Intuit Academy Tax Level 1

1/99

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

100 Terms

Below the line deductions include

Standard deduction

Eligible educators can deduct up to _______ of qualified expenses paid during the tax year.

$250

Which of the following is an ineligible medical expense for HSA, Archer MSA, and MA MSA?

Breast enhancement

The net capital gain is taxed at _______ if the married filing jointly taxpayer income is less than $80,800.

0%

To claim a child as a dependent, they must meet the qualifying child test or ________________.

qualifying relative test

Ordinary dividends are taxed at the same rate as __________ income tax rate.

ordinary

Distributions from HSA, Archer MSA, or MS MSA are non-taxable when _________________________________________.

spent for qualified medical expenses of your dependent

Which residency status is used when an individual is neither a U.S. citizen nor a resident alien for tax purposes?

Non-resident alien

_____________ and ____________ are what taxpayers must know to calculate their tax amount.

Taxable income and filing status

For mortgages entered into after December 15, 2017, the amount of interest the taxpayer can deduct is no more than ______________ of the debt used to buy, build, or substantially improve their principal home and a second home.

750,000

__________ reduce the amount of tax due.

Tax credits

Which form is for beneficiaries who get income from trusts and estates?

Form 1041

___________________ consists of both earned and unearned income that is used to calculate the tax. It is generally less than adjusted gross income due to the deductions.

Taxable income

To satisfy the Substantial Presence Test, how many minimum days (in the current year) must you be physically present in the United States?

31

Complete the equation. ___________ = Selling Price - Purchase Price

Capital Loss or Capital Gain

_________________ helps sole proprietorships calculate the profit or loss from a business while also providing the IRS with your total business income and deductions.

Schedule C

What type of deduction is a HSA contribution?

Above-the-Line Deduction Some of the common expenses on which Above-the-Line deductions are available include:

Educator expenses

Early withdrawal penalties of saving accounts

Moving expenses

Business expenses

HSA contributions

Self-employment tax

Alimony payments

Tuition fees

Contributions to a traditional IRA

Student loan interest deduction

Health insurance premiums

Retirement account contribution

As it applies to compensation income, the general rule for sourcing wages and personal services income is controlled by ________________________________.

where the service is performed The general rule for sourcing wages and personal services income is controlled by where the service is performed. The residence of the recipient of the service, the place of contracting, and the time and place of payment are irrelevant.

Which is considered non-taxable income?

military personnel allowances Payments received as a member of military service are generally taxed as wages except for retirement pay, which is taxed as a pension. Allowances generally aren't taxed.

______________ is used to offset income and payroll taxes for low-income workers and to provide an incentive to work.

Earned Income Tax Credit Earned Income Tax Credit is used to offset income and payroll taxes for low-income workers and to provide an incentive to work.

Which is a non-deductible business expense?

family vacation Expenses done for personal and recreational purposes are personal expenses and are non-deductible.

What amount of upper cap is applicable on business gifts?

$25 The upper cap of $25 is applicable on business gifts.

If yearly dividend amounts exceed __________, a Schedule B must be completed and attached to Form 1040.

$1500 If yearly dividend amounts exceed $1500, a Schedule B must be completed and attached.

The are _________ filing statuses.

five There are five filing statuses.

Single

Married Filing Jointly

Married Filing Separately

Head of Household

Qualifying Widow(er)

Taxpayers can claim a Child Tax Credit of up to __________ for each child under age 17 in 2021(2022).

$3,600.00 Taxpayers can claim a CTC of up to $3,600 for each child under age 17 in 2021(2022). Since 2021, qualifying families may now receive up to $3,600 per child under the age of 5 and $3,000 for those ages 6 to 17. That's up from $2,000 per child, provided families fall under certain income thresholds (less than $150,000 for couples and $112,500 for single parents).

______________ includes supplemental income and loss.

Schedule E includes supplemental income and loss

Supplemental Income and Loss consists of:

Income or Loss from Rental Real Estate and Royalties

Income or Loss from Partnerships and S Corporations

Income or Loss from Estates and Trusts, and

Income or Loss from Real Estate Mortgage Investment Conduits (REMICs)

Payments and refundable credits are listed between what lines on Form 1040?

Lines 25 through 30 are payments and refundable credits.

A partnership files a tax return on ______________.

A partnership files a tax return on Form 1065.

Which of the following is not a requirement for S-Corporation election?

Being an international entity is not a requirement for S-Corporation election.

________________ generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

Which is not a nonrefundable tax credit? (Select all that apply)

Child and Dependent Care Credit Nonrefundable tax credits include:

Child Tax Credit/Credit for Other Dependents

Adoption Credit

Social Security benefits can be taxed to a maximum of ___________% based on the beneficiary's annual income.

Up to 85% of your Social Security income is taxed if you receive income from other sources and your combined income is more than a certain base amount.

Which factor does not limit QBI components of QBI deduction?

reported on Schedule C

Who cannot take the standard deduction? (select all that apply)

An individual filing as Married Filing Separately and the spouse itemizes An individual filing a return for a short tax year due to a change in the annual accounting period A nonresident or dual-status alien during the year

What type of payment is not considered miscellaneous?

employment wages Miscellaneous income can include payments in the form of rents received, royalties, medical and health care, crop insurance proceeds, refund or credits of state and local taxes, unemployment compensation, and prizes and awards,

What dividend comes from mutual funds and real estate investment trusts (REITs)?

capital gain Capital gain distributions come from mutual funds and real estate investment trusts (REITs).

Which is not considered a gambling winning?

games of chance Gambling winnings include, but are not limited to, money or prizes earned from:

Casino games

Slot machines

Keno

Poker tournaments

Lotteries

Sweepstakes

Raffles

Betting pools

Gameshows

Horse or dog races

Off-track betting

Bingo

Which is considered an adjustment to Gross Income?

Moving Expense Adjustments to gross income are divided into four categories: charitable items, employment-related items, compensation and benefits, and investment-related exclusions.

What does CFC stand for?

Controlled Foreign Corporation

The self-employed health insurance deduction is limited to the net self-employment profit shown on the return reduced by the deduction for ____________ of the self-employment tax.

one-half The self-employed health insurance deduction is limited to the net self-employment profit shown on the return reduced by the deduction for one-half of the self-employment tax.

What is on Line 2b of Form 1040?

Taxable Interest Line 2b includes taxable interest. This line consists of the taxable interest earned from savings accounts, personal loans, certificates of deposits, and annuity contracts. An interest-paying institution will send these amounts on a Form 1099-INT to the taxpayer. If interest income exceeds $1500, a Schedule B will need to be completed and attached.

Taxpayers must file Form 1116 to claim the foreign tax credit when the foreign tax paid is more than ____________ for Married Filing Jointly.

$600 If the foreign tax paid is more than $300 ($600 for Married Filing Jointly) or they do not meet the other conditions to make the election to claim the foreign tax credit without filing Form 1116, taxpayers must file Form 1116 to claim the foreign tax credit.

_______________ is used to set limits to various items such as retirement contributions, certain deductions, and credits.

Adjusted Gross Income (AGI) Adjusted Gross Income (AGI) is used to set limits to various items such as retirement contributions, certain deductions, and credits.

When using the standard mileage rate or actual expense to calculate business auto expenses, which expense is separately deductible?

toll charges Toll charges and parking fees are separately deductible irrespective of the fact whether you use standard mileage rate or actual expense.

What schedule splits partnership income so that every partner is taxed at an individual income tax rate instead of the corporate tax rate.

Schedule K-1 Schedule K-1 splits partnership income so that every partner is taxed at an individual income tax rate instead of the corporate tax rate.

There are ________ types of Social Security trust funds.

two There are two types of Social Security trust funds.

Rental income or compensation for the use of tangible property is sourced to the place where the rental property is ________________.

located Rental income or compensation for the use of tangible property is sourced to the place where the rental property is located.

Taxable interest is reported on ________________.

Form 1099-INT Taxable interest is reported on Form 1099-INT.

_______________ gains are gains on assets that you have held for one year or less.

Short-term Short-term gains are gains on assets that you have held for one year or less.

A taxpayer's filing status determines the rate at which their income is taxed.

True

Filing status is used to determine

Filing requirements Standard deduction Eligibility for certain credits Correct tax Each category has specific requirements the taxpayer must meet to claim that filing status, including what people live in the household and who contributes financially.

What are the five filing status types?

Single Head of Household Married filing jointly Married filing separately Qualifying widow(er)

Single

Have never been married Divorced or legally separated Widowed before 01/01 of that year and no qualifying children Do not qualify for any other filing status (head of household)

Head of Household

Provided more than half the cost of keeping up the home Is a qualifying person Live with you

Qualifying Widow(er)

If your spouse passed away during the prior two tax years and you have not remarried and you have a qualifying dependent

Married Filing Separately

If a person's spouse files separately, both spouses have to file separately

Residency Status

Refers to a foreign national's legal status in a country where they are not citizen. In the United States, a lawful permanent resident (LPR) or Green Card holder refers to the immigration status of a foreign national who is authorized to live and work in the U.S. permanently.

What are the three different residency statuses for non-US Citizens?

Resident Aliens

Non-resident Aliens

Dual Status Aliens

Resident Alien

A person is not a U.S Citizen, they will file as a Resident Alien if they meet the Green Card test or the Substantial Presence test for the year.

Non-Resident Alien

A person is not a U.S. Citizen or a resident alien.

Dual-Status Alien

A person whose status changes during the year from resident alien to non-resident alien or vice versa.

What are the two test to determine if a non- US citizen will file taxes as a resident alien?

The green card test The substantial presence test

Dependent

Someone the taxpayer supports by providing at least half of the person's total support for the year.

Qualifying Dependents

Dependents may also be a qualifying, non-child relative. 1. Do you have a qualifying child? 2. Is your qualifying child your dependent? 3. Does your qualifying child qualify you for the child tax credit or credit for other dependents? 4. Is your qualifying relative your dependent? 5. Does your qualifying relative qualify you for the credit for other dependents?

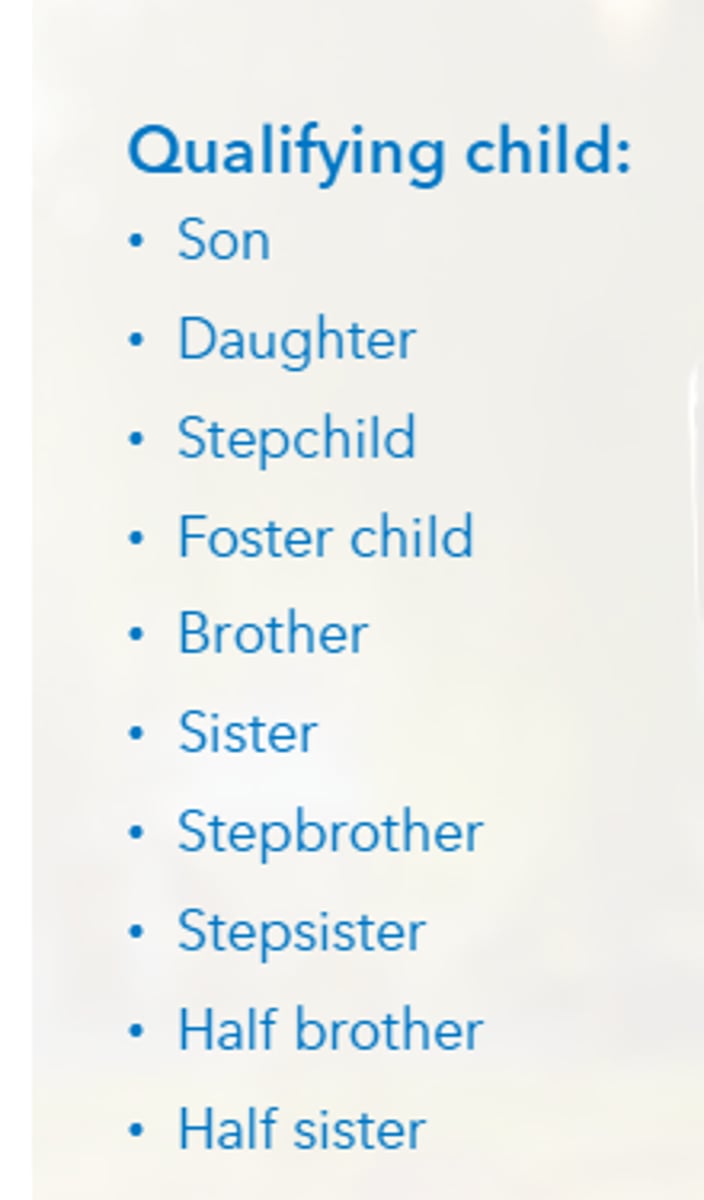

Qualifying Child

Lives with you half of the year Under the age of 19 Under the age of 24 and a full time student Disabled at any age Didn't provide over half of his or her own support for the tax year Is not filing a joint return for the tax year Is filing a joint return for the tax year only to claim a refund of withheld income tax or estimated tax paid. does not have to be your biological child but must have lived with the taxpayer for more than half of the year, meet specific age requirements, and be someone that didn't provide more than half of their support for the year.

Every US citizen is required to file a tax return.

False

Mia's niece and nephew live full-time with Mia, and her wife Judy. Mia and Judy provide full financial support for their niece and nephew.

Can Mia and Judy claim their niece and nephew as dependents?

Yes, Mia and Judy can claim them as dependents.

Daniela is a divorced, single parent who has full custody of her twelve-year-old daughter. She receives alimony payments of $1400 per month. Daniela also takes care of her 68 year old father who lives in a residential care home.

Which of the below are Daniela's qualifying dependent's?

Her daughter and father

Daniela's father receives social security as his source of income.

Does Daniela's father need to file a tax return?

No, Daniella's father doesn't need to file a tax return.

Walter is married and lives with his spouse and 3 children.

Can Walter file as a head of household?

No, Walter cannot claim head of household because he's married and lives with his spouse and 3 children.

Dan lost his spouse, Pat, to a terminal illness last year. Dan and Pat have a ten year old daughter that is their dependent. Dan was qualified to file a married filing jointly return last year.

Is Dan a qualified widower?

Yes, Dan is a qualified widower.

Henry is a divorced, single parent who has full custody of his seven-year-old son. He receives alimony payments of $1500 per month.

Based on the information above, what is Henry's filing status?

Head of Household

Sandi and Mary live together but are not married. Sandi is 67 and Mary is 68. Sandi's gross income is $28,400. Mary's gross income is $31,200.

Does Mary need to file a tax return?

Yes, Mary's gross income is more than the threshold required to file.

Sandi's daughter, Christina, is a U.S. citizen living and working outside of the US. Her annual income is $75,000.

Based on the information above, which option is correct?

Christina needs to file a US tax return.

Vihaan is an Indian citizen. He came to the US to pursue a degree in veterinary medicine. He will be in the US for three years and intends to return home to India during breaks and once he's completed his degree.

Based on the information above, what is Vihaan's filing status?

Vihaan meets the substantial presence test, and needs to file as a Resident Alien.

A taxpayer's source of income is not important for the foreign tax credit (FTC) to offset U.S. taxes on foreign source income.

False

6 Types of Income Sources

Interest Dividend Compensation Rent And Royalty Sales of Property, Pension and Retirement Plans Miscellaneous - Flow Through Information Fringe Benefits

A dividend from a foreign corporation may be U.S. source income?

True

Which of the below are considered types of income?

Interest income

Dividend income

Sales of property

Compensation

Income that is nontaxable should be be shown on the taxpayer's tax return.

True

Business and investment income provides information on the treatment of certain income from:

Rent

Royalties

Partnership income

A foreign corporation doing business in the U.S. receives interest income from Shruthi, a U.S. citizen and resident.Based on the information above, which of the following is true about the interest income?

The interest income is a U.S. source of income.

Melissa, a U.S. citizen, received dividends from an Italian corporation with no U.S. ECI.

Based on the information above, which of the following is true about the dividend income?

The dividend income is a foreign sourced income.

Levi, a citizen and resident of the Netherlands, was contracted with a U.S. corporation to develop a new product. In developing this product, Levi worked in the U.S. for nine weeks. The entire project took twenty-one weeks. He was paid $265,000.

Which of the following is true about the compensation Levi received?

The compensations Levi received requires allocation.

A partnership has 65% foreign source ordinary income.

Which of the following is true about the percentage of distribution?

65 % of the distribution would be foreign sourced income.

Tom and Gerry are U.S. citizens and form a U.S. based partnership with equal participation. The partnership sold a piece of U.S. based property for a gain of $30,000. Tom lives in the U.S. and Gerry lives in Germany.

Based on the information above, which of the following is true about their income?

Tom would have $15,000 U.S. source income.

Incorrectly selected

Gerry would have $15,000 U.S. source income

Correctly unselected

All of the above are correct.

Meghan owns a daycare center she runs from her home. She also babysits for her brother on Saturdays. Her brother reimburses her expenses instead of paying her an hourly rate.

Based on the information above, which of the following is true?

The expense reimbursement her brother provides is not taxable income.

Mark is a member of our armed forces. He receives combat pay for his duties.

Based on the information above, which of the following is true?

The amount of Mark's combat pay is not taxable.

Which of the following is true about Judy's income?

Judy doesn't have to include the housing allowance in her income.

Veronica's business partner gifted a watch to Veronica's wife as a fringe benefit.

Based on the information above, which of the following is true?

The watch is taxable because it is considered to have been gifted to Veronica.

Veronica's business partner agrees to pay 25% of Veronica's income directly to her spouse. Does Veronica need to report the 25% paid to her spouse as income?

Veronica must include the 25% paid to her spouse as income and it is taxable.

Judy is a member of the clergy. She received a housing allowance.

Which of the following is true about Judy's income?

Judy doesn't have to include the housing allowance in her income.

Employers prepare Form W-2 at the end of each year.Which employees must receive a Form W-2?

Every employee that receives payment for services from the employer during the year.

Parts of Form W-2

1. Taxable Income 2. Federal Tax Amount 3. Amount of Compensation subject to Social Security tax

4.Social Security Tax Withheld 5.Reports compensation subject to Medicare 6. Amount of Medicare tax withheld.

7. All reported earnings from tips.

8. What employer reports were earned as tips for the employee. 10. Reports the total dependent care benefits paid or incurred by the employer on behalf of an employee.

11. Deferred compensation received from the employer in a non qualified plan 12. Uses codes to list other compensation or reductions applicable on your taxable income.

16.-20. shows the employee's state and local earnings and withholding detail. This includes the state and local taxes that are deductible (if a taxpayer itemizes on their federal tax return.)

W-2

The IRS requires employers to report employee wage and salary information on Form W-2. Employees will generally receive Form W-2 from every employer they work for during the year. The employee's Form W-2 reports the total taxable wages, social security and Medicare wages, withholdings, and additional income information for the calendar year.

Form W-2 is required for every employee who receives payment for services during the year (including non-cash payments).

If an employee earns wages, they will receive a Form W-2.

If an employee earns wages and any tax is withheld, they will receive a Form W2.

Boxes 16-20 on the W-2 show the details of earnings that are:

reported state and local earnings and taxes withheld

Which box on the W-2 uses codes that represent other compensations or reductions applicable on an individual's taxable income.

Box 12

Which W-2 box reports the amount of income subject to Social Security tax?

Box 3 Social Security Wages

In 2022, there were 7 different income tax brackets.

True. That's right! There were 7 different income tax brackets ranging from $0 - $539,900+ taxable income.

Federal tax credits

While deductions can reduce the amount of income before calculating the taxpayer's tax, tax credits can reduce the actual amount of tax they owe. Taxpayers can even claim certain credits to get a refund if they don't owe any tax. Two types of credits: Refundable

A refundable credit is more advantageous. You get payment for them even if you don’t have any tax.

Examples include:

Earned Income Tax Credit

American Opportunity Tax Credit

Additional Child Tax Credit

Nonrefundable

A nonrefundable credit can’t exceed the taxpayer’s federal income tax. In other words, your savings cannot exceed the amount of tax you owe.

Examples include:

Child and Dependent Care Credit

Foreign Tax Credit Adoption Credit