FRINGE BENEFITS

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

It means any good, service or other benefit furnished or granted in cash or in kind by an employer to an individual employee (except rank and file employees)

Fringe Benefit

Nature of Fringe Benefits Tax

Final Tax

Imposed upon the fringe benefits of managerial or supervisory employee

Withheld at source; hence, paid by employers

Grossed-up tax

Quarterly tax

Procedures in Determining the FBT

Determine the Monetary Value (amount na natanggap ni employee)

a. Paid in Cash - [(Cash Paid, full), except (residential rental x 50%)]

b. Paid in Kind - transfer of title (FV or BV whichever is higher)

c. Furnished - transfer of use (Rental Value x 50%) or (Depreciation Valie x 50%)

Personal (movable) Property = 5 years (20%)

Real (immovable) Property = 20 years (5%)

Gross-up the Monetary Value

Type of employee

Gross-up Rate

Tax Rate

Resident or citizen

65%

35%

NRA-NETB

75%

25%

Compute for the FBT

The employer allow the use of one of his vacant houses to the employee. At that time, the value of the house and lot are the following:

FV | CA | |

House | 5M | 3M |

Lot | 3M | 2M |

Compute for the quarterly fringe benefit tax if the employee is a RC.

House Lot Total Divided by: Presumptive Useful Life Depreciation Expense Divided by: Quarters Depreciation Expense per Quarter x Total Monetary Amount Gross-up: x FBT FBT | 3M 2M 5M 20 years 250K 4 62.5K 50% 31,250 65% 35% 16,827 |

(3M + 2M) ÷ 20 ÷ 4 × 50% ÷ 65% x 35% = 16,827

Walang pakealam kung hindi depreciable ang land

Exempt Fringe Benefits

Mandatory Fringe Benefits (SSS, PhilHealth, HDMF) (Retirement and Hospitalization Plans) (Military Housing) (Group Insurance)

De Minimis Benefits (Regulatory Limit)

Fringe Benefits or rank and file employees (pupunta sa 13th Month and Other Benefits)

Those provided under convenience of the employer rule

Those that are necessary to the trade or business of the employer

Taxable Fringe Benefits to Rank and File Employees

Meals furnished or subsidized by employer (except OT meal which is subject to de minimis benefit)

Rental value of quarters furnished an employee

Premium of life insurance of an employee where the insured employee is directly or indirectly the beneficiary - in essence a form of additional income for the employee

Fixed or variable transportation, representation and other allowance given to employee. Advance or reimbursement-type allowance is exempt

Performance bonus, relay station allowance, and danger exposure allowance

Personnel Economic Relief Allowance (PERA) granted to government employees

Salaries and allowances during leaves of absence (vacation and sick leave)

Fees received by an employee (including director’s fees) for the performance of a service for the employer

Dismissal payments (different with separation pay)

Exempt Fringe Benefits to Rank and File Employees

Meals, living quarters, de minimis entertainment, medical services, courtesy discounts on purchases, sack or rice, etc. given for the convenience of the employer or promoting the contentment, health, efficiency or goodwill of the employee.

Reimbursement-type traveling, representation and other allowance. Excess advances retainable by the employee is taxable

Retirement and separation benefits exempt under the law

Fringe Benefits Given to Managerial or Supervisory Employees

Housing Benefits

Interest on loans at less than market rate or at 0% rate

Membership fees, dues, and other expenses borne by the employer

Expenses for foreign business travel

Household personnel

Expense Account

Holiday and vacation expense

Life and Health insurance and other non-life insurance premium or similar amounts in excess of what the law allows

Vehicle of any kind

Educational assistance granted by employer

Exemption to Housing Benefits

Housing benefits provided to military officials of the AFP

Housing unit which is within or adjacent to the premises of a business or factory. Adjacent means within 50 meters of the perimeter of the business premises of the employer

Temporary housing for an employee who stays in a housing unit for 3 months or less

What amount is subject to Fringe Benefits Tax for the interest on loans at less than market rate or at 0% rate?

The differential interest form 12% (as fixed by regulation)

Membership fees, dues, and other expenses borne by the employer for the employee in social and athletic clubs or other similar organizations are taxable benefits of the employee in full (T/F)

True

How does Fringe Benefits of Expense for Foreign Business Travel will be accounted?

First class airplane ticket - 30% of the cost of the ticket

Lodging cost in hotel or similar establishment in excess of $300 per day

Traveling expense paid by the employer for the travel of the family members of the employee

In connection with this, there must be a documentary evidence to support that the foreign travel was for business meetings or convention; otherwise the entire cost of the ticket including hotel accommodation and other expenses incidental thereto will be shouldered by the employer shall be treated as taxable fringe benefits

Documentary Evidence to support the foreign travel

Business Meetings

Business Conventions

Business Meetings - official communication from business associates abroad indicating the purpose of the meeting

Business Conventions - invitations or communications from the host organization or entity abroad

Inland travel expenses such as for food, beverages and local transportation, cost of economy and business class airplane ticket are exempt to fringe benefit tax (T/F)

True

Household Personnel subject to Fringe Benefits Tax

If shouldered by the employer the following personal expenses shall be taxable fringe benefit:

a. Salaries of household help

b. Personal driver of the employee (if not for the convenience of the employer such as doctor on call)

c. Similar expenses as payment for homeowners’ association duties, garbage dues, etc.

Expense Account

GR:

XPNs:

GR: expenses of the employees that are paid for the employer are taxable fringe benefit:

a. expenses of reimbursement type (direct payment by the employer is not necessary since subsequent reimbursement for the expense of the employee, makes him the indirect payer of the expense)

b. personal expenses (groceries etc) even if receipted in the name of the employer.

Exception:

a. Regular fixed entertainment and representation allowance - this is treated as additional compensation to the employee

b. Expenses connected with the trade of the employer and is duly receipted in the name of the employer (expenses of the employer)

Exemption to the Fringe Benefits Tax of Vehicle

a. Aircraft or helicopter owned and maintained by the employer - treated as for business purpose only and hence, not subject to FBT (Impractical to provide managerial or supervisory personnel with aircraft or helicopter for personal use due to the cost of maintaining them)

b. Yacht whether owned or leased by the employer is considered not for business purpose (by nature for pleasure), and hence subject to FBT

Educational assistance granted by employer to

The Employee

The dependents of employees

The Employee - generally, taxable as a Fringe Benefits

Exception:

a. the education or study involved is directly connected with the employer’s trade, business or profession; and

b. there is written contract that the employee is under an obligation to remain in the employ of the employer for a period of time mutually agreed upon

The dependents of employees - generally, taxable as a Fringe Benefit

Exception: When the assistance is granted through competitive scheme under a scholarship program of the company

Tax Rates for Fringe Benefits:

Type of employee | Gross-up Rate | Tax Rate |

Resident or citizen | 65% | 35% |

NRA-NETB | 75% | 25% |

Valuation of Taxable Fringe Benefits:

If granted in money or is directly paid by the employer, the value is the amount of granted or paid for

If furnished by the taxpayer in property and ownership is transferred to the employee, the value of the fringe benefit shall be at the fair market value of the property transferred

If furnished by the taxpayer in property without transfer of ownership, the value of the fringe benefit is equal to the depreciation value of the property.

For this purpose, personal property is assumed a depreciable life of 5 years (20%) while real property shall have a presumptive life of 20 years (5%)

Furthermore, since the supervisory or managerial employee cannot reasonably be expected to use the property all the time, it is assumed that usage is 50% for business use and 50% for personal use.

Deductible Amount of Fringe Benefits:

GR:

Exception Rule:

GR: Deductible Amount = Taxable Fringe Benefits + Fringe Benefit Tax

Exception Rule: Deductible Amount = Fringe Benefit Tax Paid (If Fringe Benefit Tax is based on the depreciation value, zonal value, or assessment fair value)

Filling of Return

The Fringe Benefit Tax withheld by the employer shall be remitted to BIR within 10 days after the end of each calendar quarter, however, for EFPS, 5 days later

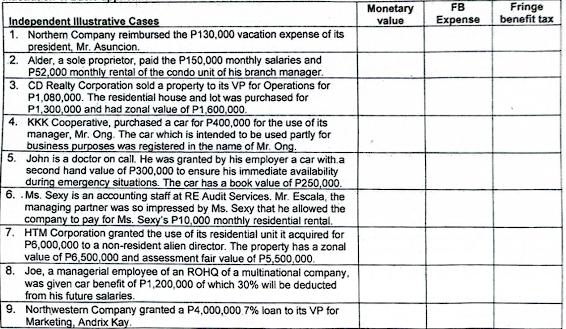

Monetary Value | Fringe Benefit Expense | Fringe Benefit Tax |

130K | 130K FBE 130K CASH 130K | 70K FBT 70K FBT Payable 70K |

26K (52 × 50%) | 52K | 14K |

520K | 220K CASH 1.08M FBE 220K H&L 1.3M | 280K |

400K | 400K FBE 400K Car 400K | 215,385 |

300K | 250K | 0 - Necessity of employer |

10K | 10K | 0 - Rank and File |

81,250 (6.5M / 20 / 4) | 0 | 27,083 |

840K (1.2M x 70%) | 840K Advances to Off 360K FBE 840K Cash 1.2M | 452,308 |

50 (4M x 5%) / 4 | 0 |

If ask for the total deductible fringe benefit expense = FBE + FBT

ABC Company paid its employees P5M fringe benefits out of which it paid P560K fringe benefit tax

Required: Determine the following

Total fringe benefit expense

Fringe benefits paid to rank and file employees

Fringe benefits paid to managerial and supervisory employees

M/S | R&F | Total | |

FBE (MV) | 1,040K | 3,960K | 5,000K |

FBT | 560K | 0 | 560K |

TOTAL | 1,600K | 3,960K | 5,560K |

5,560K

3,960K

1,040K

Mond, Inc. has a production facility that is very far from town. To minimize tardiness affecting its operations, it decided to construct housing units within the compound of the facility for employees who wants to relocate. It also agreed to pay half of the household rentals of employees who do not want to relocate. The following data relates to the quarter of grant:

Company Officers | Rank and File Employees | |

Value of housing unit | 1,200,000 | 2,000,000 |

Rental payments | 812,500 | 400,000 |

Compute the Fringe Benefits Tax

Housing within the vicinity is exempted since it is for the convenience of the business

Rental = 812,500 × 50% / 65% x 35% = 218,750

DEL Industries paid or furnished the following benefits during the quarter:

Salaries and wages | 750,000 |

Rice allowance in excess of regulatory thresholds | 60,000 |

Rental on the residence of the CEO | 120,000 |

Life insurance premium on the DEL's CEO | 40,000 |

Contribution to SSS, PhilHealth or HDMF* | 80,000 |

Groceries purchased as supplies for a field sales office | 45,000 |

DEL Industries is the beneficiary on the life insurance of its CEO. The SSS, Philhealth and HDMF contributions wereP35,000 in excess of their mandatory amounts.

Required: Compute the fringe benefit tax and the total deductible fringe benefits expense

Salaries and wages | 750,000 | X - compensation income |

Rice allowance in excess of regulatory thresholds | 60,000 | X - R&F (OB - compensation income) |

Rental on the residence of the CEO | 120,000 | (120 × 50%) / 65% x 35% = 32,308 + 120K = 152,308 |

Life insurance premium on the DEL's CEO | 40,000 | X - business expense, since DEL is the beneficiary |

Contribution to SSS, PhilHealth or HDMF* | 80,000 | X - not identified kung M/S or R&F; GR - R&F (OB) |

Groceries purchased as supplies for a field sales office | 45,000 | X - Business Expense |

In August 2020, Naga Company purchased a car for P1,500,000 to be issued to its managerial employee.

Required: Compute the FBT for the third calendar quarter if:

The car was intended for business and personal use of the employee

The car is intended for official use only

The car is allowed to be used for personal use of the employee but he will pay P5,000/month to Naga Company

Ownership of the car is given to the employee who is a travelling sales manager

1.5M / 5 years / 12months x 50% = 12,500 per month x 2 months = 25K / 65% x 35% = 13,462

Exempt - business expense

12,500 - 5,000 / 65% x 35% = 8,077

Exempt

In 2018, ABC Corporation paid for the annual rental of a residential house used by its general manager amounting to P136,000. The entry to record the benefit

FBE 136,000

FBT (136K x 50% / 65% x 35%) 36,615

Cash 172,615