Ap Macroeconomics Review

1/157

Earn XP

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

158 Terms

Economics

Science of scarcity/study of choices

Scarcity

We have unlimited wants but limited resources.

MACROeconomics

Study of the large economy as a whole or economic aggregates (ex: economic growth, government spending, inflation, unemployment, international trade etc.)

Positive Statements

Based on facts. Avoids value judgements (what is).

Normative Statements

Includes value judgements (what ought to be).

5 Key Economic Assumptions

1. Society has unlimited wants and limited resources (scarcity).

2. Due to scarcity, choices must be made. Every choice has a cost (a trade-off).

3. Everyone’s goal is to make choices that maximize their satisfaction. Everyone acts in their own “self-interest.”

4. Everyone makes decisions by comparing the marginal costs and marginal benefits of every choice.

5. Real-life situations can be explained and analyzed through simplified models and graphs.

Marginal analysis

(aka: thinking on the margin) making decisions based on increments.

Example:

• When you decide to go to the mall you consider the additional benefit and the additional cost (your opportunity cost).

• Once you get to the mall, you continue to use marginal analysis when you shop, buy food, and talk to friends.

• Since your marginal benefits and costs can quickly change your analyzing them every second.

• What if your ex-girlfriend shows up?

The Point: You will continue to do something as long as the marginal benefit is greater than the marginal cost

Trade-offs

ALL the alternatives that we give up when we make a choice.

(Examples: going to the movies)

Opportunity cost

Most desirable alternative given up when you make a choice.

Utility

Satisfaction!

Marginal

Additional!

Allocate

Distribute!

Price

Amount buyer (or consumer) pays

Cost

Amount seller pays to produce a good

Investment

the money spent by BUSINESSES to improve their production

Consumer Goods

created for direct consumption

(example: pizza)

Capital Goods

created for indirect consumption

(oven, blenders, knives, etc.)

The Four Factors of Production

1. Land - All natural resources that are used to produce goods and services. (Ex: water, sun, plants, animals)

2. Labor - Any effort a person devotes to a task for which that person is paid. (Ex: manual laborers, lawyers, doctors, teachers, waiters, etc.)

3. Capital -

Physical Capital - Any human-made resource that is used to create other goods and services ( Ex: tools, tractors, machinery, buildings, factories, etc.)

Human Capital - Any skills or knowledge gained by a worker through education and experience

4. Entrepreneurship - ambitious leaders that combine the other factors of production to create goods and services.

• Examples-Henry Ford, Bill Gates, Inventors, Store Owners, etc.

Economic System

Method used by a society to produce and distribute goods and services.

Centrally-Planned Economies

(aka Communism)

In a centrally planned economy (communism) the government…

1. owns all the resources.

2. answers the three economic questions

The Three Economic Questions

Every society must answer three questions:

The Three Economic Questions

1. What goods and services should be produced?

2. How should these goods and services be produced?

3. Who consumes these goods and services?

Advantage of Communism

1. Low unemployment- everyone has a job

2. Great Job Security- the government doesn’t go out of

business

3. Equal incomes means no extremely poor

people

4. Free Health Care

Disadvantage of Communism

1. No incentive to work harder

2. No incentive to innovate or come up

with good ideas

3. No Competition keeps quality of goods poor.

4. Corrupt leaders

5. Few individual freedoms

Free Market System

(aka Capitalism)

1. Little government involvement in the economy.

(Laissez Faire = Let it be)

2. Individuals OWN resources and answer the three economic questions.

3. The opportunity to make PROFIT gives people INCENTIVE to produce quality items efficiently.

4. Wide variety of goods available to consumers.

5. Competition and Self-Interest work together to regulate the economy (keep prices down and quality up).

Example of Free Market

Example of how the free market regulates itself:

If consumers want smartphones and only one company is making them…

•Other businesses have the INCENTIVE to start making smartphones to earn PROFIT.

•This leads to more COMPETITION….

•Which means lower prices, better quality, and more product variety.

•We produce the goods and services that society wants because “resources follow profits”.

The End Result: Most efficient production of the goods that consumers want, produced at the lowest prices and the highest quality.

Why did communism fail?

If consumers want smartphones and only one

company is making them…

•Other businesses CANNOT start making computers.

•There is NO COMPETITION….

•Which means higher prices, lower quality, and less product variety.

•More phones will not be made until the government decides to create a new factory.

The End Result: There is a shortage of goods that consumers want, produced at the highest prices and the lowest quality.

The Invisible Hand

The concept that society’s goals will be met as individuals seek their own self-interest.

Example: Society wants fuel efficient cars…

•Profit seeking producers will make more.

•Competition between firms results in low prices, high quality, and greater efficiency.

•The government doesn’t need to get involved since the needs of society are automatically met.

Mixed Economies

A system with free markets but also some government intervention

Production possibilities curve

A model that shows alternative ways that an economy can use its scarce resources

4 Key Assumptions of PPC

• Only two goods can be produced

• Full employment of resources

• Fixed Resources (Ceteris Paribus)

• Fixed Technology

Constant Opportunity Cost

Resources are easily adaptable for producing either good.

• Result is a straight line PPC (not common)

Law of Increasing Opportunity Cost

As you produce more of any good, the opportunity cost (forgone production of another good) will increase.

• Why? Resources are NOT easily adaptable to producing both goods.

• Result is a bowed out (Concave) PPC

Productive Efficiency

• Products are being produced in the least costly way.

• This is any point ON the Production Possibilities Curve

Allocative Efficiency

The products being produced are the ones most desired by society.

• This optimal point on the PPC depends on the desires of society.

3 Shifters of the PPC

1. Change in resource quantity or quality

2. Change in Technology

3. Change in Trade Production Possibilities

Absolute Advantage

•The producer that can produce the most output OR requires the least amount of inputs (resources)

•Ex: Papa John has an absolute advantage in pizzas because he can produce 100 and Ronald can only make 20.

Comparative Advantage

The producer with the lowest opportunity cost.

•Ex: Ronald has a comparative advantage in burgers because he has a lowest PER UNIT opportunity cost.

Output Questions

OOO = Other goes Over

Input Questions

Other goes Under

Terms of Trade

The agreed upon conditions that would benefit both countries

The Product Market

The “place” where goods and services produced by businesses are sold to households.

The Resource (Factor) Market

The “place” where resources (land, labor, capital, and entrepreneurship) are sold to businesses.

Private Sector

Part of the economy that is run by individuals and businesses

Public Sector

Part of the economy that is controlled by the government

Factor Payments

Payment for the factors of production, namely rent, wages, interest, and profit

Transfer Payments

When the government redistributes income (ex: welfare, social security)

Subsidies

Demand

Different quantities of goods that consumers are willing and able to buy at different prices.

(Ex: You are able to purchase diapers, but if you aren’t willing to buy then there is NO demand)

Law of Demand

There is an INVERSE relationship between price and quantity demanded,

The law of demand is the result of three separate behavior patterns that overlap:

1.The Substitution effect

2.The Income effect

3.The Law of Diminishing Marginal

Utility

The Substitution Effect

If the price goes up for a product, consumer buy less of that product and more of another substitute product (and vice versa)

The Income Effect

If the price goes down for a product, the purchasing power increases for consumers - allowing them to purchase more.

Law of Diminishing Marginal Utility

States that as you consume anything, the additional satisfaction that you will receive will eventually start to decrease

• In other words, the more you buy of ANY GOOD the less satisfaction you get from each new unit consumed.

5 Shifters (Determinates) of Demand (SPICE)

1. Tastes and Preferences

2. Number of Consumers

3. Price of Related Goods

4. Income

5. Future Expectations

Normal Goods

– Ex: Luxury cars, Sea Food, jewelry, homes

– As income increases, demand increases

– As income falls, demand falls

Inferior Goods

– Ex: Top Ramen, used cars, used clothes

– As income increases, demand falls

– As income falls, demand increases

Supply

Different quantities of a good that sellers

are willing and able to sell (produce) at different prices.

Law of Supply

There is a DIRECT (or positive) relationship between price and quantity supplied.

•As price increases, the quantity producers make increases

•As price falls, the quantity producers make falls.

5 Shifters (Determinants) of Supply (COTTON)

1. Prices/Availability of inputs (resources)

2. Number of Sellers

3. Technology

4. Government Action: Taxes & Subsidies

5. Expectations of Future Profit

Double Shift Rule

If TWO curves shift at the same time, EITHER price or quantity will be

indeterminate (ambiguous).

Consumer Surplus

Difference between what you are willing to pay and what you

actually pay.

CS = Buyer’s Maximum – Price

Producer’s Surplus

Difference between the price the seller received and how much

they were willing to sell it for.

PS = Price – Seller’s Minimum

Gross Domestic Product (GDP)

Dollar value of all final goods and services produced within a country’s borders in one year.

Percent change

(Year 2 - Year 1/Year 1) * 100

GDP Per Capita (per person)

GDP divided by the population. It identifies on average how many products each person makes.

Two Ways of calculating GDP

1. Expenditures Approach - Add up all the spending on final goods and services produced in a given year.

2. Income Approach - Add up all the income that resulted from selling all final goods and services produced in a given year.

Four components of GDP (Expenditures Approach)

1. Consumer Spending - Purchases of final goods by private individuals.

Ex: $5 Sandwich at Subway

2. Investment - Businesses spending tools and equipment.

Ex: Walmart buys self-checkout machines

3. Government Spending - Ex: School, tanks, but NOT transfer payments

4. Net Exports- Exports (X) – Imports (M)

Ex: Value of 3 Ford Focuses minus 2 Hondas

GDP = C + I + G + Xn

Income Approach

1. Labor Income - Purchases of final goods by private individuals. Ex: $5 Sandwich at Subway

2. Rental Income - Income earned from property owned by individuals

3. Interest Income- Interest earned from loaning money to businesses

4. Profit - Money businesses have after paying all their costs

These are called FACTOR PAYMENTS. Labor earns wages, land earns rent, capital earns interest, and entrepreneurship earns profit.

Nominal GDP

GDP measured in current prices. It does not account for inflation from year to year.

Real GDP

GDP expressed in constant, or unchanging, dollars. Real GDP adjusts for inflation.

Inflation

Rising general level of prices and it reduces the “purchasing power” of money

Deflation

Decrease in general prices or a negative inflation rate.

Disinflation

Prices increasing at slower rates

Hurt by Inflation

• Lenders-People who lend money (at fixed

interest rates)

• People with fixed incomes

• Savers

Helped by Inflation

• Borrowers-People who borrow money

• A business where the price of the product

increases faster than the price of resources

Nominal Wage

Wage measured by dollars rather than purchasing power

Real Wage

Wage adjusted for inflation

The Inflation Rate

The percent change in prices from year to year

Price Indices

Index numbers assigned to each year that show how prices have changed relative to a specific base year.

Consumer Price Index (CPI)

CPI = (Price of Market Basket/ Price of Market Basket in Base Year) * 100

Problems with the CPI

1. Substitution Bias- As prices increase for the fixed market basket, consumers buy less of these products and more substitutes that may not be part of the market basket. (Result: CPI may be higher than what consumers are really paying)

2. New Products- The CPI market basket may not include the newest consumer products. (Result: CPI measures prices but not the increase in choices)

3. Product Quality- The CPI ignores both improvements and decline in product quality. (Result: CPI may suggest that prices stay the same though the economic well being has improved significantly)

GDP deflator

Measures the prices of all goods produced, whereas the CPI measures prices of only the goods and services bought by consumers.

GDP Deflator = (Nominal GDP/ Real GDP) * 100

Nominal GDP = (Deflator) * (Real GDP) / 100

3 Causes of Inflation

1. The Government Prints TOO MUCH Money (The Quantity Theory)

2. Demand- Pull Inflation, DEMAND PULLS UP PRICES!!!

3. Cost-Push Inflation, Higher production costs increase prices

Quantity Theory of Money Equation

Real Interest Rates

The percentage increase in purchasing power that a borrower pays. (adjusted for inflation)

Real = nominal interest rate - expected inflation

Nominal Interest Rates

The percentage increase in money that the borrowerpays not adjusting for inflation.

Nominal = Real interest rate + expected inflation

Aggregate Demand

all the goods and services (real GDP) that buyers are willing and able to purchase at different price levels.

AD = = C + I + G + Xn

Why is AD downward sloping?

1. The Wealth Effect-

• Higher price levels reduce the purchasing power of money. This decreases the quantity of expenditures

• Lower price levels increase purchasing power and increase expenditures

2. Interest-Rate Effect-

• When the price level increases, lenders need to charge higher interest rates to get a REAL return on their loans.

• Higher interest rates discourage consumer spending and business

investment.

3. Foreign Trade Effect-

• When U.S. price level rises, foreign buyers purchase fewer U.S. goods and Americans buy more foreign goods

• Exports fall and imports rise causing real GDP demanded to fall. (XN Decreases)

Shifters of Aggregate Demand

1. Change in Consumer Spending

2. Change in Investment Spending

3. Change in Government Spending

4. Change in Net Exports (X-M)

Aggregate Supply

The amount of goods and services (real GDP) that firms will produce in an economy at different price levels.

Short-run Aggregate Supply

Wages and Resource Prices will not increase as price levels increase.

Long-run Aggregate Supply

Wages and Resource Prices will increase as price levels increase.

Shifters of Aggregate Supply (RAP)

1. Change in Resource Prices

2. Change in Actions of the Government

3. Change in Productivity

Inflationary Gap

Output is high and unemployment is less than National Rate of Unemployment

Recessionary Gap

Output low and unemployment is more than NRU

Capital Stock

Machinery and tools purchased by businesses that increase their output

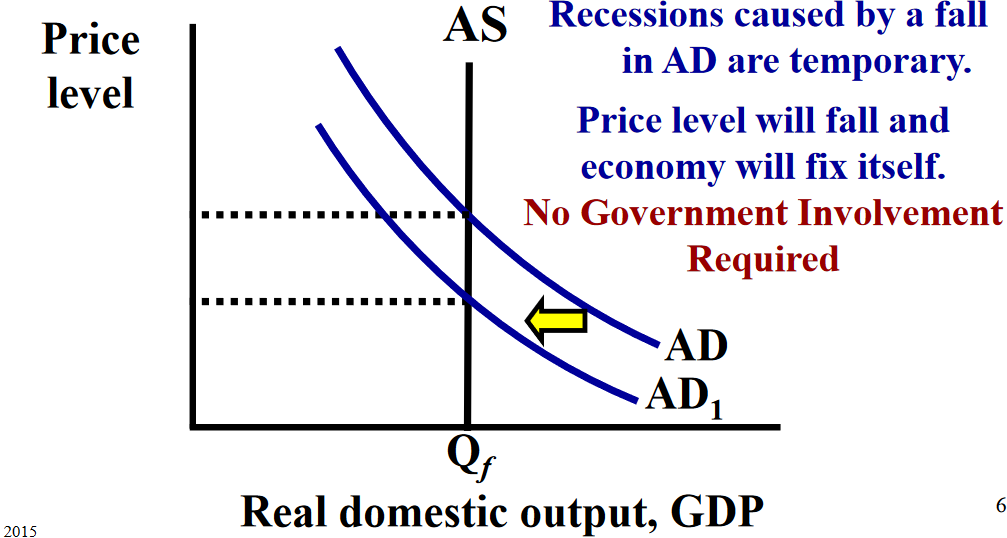

Classical Theory

1. A change in AD will not change output even in the short run because prices of resources (wages) are very flexible.

2. AS is vertical so AD can’t increase without causing inflation.

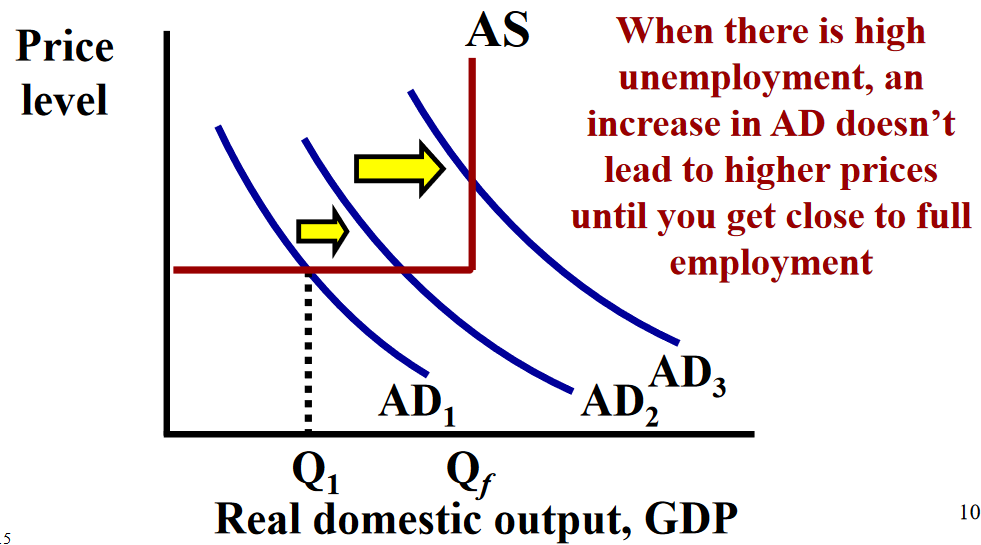

Keynesian Theory

1. A decrease in AD will lead to a persistent recession because prices of resources (wages) are NOT flexible.

2. Increase in AD during a recession doesn’t cause inflation

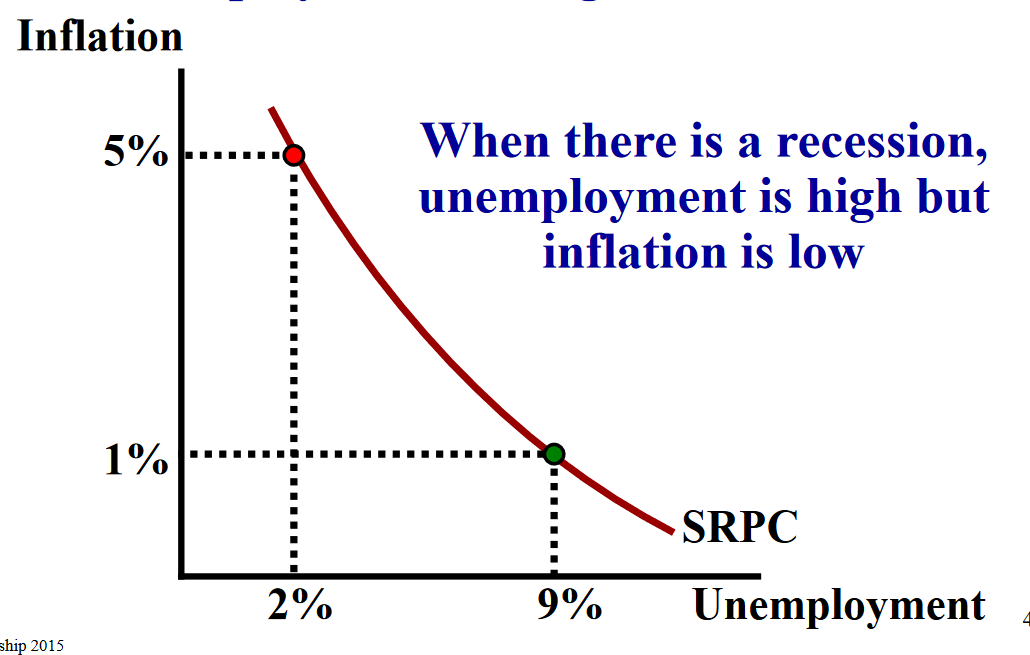

Short Run Phillips Curve

When the economy is overheating, there is low unemployment but high inflation

Fiscal Policy

Actions by Congress to

stabilize the economy.

Monetary Policy

Actions by the Federal Reserve Bank

to stabilize the economy.