implementing macro policy (chap 30-33)

1/69

Earn XP

Description and Tags

fiscal policy, monetary policy, supply side policy, ( not done but the Phillips curve and policy conflicts)

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

70 Terms

fiscal policy

process of regulating government spending and taxation in order to control the economy

what are the roles of fiscal policy

finance spending, redistributing income, welfare, tackling failure, improving competitiveness

current expenditure

money spent on current goods and services e.g hospital equipment, staff in public sector

capital expenditure

money spent on capital that is used to produce/ support goods and services for current expenditure e.g investments into infrastructure

transfer payments

money that provides the welfare net e.g benefits, nhs

what is government spending generally on

education, welfare, healthcare, infrastructure, services etc, all are merit goods

what are the two types of fiscal policy

expansionary and discretionary

expansionary fiscal policy and examples

policy that increases the money supply and therefore spending, cuts in income tax, cuts in indirect tax, cuts in corporation tax, cut in interest from saving tax

discretionary fiscal policy and examples

policy to control inflation or decrease spending, increasing taxation such as income and vat

automatic stabilisers

automatic policies and government behaviours that aid the economy through the cycle e.g more spending in a recession and increase in benefits when unemployment is rising

what are the two main ways the government funds its spending

taxation and borrowing

direct tax

taxation on income

progressive tax and example

tax rate that rises as income rises such as tax brackets

proportional tax and example

tax that is constant no matter what income is earned e.g flat business tax in Poland that has the same percentage for all businesses

regressive tax and example

tax that is more of a burden on those with lower incomes e.g smoking tax is a larger proportion of a lower income persons’ income

what are some influences on supply/ producers when tax changes *includes citizens

work incentives, inward migration of workers, more investment, more enterprise and entrepreneurship, incentives to study, incentives for research and development, lower business costs when carbon tax reduces

what are some examples of UK fiscal policy

raising vat to 20%, raising national insurance, cuts in local authority spending e.g bins and bus routes, welfare caps and reform

what are some global examples of fiscal policy *don’t have to name country

Poland flat business tax, freezing fuel duties, cutting corporation tax, freezing council tax, cutting NI

government budget

proposal for the years fiscal behaviour including spending, taxation, borrowing etc

what are the three stages a budget can be in

balance, surplus (too much taxation), deficit (too much borrowing)

what is the governments opportunity cost when predicting a budget deficit

subsequent years of interest payments on the borrowing, creates burden on future generations

what is the cyclical budget deficit

deficit is in line with business activity

structural budget deficit

deficit is still there even when employment is full

national debt

money the government owes from borrowing, UK always in debt, currently at around £2.5 trillion

what are the justifications for the UKs national debt

more spending boosts AD, encourages more employment, investment helps fix long run deficit

what did Keynes say about the budget and fiscal behaviour

we must spend our way out of trouble

monetary policy

government policy that can influence the money supply and interest rates

money supply

amount of money in the economy

who are the MPC

monetary policy committee, there to discuss every month if the base interest rate should be changed to make sure the inflation target is met

what is the inflation target and who sets it

UK target for inflation 2%, set by the government

what are the two types of monetary policy

expansionary and deflationary

what is the aim of expansionary monetary policy

increase the money supply, fall in interest rate, growth in spending, depreciating exchange rate to increase exports

what is the aim of deflationary monetary policy

raise the interest rate, make credit/ money supply tighter, appreciate exchange rate

who sets the base interest rate and what is it

basic interest rate that all businesses build off of, bank of England set in in relation to how the inflation target is being met

what is the base interest rate also known as

bank rate as banks are the lenders of credit and loan agreements

what factors do the MPC take into account when deciding on adjusting the interest rate

spare capacity, GDP growth, trends in global markets, unemployment data, commodity prices, demand, credit availability, consumer confidence

liquidity trap

when the interest rate is lowered yet doesn’t stimulate increased consumption

what may the government do to stimulate the economy when a liquidity trap occurs

borrow and spend more to increase the overall GDP and account for any projected consumption that did not take place

what way can the government create more money for the money supply

quantitative easing

quantitative easing

increasing the money supply through the purchase of financial assets, bank of england buys the assets from the government

what is the point of quantitative easing

prevent the liquidity trap and subsequent recession

what are the benefits of low interest rates

more consumer and business confidence therefore more consumption and investment, less export pressure as the pound appreciates, preventative of deflation, encourages the multiplier

what are the drawbacks of low interest rates

consumers less likely to save, high pressure on credit supply, less exports means businesses fail, mortgage debt, bad for savers, doesn’t aid times of low unemployment where higher interest can benefit more

evaluate monetary policy

time lags are long as inflation takes approx 2 years to cycle through economy, assumes consumers and business behaviour which may be wrong, need to acknowledge fiscal too as they work in conjunction, costs can fluctuate and change rate of inflation and behaviours, long run sustainability?!

supply side policy

policies that directly aim to improve productivity and promote an outward shift in the PPF or LRAS

what are some key challenges that SSP focuses on

real gdp growth, productivity gap, emerging nations, youth unemployment, regional economic divides, trade deficit, inequality and relative poverty, capital research and investments

what are the two branches of SSP policies

market led policies and interventionist policies

what are market led policies

policies that allow a more free working market, reducing government intervention

what are some generic examples of market led SSP

privatisation, deregulation, tax and benefit reforms, labour market flexibility through migration trade union power and minimum wage

what are some specific UK examples of market led SSP

privatising Royal Mail, reducing the national insurance payments

what are interventionist policies

policies that surround government intervention in order to stimulate AS

what are some generic examples of interventionist policies

public sector investment, education initiatives, more housing, subsidies, r+d investment, immigration control, competition policies

what are some specific examples of interventionist policies

migrants minimum earning (around £39,000), HS2 investment, CMA forming

trade off

a gain in one item must be accompanied by a loss in another

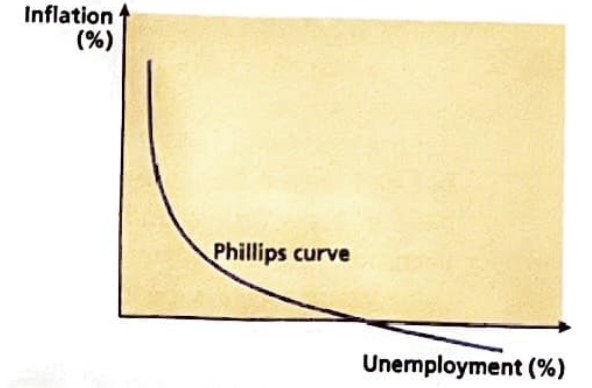

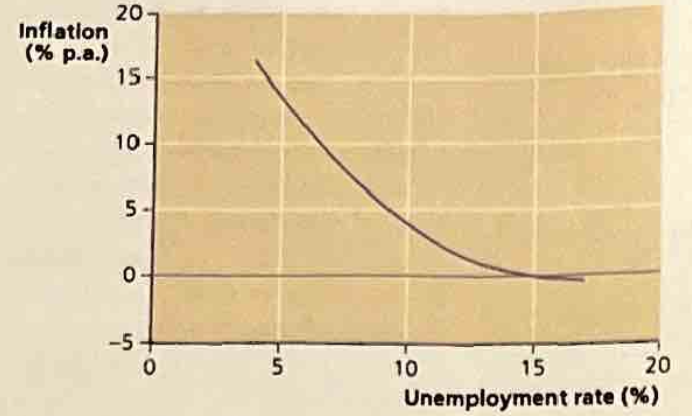

phillips curve

diagram that illustrates the trade off between unemployment and inflation

what does the philips curve look like in the short run and why

downward sloping inverse relationship, as unemployment is high inflation is low as people cannot afford to spend and vice versa, when unemployment is low inflation is high

politically link the phillips curve to economic policy

aspiring political candidates can say they will decrease inflation through increasing unemployment. and vice versa yet this doesn’t always work in the long run, cannot really use the curve for policy due to the long run effects

stagflation

high unemployment and high inflation, the phillips curve has effectively disappeared in this case

what is another theory for the disappearance of the phillips curve in the event of stagflation

an upward shift of the phillips curve whereby wage bargaining takes place on the expectations of inflation as it has become so normalised in society

what is the natural rate of unemployment

rate at which there is only frictional and structural unemployment and real wages are at an equilibrium level

NAIRU (non-accelerating inflation rate of unemployment)

rate of unemployment that is consistent with a constant rate of inflation or just the natural rate of unemployment (full employment on LRAS)

what does the long run phillips curve look like and why

a vertical line at the natural rate of unemployment as neoclassical assumptions argue that there is no long run trade off between inflation and unemployment as they will both occur due to growth and the natural rate of unemployment

what are the seven key macro policy objectives

economic growth, low inflation, full employment, BOP stability, balanced budget, sustainable growth environmentally, acceptable income distribution

how can economic growth and the balance of payments conflict

more growth means more real income which means more imports of goods and services which results in a disrupted trade balance

how did economic growth and the balance of payments conflict in the 50s and 60s

fixed exchange rate and lost of abroad spending meant that growth was short lived as the deficit on the current account came quickly

how can economic growth and inflation conflict

demand side policies for growth may cause demand pull inflation, governments may want to work on supply side policies to reduce the effect that growth may have on inflation

how can fiscal and monetary policy conflict

an increase in government spending (fiscal) can push up interest rates for banks as the government decides to borrow more (monetary) which results in less spending as a country (economic growth)

how can hot money link to the conflict between fiscal and monetary policy

higher interest rates attract hot money flows which affects the international position of domestic economies

how do growth and inequality link

rapid economic growth can cause more inequality within society as skills are adopted but not by all, certain sectors such as investment may grow more than working class jobs, may be education gaps

why is it important to create a stable macroeconomic environment

promotes effective operation of microeconomic markets whereby supply and demand are boosted, profits are more likely to be domestically reinvested and social welfare will go up