Ch 7: Valuation of Inventories: A Cost-Basis Approach

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

Inventories

- assets items that a company holds for sale in the ordinary course of business, or goods that it will use or consume in the production of goods to be sold

- inventory on hand is an asset

Merchandising Companies

- usually purchase their merchandise in a form ready for sale

- they report the cost assigned to unsold units left on hand: merchandise inventory

- only one inventory account, Inventor appears in the financial statements

Manufacturing companies

- they produce goods to sell to manufacturing companies. Although the products they produce may differ, manufacturers normally have three of these inventory accounts:

1. Raw material inventory

2. Work in process inventory

3. finished goods inventory

Raw Materials Inventory

- the cost of goods and materials on hand but not yet placed into production. The materials can be traced directly to the end product

Work in Process Inventory

- at any point in a continuous production process, some units are only partially processed. This account represents the cost of the raw material for these unfinished units plus the direct labor cost applied specifically to this material and a ratable share of manufacturing overhead costs

Finished goods inventory

- includes the costs identified with the completed but unsold units on hand at the end of the fiscal year

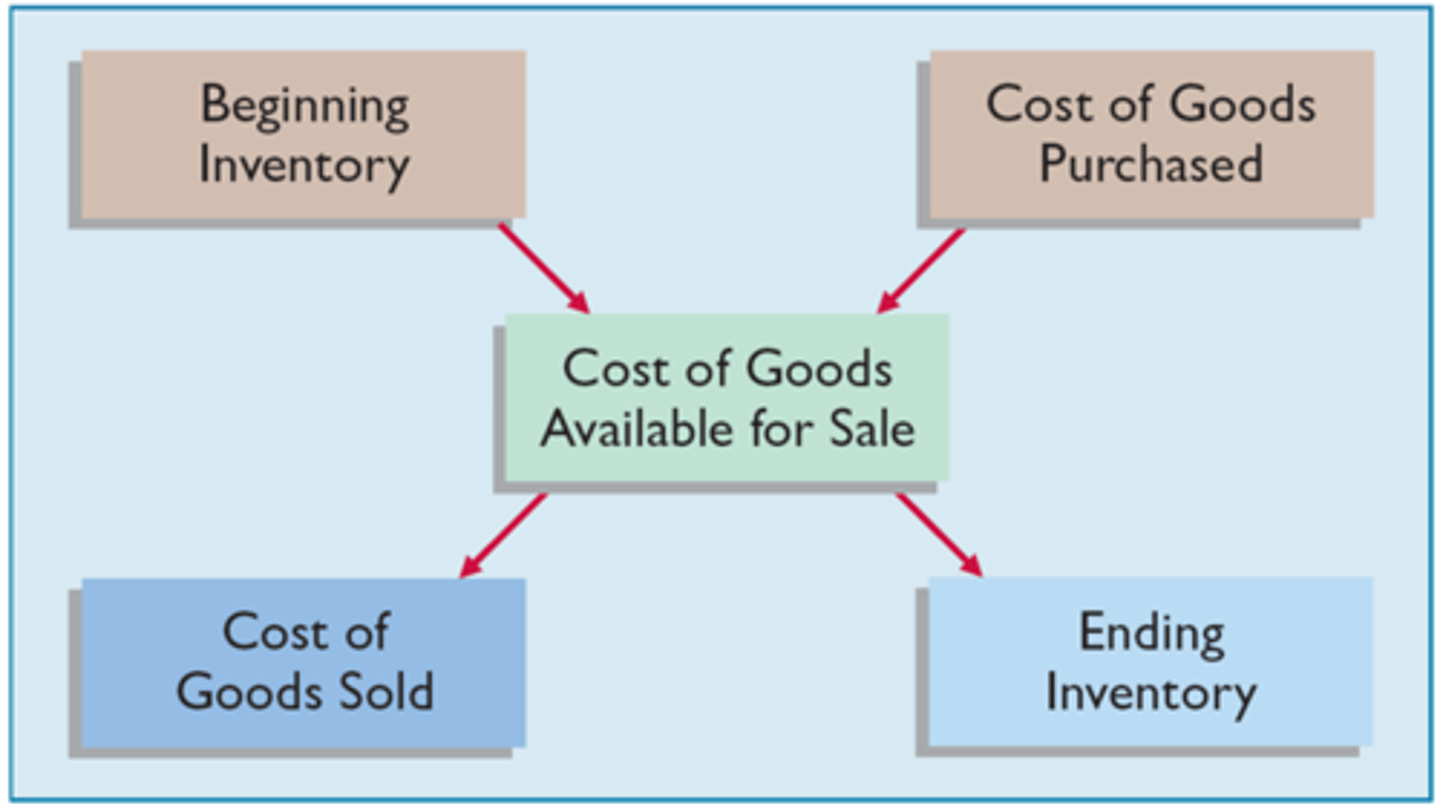

Inventory Cost Flow

- 1. Beginning inventory plus COGS purchased or manufactured is the cost of goods available for sale

2. As goods are sold, they are assigned to COGS

3. Those goods that are not sold by the end of the accounting period represent ending inventory

Ending Inventory

the total cost of inventory that remains on hand that will be reported on the BS as a current asset

COGS

- the total cost of the items that were sold that will be reported as an expense on the income statement

Cost of Goods Sold Formula

Beg Inv, Jan 1

+ Cost of goods acquired or produced during the year

= Total Cost of Goods Available for Sale (COGAS)

- Ending Inv, Dec 31

= Cost of Goods Sold During the Year (COGS)

Perpetual Inventory System

- continuously tracks changes in the inventory account

- company records all purchases and sales of goods directly in the inventory account as they occur

- accounting features of a PIS:

1. Purchases of merch for resale or raw materials for production are debited to inventory rather than to purchases

2. Freight-in is debited to inventory, not purchases. Purchase returns and allowances and purchase discounts are credited to inventory rather than to separate accounts

3. COGS is recorded at the time of each sale by debiting COGS and crediting inventory

4. A subsidiary ledger of individual inventory records is maintained as a control measure. The subsidiary records show the quantity and cost of each type of inventory on hand

Inventory (perpetual system):

DR: Beg bal, Purchases, Freight-in

CR Returns/allow, Discounts, Sales

= DR End Balance

Periodic System

- A company determines the quantity of inventory on hand only periodically

- the company:

1. records all acquisitions of inventory during the accounting period by DR purchases

2. adds the total in the purchases account at the end of the accounting period (including adjustments for freight, discounts, and returns captured in related accounts) to the cost of the inventory on hand at the beginning of the period to determine the total COGAS during the period

3. Computed the COGS by subtracting the ending inventory from the COAS

Purchases and Related Accounts (periodic system):

DR: Beg Bal, Purchases, Freight-in

CR: Returns/allow, discounts

= End Bal

- Note that under a periodic inventory system, the cost of goods sold is a residual amount that depends on a physical count of ending inventory. This process is referred to as "taking a physical inventory." Companies that use the periodic system take a physical inventory at least once a year.

Goods included in inventory

- goods in transit, consigned goods, sales with returns

Goods in Transit

- FOB Shipping point: title passes to company when the supplier delivers the goods to the common carrier, which which acts as an agent for company (ownership passes to buyer when loaded on the truck)

- FOB destination: title passes to company only when it receives the goods from the common carrier (ownership passes to buyer upon delivery)

Consigned goods

- items owned by one party (the consignor) but held and sold by another party (the consignee) on the consignor's behalf.

- The consignee does not own the goods—only sells them and earns a commission when they're sold. Until the sale happens, the goods remain the property of the consignor and are included in the consignor's inventory records.

Costs included in inventory

- product costs, period costs, cash discounts (purchase discounts)

Product costs

costs directly connected with bringing the inventory to the buyer's place of business and converting the goods to a salable condition

- Examples: freight charges on goods purchased, insurance costs incurred by buyer while goods are in transit, unpacking and unloading costs, preparing goods for sale

- Included in the inventory asset account in the balance sheet

Period Cost

indirectly related to the acquisition of goods and are generally more difficult to assign to specific inventory items

- Examples: selling expenses related to inventory, interest costs related to financing inventory purchases, general and admin costs inventory

- Expenses as incurred in the income statement

Cash Discounts (purchase discounts)

- purchase discounts can be accounted for using either gross or net method

- gross method: under periodic inv system, it records the purchases and A/P at the invoice price (the gross amount). A purchase discount is recorded if the company pays within the discount period. A company reports purchase discounts as a deduction from purchases when determining COGS

- net method: company recognizes the purchase and related A/P at the invoice price less the cash discount. If the company does not take the discount within the discount period, it records purchase discounts lost. Purch discount lost is a financial expense and is reported in the other expenses and losses section of the IS

Why is the net method considered better?

- it provides a correct reporting of the cost of the asset and related liability

- it can measure management inefficiency by holding management responsible for discounts not taken

Specific Identification

identifying the specific cost of each item sold and each item left in inventory

- used where it is practical to physically separate purchases made. like small number of costly, easily distinguishable items

- matches actual costs against actual revenue, and it reports ending inventory at actual cost

- the cost flow matches the physical flow of the goods

Average Cost Method

tracks inventory items on the basis of the average cost of all similar goods available during the period

- different kinds for periodic and perpetual

- simple to apply and objective

- not as subject to income manipulation as some of the other methods

Average Cost Method: With Periodic Inventory Method

- when the amount of inventory is computed at the end of the period use the Weighted-Average Method

Average Cost Method: With Perpetual Inventory Method

- use the moving average method

- since the inventory account is continuously updated for purchases of inventory, the average inventory cost will change each time a purchase is made, which results in a moving average

First-in, first-out (FIFO) method

- assumes that a company sells goods in the order in which it purchases them

- assumes that the first goods purchased are the first sold

- the inventory remaining must represent the most recent purchases

Last-in, first-out (LIFO) method

- matches the cost of the last goods purchases against revenue

- the cost of the total quantity sold during the month

LIFO conformity rule

The IRS requirement that when LIFO is used on a tax return, it must also be used in reporting income to stockholders/ financial reporting purposes.

- if the company wants to take advantage of lower taxes, it must also report lower income and inventory in its financial statements

Factors to consider when deciding btwn FIFO and LIFO: Physical Flow of Goods

- FIFO: typically, companies like to sell older goods first, so FIFO may mirror the actual flow of goods

- LIFO: Typically, goods are not sold on a LIFO basis except in specific situations. Therefore, LIFO generally does not mirror the actual flow of goods

Factors to consider when deciding btwn FIFO and LIFO: Income Tax Effect

- FIFO: In periods of rising inventory costs, FIFO results in higher income taxes. Higher tax payments reduce cash flows

- LIFO: In periods of rising inventory costs, LIFO results in lower income taxes. Lower income taxes owed translates to a true cost savings. **BIGGEST ADV of LIFO

Factors to consider when deciding btwn FIFO and LIFO: Earnings Impact

- FIFO: In periods of rising inventory costs, FIFO results in higher reported earnings which is pleasing to inventors and the company's stock price. Corporate managers may prefer to have higher reported profits than lower taxes

- LIFO: In periods of rising inventory costs, LIFO results in lower reported earnings, which may not be pleasing to investors and may negatively impact the company's stock price. Corporate managers may prefer to have lower taxes to conserve cash than to have higher reported profits

Factors to consider when deciding btwn FIFO and LIFO: Matching of Revenue and Current costs on the Income statement

- FIFO: results in poor matching because older inventory costs (first in) are matched against current revenue. A company appears to be more profitable here, but it is a paper profit/inventory profit

- LIFO: Results in better matching because recent inventory costs (last in) are matched against current selling price. LIFO reduced or eliminated the paper profit/inventory profit

Factors to consider when deciding btwn FIFO and LIFO: Inventory on the BS

- FIFO: reflects current inventory costs bc the old items (first in) are assumed to be sold. This can be a disadvantage bc the inventory is more vulnerable to declines in a value, which can lead to a substantial write down. Can be an advantage bc the more recent costs in inventory boosts the company's working capital position

- LIFO: Reflects old inventory costs bc the new items (last in) are assumed to be sold. This can be an advantage because it substantially minimizes write downs to market if inventory value declines. Can be a disadv bc the old costs in inventory makes the working capital position of the company appear worse than it is

Companies that use LIFO for tax and external reporting purposes often maintain a FIFO or avv cost system for internal reporting purposes. They do this bc:

1. companies base their sales pricing decisions on a FIFO or avg cost assumption, rather than on a LIFO basis

2. Recordkeeping on some other basis is easier bc the LIFO assumption usually does not approximate the physical

3. Profit sharing and other bonus arrangements often depend on a non LIFO inventory assumption

4. The use of pure LIFO system is troublesome for interim periods, which require estimates of year end quantities

LIFO Reserve

Allowance to Reduce Inventory to LIFO account/LIFO reserve

- the balance in this account if carried forward each year and adjusted as necessary

LIFO Effect

- the change in the allowance balance from one period to the next

Inventory adjustment

Inventory Adjustment: LIFO Inventory + LIFO Reserve = FIFO Inventory

Specific goods approach to costing LIFO inventories is approach is unrealistic for two reasons:

1. when a company has many different inventory items, the accounting cost of tracking each inventory item is expensive

2. a rapid decline in a company's LIFO inventory inventory levels can occur. This results in older inventory being matched with current revenues which distorts net income and leads to substantial tax payments. This is called LIFO liquidation

LIFO liquidation

- can occur frequently when using a specific goods approach.

- a Pool groups items of similar nature Instead of only identical units, a company combines and counts as a group a number of similar units of products

- the specific goods pooled LIFO approach usually results in fewer LIFO liquidations. Bc the reduction of one quantity in the pool may be offset by anoher

specific goods pooled LIFO approach two main problems

1. Most companies continually change the mix of their products, materials, and production methods. As a result, in employing a pooled approach using quantities, companies must continually redefine the pools. This can be time-consuming and costly.

2. Even when practical, the approach often results in an "erosion" (LIFO liquidation) of the layers, thereby losing much of the LIFO costing benefit. Erosion of the layers occurs when a specific good or material in the pool is replaced with another good or material. The new item may not be similar enough to be treated as part of the old pool. Therefore, a company may need to recognize any inflationary profit deferred on the old goods as it replaces them.

Dollar-Value LIFO

- determines and measures any increases and decreases in a pool in terms of total dollar value, not the physical quantity of goods in the inventory pool

- Two advantages:

1. companies may include a broader range of goods in a dollar value LIFO pool

2. a dollar value LIFO pool permits replacement of goods that are similar items in use, or interchangeable (in contrast, a specific goods LIFO pool only allows replacement of items that are substantially identical)

- helps protect LIFO from erosion

Double-Extension Method

- price ending inventory at the most current cost

- the value of the units in inventory is extended at both base year prices and current year prices

- price index for current year= ending inv for the period at current cost/ending inv for the period at base year cost

Comparison of LIFO approaches

- The use of the specific-goods LIFO is unrealistic. Most companies have numerous goods in inventory at the end of a period. Costing them on a unit basis is extremely expensive and time-consuming.

- The specific-goods pooled LIFO approach reduces recordkeeping and clerical costs. In addition, it is more difficult to erode the layers because the reduction of one quantity in the pool may be offset by an increase in another. Nonetheless, the pooled approach using quantities as its measurement basis can lead to untimely LIFO liquidations.

- Most companies using a LIFO system employ dollar-value LIFO. This is because of the disadvantages of the specific-goods LIFO and specific-goods pooled LIFO approaches. Although the dollar-value LIFO approach appears complex, the logic and the computations are actually quite simple, after determining an appropriate index.

Ending Inventory Misstated

- if ending inventory is understated (too small), then the resulting COGS will be overstated (too large)

- if ending inventory is understated, working capital (current assets-current liabilities) and the current ratio (current assets/current liabilities) are understated. If COGS is overstated then NI is understated

Purchases and Inventory Misstated

- the omission of goods from purchases and ending inventory results in an understatement of inventory and A/P in the BS. Also results in an understatement of purchases and ending inventory in the IS