Exam 2: Ch 15 (econ)

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

44 Terms

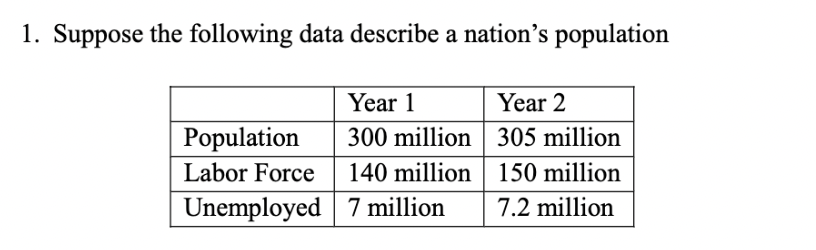

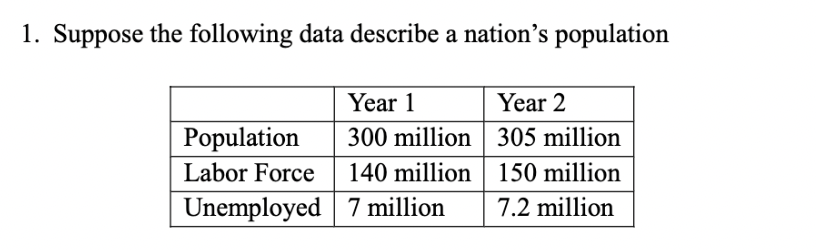

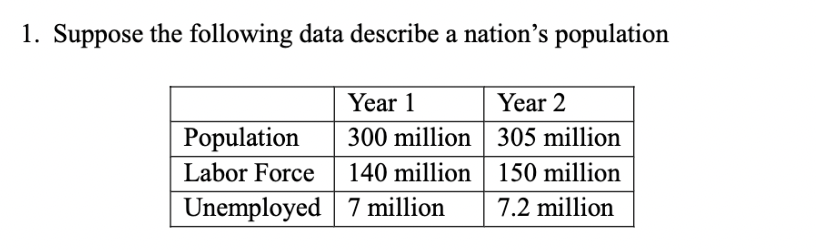

(A) What is the unemployment rate in each year?

The unemployment rate is calculated as the number of unemployed divided by the labor force. Using this formula, the unemployment rate in year 1 is 7 million/140 million = 0.05 or 5 percent. The unemployment rate in year 2 is 7.2/150 million = 0.048 percent or 4.8 percent.

(B) How has the number of unemployed changed from Year 1 to Year 2?

The number of unemployed increases by 0.2 million or 200,000 workers

(C) How is the apparent discrepancy between (a) and (b) explained?

The unemployment rate is determined by both the number of unemployed and the size of the labor force. Even though the number of people who were counted as unemployed increased by 400,000, the size of the labor force increased by a greater proportion, resulting in a decrease in the unemployment rate.

What is the relationship between unemployment rate and GDP growth rate?

When GDP growth is low, it's harder to find jobs, leading to a higher unemployment rate.

There is a negative correlation between unemployment and GDP growth — as GDP increases, unemployment tends to decrease, and vice versa.

This relationship is described by Okun’s Law, which states that for every 1% decrease in unemployment, GDP grows by about 2% (though this can vary).

Who measures and calculates the unemployment rate in the United States?

In the United States, the unemployment rate is measured and calculated by the Bureau of Labor Statistics (BLS), which is part of the U.S. Department of Labor.

How is unemployment measured?

Unemployment is measured using data from the Current Population Survey (CPS), which is conducted monthly by the Bureau of Labor Statistics (BLS) and the U.S. Census Bureau.

Labor force

All persons over age 16 who are either working for pay or actively seeking paid employment.

• Labor force = employed + unemployed

Unemployed

The state of not being employed despite trying to find a job in the past 4 weeks and still actively seeking paid employment

Employed

Full-time and part-time paid employees, or work in own business

Unemployment Rate

The proportion of the people in the labor force who are currently looking for jobs but

cannot find them yet.

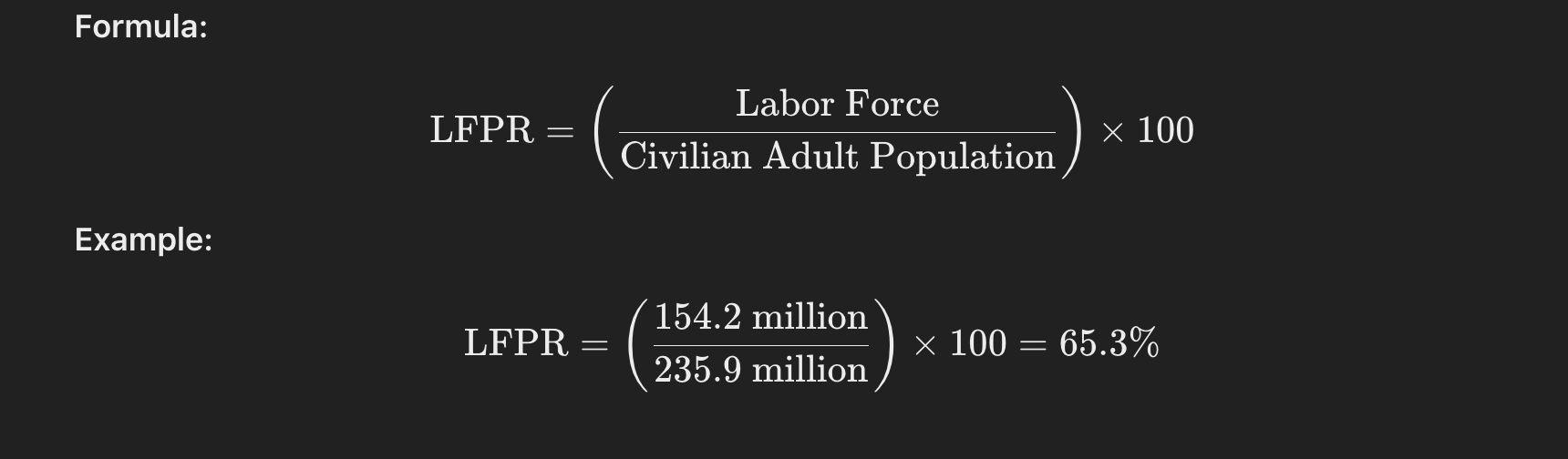

Labor force participation rate

LFP= LF/civilian adult population x 100% = 154.2/235.9 million x 100%= 65.3%

Who is excluded from the adult population used to calculate the labor force?

o What special cases are included?

Excluded:

- Under 16 years old

- Active-duty military

- People in institutions (e.g., prisons, nursing homes)

- People outside the U.S.

Included (special cases):

- Full-time students

- Retired individuals

- Stay-at-home parents

- Others not working/looking for work (counted in population but not in the labor force)

Discouraged worker

would like to work but have given up looking for jobs. Classified as

“not in the labor force” rather than “unemployed”

Marginally attached workers

People who are not in the labor force, but want and are available for work, and have looked for a job in the past 12 months, but not in the past 4 weeks.

➡ They are not counted as unemployed because they haven’t looked for work recently.

What are the 6 different ways to classify someone as unemployed?

o What is the official definition?

U-1: Persons unemployed for 15 weeks or longer (i.e. only includes very long-term unemployment).

• U-2: job losers and persons who completed temporary jobs

• U-3: Persons with no jobs and actively looking for work the past 4 weeks (OFFICIAL DEFINITION).

• U-4: U-3 + discouraged workers.

• U-5: U-4 + those marginally attached to the labor force.

• U-6: U-5 + involuntary part time.

Official Definition:

A person who is not working, is available for work, and has actively looked for a job in the past 4 weeks.

What are the 6 different ways to classify someone as unemployed?

Difference between U3 and U6. How to calculate (how does unemployed and labor force change when you calculate these rates – U3 thru U6)

U-3 (Official Rate): |

What are the 6 different ways to classify someone as unemployed?

What is the most comprehensive measure?

U-6 — includes:

- Official unemployed (U-3)

- Marginally attached workers

- Discouraged workers

- Part-time workers wanting full-time work

How does the “Discouraged worker effect” change the value of U3 during recessions and recoveries?

During a recession: |

Natural rate of unemployment (NRU)

The normal rate of unemployment around which the unemployment rate fluctuates

Types of unemployment

1) Cyclical unemployment

The deviation of unemployment from its natural rate

Types of unemployment

2) Frictional unemployment

Unemployment that results as people move in and out of new jobs. Searching for a new job takes time. Matching problem. It happens due to disconnect between job creation and skill creation.

• Occurs when workers spend time searching for the jobs that best suit their skills and tastes

• Short-term for most workers

Types of unemployment

3) Structural unemployment

Unemployment that occurs because of inefficiencies in the structure of the labor market. This efficiency is captured by the concept of “wage rigidity.”

• Occurs when the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one

• Usually longer-term

Types of unemployment

4) Seasonal unemployment

can correct for this with “seasonally adjusted unemployment rates.”

Why is there a natural rate of unemployment? (Which two are part of the natural rate of unemployment)?

There is a natural rate of unemployment because even in a healthy economy, some unemployment is unavoidable due to normal labor market movement.

Two types that make up the natural rate:

1. Frictional unemployment – time spent between jobs

2. Structural unemployment – mismatch between workers’ skills and job requirements

What is full employment goal?

The lowest rate of unemployment that is compatible with price stability. Usually between 4 to 6 % (natural rate of unemployment).

Wage rigidity - 3 reasons for it.

(the cause of structural unemployment) could be due to three reasons (among others)

• Minimum wages

• Unions

• Efficiency wages

Minimum wage

Employers by law are not permitted to pay workers an hourly wage that is any lower than a predetermined value. E.g. in CA, the min. wage is currently $16.50/hour

Labor demand

Businesses’ desire to hire workers at different wage levels.

Labor supply

The number of workers willing to work at different wage levels.

Equilibrium wage

The wage at which labor demand = labor supply — the labor market is balanced, and there’s no shortage or surplus of workers.

What is the effect of a minimum wage on unemployment?

A minimum wage set above the equilibrium wage can lead to unemployment, because employers may hire fewer workers while more people want jobs at the higher wage.

What is the effect of a minimum wage on unemployment?

o When minimum wage is above the equilibrium wage

The minimum wage is binding, meaning it's higher than what the market would naturally pay.

➡ This can cause unemployment, especially structural unemployment, because more people want jobs at the higher wage, but employers hire fewer workers.

What is the effect of a minimum wage on unemployment?

o When minimum wage is below the equilibrium wage

The minimum wage is non-binding, so it has no effect on wages or employment. The market naturally sets wages higher than the minimum.

What is the effect of a minimum wage on unemployment?

o Who gains from a minimum wage?

Workers who keep their jobs at the higher wage benefit, because they earn more money.

Also, workers with fewer hours may earn a higher income per hour.

➡ However, not all workers benefit — some may lose jobs or have hours cut.

Unions

Unions purposefully bargain collectively to secure wages that are higher than the equilibrium wages for their members. This higher than equilibrium wage leads to more structural unemployment

What is the effect of unions on unemployment?

Unions often raise wages above the equilibrium level, which can lead to lower employment in that industry.

➡ This can cause structural unemployment, as the higher wage leads employers to demand fewer workers.

Union wages versus non-union wages

Union wages are typically higher than non-union wages for similar jobs.

Unions negotiate better pay, benefits, and working conditions. However, these higher wages can lead to lower employment in unionized industries due to increased labor costs.

Efficiency Wages

Wages paid above the market rate to boost worker performance, reduce turnover, and attract better employees.

➡ Can cause structural unemployment due to higher labor costs.

o What is the effect of efficiency wages on unemployment?

can cause structural unemployment because firms hire fewer workers at the higher-than-equilibrium wage, leaving more people unemployed.

o What are some reasons to pay efficiency wages?

- Attract higher-quality workers

- Reduce worker turnover

- Increase worker effort and motivation

- Improve worker health and productivity

- Lower costs from training and supervision

Job search

as a reason for frictional unemployment

• Process by which workers find appropriate jobs given their tastes and skills

2 reasons for Frictional Unemployment

• Changing patterns of international trade

• Because the economy is always changing

• People need time to find a job that suits them. Employers need time to find employees who suit their firm.

Policies for dealing with frictional unemployment

• Government-run employment agencies: give out info about job vacancies and connect unemployed workers to job vacancies.

• Public training programs (Active labor market program)

• Equip displaced workers with skills needed in growing industries

• Unemployment Insurance (UI) - A government program that partially protects workers’ incomes when they become unemployed.

Unemployment insurance - and its effect on unemployment.

• Workers who are involuntarily separated from their jobs are eligible to receive, up to a certain number of weeks (26-50), a fraction of their previous salary.

A government program that partially protects workers’ incomes when they become unemployed

effect: many economists believe that UI reduces the incentive to find jobs quickly because UI payments stop when workers get new jobs.