chapter 19 Open-Economy Macroeconomics: Balance of Payments & Exchange Rates

1/103

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

104 Terms

Balance of Payments

The record of a country's transactions in goods, services, and assets with the rest of the world; also the record of a country's sources (supply) and uses (demand) of foreign exchange.

Exchange Rate

The price of one country's currency in terms of another country's currency; the ratio at which two currencies are traded for each other.

Foreign Exchange

All currencies other than the domestic currency of a given country.

Balance of Trade

A country's exports of goods and services minus its imports of goods and services.

Trade Deficit

Occurs when a country's exports of goods and services are less than its imports of goods and services.

Balance on Current Account

The sum of income from exports of goods and services and income from investments and transfers minus payments for imports of goods and services and payments for investments and transfers.

Current Account

A record that includes the balance of trade, investment income, and transfer payments.

Capital Account

An account that records the net change in ownership of national assets.

Net Wealth Position

The difference between a country's assets and liabilities with the rest of the world.

Debtor Nation

A country that owes more to other countries than it is owed.

Investment Income

Income earned from investments abroad.

Investment Payments

Payments made to foreign investors.

Transfer Income

Income received from abroad that does not require a reciprocal transfer.

Transfer Payments

Payments made to foreign entities that do not require a reciprocal transfer.

Statistical Discrepancy

The difference between recorded inflows and outflows of funds.

Net Capital Transfer Receipts

The net amount of capital transferred into a country.

Change in Net U.S. Liabilities

The change in the total amount of liabilities the U.S. has to foreign entities.

Net Receipts from Financial Derivatives

The net amount received from financial derivative transactions.

Balance of Payments (2017)

The total of the current account balance, net capital transfer receipts, change in net U.S. liabilities, net receipts from financial derivatives, and statistical discrepancy.

Equilibrium Output

The level of output where the quantity of goods and services demanded equals the quantity supplied.

Trade Feedback Effect

The impact that changes in trade have on the overall economy.

Price Feedback Effect

The influence of price changes on trade and economic output.

Bretton Woods System

An international monetary system established in 1944 that set fixed exchange rates.

Debtor Nations

Nations that owe more to other countries than they own in foreign assets.

Creditor Nations

Nations that own more in foreign assets than they owe to other countries.

Net International Investment Position (NIIP)

The difference between a country's external financial assets and its external financial liabilities.

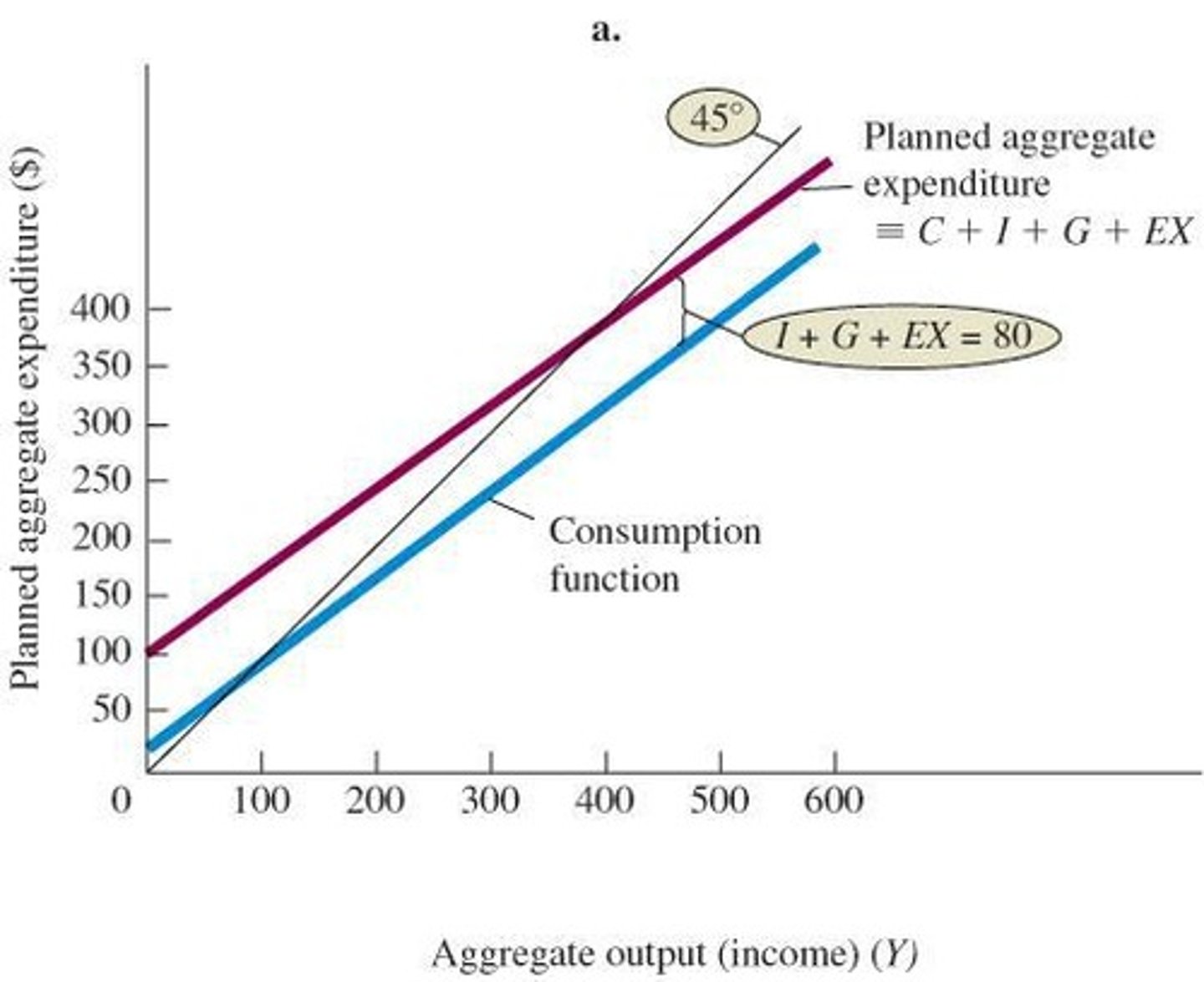

Planned Aggregate Expenditure (AE)

The total amount that households, businesses, and the government plan to spend in an economy.

Net Exports

The difference between a country's total exports (EX) and total imports (IM).

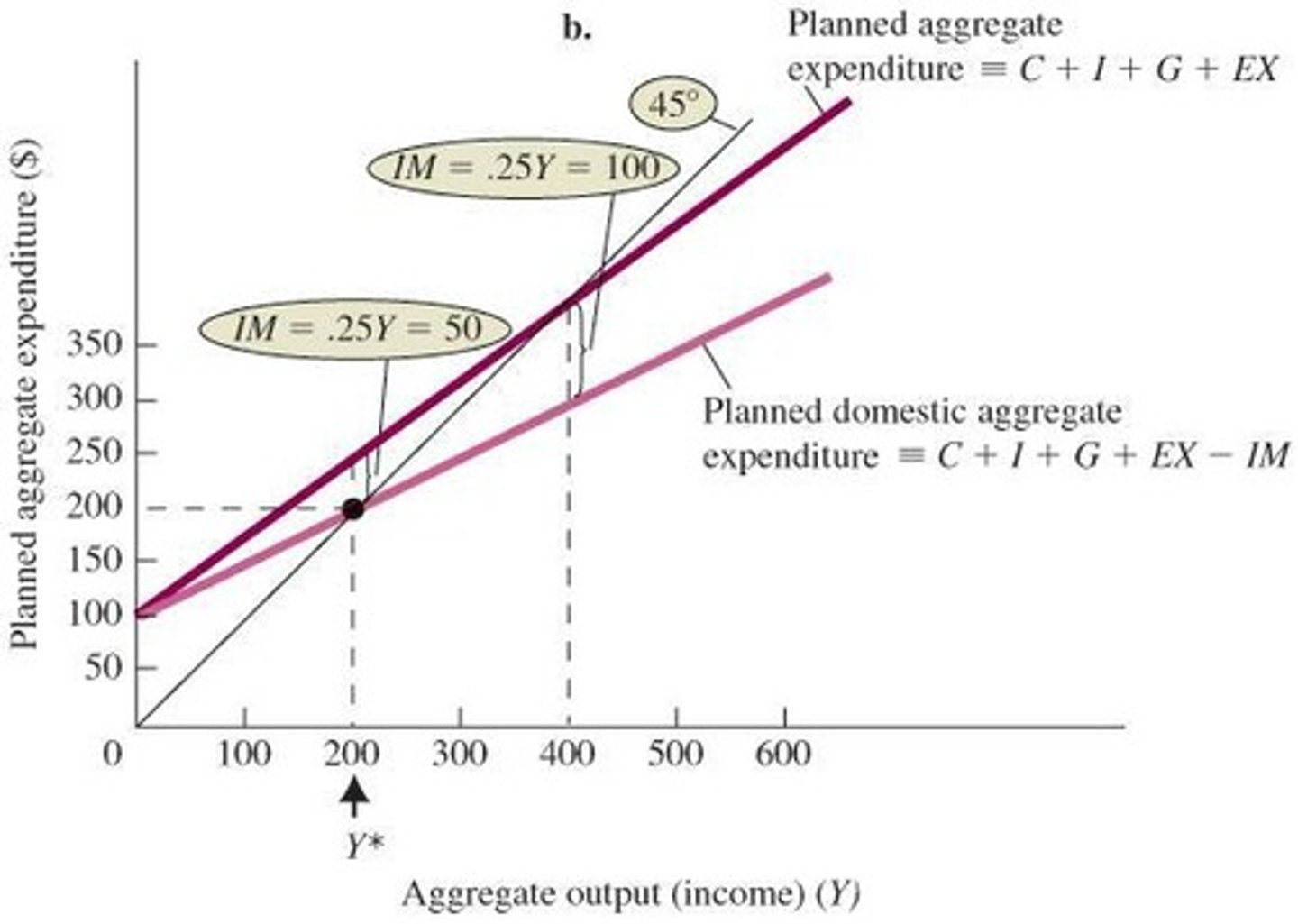

Marginal Propensity to Import (MPM)

The change in imports caused by a $1 change in income.

Equilibrium Output (Y*)

The level of output where planned domestic aggregate expenditure equals total output, occurring at Y* = 200.

Open-Economy Multiplier

A formula that shows how much income will increase in response to an increase in government spending or investment in an open economy.

Multiplier Effect

The phenomenon where an initial change in spending leads to a larger overall increase in income.

Determinants of Imports

Factors that influence the demand for imports, including household consumption behavior and relative prices.

Determinants of Exports

Factors that influence the demand for exports, including foreign economic activity and relative prices of goods.

Trade Feedback Effect

The tendency for an increase in the economic activity of one country to lead to a worldwide increase in economic activity.

Consumption (C)

The total amount of goods and services consumed by households.

Investment (I)

Spending on capital goods that will be used for future production.

Government Spending (G)

Total government expenditures on goods and services.

Exports (EX)

Goods and services sold to other countries.

Imports (IM)

Goods and services purchased from other countries.

Algebraic Representation of Imports

IM = mY, where Y is income and m is some positive number.

Economic Activity

The level of production and consumption in an economy.

Relative Prices

The price of one good or service compared to another, influencing consumer and business spending.

Consumption Goods

Goods that are purchased for immediate consumption.

Investment Goods

Goods that are used for future production and investment.

Foreign Products

Goods and services produced in other countries.

Domestic Goods

Goods and services produced within a country.

Trade Feedback Effect

An increase in U.S. economic activity leads to a worldwide increase in economic activity, which then 'feeds back' to the United States.

Export Prices

Export prices of other countries affect import prices, and a country's export prices tend to move fairly closely with the general price level in that country.

Inflation Rate Abroad

The general rate of inflation abroad is likely to affect U.S. import prices. If the inflation rate abroad is high, U.S. import prices are likely to rise.

Price Feedback Effect

The process by which a domestic price increase in one country can 'feed back' on itself through export and import prices. An increase in the price level in one country can drive up prices in other countries, further increasing the price level in the first country.

Floating Exchange Rates

Exchange rates that are determined by the unregulated forces of supply and demand.

Demand for Pounds

Firms, households, or governments that import British goods into the United States or want to buy British-made goods and services.

U.S. Citizens Traveling in Great Britain

U.S. citizens traveling in Great Britain demand pounds to facilitate their purchases.

Holders of Dollars Buying British Financial Instruments

Holders of dollars who want to buy British stocks, bonds, or other financial instruments demand pounds.

U.S. Companies Investing in Great Britain

U.S. companies that want to invest in Great Britain demand pounds.

Speculators Anticipating Dollar Decline

Speculators who anticipate a decline in the value of the dollar relative to the pound demand pounds.

Supply of Pounds

Firms, households, or governments that import U.S. goods into Great Britain or want to buy U.S.-made goods and services.

British Citizens Traveling in the U.S.

British citizens traveling in the United States supply pounds to obtain dollars.

Holders of Pounds Buying U.S. Financial Instruments

Holders of pounds who want to buy stocks, bonds, or other financial instruments in the United States supply pounds.

British Companies Investing in the U.S.

British companies that want to invest in the United States supply pounds.

Speculators Anticipating Dollar Rise

Speculators who anticipate a rise in the value of the dollar relative to the pound supply pounds.

Price of Pounds Falling

When the price of pounds falls, British-made goods and services appear less expensive to U.S. buyers.

Price of Pounds Rising

When the price of pounds rises, the British can obtain more dollars for each pound, making U.S.-made goods and services appear less expensive to British buyers.

Equilibrium Exchange Rate

The equilibrium exchange rate occurs at the point at which the quantity demanded of a foreign currency equals the quantity of that currency supplied.

Appreciation of a Currency

The rise in value of one currency relative to another.

Depreciation of a Currency

The fall in value of one currency relative to another.

Equilibrium Exchange Rate

When exchange rates are allowed to float, they are determined by the forces of supply and demand.

Excess Demand for Pounds

An excess demand for pounds will cause the pound to appreciate against the dollar.

Excess Supply of Pounds

An excess supply of pounds will lead to a depreciating pound.

Law of One Price

If the costs of transportation are small, the price of the same good in different countries should be roughly the same.

Purchasing-Power-Parity Theory

A theory of international exchange holding that exchange rates are set so that the price of similar goods in different countries is the same.

High Inflation Effect

A high rate of inflation in one country relative to another puts pressure on the exchange rate between the two countries, and so the currencies of relatively high-inflation countries tend to depreciate.

Demand Shift for Pounds

The higher price level in the United States makes imports relatively less expensive, leading U.S. citizens to increase their spending on imports from Britain, shifting the demand for pounds to the right.

Supply Shift for Pounds

At the same time, the British see U.S. goods getting more expensive and reduce their demand for exports from the United States, shifting the supply of pounds to the left.

Price of Pounds

The result of the shifts in demand and supply is an increase in the price of pounds, leading to the pound appreciating and the dollar being worth less.

Relative Interest Rates

If U.S. interest rates rise relative to British interest rates, British citizens holding pounds may be attracted into the U.S. securities market.

Pound Supply Shift

To buy bonds in the United States, British buyers must exchange pounds for dollars, shifting the supply of pounds to the right.

Pound Demand Shift

U.S. citizens are less likely to be interested in British securities because interest rates are higher at home, shifting the demand for pounds to the left.

Currency Depreciation Effect

A depreciation of a country's currency is likely to increase its GDP.

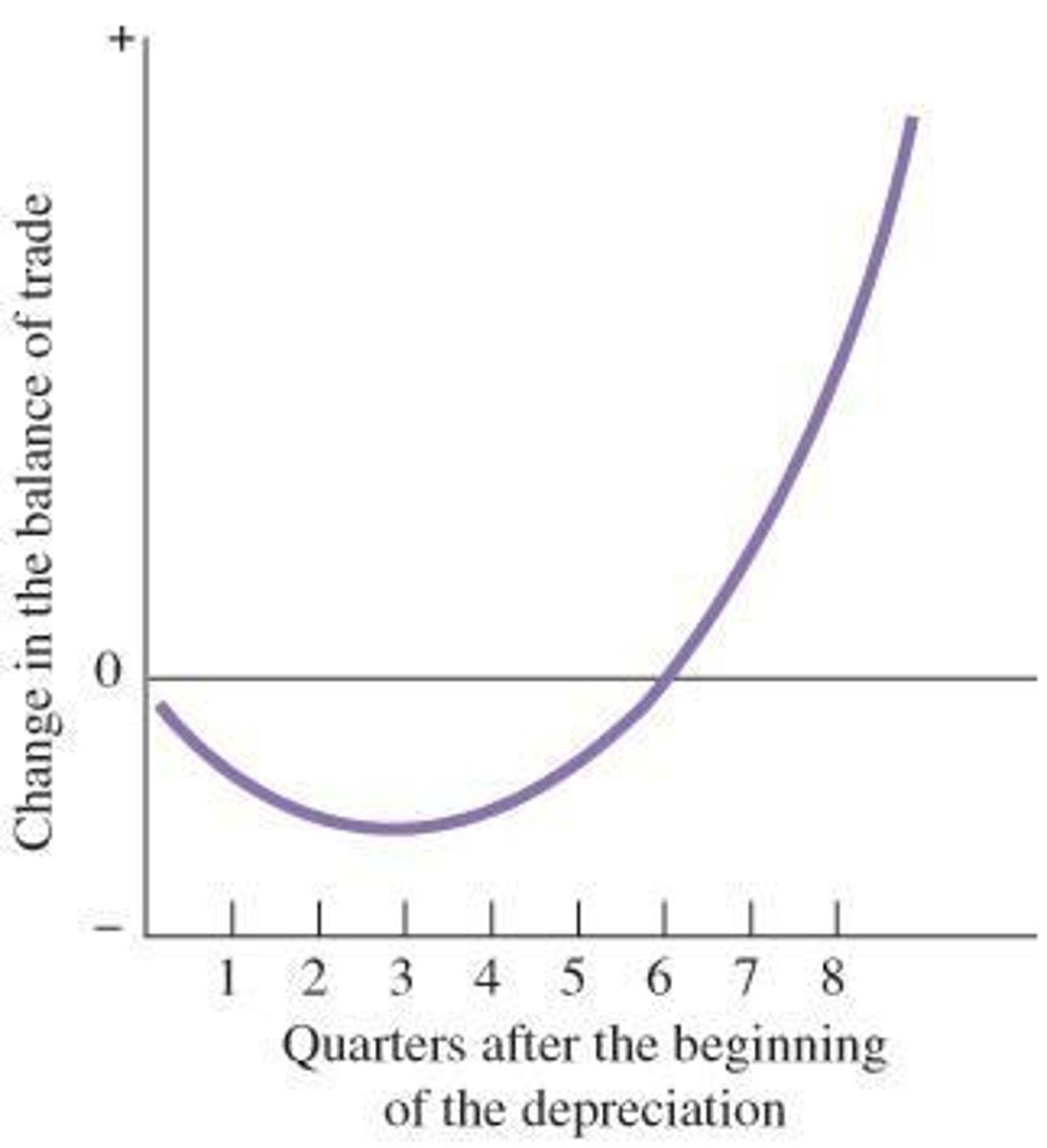

J-Curve Effect

Following a currency depreciation, a country's balance of trade may get worse before it gets better, represented graphically as a J shape.

Balance of Trade Formula

Balance of trade = (dollar price of exports × quantity of exports) - (dollar price of imports × quantity of imports).

Initial Balance of Trade Effect

Initially, a depreciation of a country's currency may worsen its balance of trade due to the negative effect on the price of imports dominating the positive effects of an increase in exports and a decrease in imports.

Depreciation of currency

The depreciation of a country's currency tends to increase its price level.

Cheaper dollar

A cheaper dollar means more U.S. exports and fewer imports.

Multiplier effect

If consumers substitute U.S.-made goods for imports, they will spend more on domestic products, so the multiplier increases.

Higher interest rate

A higher interest rate lowers planned investment and consumption spending, thus lowering the price level.

Attracting foreign buyers

A higher interest rate attracts foreign buyers to U.S. financial markets, driving up the value of the dollar, which reduces the price of imports.

Aggregate supply curve

The reduction in the price of imports causes a shift of the aggregate supply curve to the right, which helps fight inflation.

Fiscal authorities and flexible exchange rates

Flexible exchange rates hurt the fiscal authorities if they want to contract the economy to fight inflation.

Interest rate and fiscal policy

If the Fed does not change the interest rate in response to the fiscal policy change, there is no change in the currency value and thus no offset to what the fiscal authorities are trying to do.

Fixed exchange rates and interest rates

The one case in which a country can change its interest rate and keep its exchange rate fixed is if it imposes capital controls.

Capital controls

Imposing capital controls means that the country limits or prevents people from buying or selling its currency in the foreign exchange markets.

Interdependent world economy

The performance of the U.S. economy is heavily dependent on events outside U.S. borders.

Gold standard

The gold standard was the major system of exchange rate determination before 1914.

Currency pricing in gold standard

All currencies were priced in terms of gold, with an ounce of gold worth so much in each currency.

Problems with gold standard

The gold standard implied that a country had little control over its money supply.

Bretton Woods system

Under the Bretton Woods system, countries were to maintain fixed exchange rates with one another in terms of the U.S. dollar instead of ******* their currencies directly to gold.

Fundamental disequilibrium

Countries experiencing a 'fundamental disequilibrium' in their balance of payments were allowed to change their exchange rates.

Pure fixed exchange rates

Under a pure fixed exchange rate system, governments set a particular fixed rate at which their currencies will exchange for one another and then commit themselves to maintaining that rate.