Macroeconomics

1/20

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

21 Terms

GDP vs GNP/GNI

GDP: gross domestic product; measures the total value of goods and services within a countries borders

GNP: gross national product: GDP+outside a country’s borders, nationality+remittances

GDP types and pros of using it to measure economic growth

Nominal GDP: total economic output, without adjusting for inflation

Real GDP: adjusts for inflation-more accurate

real GDP=nominal GDP/price deflator times 100

PROS of using GDP to measure growth:

comparison of economic strengths

provides GDP per capita-avg. income

easy to track and manage

CONS

overestimates quality of life

GDP doesn’t equal happiness

does not show inequality

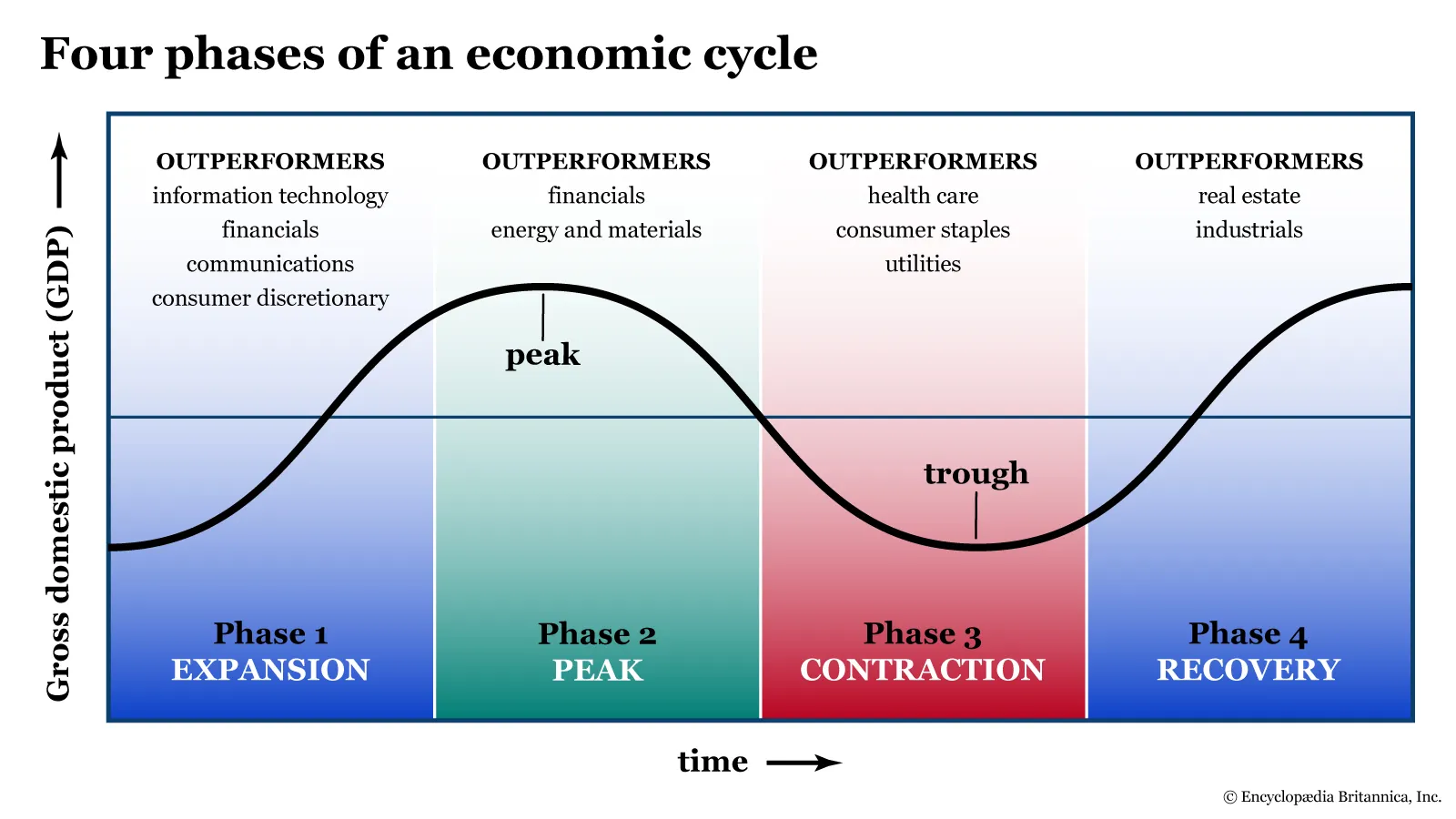

The business cycle

natural cycle of ups and downs in economic activity of a firm

Expansion: growth, employment rises, business expands

Peak: growth reaches a peak, slows down

Contraction: economic activity declines, possible recession

Trough: lowest point before recovery

alternative measures of well being

world happiness report

gross national happiness

OECD

green GDP

aggregate demand-AD and factors affecting it

total demand for goods and services in an economy

C+I+G(X-M)

factors affecting:

changes in consumption, investment, G, X, M

aggregate supply-AS, types and factors affecting them

total output of goods and services at every price level

short run(SRAS): period where prices remain the same

Long run(LRAS): maximum sustainable output

factors affecting:

SRAS: temporary; wage changes, taxes, subsidies

LRAS: permanent; labor force, education, technological improvements

new classical SRAS vs keynesian LRAS model

New classical: supply creates demand

supply side

efficiency of market forces-no gov. intervention

Keynesian: demand creates its own supply

demand side

gov. intervention needed

LRAS graph stages: in the short run an economy can produce more without raising prices-when at full capacity, output can’t increase without causing inflation

Flat section: room for growth, output is below potential

upward slope: closer to full employment-resources become more scarce

firms raise wages and prices

vertical section: full employment, can no longer increase output

say’s law

classical economic idea: supply creates its own demand

in the long run, there can’t be general overproduction or unemployment

argued against government intervention

economic growth in the short run vs long run

short run:

increased consumption

fiscal/monetary policy

excessive AD-causes inflation

Long run:

improvement in factors of production

capital: better technology

labor: population growth

natural resources

inflation vs deflation vs disinflation

inflation: persistent increase in the general price level

deflation: persistent fall in the general price

disinflation: a slowing down of inflation

types of inflation

formula: CPI1-CPI2/CPI1 times 100

demand pull: the good inflation

higher demand than supply, prices go up but GDP goes up

cost push inflation: the bad inflation

higher cost of producing, prices go up, GDP goes down

costs of government debt

debt servicing cost

credit ratings

impact on future taxation and spending

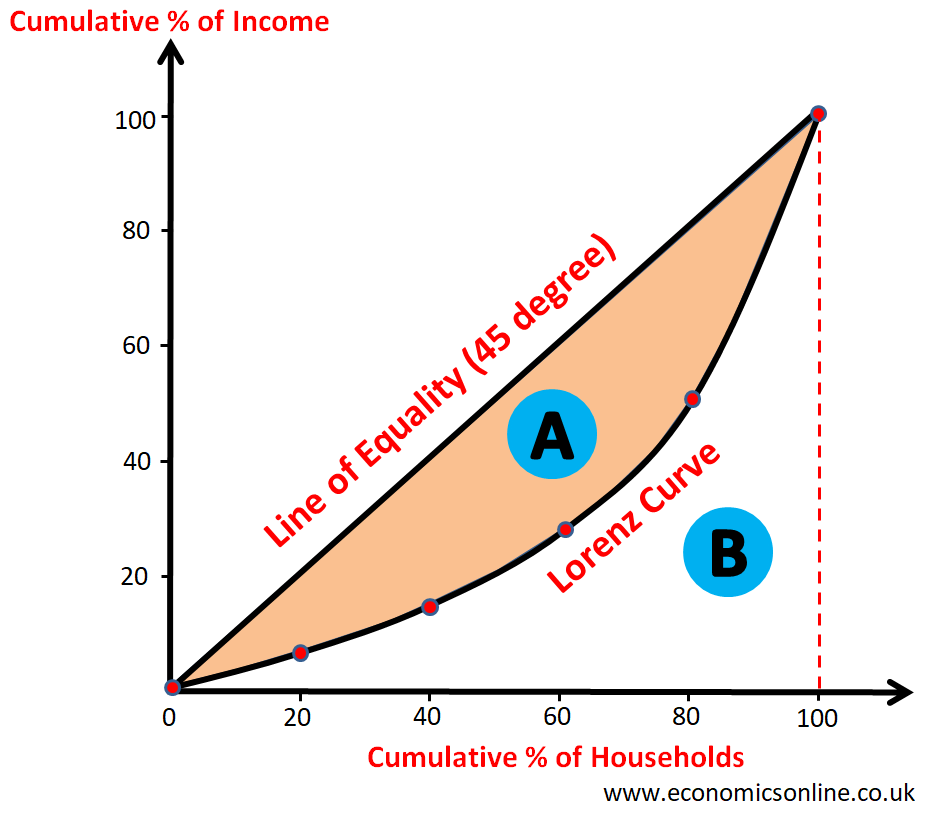

lorenz curve and gini coefficient

lorenz curve: visual indicator of distribution of wealth

gini coefficient: math indicator A/A+B

0-perfect equality 1-perfect inequality

types of poverty and inequality causes and fixes

absolute poverty: unable to access basic human needs (food, shelter)

Relative poverty: below 50% of a countri’s averge earnings

Inequality causes:

opportunity

discrimination

human capital levels (skills, knowledge, education)

Policies to reduce inequality:

direct, indirect taxes

minimum wage

UBI

policies reducing discriminations

5 types of unemployment

1. Frictional Unemployment

people are between jobs or looking for their first job, usually short-term

2. Structural Unemployment

Caused by a mismatch of skills or changes in the economy, often long-term

3. Cyclical Unemployment

Caused by a fall in demand during a recession

4. Seasonal Unemployment

Happens because of seasonal changes in demand for certain jobs

5. Real Wage Unemployment

Caused when wages are too high, above the market-clearing level

minimum wage laws or strong unions

government policies; Fiscal policy types and pros and cons

use of government spending

expansionary fiscal policy:

aim: close recessionary gaps, boosting the economy

cut taxes-more consumption and investment

increase government spending

contractionary FP:

aim: close inflationary gaps, slowing the economy

increasing taxes-decreasing consumption, investment

decrease government spending

ex. austerity

PROS:

can target specific economic sectors

effective in a recession-boosts confidence

CONS:

political pressure

time lags-bureaucracy takes time

government debt rises, crowding out possibilities

keynesian multiplier

government spending leads to a larger overall increase in income, GDP

more gov. spending=bigger impact on GDP, people spend even more money

formula=1/1-MPC

MPC: marginal prosperity to consume

government policies; Monetary policy types and pros and cons

Central bank's way to control economic factors

Expansionary MP: promote growth during times of trouble

decrease interest rates-increased spending

buy government bonds

decrease minimum reserve ratio

Contractionary MP: slowing down the economy during high inflation

increase minimum reserve ratio

sell government bonds

increase interest rates-decrease spending

PROS:

flexible, easily reversible

short time lags-policies implemented quickly

CONS:

low consumer and business confidence

lowering interest rates is ineffective when close to 0

money multiplier effect

process by which banks make money through lending

initial deposit of money leads to a larger increase in the money supply

government policies; supply side types and pros and cons

aim at improving the production side of the economy

Market based: reducing barriers for businesses

deregulation-removing rules, regulations

privatization: greater incentive to innovate

trade liberalization

PROS:

no burden on government budget

improved resource allocation-private entities are better are determining equilibrium

CONS:

equity issues (profit>equity), business self interest

time lags

environmental impact

Interventionist: government intervention needed

investment in infrastructure, education, training

PROS:

direct support for a specific industry

improvs long term growth, reducing inequality

CONS:

time lag

high costs

may cause inflation

crowding out

government borrowing pushes out private investment by raising interest rates