Accounting Exam #1 Notes 🎏🧧

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

What are the two primary functions of accounting? Mod. 1

1) measure business activities of a company (measure company activities)

2) communicate those measurements to external parties for decision making purposes (communicate information to decision makers)

What are the three basic business activities that financial accounting seeks to measure and communicate? To whom, are these activities communicated? (FIO)

Financial Activities

Obtaining funds to operate business:

Borrowing money (loans, etc.)

Selling stocks to investors

Repaying debts or paying dividends

Investing Activities

Transactions involving the purchase and sale of resources that are expected to benefit the company for several years

Purchasing buildings, equipment, land

Selling those assets

Making investments in other businesses

Operating Activities

Day to day functions of business that generates revenue and incur expenses

Selling goods or services

Paying wages

Purchasing inventory

Paying for utilities, rent, etc.

Communicated to external users (investors, creditors, customers, analysts, etc.) to make informed decisions

What are the major legal forms of business organization? What are the principle advantage and disadvantages of each? (think of what type of business org. chuy has)

Sole Proprietorship (owned and operated by 1 individual)

Advantage: Easy to form, full control

Disadvantage: Unlimited personal liability

Partnership (Owned by 2 or more individuals, share profits/responsibilities)

Advantage: Shared resources and skills

Disadvantage: Unlimited liability (general)

Corporation (A separate legal entity owned by shareholders)

Advantage: Limited liability, capital access

Disadvantage: Double taxation, complex setup

LLC (Limited Liability Company) (Hybrid business combing features of a corporation and a partnership)

Limited liability, tax flexibility

Varying state rules, possible limits

Provide a basic definition for each account type: asset, liability, stockholders equity, revenue, and expense

Asset: A companies resources that have value

Liability: Amounts owed to others

Stockholders equity: What the shareholders own

Revenue: Money earned / recognized from sales/services given

Expense: Cost of selling the product or services

What is the accounting equation? If I give you two of the inputs, you’d be able to compute the third. Represents relationship between what a company owns (assets) and how those assets were financed (liabilities and equity)

Assets = Liabilities + Stockholders Equity

How is net income (loss) calculated?

Net less = Revenues - Expenses (COGS + Operating Expenses + Interest + Taxes)

What are the 4 basic financial statements and which accounts appear in each?

Income Statement

Reports company’s revenues and expenses over an interval of time (shows if company was able to generate enough money to cover the expenses of running the business)

Statement of stockholders equity

Summarizes change in stockholders equity over an interval of time

Balance Sheet

Statement that presents financial position of company on a particular date

Statement of Cash flows

Measures activities involving cash receipts and cash payments over an interval of time

What is meant by GAAP?

Generally Accepted Accounting Principles; set of standardized rules, guidelines, and procedures used in the US for financial accounting and reporting.

Explain the difference between internal and external transactions. (Mod.2)

Internal: Transactions that occur within the company

External: Transactions conducted between the company and a separate economic entity

Ex: paying salaries to an employee, borrowing money from a bank, purchasing supplies from a vendor, etc.

What is the chart of accounts?

Organized list of account names and numbers that a company uses to categorize and track all its financial activities.

Each account in COA represents a specific type of asset (cash, accounts receivable, inventory), liability (accounts payable, loans payable), equity, revenue, or expense

What are the normal balances in each account type? (ie. asset, liability, stockholders’ equity, revenue and expense) (which is debit/credit, which increases and decreases with which)

The “normal balances” are the ones they’re increasing w/

Dividends

Increase w/ Debit - Decrease w/ Credit (DEA)

Expenses

Assets

Liabilities

Increase w/ Credit - Decrease w/ Debit (LOR)

Owners Equity

Revenue

What’s a journal? What’s a journal entry?

Journal: Provides summary of all debits and credits made during the period (in chronological order)

Journal entry: The place you enter the info

Explain the phrase “debits equal credits”

Because of the double-entry accounting system, which is based on the idea that every transaction affects at least two accounts and keeps the accounting equation (Assets = Liabilities + Equity) in balance.

Every value that goes in (debit) must come from somewhere (credit), ensuring the books stay balanced.

What does the T-account represent? What’s the left & right side called?

T account represents: a visual aid to show how a transaction affects individual accounts

Left side: Debit

Right side: Credit

What’s trial balance?

A list of all accounts and their balances at a particular date, showing that total debits equal total credits

What is the revenue recognition principle? (2 types of revenue recognized) Chapter 3

Accrued Revenue: revenue recognized BEFORE cash is received

Deferred Revenue: recognized AFTER cash is received

What type of revenue is recognized before cash is received and which is recognized after cash is received?

Accrued Revenue

Deferred Revenue

What is the difference between cash and accrual basis accounting?

Cash basis accounting: recorded ONLY when cash is RECEIVED or paid

Accrual Basis Accounting: revenues/expenses are recorded when they are earned/incurred, regardless of when cash changes hands

Ex: You send an invoice in April and get paid in May —> But atill record revenue in April

What are the adjusting entries under accrual basis accounting? (Theres 4)

Accrued Revenue: revenue recognized BEFORE cash is received

Deferred Revenue: recognized AFTER cash is received

Accrued Expense: Expense recognized before cash is paid

Deferred Expense: recognized AFTER cash is paid

What are temporary vs permanent accounts? Which affects what financial statement?

Permanent: Carry forward their balances from one period to the next

Temporary: For these accounts we transfer each balance at the end of the year to ONE account (retained earnings) and then ALL revenue, expense, and dividend accounts start with $0 at beginning of year

So move money to one big account so each balance could start at $0 (restarts)

How does the initial (unadjusted) trial balance differ from the adjusted trial balance?

Unadjusted trial balance lists account balances before any adjusting entries are made - less accurate picture of financial position

Adjusted trial balance: include adjusted entries, reflect a more accurate and complete picture of the company’s financial position

Explain what is meant by the term classified when referring to a balance sheet

Classified just means that the financial info is organized into subcategories or groups that make balance sheet easier to understand and analyze

What is internal control? Why should a company establish a system of internal controls?

Internal control: Served to safeguard the companies assets and improve the accuracy and reliability of accounting information

What is a bank reconciliation? How can it help in determining whether proper controls over cash has been maintained?

Bank reconciliation: Matches the balance of cash in the bank account with the balance of cash in the company’s own records

Can help maintain control of cash

When preparing a bank reconciliation, what types of transactions will need to be accounted for to make it balance?

Deposits, Credits, Withdrawals & debits, deposits in transit, outstanding checks, bank fees, interest earned

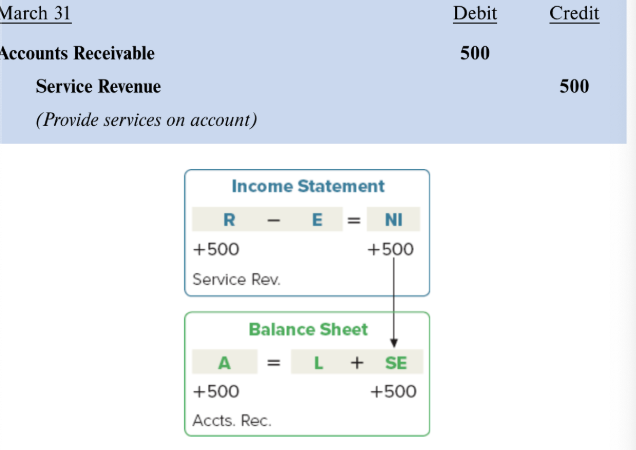

What are credit sales? How are they recorded (what accounts are debited/credited) Chapter 5

Credit sales: Transactions where companies provide goods or services to customers, on account not for cash (the literal meaning of credit sales)

Typically recorded in accounts receivable and revenue

Why do some companies use trade discounts? How are they recorded? Hint: look at the second word of trade discount

Can be a way to represent a reduction in a listed price of a good or service

Appeal to larger customers or consumer groups to purchase from company

A way to change prices without publishing a new price to list or to disguise real prices from competitors

What is meant by sales returns and allowances? How are they recorded?

Sales Return: When customer returns goods they previously purchased

Sales Allowances: When customers leep the goods but receive a partial refund due to defects, errors, or other issues

What is the difference between a trade receivable and a non-trade receivable

Trade receivable = from customer (sales)

recorded under accounts receivable

Non-trade receivable = from others (non-sales)

transactions outside regular sales activities

recorded separately from trade receivables

Can you explain the purpose of estimating future uncollectible accounts (bad debts)?

Uncollectible Accounts (bad debts): Customers’ accounts receivable we no longer expect to collect

This allows the company to create a buffer of how much money they can “lose” without it causing actual harm to the company

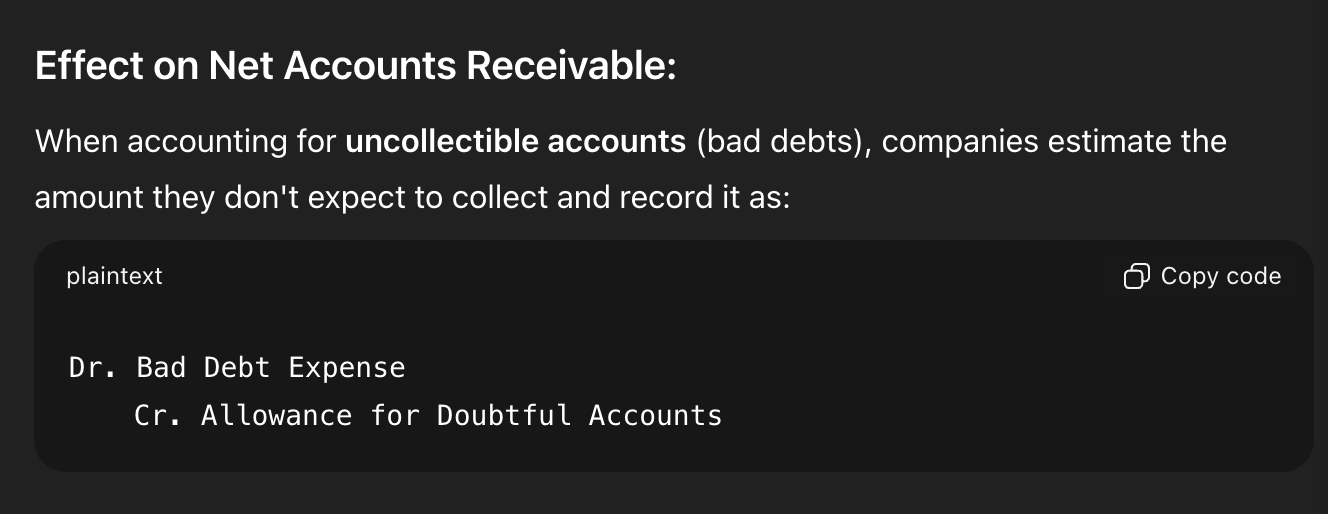

How does the accounting for uncollectible accounts (bad debts) affect the amount reported for net accounts receivable?

They record bad debt (as image)

Net Accounts Receivable = Accounts Receivable - Allowance for Doubtful Accounts

Allowance reduces the amount reported as net accounts receivable, giving a more accurate picture of what the company expects to actually collect

What two methods exist for adjusting for uncollectible accounts receivable? Which is acceptable under GAAP?

Allowance Method (allowed by GAAP)

Direct-write off method

What is the formula for accounting for bad debt expense?

Bad Debt Expense = Estimated Ending Balance in Allowance for Doubtful Accounts − Current Balance in Allowance Account

What are the key differences between an accounts receivable and a notes receivable?

Accounts Receivable: Represents amounts owed to a company by its customers from the sale of goods or services on account.

Notes Receivable: They are more formal credit arrangements evidenced by a written debt instrument, or note (typically arise from loans, other assets/services, sale of merchandise) (still amounts owed just from other stuff)