Unit 5: The Financial Sector and Stabilization

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

41 Terms

money

anything used to exchange for goods & services

double coincidence of wants

both parties must need or what what the other is offering (reason why bartering trade failed —> need for rmoney)

wealth

consists of assets someone has including property and valuable goods

income

earnings someone receives from performing a service or offering goods for sale

3 types of money

commodity money, fiat money, and commodity-backed money

commodity money

a good that comes from its own value & is used as a medium of exchange (ex: gold, silver, salt, shells, oil, etc.)

fiat money

something which serves as a medium of exchange, but has no intrinsic value (ex: coins, paper, crypto, etc.)

commodity-backed money

any type of currency that is backed by a physical commodity that has intrinsic value (ex: USD, Euro, etc.)

functions of money

medium of exchange

unit of count

store of value

liquidity

how quickly a particular form of currency can be turned into cash

2 categories of money based on this

M1 liquidity

paper currency, coins, traveler’s checks, demand deposits, or checking accounts

M2 liquidity

M1 + savings deposits, time deposits, certificates of deposits, & money market fund

4 important financial assets

stock, loans, bonds, and bank deposits

loans

agreements about the exchange of money between borrowers and lenders

bank deposits

assets held in bank account into which customers deposit money to keep it safe

bonds

IOUs from issuer to purchaser issued by governments on national, state, and local levels

stock

a state of ownership in corporation using the stock

money market demand curve

x-axis quantity of money, y-axis = interest rate

2 types of money demands

transaction demand: money people need for every day transactions (ex: groceries, coffee, etc.)

asset demand: money being used as store of value for future use (ex: stock, investment, etc.)

opportunity cost of holding cash as an asset

determined by calculating the return on investment (ROI) it could have had in another asset

when interest rates are low, the opportunity cost of holding cash is low and vice versa

factors that change demand for money

inflation: increases Dm because PL goes up

PL decreases: decreases Dm because PL goes down

real GDP: when it increases, economic output goes up and Dm goes up & vice versa

fractional reserve banking

funds banks hold when customers deposit money into their demand deposits

bank balance sheets

assets: reserves (required reserves, excess reserves), loans, securities and physical assets — funds the bank owns

liabilities: demand deposits, savings/other deposits, debts and owner equity — funds the bak owes

required reserves ratio

The percentage of demand deposits the bank must hold in its vaults within the federal reserve bank

lower = higher multiplier

debts

Money the bank owes to institutions (ex. other banks)

owner equity

profit shared with bank owners

federal funds rate

a bank might borrow from another bank to loan out to customers who want loans (interest on this loan)

discount rate

interest rate on funds that a commercial bank borrows from the federal reserve bank

factors of money supply expansion

banks must loan out all of their excess reserves

all loans the bank makes must be redeposited in the banking system

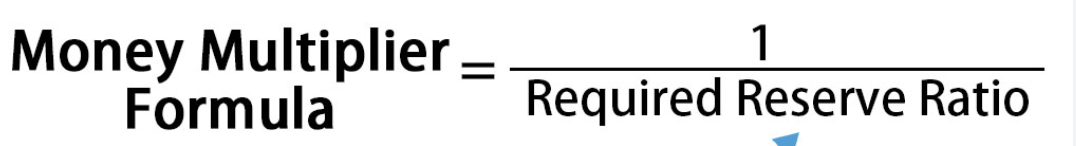

money multiplier formula

expansion of money supply

expansion = excess reserves * money multiplier

expansionary monetary policy

increases the supply of money

decreases reserve requirement ratio

decreases the discount rate

buy bonds

contractionary monetary policy

decreases the supply of money

increases reserve requirement ratio

increases the discount rate

sell bonds

loanable funds market

where demand from borrowers and supply from lenders come together

price of loans is the interest rate

occurs at the point where demand for loanable funds = supply

3 shifters of demand for loanable funds

changes in business and consumer confidence

government budget plans

change in income levels

factors that affect the supply of loanable funds

changes in amount of money people and the company save

changes in foreign investment

tool federal reserve banks use to impose monetary policy

reserve requirement ratio

discount rate

open market operation

crowding out effect

occurs as a result of expansionary monetary policy

complete crowding out

government’s plan backfires

results in huge decrease in consumer spending either not moving or decreasing aggregate demand

partial crowding out

consumers decrease spending which decreases AD but with an overall increase present - just not as much as the government plan.

quantity theory of money

states that there is a direct relationship between money supply and price levels (MV = PY)

M=money supply; V=velocity of money; P=price level; Y=real output

one of the main arguments that classical economists promote for the case of keeping the government out of the economy

velocity of money

how many times a dollar changes hands to buy goods and services in a time period

monetarists assume that this will stay relatively constant in an economy