aggregate demand

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

aggregate demand

The total demand for the goods and services of a nation at a given price level and time period.

aggregate demand is equal to consumption + investment + government spending + net exports, which is equal to GDP using the expenditure method

= C+I+G+(X-M)

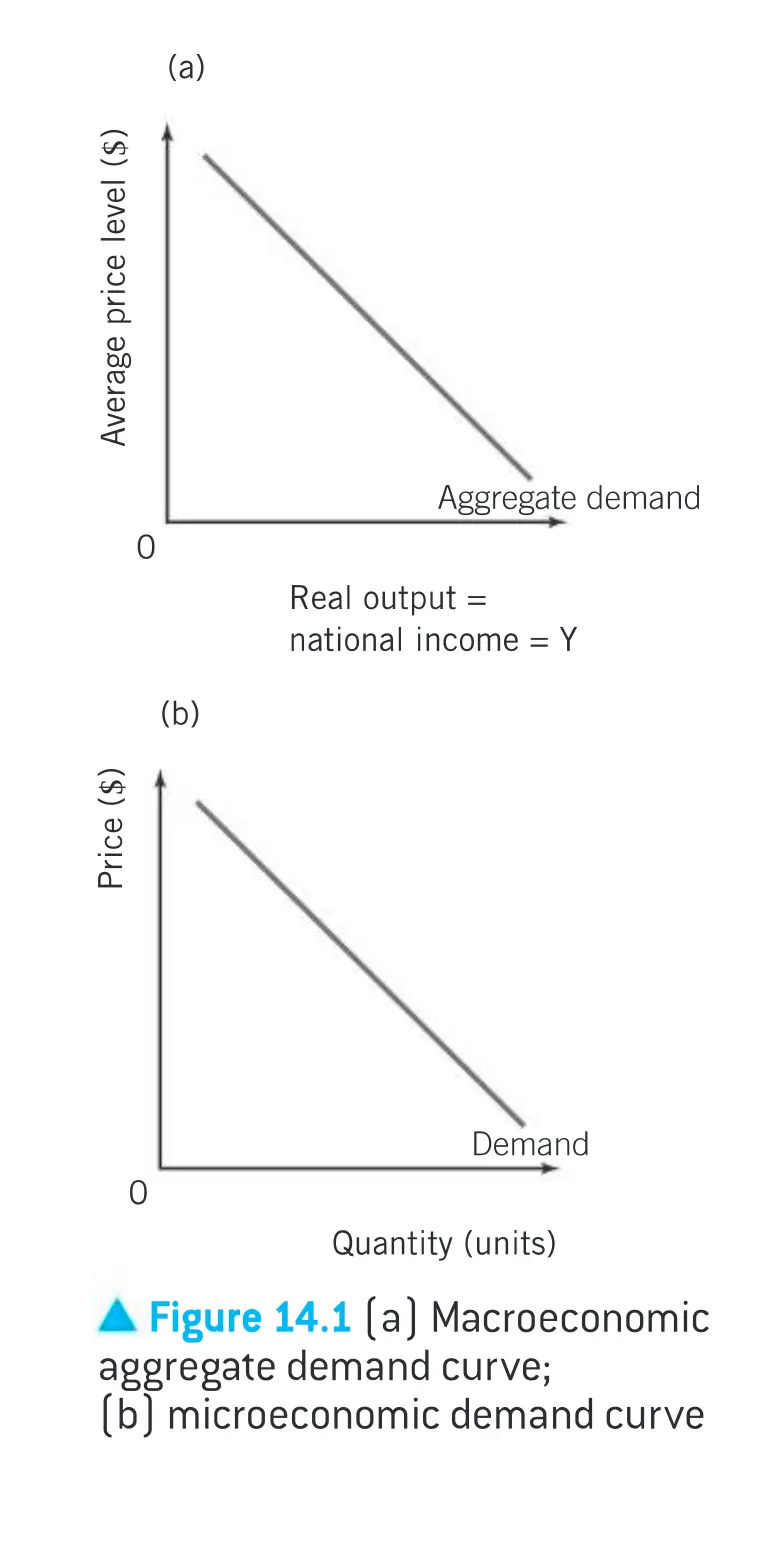

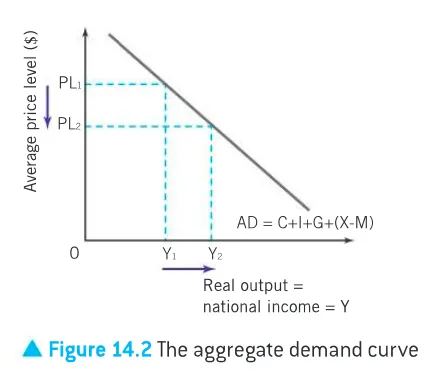

AD curve

AD curve shows the inverse relationship between the average price level and the total real output demanded → at a lower average price level, a higher quantity is demanded (Law of Demand on an aggregate level)

aggregate means total

when constructing an aggregate demand curve, we look at the demand from all possible sectors within the economy

consumption

the total spending by consumers on domestic goods and services → durable goods and non durable goods

durable goods are goods such as cars and phones that are used by consumers over a period of time (usually more than one year)

non-durable goods are goods such as rice and toilet paper that are used up immediately or over a relatively short period of time

investment

defined as the addition of capital stock to the economy

carried out by firms → two main types

replacement investment → occurs when firms spend on capital in order to maintain the productivity of their existing capital

induced investment → occurs when firms spend on capital to increase their output to respond to higher demand in the economy

the economy’s capital stock includes all goods that are made by people and are used to produce other goods or services, such as factories, machines, offices or computers

government spending

governments at a variety of levels spend on a wide variety of goods and services such as health, education, law and order, transport, social security, housing and defence

the amount of government spending depends on the policies and objectives of the government

exports

domestic goods and services that are bought by foreigners. When the firms in a country sell exports to foreigners, it results in an inflow of export revenues to the country

imports

goods and services that are bought from foreign producers. When imports are bought it results in an outflow of import expenditure.

net exports

the net trade component of AD is actually export revenues minus import expenditure

positive: whereby export revenues exceed import expenditure

negative: whereby import expenditure exceeds export revenues

shift along AD curve

when the average price level in the economy falls from PL1 to PL2, the level of output demanded by consumers (C) plus firms (I) plus governments (G) and the net foreign sector (X-M) increases from Y1 to Y2

income effect allows consumers to spend more

factors of consumption

change in income taxes

change in interest rates

change in consumer expectations/ confidence

change in wealth

lack of household incomes

changes in income taxes

most significant determinant of consumption is income

as incomes rise people have more money to spend on goods and services, so consumption increases

if there is an increase in direct income taxes (the taxes paid on income by individuals), then people will have less disposable income

the income the people have remaining for spending and saving after income taxes have been paid

change in interest rates

spending on non-durable goods is carried out with the day-to-day money that people earn (their income)

but some of that money that is used to buy durable goods comes from money which people borrow from the bank

when people borrow money they must pay interest to the bank

if there is an increase in interest rates (price of borrowed money) then there is likely to be less borrowing (as it is more expensive). Therefore consumption will fall, resulting in a fall in AD

a rise in interest rates makes saving more attractive → people would prefer to put their extra income in the bank to earn money rather than spend it on goods and services

wealth

defined as the net worth of an individual or a household including the value of all its assets minus all its liabilities.

household assets include

financial assets: value of money in savings or retirement

real assets: value of a house or stock in companies

change in house prices: when house prices increase across the economy, consumers feel more wealthy and are likely to feel confident enough to increase their consumption by saving less or borrowing more

change in the value of stocks and shares: many consumers hold shares in companies. If the value of those shares increases then people feel wealthier. This might encourage them to spend more. Or they might sell those shares and then use the earnings to increase consumption

change in consumer confidence/ expectations

if consumers are optimistic about their economic future, then they are likely to spend more now

likely to get a promotion due to a booming economy and strong sales

economists regularly measure consumer confidence and put the information together in the form of a consumer confidence index

consumer expectations regarding the future price level will also affect consumption

If consumers expect the price level to increase in the future, ie inflation, then they will increase consumption now, especially on durable consumer goods.

household debt

Household debt is the amount of money owed by a household to lenders, including consumer debt accrued through the use of credit cards or by borrowing from a bank to finance consumption of durable goods.

In the short run, an increase in consumer debt allows households to increase consumption at each level of household income.

But in the long run, debts must be paid back, which is only achieved through reductions in future consumption as household income must go towards repaying past debts.

changes in investment

changes in interest rates

changes in business taxes

technological change

changes in business confidence/ expectations

levels of corporate indebtedness

changes in interest rates

in order to invest, firms need money. The money that firms use for investment comes from several sources.

ex: retained profits or borrowing money

If the money is to be borrowed, then an increase in the cost of borrowing may lead to a fall in investment. If interest rates are high, then firms may prefer to put their retained profits in the bank to earn higher returns as savings, rather than use

them to invest.

changes in business taxes

If the government increases taxes on business profits, then it will reduce post-tax profits, which will mean that firms have less money to invest and so we would expect to see a fall in AD.

In the same way, if the government was to lower taxes on business profits, then more investment could take place and there would be an increase in AD,

ie a shift of the AD curve to the right.

technological change

In order to keep up with advances in technology and to remain competitive firms will need to invest. This will increase AD.

changes in business confidence/expectations

If businesses are very confident about the future of the economy and expect consumer demand to rise then they will want to be ready to meet the increases in consumer demand by investing to increase potential output and productivity.

Levels of corporate indebtedness

The extent to which businesses are willing and able to borrow money affects investment. If it is easy to borrow money (easy credit) and interest rates are low then it is likely that businesses will take on more debt and investment will rise.

government spending

depends on the political and economic priorities of the government

rises: when the gov has made a commitment to financially support a given industry, when gov is obliged to correct the market failure, a new education/health policy

rises → AD shift right

falls → AD shift left

trade surplus

a positive (X-M), a trade surplus, will lead to AD shifting right

trade deficit

a negative (X-M), a trade deficit, will shift AD left

changes in level of exports

changes in foreign countries income → If foreign incomes rise, then their consumption of imported goods will rise.

changes in the value of a country’s currency (its exchange rate) → if a country’s exchange rate becomes stronger, then this makes the country’s exports relatively more expensive to foreigners. According to the Law of Demand, this will cause the quantity of exports to fall → affects export revenues

changes in countries’ trade policies → if a country decides to adopt a policy of more liberalised (free) trade, then it may reduce the tariffs that it charges on imports (goods coming in) and allow countries to export more to that country

changes in level of imports

as people consume more goods, some of these goods will be imported

as national income rises, so does spending on imports + if national income falls, there will be reduced spending on imports