2.1.1 Macroeconomics objectives

1/40

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

41 Terms

Economic growth

Economic growth is the increase in real and/or potential GDP (output) in an economy in a given period of time

GDP

GDP (Gross Domestic Product) is a measure of economic growth.

GDP is the value of production of goods and services in an economy in a given period of time (normally a year).

Nominal and Real GDP

Real – takes into account inflation

Nominal –Not adjusted to take into account inflation

Limitations of using GDP to measure economic growth

GDP overestimates well-being – e.g. it does not take into account the environmental damage of production

GDP underestimates well-being - e.g. natural resources are not included

GDP lacks information – e.g. numbers do not indicate the type of production

GDP does not take into account the quality of production (in particular technological goods)

GDP does not include unofficial or unpaid work.

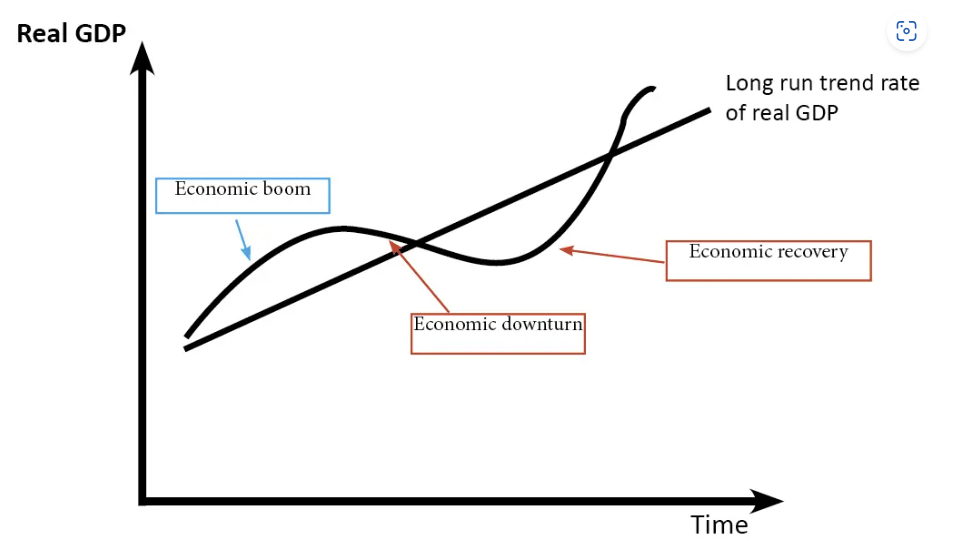

The economic cycle

The Economic cycle shows how the economy tends to exhibit recurring trends in economic growth rates.

Draw a graph of the economic cycle

What two main things occur ina n economic boom period

High rates of growth, low rates of unemployment

What is a recession

a period of two or more consecutive quarters of negative economic growth

Characteristics of a recession

Negative rates of economic growth, high rates of unemployment

Benefits of economic growth (6)

Increased revenues and profits for firms.

Increased employment opportunities.

A decrease in absolute poverty rates

Improvement in the environment as more efficient, cleaner technology is developed

Education standards increase

Health improves

Potential costs of economic growth (4)

A negative impact on the environment as non-renewable resources are used up

Increased inflationary pressure

An increase in relative poverty/income inequality

The social effects of increased production – more stress, less leisure time.

Inflation

A general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI)

Deflation

A fall in the average price level in an economy in a given period of time.

Disinflation

A fall in the rate of inflation (prices increasing but at a slower rate)

Consumer price index (CPI)

measures the change in prices over a year.

Types of inflation (2)

Demand-pull inflation

Cost-push inflation

Demand pull inflation

An increase in demand with no increase in supply will increase the price level. This is because there is less spare capacity in the economy.

Cost-push inflation

An increase in costs of production can increase the price level in an economy. E.g. an increase in wages, import prices or taxes. Firms will pass increased costs onto consumers.

Costs of high inflation (7)

Lack of purchasing power

Growth and unemployment

International Competitiveness

Wages increase

Redistribution costs

Psychological costs

Uncertainty

Benefits of low inflation (3)

The real value of borrowing is decreased over time

An inflation target can help policy makers make decisions

Stable and low inflation boosts business and consumer confidence

Employment and unemployment

Employment – those in paid word

Unemployment – when individuals are without a job but actively seeking work

Unemployment rate

Number unemployed divided by the population of working age.

Types of unemployment (5)

Frictional unemployment

Seasonal unemployment

Structural unemployment

Cyclical or demand-deficient unemployment

Voluntary unemployment

Frictional unemployment

Short-term unemployment. People who are in-between jobs or those who have just finished studying.

Seasonal unemployment

Occurs when people are unemployed at certain times of the year, because they work in industries where they are not needed all year round. E.g. tourism.

Structural unemployment

Unemployment resulting from industrial re-organization, typically due to technological change, rather than fluctuations in supply or demand. This often happens because there is occupational and geographical immobility of labour. Structural unemployment is likely to have a more long-term detrimental effect than others such as frictional and seasonal.

Cyclical or demand-deficient unemployment

Unemployment resulting from there being insufficient demand in an economy. This tends to vary with an economic cycle.

Voluntary unemployment

when a person chooses not to work

Consequences of unemployment

Loss of income

Use of scarce resources

Poverty

Government spending on benefits

Loss of national output

Loss of tax revenue

Social costs

Consumer confidence

Business confidence

Social costs

Refer to notes for more in-depth explanation

A countries current account equation

value of exports – value of imports

Current account deficit

the value of imports is greater than the value of exports. This means money is flowing out of the country. The current balance will be negative.

Current account surplus

the value of exports is greater than the value of imports. This means money is flowing into the country. The current balance is positive.

Impact of a current account deficit (3)

Leakage from the economy

Can be inflationary if prices rise abroad: Low demand for our exports

Problems finding foreign reserves to fund the deficit

Refer to notes for more in-depth explanation

Business activity that damages the environment (4)

Mining

Power generation

Agriculture

Construction

Refer to notes for more in-depth explanation

Ways businesses damage the environment

Visual pollution (including litter)

Noise pollution

Air pollution

Water pollution

Refer to notes for more in-depth explanation

Government intervention to protect the environment (5)

Taxation

Subsidy

Regulation

Fines

Pollution permits

Refer to notes for more in-depth explanation

Income inequality

differences in income that exist between the different groups of earners in society, that is, the gap between the rich and the poor

Absolute poverty

Where people do not have enough resources to meet all of their basic human needs.

Relative poverty

poverty that is defined relative to existing living standards for the average individual. There is no precise measurement of relative poverty

Reasons to reduce poverty and inequality

Meet basic needs

Raise standards of living

Ethical reasons – some people feel the need to act morally correct and give to charity to help end poverty.

Government intervention to reduce inequality and poverty (3)

Progressive taxation

Redistribution through benefit payments

Investment in education and healthcare

Refer to notes for more in-depth explanation