Monopoly

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

Characteristics of Monopoly

A monopoly is a market structure in which there is a single seller

There are no substitute products

The firm has complete market power and is able to set prices and control output

This allows the firm to maximise supernormal profit in the short-run

There is no long-run erosion of supernormal profit as competitors are unable to enter the industry

High barriers to entry exist

One of the main barriers is the ability of the monopoly to prevent any competition from entering the market

E.g. by purchasing companies who are a potential threat

The UK Competition and Markets Authority defines a legal monopoly as any firm having more than 25% market share

It acts to prevent this from happening in most industries

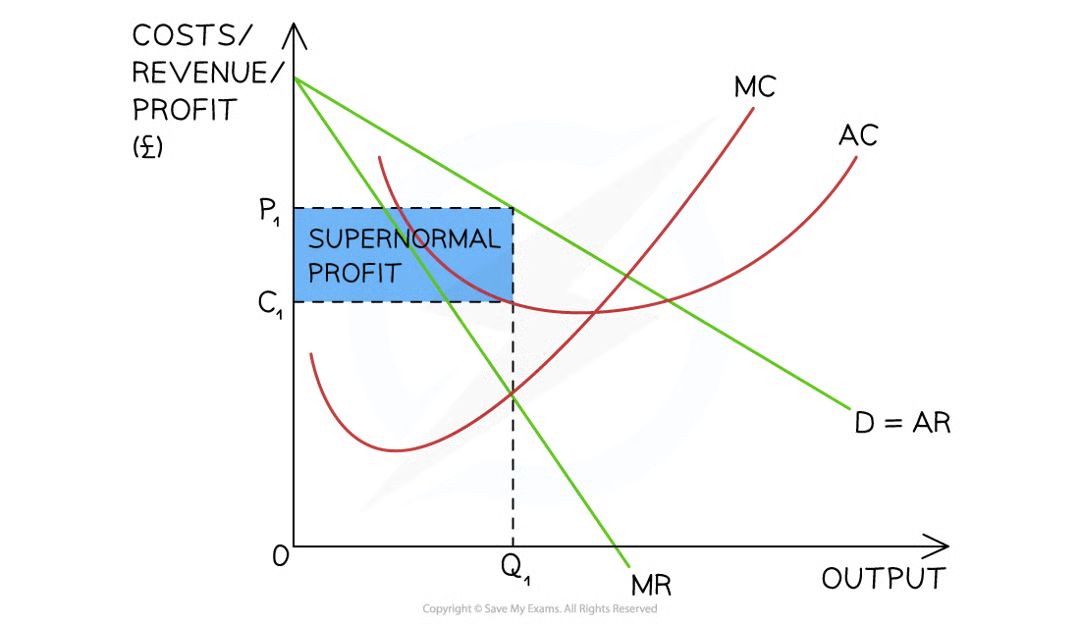

Profit Maximising Equilibrium

As a single seller of goods/services, the firm in a monopoly market is also the entire market. Its concentration ratio is CR1=100%

There is no differentiation between the firm and the industry

It is a price maker or price setter

This means that its demand and revenue curves are downward sloping

In order to maximise profits, it produces at the point where marginal cost (MC) = marginal revenue (MR)

A diagram illustrating a monopoly making supernormal profit in the short-run and long-run as the AR > AC at the profit maximisation level of output (Q1)

Diagram analysis

The firm produces at the profit maximisation level of output, where MC = MR (Q1)

At this level, the AR (P1) > AC (C1)

The firm is making supernormal profit

(P1-C1)XQ1

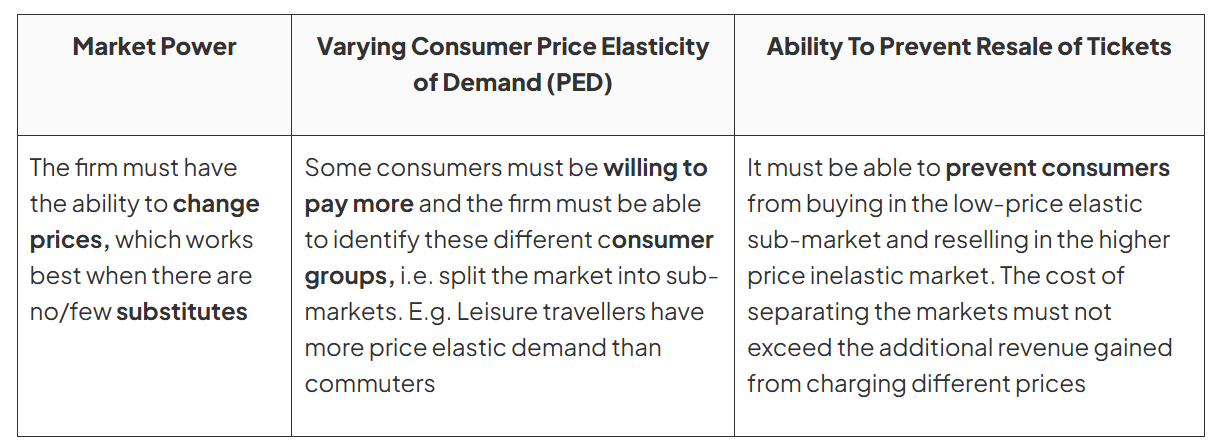

When does price degree price discrimination occur?

Price discrimination occurs when a firm charges a different price for the same good/service in order to maximise its revenue

Three degree price discrimination

Third degree price discrimination occurs when a firm charges different prices to different consumers for the same good/service e.g. rail fares are priced differently depending on the time of travel

Markets are often sub-divided based on time, age, income and geographic location

Some airline ticket portals charge higher prices to customers using an Apple computer as they are likely to have higher income

The Following Conditions Must Be Met for Third Degree Price Discrimination to Occur

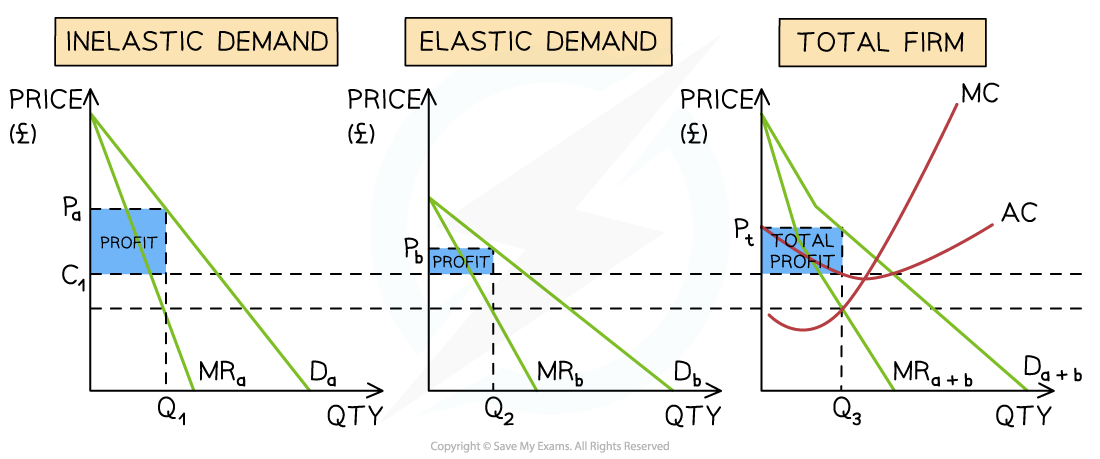

A third-degree price discrimination diagram demonstrates a market that has been divided based on price inelastic (peak travel) and price elastic demand (off-peak travel). Following the revenue rule, prices are raised for peak demand and lowered for off-peak demand

Diagram analysis

Each train route has an effective monopoly provider

The overall firm is producing at the profit maximising level of output where MC=MR

This point is extrapolated to both sub-markets on the left by using the lower dotted line

The average cost is extrapolated across both sub-markets using the upper dotted line (C1)

A higher price for peak travel has been set at Pa and a lower price for off-peak travel has been set at Pb

Following the revenue rule, total revenue increases in both markets

The profit for sub-market A = (Pa-C1) * Q1

The profit for sub-market B = (Pb-C1) * Q2

The firm's total profit is the average selling price - the average costs

Total profit = (Pt-C1) * Q3

The firms' total profits are higher than if they had charged a single price to all customers

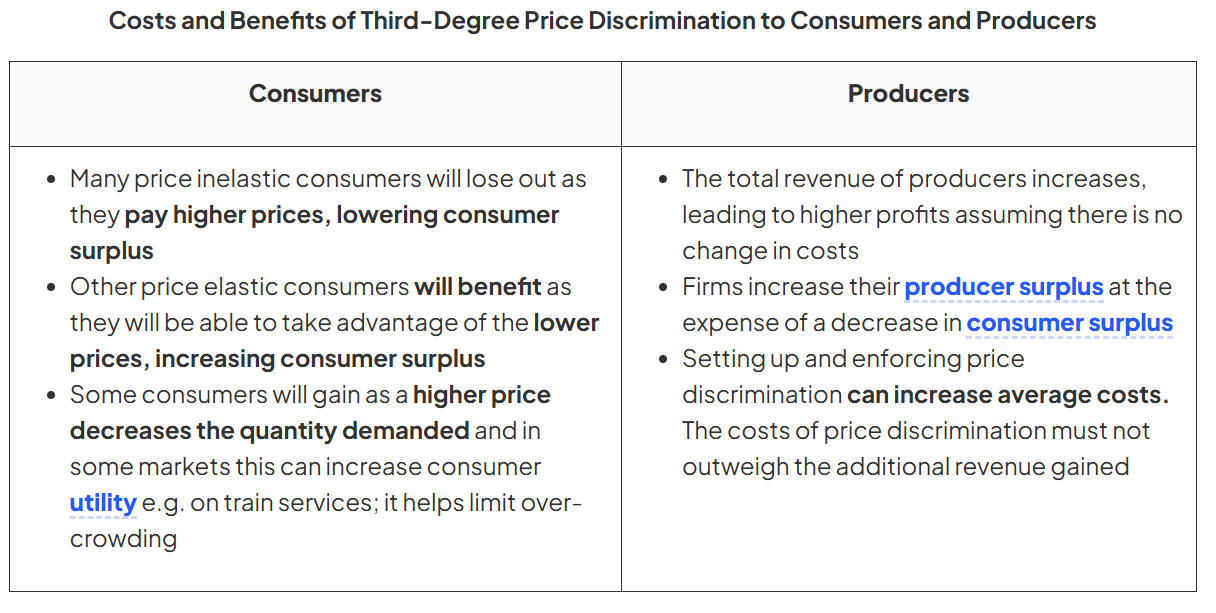

Costs and benefits of third-degree price discrimination

Costs & Benefits of Monopoly

In several instances where the Competition and Markets Authority has acted to decrease/limit monopoly power, firms have taken the Regulator to court to attempt to convince them that the firms market power will benefit consumers

Theoretically this is possible, however, in many cases, the desire to maximise profits would prevent this from happening

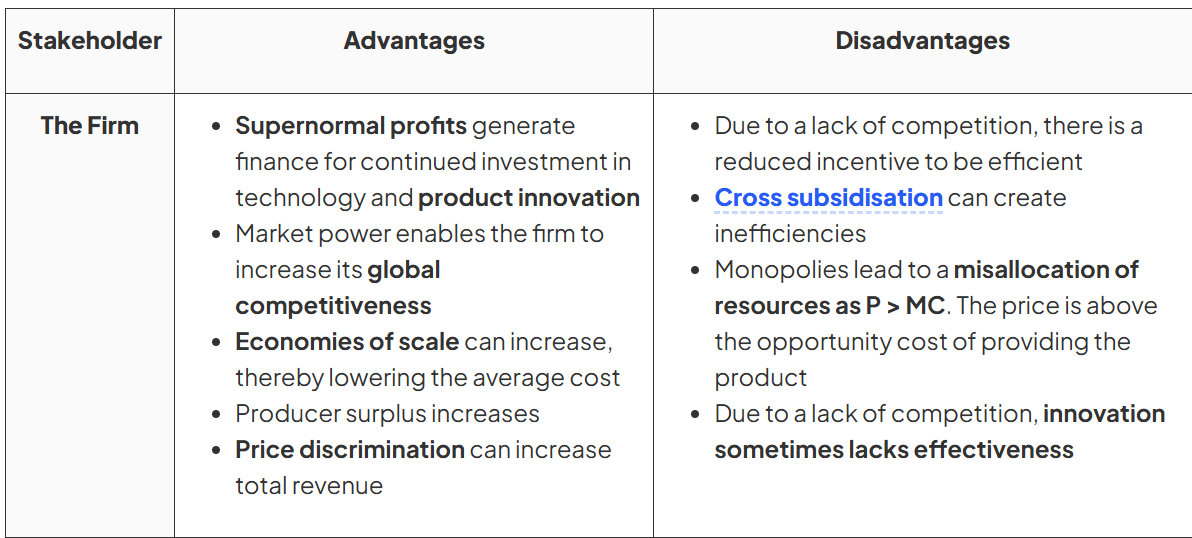

The Advantages and Disadvantages Of Monopoly Power

The firm: The Advantages and Disadvantages Of Monopoly Power

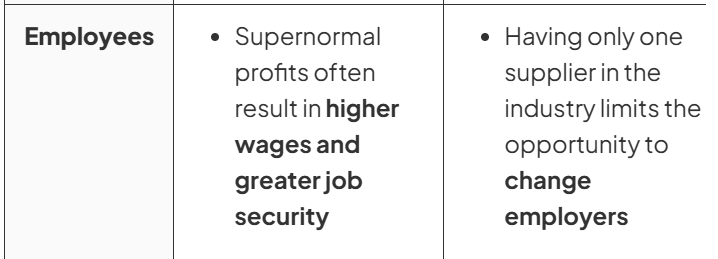

The Advantages and Disadvantages Of Monopoly Power: employees

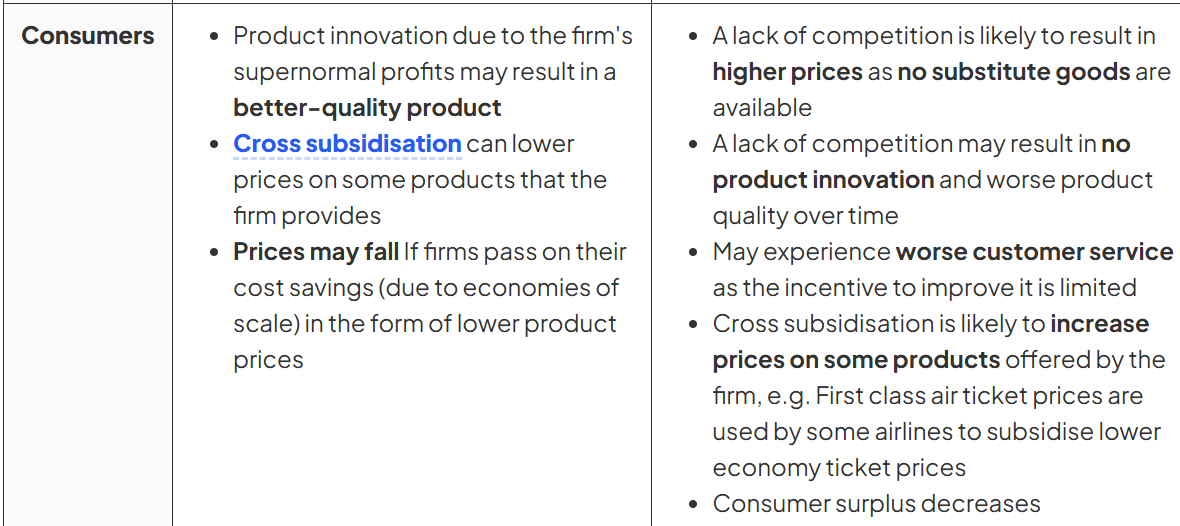

The Advantages and Disadvantages Of Monopoly Power - consumer

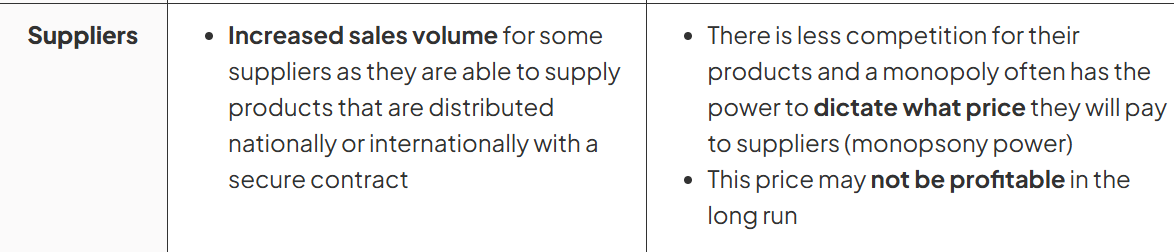

The Advantages and Disadvantages Of Monopoly Power - suppliers

Natural monopoly

A natural monopoly occurs when the optimum number of firms in the industry is one

This is often due to associated infrastructure issues e.g. delivery of utility services like water, where it does not make sense to have multiple pipelines

It can also be due to the significant cost that is generated when entering or exiting the industry, e.g. the sunk costs

It can also be due to the ability of economies of scale to lower prices for consumers, e.g. it makes sense to have one firm building five nuclear power stations as opposed to five firms, as average costs will be lower with one firm constructing

Even one firm in the industry cannot achieve an output at the lowest average cost where AC=MC, productive efficiency. More competition would simply increase average costs, further increasing prices for consumers

When do natural monopolies occur:

Natural monopolies usually occur in utility industries and are regulated by the Government to ensure that consumers are not charged higher monopoly prices

This regulation is often in the form of a maximum price or a price cap

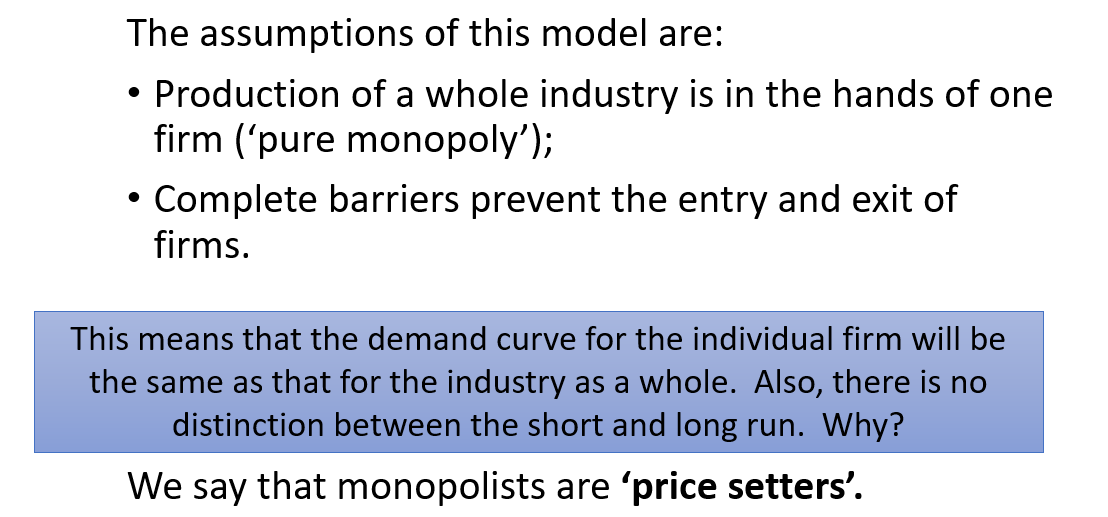

The monopoly model

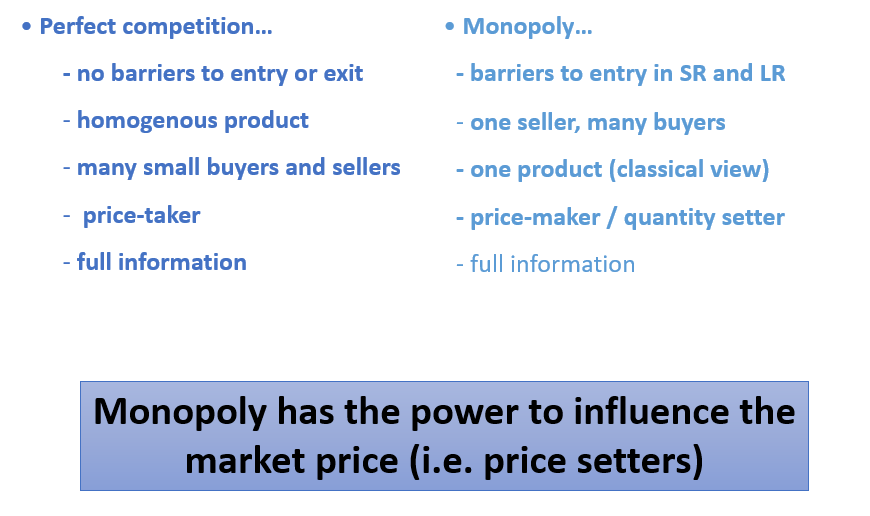

Assumptions – perfect competition vs. monopoly

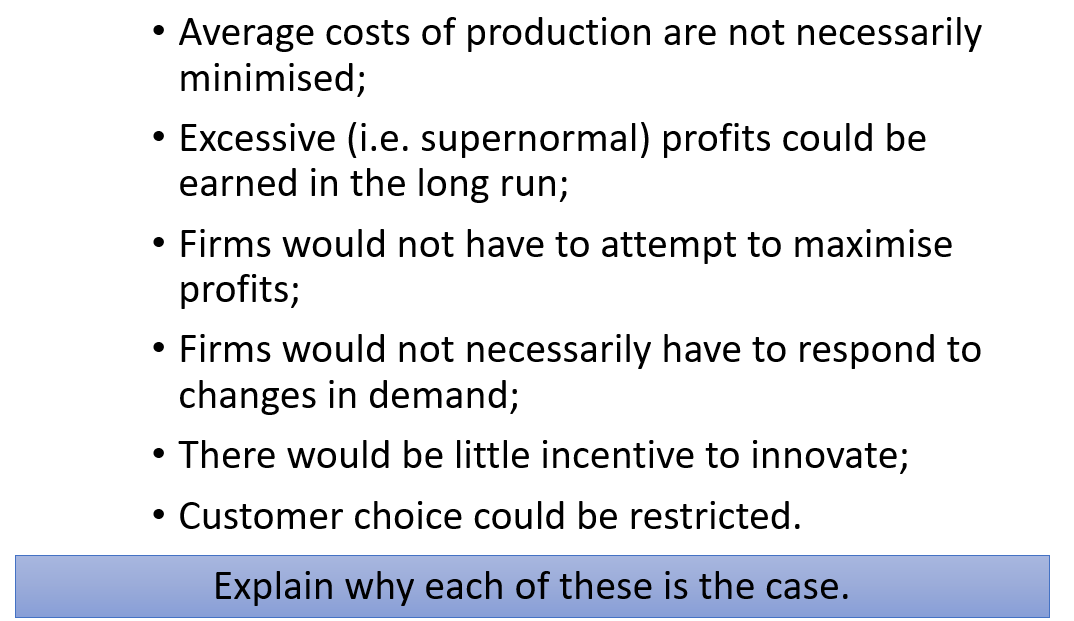

If markets exist which conform to the monopoly model:

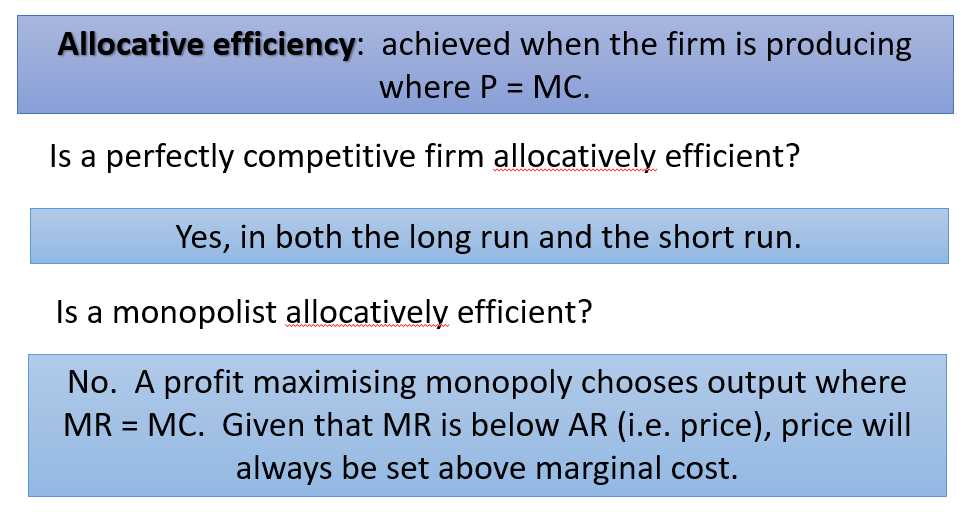

Economic efficiency

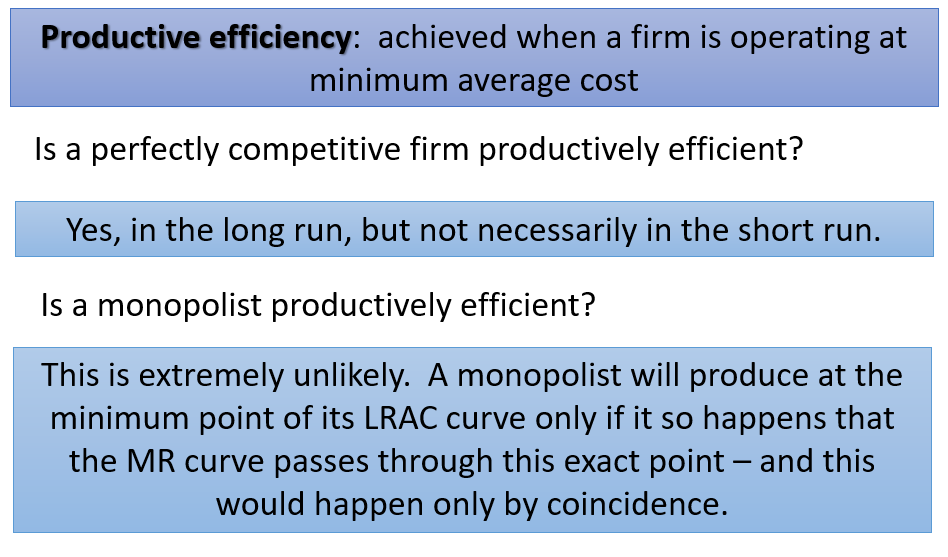

X-inefficiency

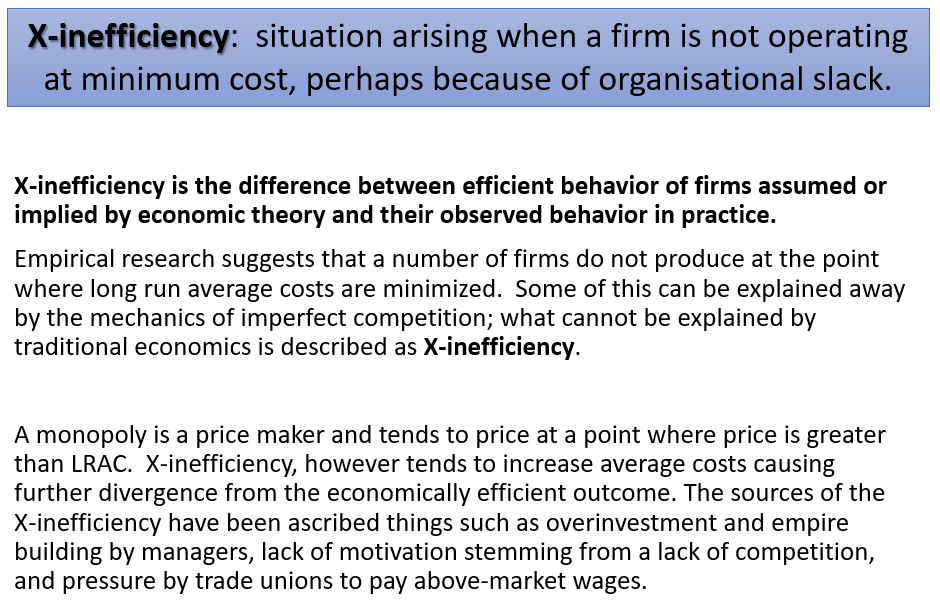

Monopolies and economies of scale

Barriers to entry

How do monopolies arise?

Barriers to entry 1

Barriers to entry 2

Barriers to entry

Why are barriers to entry significant?

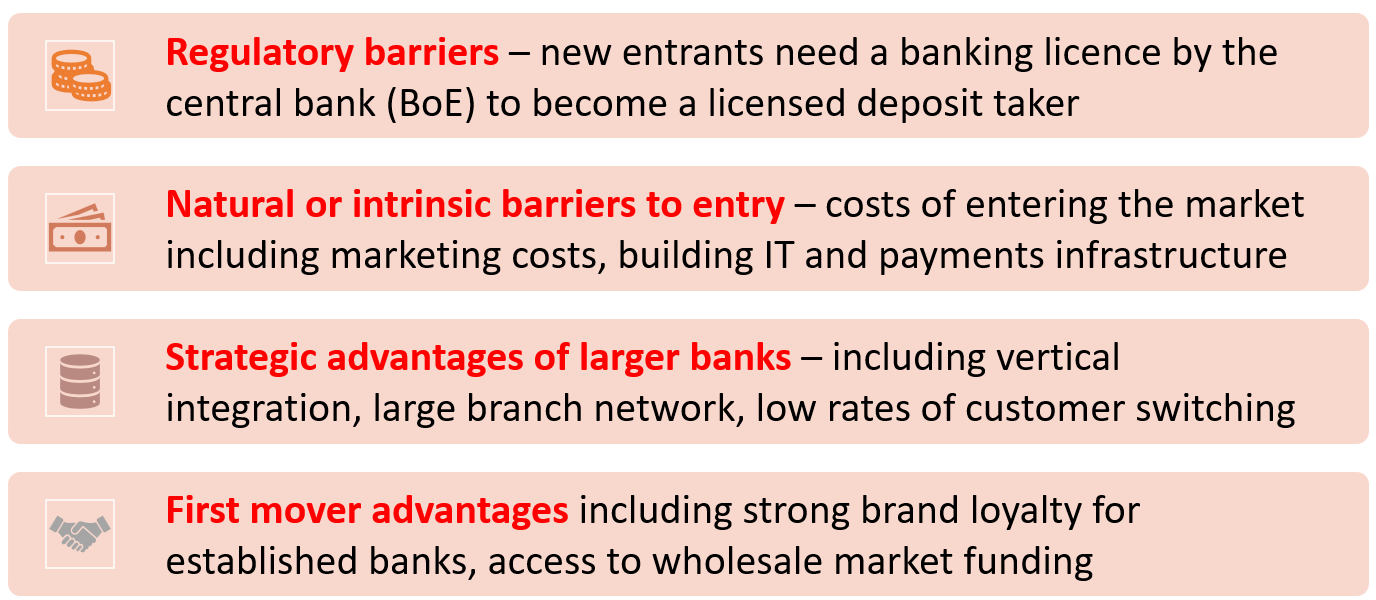

Barriers to entry in commercial banking

First mover advantage

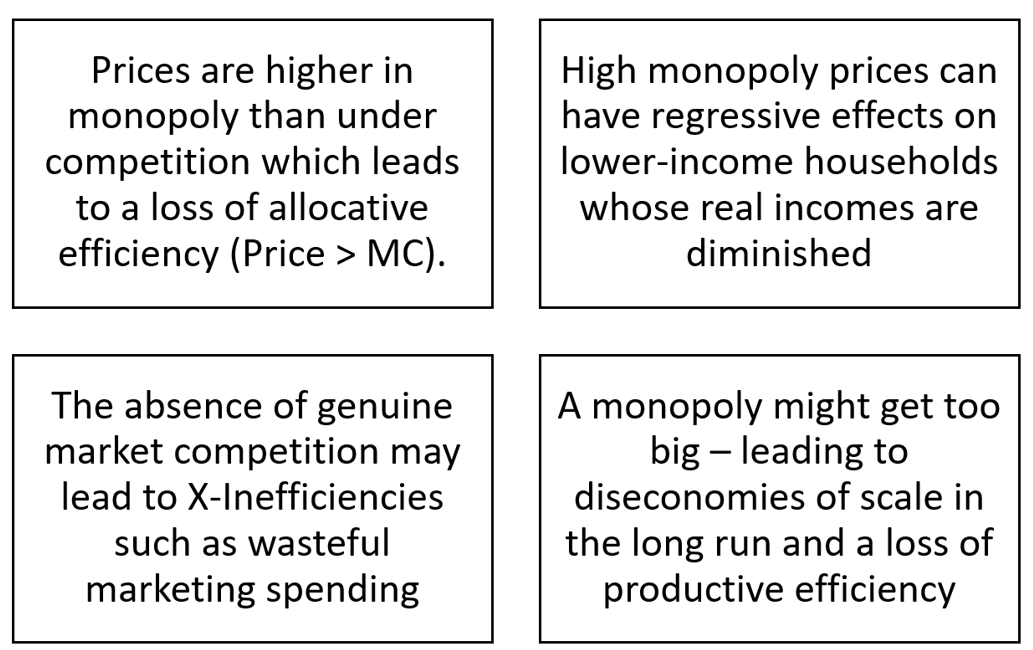

Disadvantages of monopoly power

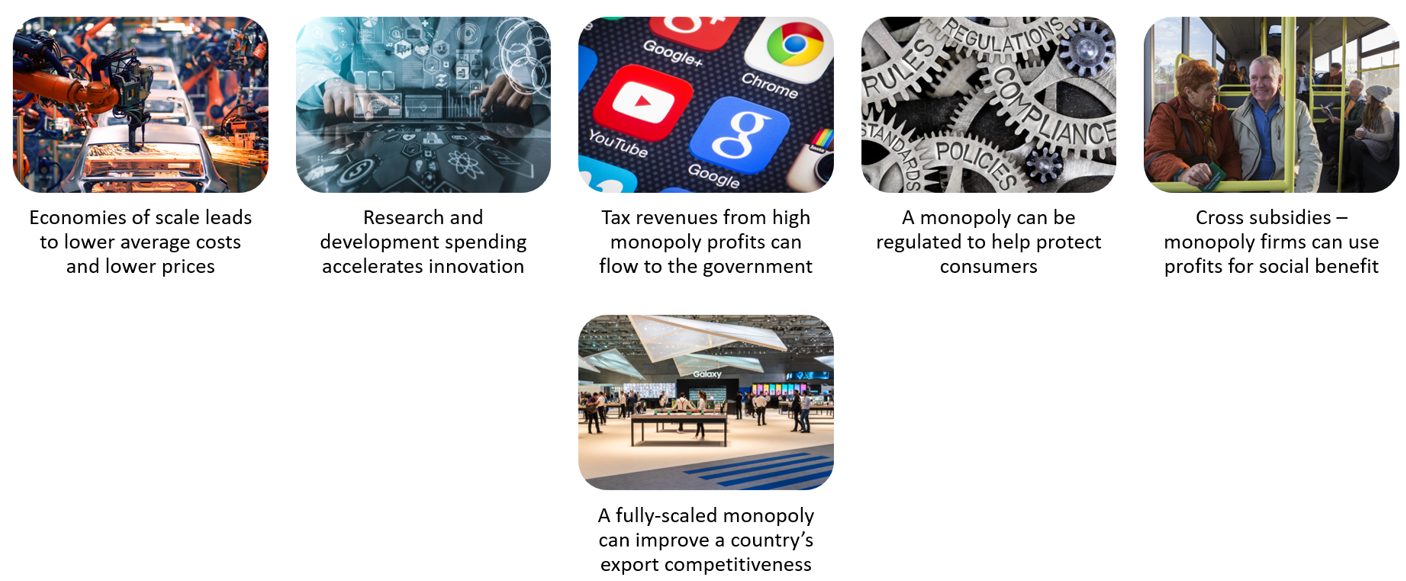

Potential advantages of monopoly power

price discrimination

Price discrimination happens when a firm charges a different price to different groups of consumers for an identical good or service, for reasons not associated with costs of supply.

Main aims of price discrimination