Merchandising Operations

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Merchandising Operations

Operating Cycles

Flow of costs

Perpetual and periodic inventory systems

Recording Purchasing and Merchandising

Freight costs

Purchase returns and allowances

Purchase discounts

Summary of purchasing transactions

Recording Sales of Merchandise

Sales returns and allowances

Sales discounts

Completing the Accounting Cycle

Adjusting entries

Closing entries

Summary of merchandising entries

Forms of Financial Statement

Income Statement

Classified statement of financial position

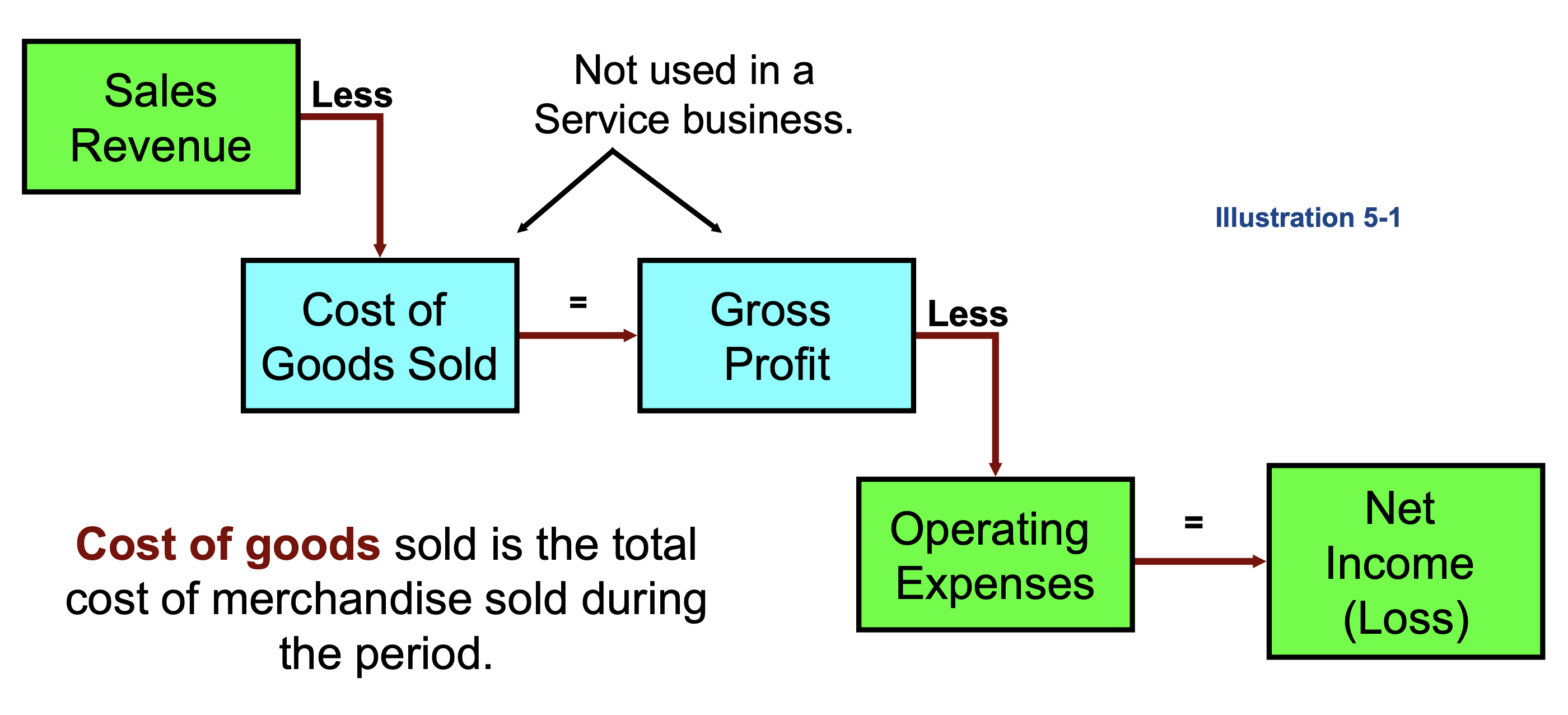

Income Measurement

Operating Cycle

the days required for a business to receive inventory, sell the inventory, and collect cash from the sale of the inventory.

Perpetual System

Provides a continuous record of merchandise inventory and cost of goods sold.

Purchases increase merchandising inventory

Freight costs, purchase returns and allowances, and purchasing discounts are included in the merchandise inventory

Costs of Goods Sold are increased, and merchandise inventory is decreased for each sale

Physical count is done to verify merchandising inventory balance

Periodic System

Purchases of merchandise increase purchases

Ending inventory determined by physical count

Calculation of Cost of Goods Sold

Recording Purchases of Merchandise

Made using cash or credit on account

Normally recorded when goods are received

Purchase invoice should support each credit purchase

Freight costs

The cost of transporting goods from one place to another

Record of Sales Merchandise

Made for cash or credit on account

Normally recorded when earned, usually when goods transfer from seller to buyer

Sales invoice should support each credit sale

Entries to record sale

Cash or Accounts Receivable (debit)

Costs of Goods Sold and Merchandise Inventory

Sales Return and Allowance

Also known as “Contra-Revenue”

Income Statement

Primary source for evaluating a company’s performance

Format designed to differentiate between the various sources of income and expense

Formula for Net Sales

Sales - Sales Return

Formula for Costs of Goods Sold

Net Sales - Gross Profit

Formula for Gross Profit

Operating expense + Income from operations

Formula for Net Income

Income from operations - other expenses and loses

Income Measurement Formula

Sales Revenue - Cost of Goods Sold = Gross profit - Operating Expenses = Net income