Lecture 10: Cashflow of stocks (dividends), common shares, preferred shares,intrinsic value

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

What are the 2 types of equity securities?

Common shares: dividends after preferred, but control over firm’s decisions (voting rights)

Preferred shared: priority in dividend payments & liquidation but have no voting rights

shares have no maturity date (dividends as long as company exists)

How do you find the value of common stock?

The value (intrinsic value) of any asset is the present value of its expected future cash flows

Value of asset = PV of future cashflow

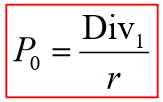

What is case 1: zero growth?

Assume that company pays a constant dividend forever

PV of a perpetuity

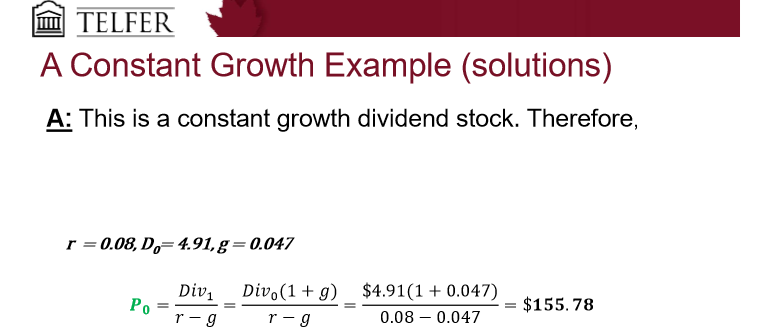

What is case 2: constant growth?

Assumes that the dividends grow at a constant rate forever

Growing perpetuity formula

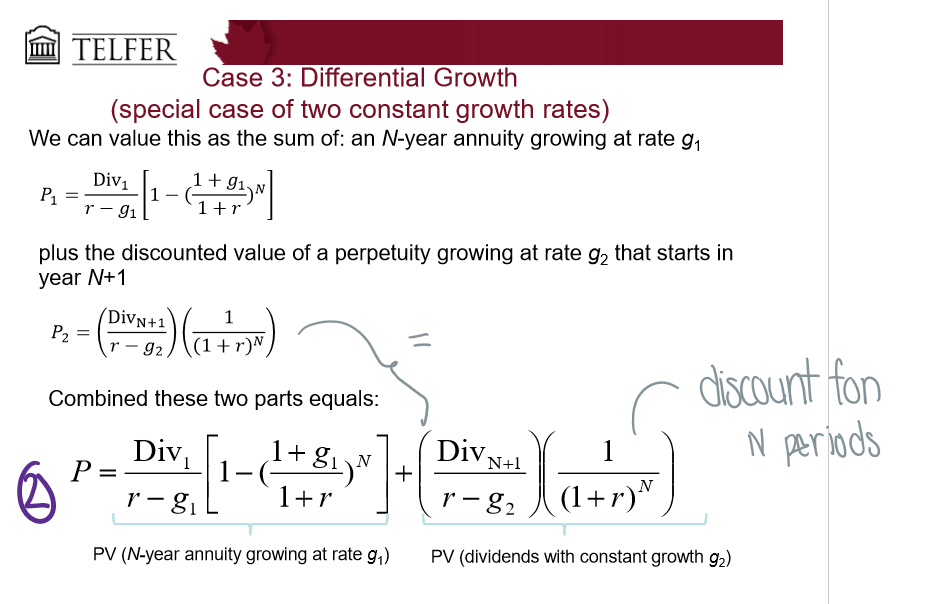

What is the general formula for differential growth?

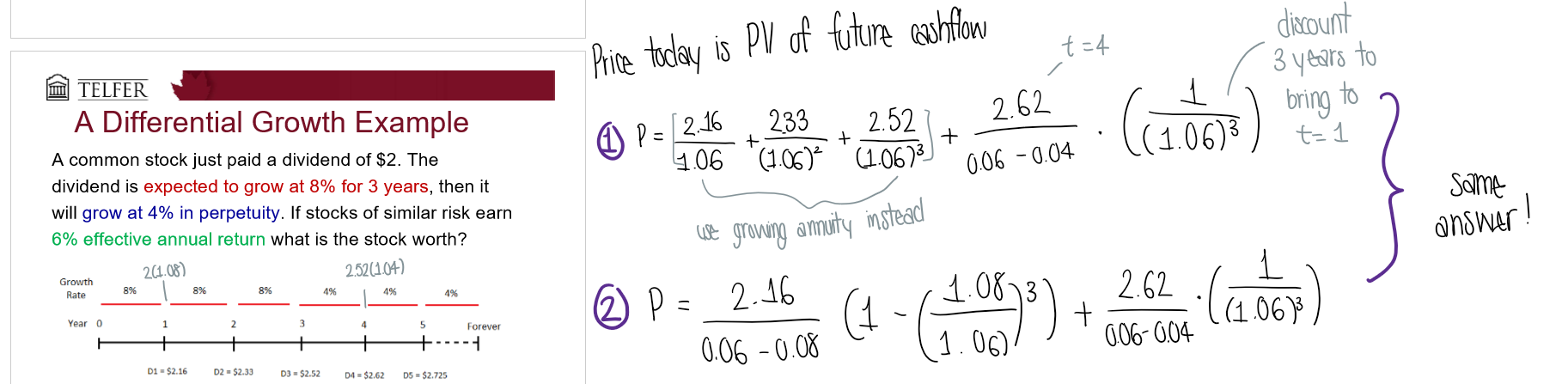

What is case 3: differential growth?

Assume that dividends grow at different rates in the near future, but then will grow at a constant rate after

estimate future dividends in the future

estimate future stock price when stock becomes a constant growth stock

How do you estimate the growth rate g?

Growth rate = retention ratio x return on earnings

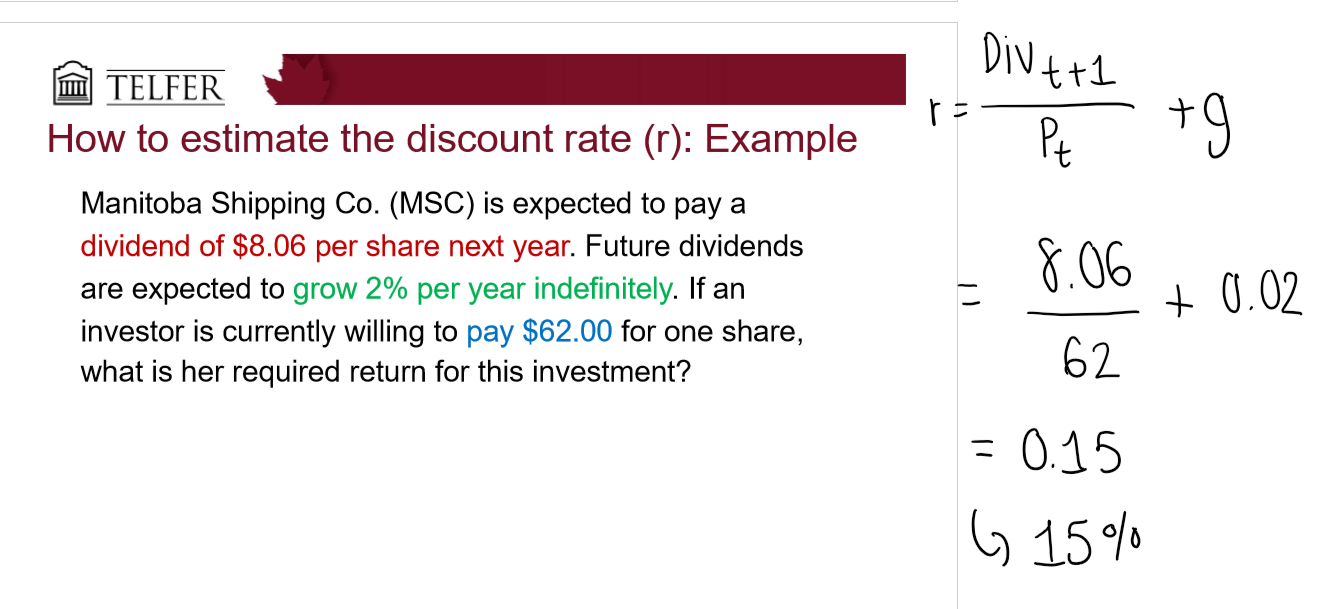

How do you estimate the discount rate r?

Re-arrange the constant dividend growth formula

What are some concerns of the dividend discount model?

Many things are hard to estimate

what if firms don’t pay dividends?

growth rate must be LESS than the return rate