

- secondary market in mortgages

Investment banks

Financial institutions that package mortgages as mortgage-backed securities and resell them to investors.

Mortgage-backed securities

Securities created by pooling together mortgages and selling them to investors.

- appealing to investors because they paid high interest rates with apparently low default risk

Leveraged

with a smaller downpayment, you are said to be leveraged, exposed to large potential changes in the value of your investment

- ex) by owning a house, you become exposed to increases or decreases in the price of the large asset

Financial panic

A situation where a sudden loss of confidence in the financial system leads to widespread selling of assets.

Primary dealers

Firms that participate in regular open market transactions with the Fed.

Bear Stearns

An investment bank that was close to failing and was acquired by JPMorgan Chase with the help of the Fed and Treasury

- An investment bank that was underwritten by the Fed prior to Lehman Brothers' bankruptcy.

2020 Recession

An economic downturn that occurred due to the COVID-19 pandemic, leading to various monetary policy responses.

Dot-com bubble

A period in the late 1990s when stock prices of Internet-related companies were excessively high before crashing in March 2000.

Lehman Brothers

An investment bank that declared bankruptcy on September 15, 2008.

Moral Hazard

A problem where managers have less incentive to avoid risk due to the expectation of being saved from their mistakes.

TARP

Troubled Asset Relief Program, providing funds to banks in exchange for stock

- designed to achieve traditional macroeconomic goals: high employment, price stability, and financial market stability

AIG

American International Group, which received an $85 billion loan from the Fed after Lehman Brothers' bankruptcy.

Credit Facilities

Facilities that allow the Fed to make loans to non-financial firms and state and local governments.

Lending Facilities

Facilities that allow the Fed to make loans to banks.

Investment Banks

Financial institutions that engage in underwriting, facilitating mergers and acquisitions, and acting as intermediaries in the issuance of securities.

Bankruptcy

A legal proceeding involving a person or business that is unable to repay outstanding debts.

Control of Fannie Mae and Freddie Mac

The action taken by the Treasury in September 2008 to prevent a collapse in confidence in mortgage-backed securities.

Fed Response to Covid-19

the Fed responded to the 2020 recession caused by the Covid-19 pandemic by cutting its target for the federal funds rate to zero and by introducing temporary lending facilities that would allow it to make loans to businesses other than the commercial banks that can borrow from the Fed using discount loans