ECON10004

1/183

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

184 Terms

What are the 10 principles of economics?

1. People face trade-offs

2. The cost of something is what you give up to get it

3. Rational people think at the margin

4. People respond to incentives

5. Trade can make everyone better off

6. Markets are usually a good way to organize economic activity

7. Governments can sometimes improve market outcomes

8. A country's standard of living depends on its ability to produce goods and services

9. Prices rise when the government prints too much money

10. Society faces a short-run trade-off between inflation and unemployment

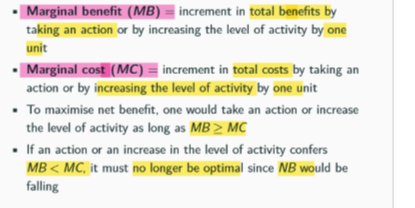

net profit benefit

= total benefits (TB)- TC

absolute vs comparitive advantage

absolute advantage is the ability to produce a good using fewer inputs than another producer

comparative advantage: is the ability to produce a good at a lower opportunity cost than another producer

sunk costs

reflect the value of resources that were already used before making a decision about which action to take

rational decision makers think at the margin

substitutes vs compliments

S: the price of one good is positively related to the deman of the other good

C: inversly related

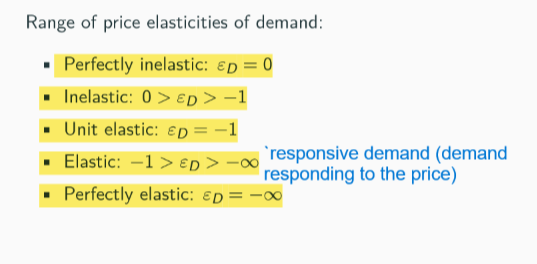

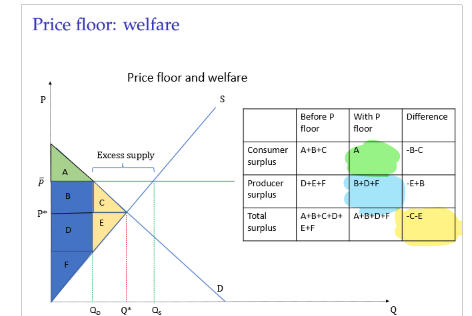

elasticity of demand demand

when there is change in P, there is a little change in quantity (inc p= dec in q)= insensitive to change

Price inc= total revenue inc (vice versa)

Eleastic demand= sensitive to change.

Price inc= TR dec

Unit elastic demand: equal change. Inc in p by 20% and dec in q by 20% = 1 (p%/Q%)

Perfect inelastic: inc/dec in price= no change to quantity= 0 (vertical line)

Perfect elastic (horizontal line)

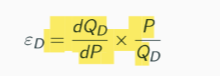

elasticity formula

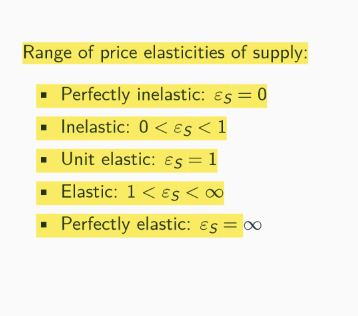

price elasticity of supply

measures the responsiveness of quantity supplied to a change in price

elastic=sensative

inelastic= insensitive

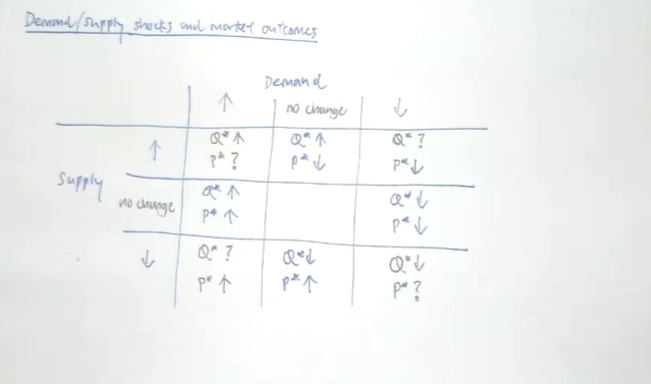

effects on equilibrium

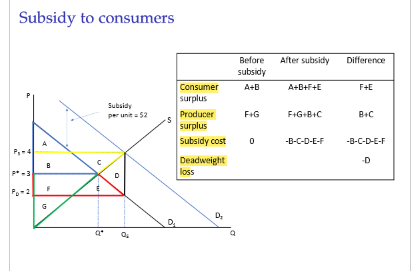

subsidy on consumer

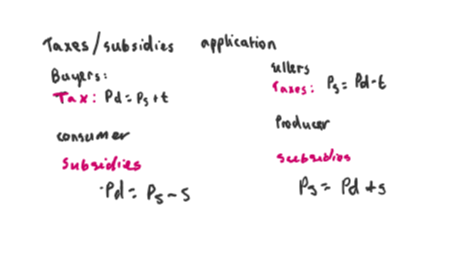

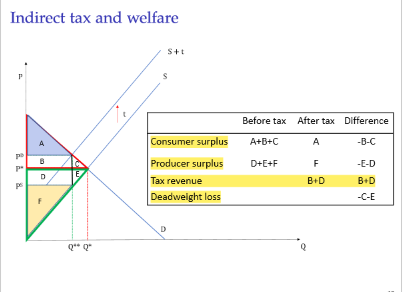

tax/subsidy application

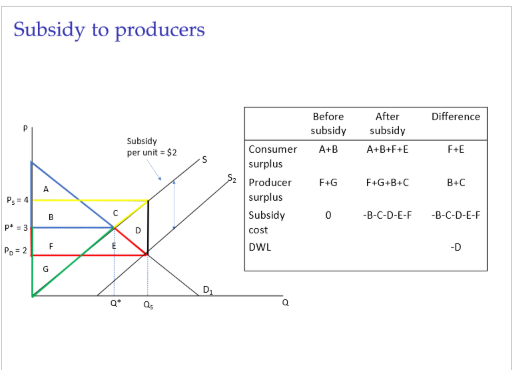

tax revenue= T times Qtax

DWL= 1/2x Tx (Qno tax-Qtax)

gov spending=SxQsubsidy

elasticity for tax and subsidy

For a Tax:

If demand is more inelastic than supply → Consumers bear more of the tax.

If supply is more inelastic than demand → Producers bear more of the tax.

🔹 For a Subsidy:

If demand is more inelastic than supply → Consumers get more of the subsidy benefit (lower prices).

If supply is more inelastic than demand → Producers get more of the subsidy benefit (higher revenues)

subsidy to producers

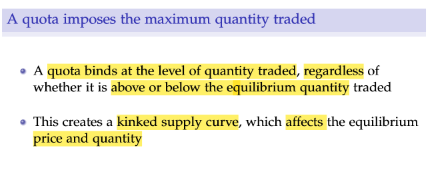

quota

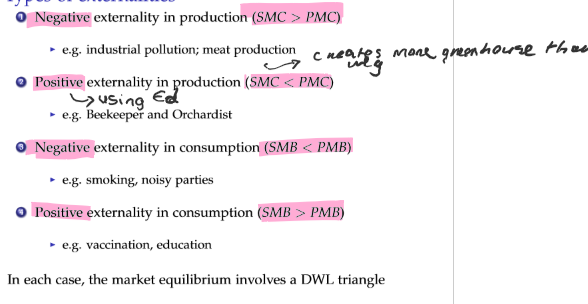

types of externalities

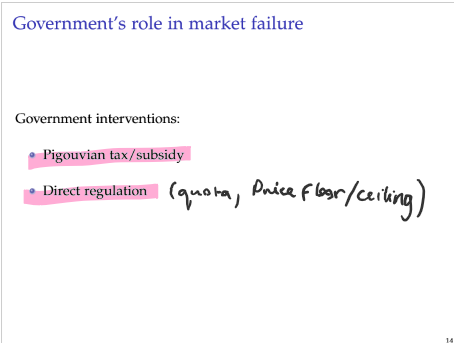

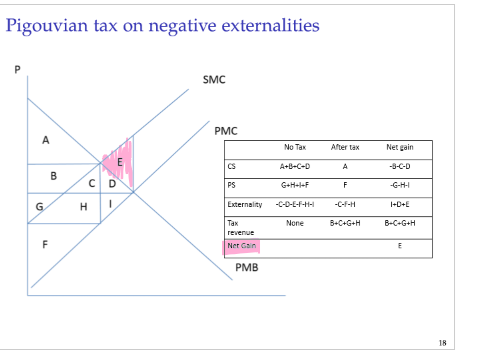

government interventions

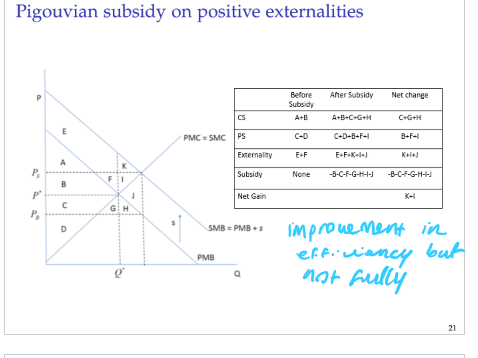

pigouvian subsidy on positive externalities

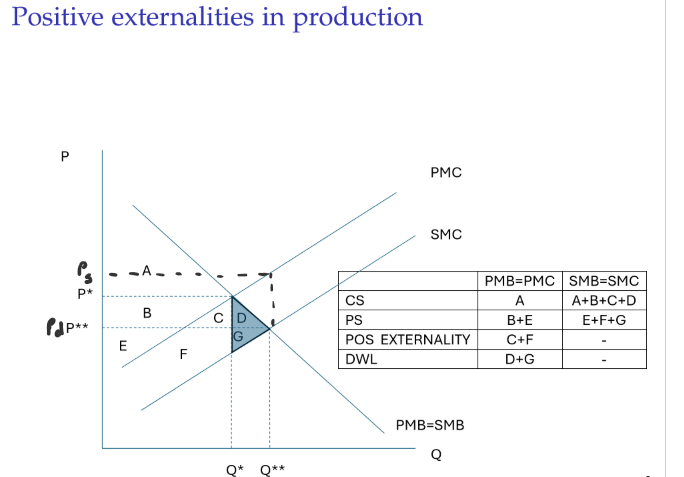

positive externalities in production

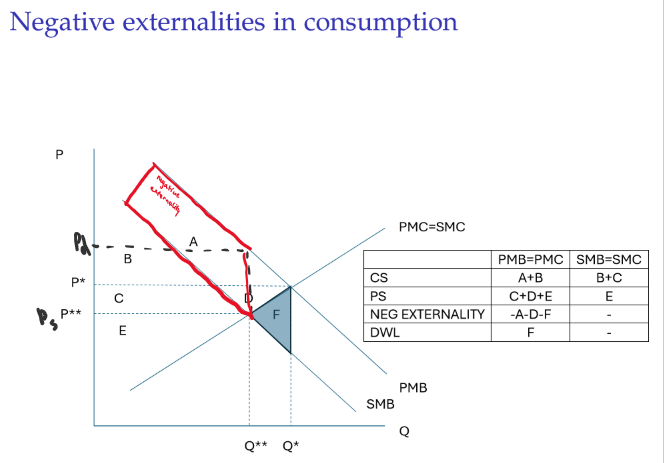

negative externalities in consumption

coasian bargaining

sees bargaining as the most efficient solution to resolving negative externalities => creating a market-like solution

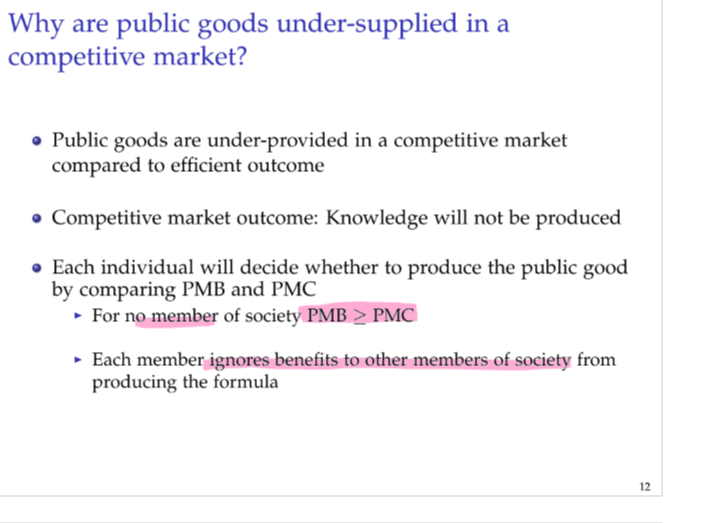

why are public goods under-supplied in a competative market

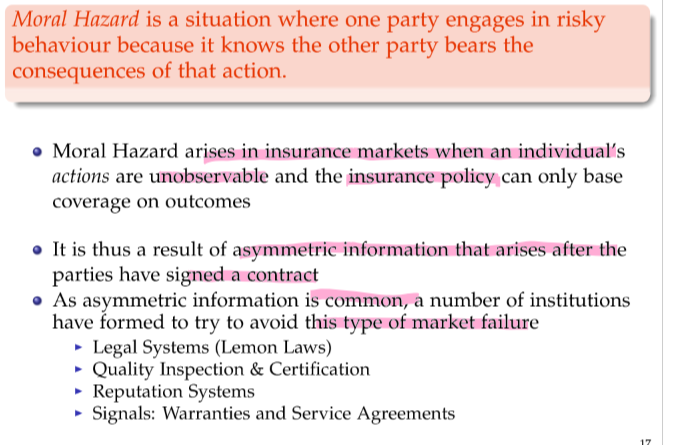

moral hazard

total product & marginal product

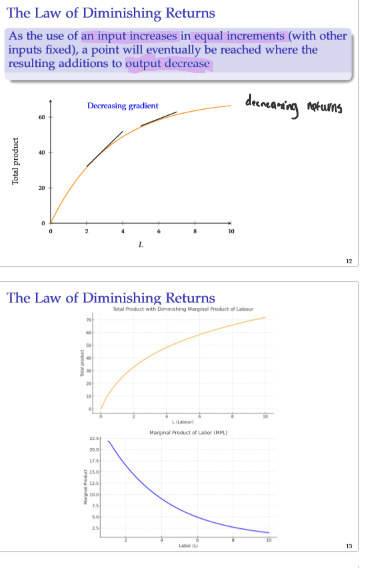

law of deminishing returns

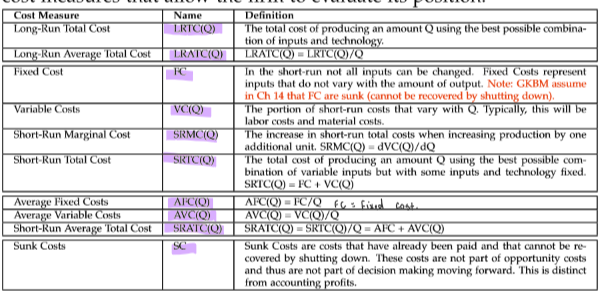

costs

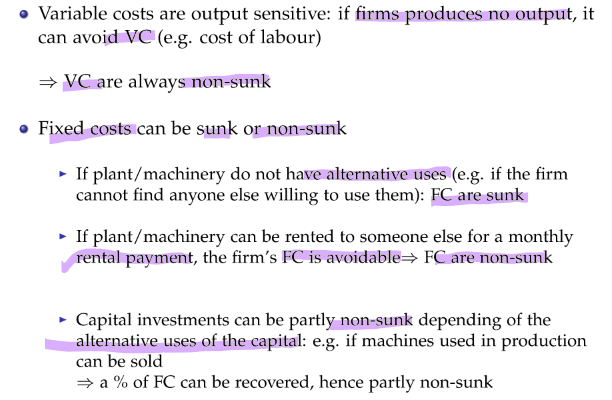

are fixed cost and sunk costs the same

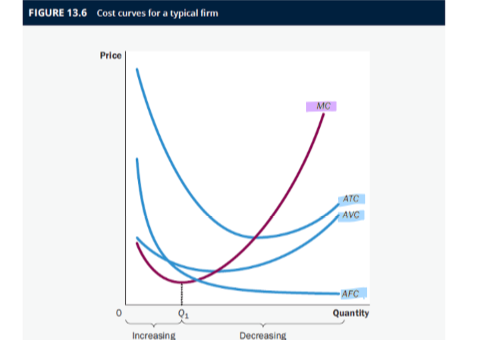

cost curves in the short run

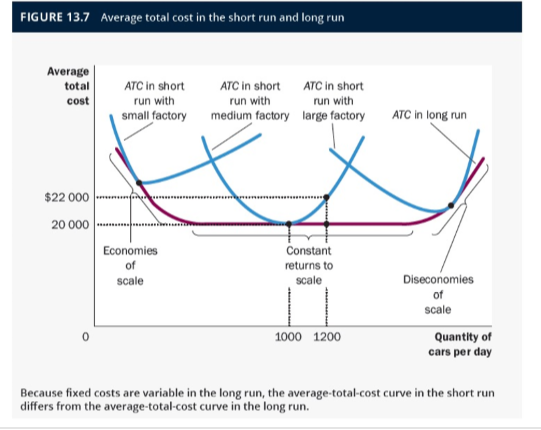

short run and long run ATC

economies and diseconomies of scale

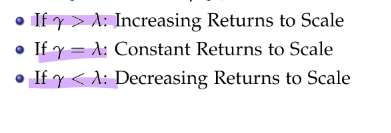

return to scale= % change output Q/% change input Q

economies of scale= the output range over which long-run ATC are falling

diseconomies of scale describes the ouput range over which long-run ATC are rising

a perfectly competitive market has three key features

price taking: Each firm accounts for a small share of the market output and its decisions have no impact on the market price

product homogeneity: all products are perfectly substitutable

free entry and exit

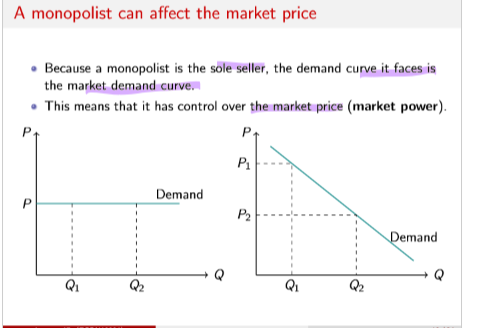

pure monopoly

is a market that has only one seller but many buyers

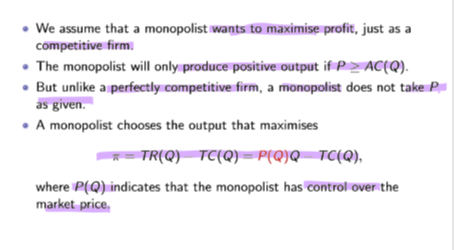

monopolists production problem

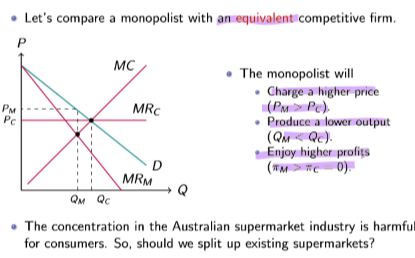

monopoly vs perfect competition

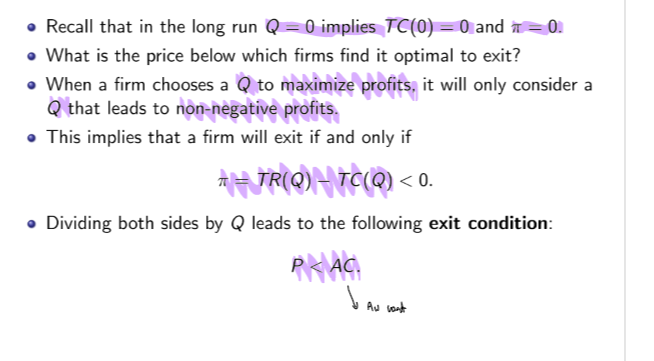

long-run exit price

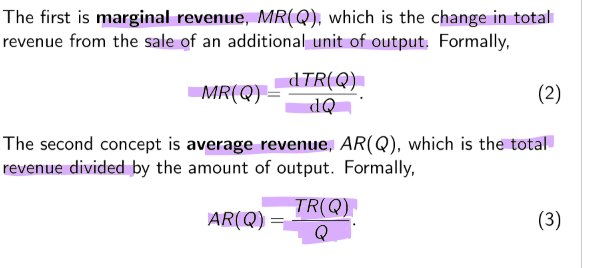

marginal revenue and average revenue

What is the production possibilities frontier?

A graph the shows the various combinations of output that an economy could produce given the available factors of production and the available technology.

What is opportunity cost?

The loss of potential gain from other alternatives when one alternative is chosen.

What is comparative advantage?

The ability to produce a good or service at a lower opportunity cost than other producers.

How should a price be set in trade?

It should lie between the two opportunity costs of the supplier and consumer.

What Assumptions are made in a Perfectly Competative Market?

1. All goods are exactly the same

2. Buyers and Sellers are numerous hence no individuals can have an impact.

What causes a shift in the demand curve?

Income

Prices of substitutes and complements

Taste

Expectations

Number of Buyers

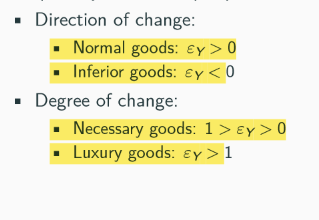

Whats an inferior good?

When an increase in income leads to a decrease in demand. Suggesting a lower IED.

What is a normal good?

Increase in income leads to an increase in demand and elasticity.

What is a substitute good?

Two goods for which a decrease in price of a good leads to a decrease in demand for another.

What is a complementry good?

Two goods for which a decrease in the price of one good leads to an increase in demand for another.

What is the Law of Demand?

The claim, other than things being equal, the quantity demanded of the good falls when the price rises.

What is the Law of Supply?

The claim, other than things being equal, the quantity supplied of a good rises when the price of a good rises.

What shifts the supply curve?

Input prices

Technology

Expectations

Number of Sellers

What happens when input prices rise?

When costs rise and the product becomes less profitable, decreasing quantity supplied.

When is there a surplus?

When the Quantity Supplied is greater than Quantity Demanded. Suppliers can respond by cutting prices to increase demand.

When is there a shortage?

When the Quantity Demanded is greater than Quantity Supplied. Suppliers can increase price to decrease demand toward shortage.

What is Price Elasticity of Demand?

A measure in how much quantity is demanded of a good response to a change in the price of that good. Calculated by the percentage change in price quantity demanded divided by the percentage change in price.

Determinants of PED?

Availability of close substitutes

Necessities vs Luxuries

Definition of the specific market

Time Horizon

How is revenue affected depending of PED?

Inelastic demand causes an increase in revenue when their is an increase in price.

Elastic demand causes a decrease in revenue when price increases.

What is the Income Elasticity of Demand?

A measure of how much the quantity demanded of a good responds to a change in consumers income. Calculated as percentage change in quantity demanded divided by the percentage change in income.

What is the Cross Price Elasticity of Demand?

A measure of how the quantity demanded of a good responds to a change in price of another good. Calculated as Percentage change in quantity demanded of good 1 divided by the percentage change in the price of good 2.

What is the Price Elasticity of Supply?

A measure of how much the quantity supplied of a good responds to a change in price of that good. Calculated as the percentage change in quantity supplied divided by the percentage change in price.

Determinates of PES?

Flexibility of production.

Time period.

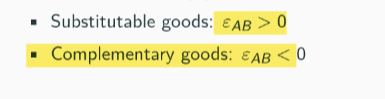

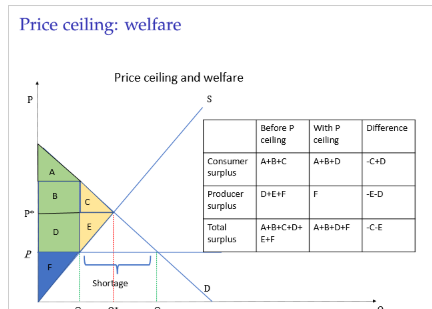

What is Consumer Surplus?

Willingness to pay less the actual amount paid, influencing the quantity demanded. Represented by the area below the demand curve. Is a measure of wellbeing from the consumer's view.

How does a lower price rise Consumer Surplus?

The initial consuer surplus will increase, and new consumer surplus will be created as the equalibrium moves along the supply curve as theyre is a lower willingness to pay.

What is Producer Surplus?

The amount a seller is paid for a good minus the sellers cost, influencing the quantity supplied. Represented by the area above the graph.

What is Total Surplus?

The sum of consumer surplus and producer surplus to measure toal economic wellbeing (welfare) and when maximised is considered a effecient market. Calculated by Value to Buyers less Cost of Sellers.

How can Total Suprlus be inefficient?

When a high cost producer is used, opposed to low cost; Or their are consumers who value the good more are not consuming .

How is Market Equalibrium Efficient?

Free Markets allocate supply of goods to the buyers who value most highly. Simirally, allocate demand for sellers who can produce at a lower cost. Hence, producing the quantity of goods that maximise total surplus.

Define Price Ceiling

a legal maximum on which a good can be sold. It can create a market shortage if below the equilibrium price., which can grow in the long run.

Define Price Floors

A legal minimum on the price at which a price can be sold if above equilibrium can create an excess surplus. supports workers

What is a tax on the supplier?

The supplier receives less than the price, hence they will look for the quantity at which the distance between supply and demand equals the tax. This discourages market activity, as both parties incur the tax.

What is a tax on the consumer?

When buyers pay the tax, the price buyers pay is higher than sellers by the amount of tax.

What happens to tax when there is elastic supply and inelastic demand?

the incidence of tax falls more heavily on consumers

What happens to tax when there is inelastic supply and elastic demand?

The incidence of tax falls more heavily on producers.

How do subsidies affect market outcome?

decrease prices for the consumer and increase priec received by the producer

funded by taxes

Define Dead Weight Loss?

the surplus that is lost because tax discourages those mutually advantageous trades.

What are the determinants of DWL

size of loss refers to greater on change in quantity demanded/ supplied.

The greater the elasticities of supply and demand, greater DWL is.

What is the laffer curve?

shows the relationship between the size of tax and government revenue.

What is the market status of a exporting company?

equilibrium is at the world price, which suggests producers are better off compared to selling to domestic markets, making consumers worse off. The trade raises economic wellbeing, as gains exceed losses.

Define Tarrifs?

A tax on goods produced abroad and sold domestically, reducing domestic quantity demanded and increasing domestic quantity supplied. This moves the domestic market closer to equilibrium.

What is the DWL for Tarrifs?

Left is from overproduction and right is from underproduction.

What are the other benifits from trade?

Increased variety of goods

lower cost through economies of scale

increased market competition

increased productivity

enhanced flow of ideas

What are the arguments for restricting trade?

destroys domestic jobs whilst growing other economies

can threaten national security as dependence on other countries is formed.

infant industries'

unfair competition

protection as bargaining

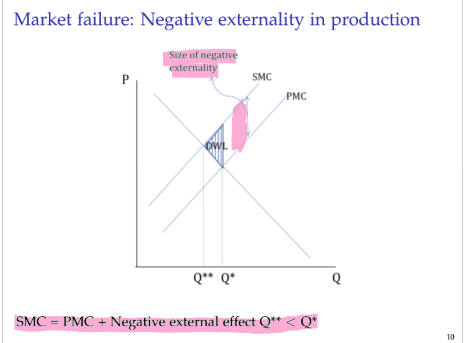

Define negative externality

the harm, cost, or inconvenience suffered by a third party because of actions by others

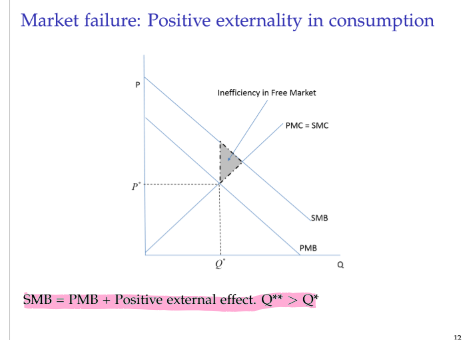

Define Positive Externality

the social value of the good is above the demand curve, to which the private curve shall meet.

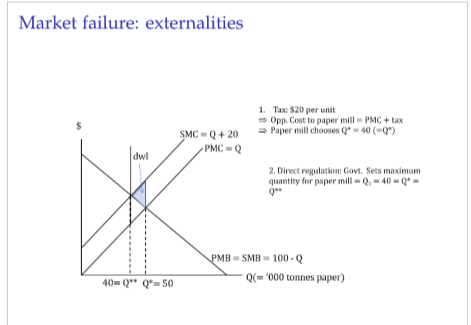

Define Corrective Tax and Subsidies

taxes aim to resolve negative externalities whereas subsidies solve positive externalities. The tax are more efficient, as the producer can equally meet the regulation, however it can encourage tax evasion.

Define tradeable Permits (Externalities)

permits may be paid for to pass regulation; usually when allocation is efficient and requires the company to pay, internalising the externality

What are the private solutions to externalities?

charities

private sponserhips

contracts

What is the Coase Theorem?

Private economic actors can potentially solve the externalities themselves. Whatever the initial distribution is, the interested party can reach a bargain in which everyone is better off.

Why private solutions to externalities do not always work?

bargaining doesn't always work

transaction costs.

What are the classification factors for goods?

excludability, where someone can be stopped from using it.

rivalry, where a persons use decreases someone elses use.

Define Private Goods?

Goods are both rival and excludable (ice cream)

Define Public Goods

neither excludable nor rival, street lighting

Define Common Resource?

goods are rival in consumption but not excludable (fish)

Define Club Goods

excludable but not rival (netflix)

What is the free-rider problem?

People receive benefits for a good without paying for it. In a private market, free riders create an externality and prevent the market from supplying certain goods.

Define Market Failure

inefficient outcomes: externalities, public goods, asymmetric information and imperfect consumption.

Define Pigouvian tax

When SMC = PMC + Tax. Used on negative externalities in production. DWL is a good effect as there is less wastage, and gain on the welfare of the original room for efficiency.

Define implicit and explicit costs.

Implicit does not require an outlay of money from the firm, whereas explicit does.

Define the short run?

A period of time in which atleast one costing factor is fixed.

Define the long run?

The period of time needed for all factors of production become variable

Define diminishing Marginal Product?

Marginal Product of an input declines as quantity increases.

Define Rising Marginal Costs

Reflects the property of diminishing marginal product. All assets may not be utilized, and initially will provide a higher product for a lower marginal cost.