3.5 Monetary Policy

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

34 Terms

Monetary Policy

Changes made to the interest rate, money supply and exchange rate by the Central Bank to influence aggregate demand

Money supply

The entire quantity of money circulating in an economy including notes, coins, loans and savings

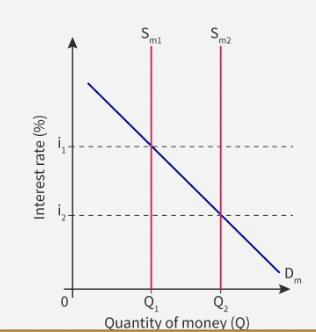

Money supply diagram

Supply for money is fixed

Sm is perfectly inelastic

Monetary policy goals

Low unemployment

Reduce business cycle fluctuations

Promote a stable economic environment

External balance (exports = imports)

Low and stable rate of inflation - target is usually 2% for developed countries, developing countries usually have it a bit higher

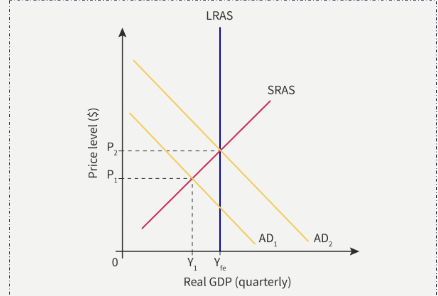

Expansionary monetary policy

An increase in money supply or decrease in interest rates to stimulate aggregate demand

The aim is usually to reduce unemployment, encourage investment and consumption and close a deflationary / recessionary gap

Contractionary monetary policy

A decrease in the money supply or a rise in interest rates to reduce aggregate demand

The aim is usually to lower inflationary pressures, discourage excessive borrowing and spending and close an inflationary gap

Role of central bank

Determines the money supply and interest rate

Prints physical money and mints coins

Lender of ‘last resort’

Issues bonds and other financial instruments (open market operations)

Regulates the banking system

Factors the central bank must consider

State of the economy

Rate of growth of nominal wages

Business confidence levels

House prices

Exchange rate

Mint coins

Produce new coins officially, usually by a government’s mint (the authority responsible for making currency). Also, when new coins like Bitcoin are created and added to circulation, this process is called minting (also sometimes mining)

Lender of ‘last resort’

The central bank providing emergency liquidty (loans) to commercial banks or financial institutions when no one else is willing to lend them

Bonds

A financial asset representing a loan made by an investor (the bondholder) to a borrower (often government)

Basically, a bond = an IOU with interest

Monetary policy tools

Open market operations

Minimum reserve requirements

Changes in the central bank minimum lending rate (base rate)

Quantitative Easing

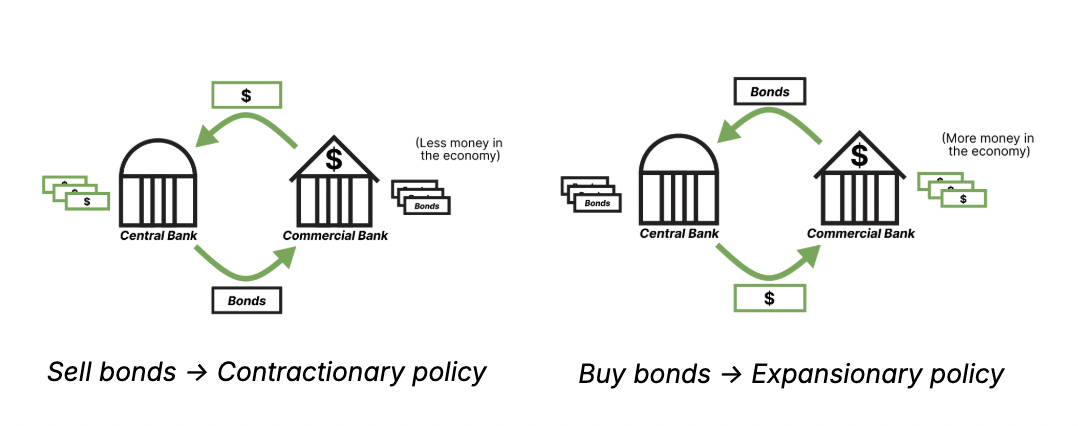

Open market operations (OMOs)

The buying and selling of government bonds by the central bank

If the central bank sells bonds, it gets money while the buyer gets a bond

The central bank can lock this money up and this reduces money supply in the economy thereby increasing interest rates and reducing inflation

If the central bank buys bonds, it gets bonds while the buyer gets money

This increases the money supply in the economy thereby decreasing interest rates and encouraging economic growth

Open market operations diagram

Minimum reserve requirements

Banks want to lend out as much money as possible as they make more off of interest

More money lent out = more money invested and consumed

If the central bank sets a minimum reserve requirement, banks are obliged to keep a certain amount of customer deposits safe (not lending them out)

This decreases the amount of money lent out, indirectly decreasing investment and consumption

Changes in the central bank minimum lending rate (base rate)

Central banks sometimes lend money out to commercial banks when they need it

If they increase this interest rate, commercial banks have a higher cost of

borrowing moneyCommercial banks will offset this by raising their interest rates, making borrowing more expensive for households and firms

This decreases consumption and investment

Quantitative Easing

Sometimes the central bank base interest rate is so low it can’t go lower but that doesn’t mean the economy won’t be in need of expansion

Quantitative easing refers to the buying and selling of bonds but on a larger scale and more long-term than OMOs

Same principle as OMOs but the purchases are larger and typically involve riskier bonds

E.g corporate bonds instead of government bonds

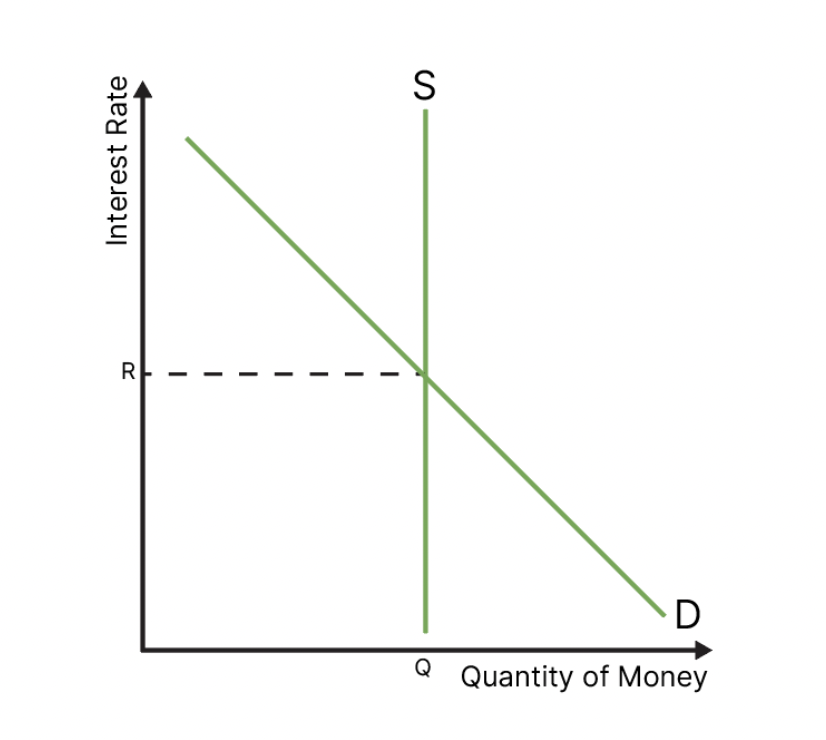

Interest rates

The cost of borrowing or the reward for saving money

Lower interest rates stimulate consumption and investment to boost AD

Bailout

Rescue from outside using public money (usually government / taxpayers)

E.g used in 2008 global financial crisis

Bail-in

Rescue from inside by forcing the bank’s own stakeholders to absorb losses

E.g. used in Cyprus in 2013 for bank recovery and resolution directive framework

Real interest rate

The interest rate with inflation taken into account

It indicates the true cost of borrowing money

Nominal interest rate

The interest rate quoted by commercial banks

If you borrow $100 at a 9% interest rate you will pay 9% in interest

But, the nominal interest rate is not adjusted for inflation

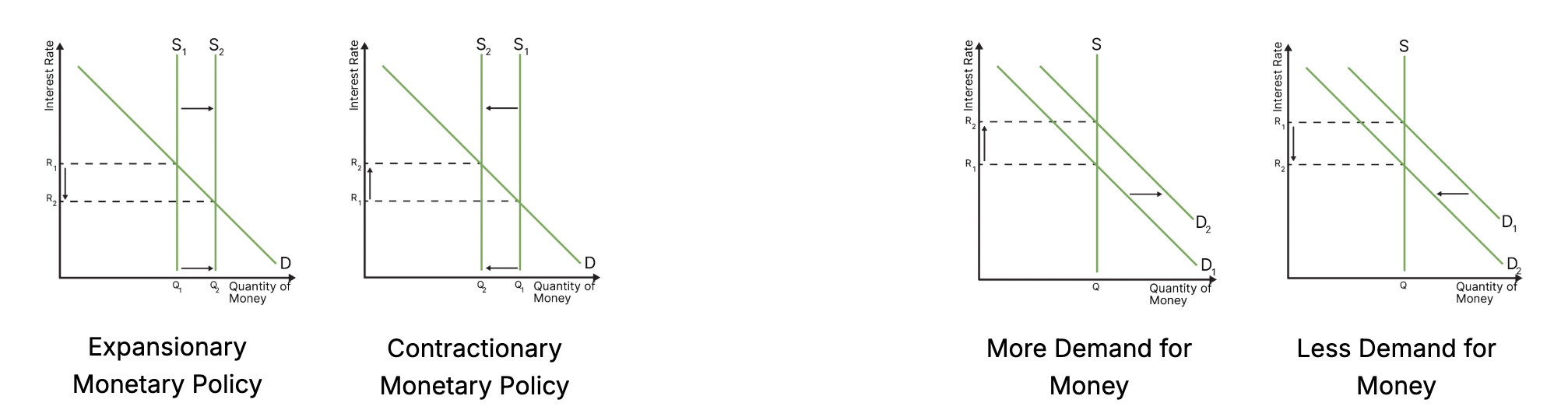

Equilibrium interest rate diagram

Expansionary MP - supply shifts right

Contractionary MP - supply shifts left

Interest rate diagrams

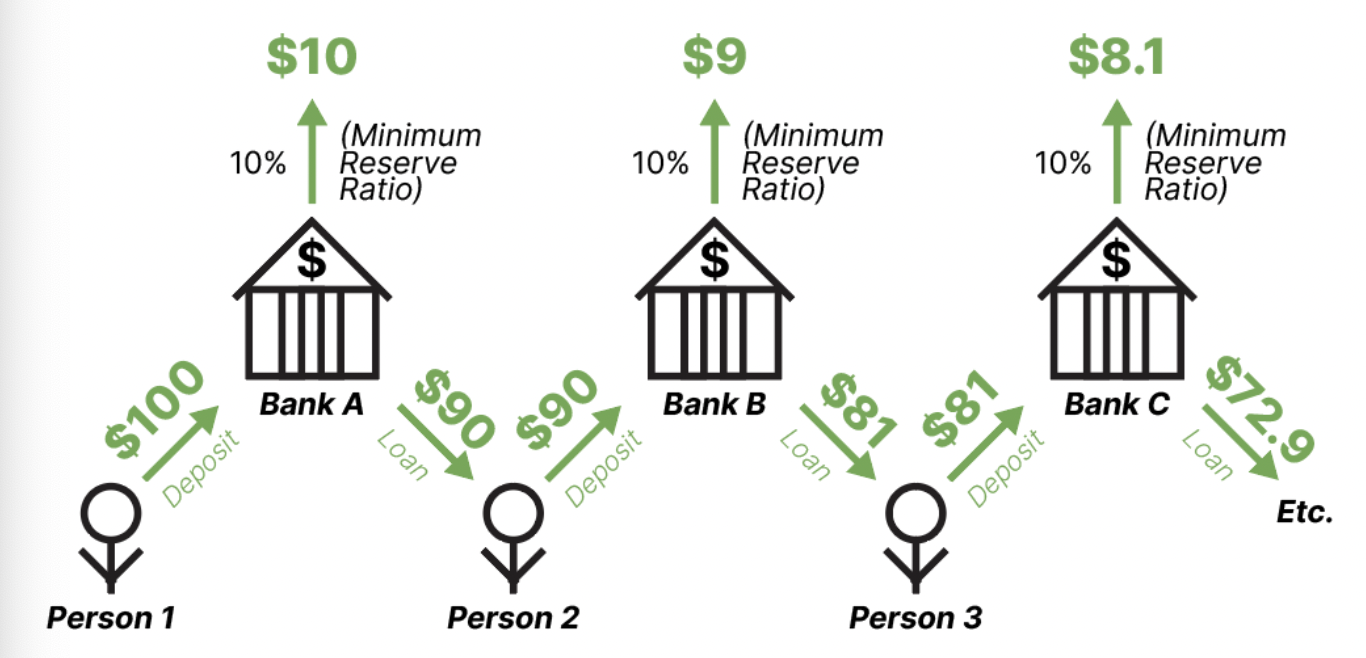

Money creation by commercial banks

Person 1 deposits $100 into bank Z

The bank is obliged to keep at least 10% of this deposit safe somewhere and is able to lend out the rest

$90 is lent out to person 2 who then needs a place to keep that money

Person 2 therefore deposits this loan into bank S

Bank S, like any other bank, must keep 10% of its deposits safe so it can lend out $81 to person 3

Person 3 now has $81 and can put that into bank Y who does the same thing as bank Z and bank S

The cycle repeats

Money multiplier formula

1 / Reserve Ratio

Example

1 / 0.1 = 10 = money multiplier

for every $100 deposited, the economy actually has 10×100 = 1000

Meaning an additional $900 is made by commercial banks from just a $100 deposit

Low MMR = more money creation = more money = cheaper borrowing = cheaper investing = higher real GDP

Role of expansionary MP

Decrease minimum reserve ration so commercial banks can lend out more

Decrease the central bank interest rate so commercial banks can take out cheaper loans so consumers and firms hopefully also get cheaper loans - this is not that effective for expansionary policy as banks will often simply retain their loans' interest rates to increase profit margins

Buy government bonds (so there is more money in the economy)

Buy corporate bonds (quantitative easing, so there is more money in the economy)

Role of contractionary MP

Increase minimum reserve ratio

Increase central bank interest rate

Sell government bonds

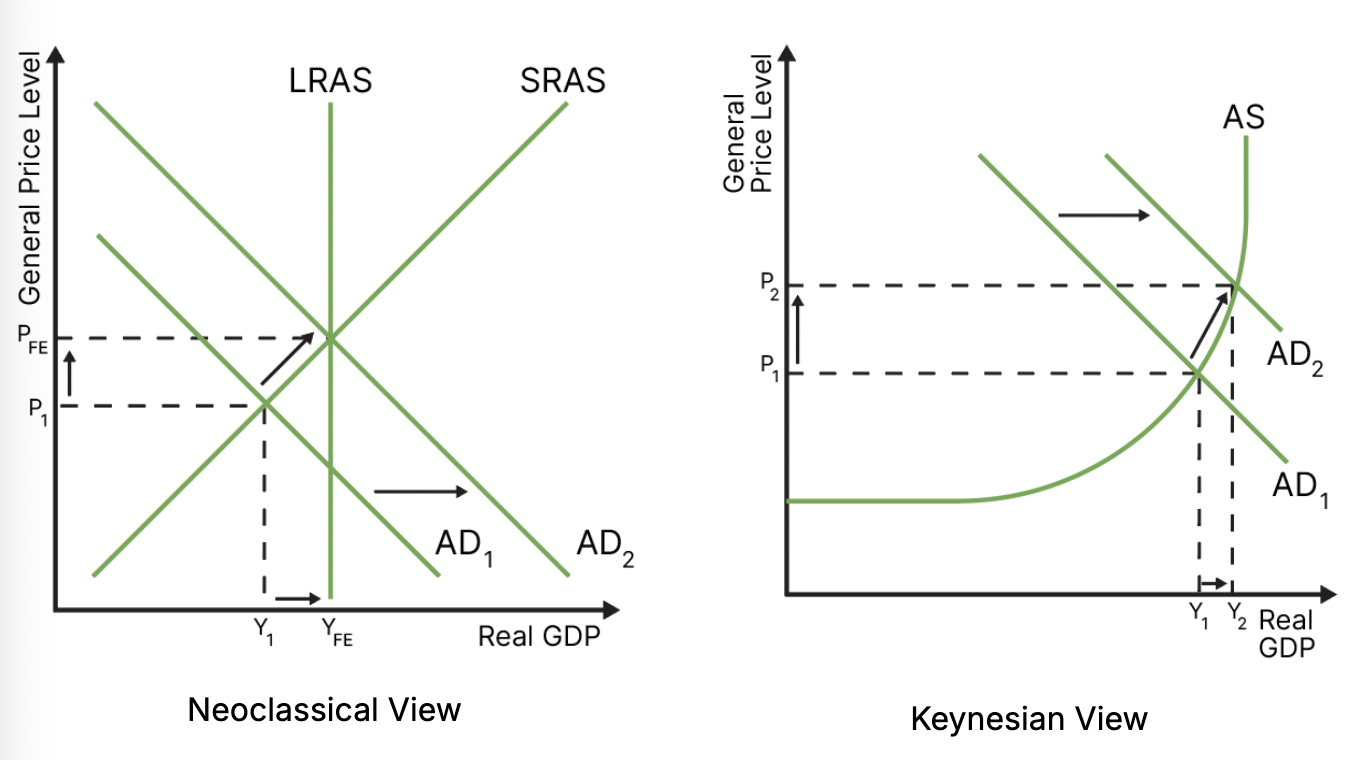

Expansionary diagrams (Neoclassical & Keynesian)

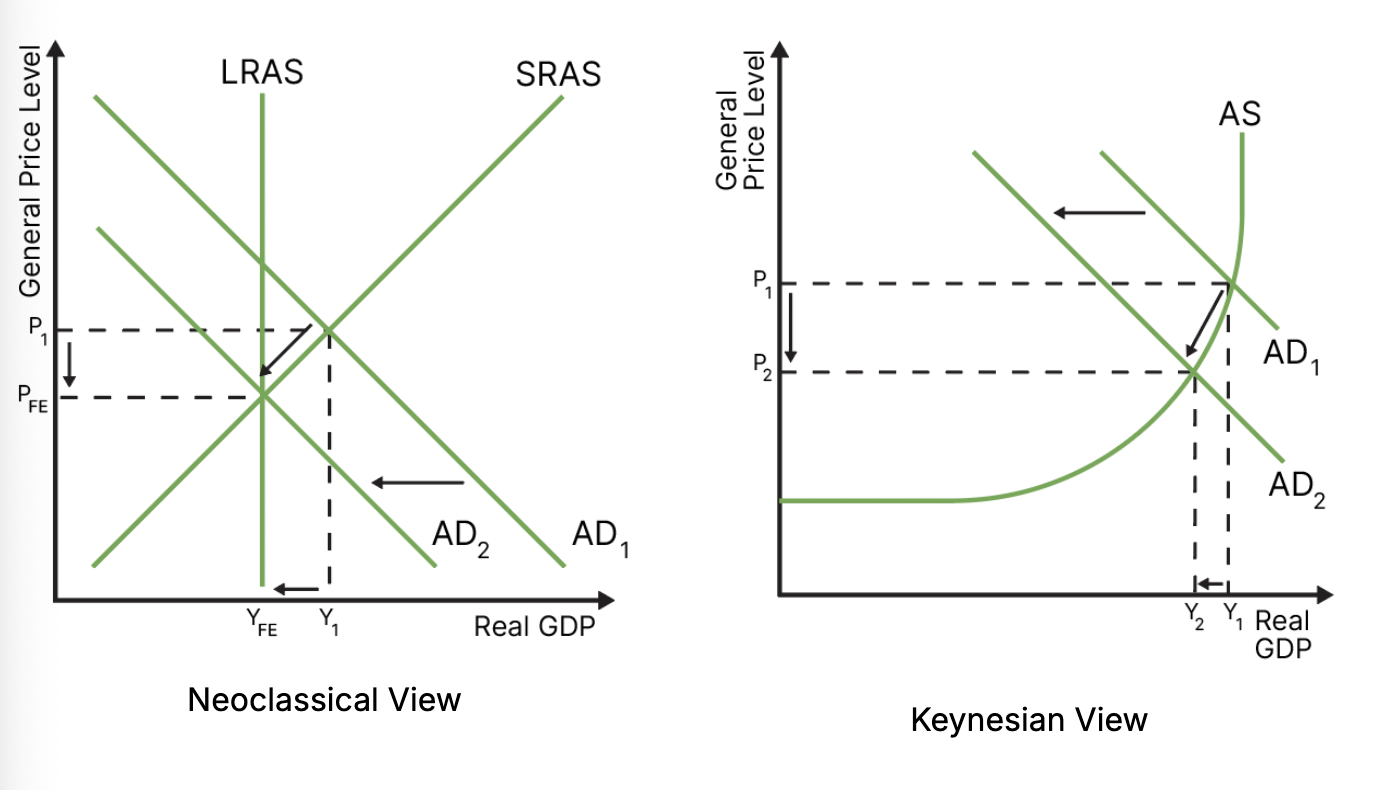

Contractionary diagrams (Neoclassical & Keynesian)

Monetary policy strenghts

Incremental and flexible

Central banks can adjust rates in small steps and easily reverse decisions

Short time lags

Independent central banks can act quickly without political delays

Monetary policy weaknesses

Limited at very low rates

When interest rates are near 0, cutting them further is difficult

Confidence levels

Changes in rates can reduce consumer and business confidence, lowering consumption and investment