chapter 9- long-lived assets

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

PPE

long lived assets

a “non-current” asset

ex.

buildings

land

includes land improvement

leasehold improvements

right-of-use assets

conditions

controlled by company

tangible

used in operations

not for sale to customers

includes:

acc. amortization

finding cost of PPE

includes:

purchase price

includes non-refundable taxes and duties - discounts or rebates

freight and cost to make it ready for sale

est. cost of dismantling it at end of life

ex.

purchase price = 89,000

freight = 2,400

ready for use = 14,400+1,400

cost = sum of the above = 107,200

je

dr equip. 107,200

cr cash 107,200

classes

land

land improvements

buildings

equipment

Land

cost includes

purchase price + closing costs + costs to prepare land for use - any proceeds from salvage

ex. of closing costs

surveying land

title search

legal fees

has unlimited life

NO DEPRECIATION

ex. of expensed to land for

restoration costs

land improvements

costs of turning into a property

ex.

paving

fencing

making sidewalks

decline in service potential over time

therefore → recorded separate from land

depreciation occurs

does NOT include:

cost of making land ready for use

this is under “land”

buildings

cost includes:

purchase price + closing costs aka legal fees + cost of making building ready for use + construction costs - disposal proceeds

constructing

contract price

architect fees

building permits

excavation cost

interest costs

equip.

cost include

purchase price + purchasers freight charges + assembling + installing + testing

includes sales tax or cost of ins.

2 types of expenses during useful life

operating expenditures

benefits only the current period

maintenance to keep the asset at normal operating condition or cosmetic reasons

ex.

repairs

purchasing oil and gas for truck

replacing tires

paint jobs

je

dr expense

cr cash

capital expenditures

increases cost of asset

aka capitalizing an asset

increases:

life of asset

productivity

efficiency

ex.

replacing roof

purchasing buildings

purchasing ins. on equip. on transit

purchasing truck

anticipated retirement costs

adding a new wing to a building

je

dr ppe account

cr cash

leasing

pros

little to no down payment

low risk of obsolescence

cash outlays

instead of paying up front

100% financing

income tax advantage

lessor

owner of an asset for lease

ex. a landlord

lessee

person who’s leasing

ex. a tenant

obsolescence

being outdated or no longer in use due to the emergence of newer, more advanced alternatives or technologies

leasing rules IFRS

defines a lease as

an asset purchase financed with a loan provided by the lessor (owner)

risk and rewards of ownership transferred to lessee (renter) even though legal title has not passed

lessee (renter) needs to report the asset as a “right-of-use asset” and the related liability

lease can be treated as a period expense

conditions:

lease term is less than 12 months

the asset is low-value

lease rules for ASPE

2 types of leases

capital lease

all benefits and risk transferred to lessee

lessee needs to record the leased asset and related liab. at present value of min. lease payments

operating lease

benefits and risks NOT transferred to lessee

lease payment recorded as

expense for lessee

rev. for lessor

depreciation

allocation of the cost of a PPE over the asset’s useful life

does not determine current value of asset

does not use cash or provide cash to replace the asset

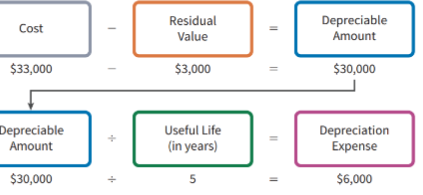

calculating depr.

factors

cost

purchase price + cost to get asset ready for use + est. asset retirement costs

useful life

period of time asset is expected to be used

or

# of units asset expected to produce

aka units of output expected

residual value

est. amount to be received from disposal at end of life

what it is expected to be sold for at end of life

depr. methods

methods:

straight-line

diminishing-balance

units-of-production

how to choose?

which best reflects the pattern of use of the benefits from the asset

if asked “ what depr. method should be used?”

do all 3 methods and find the one with the lowest depr. expense for the year

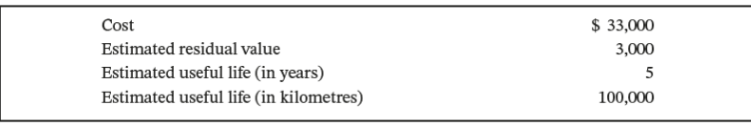

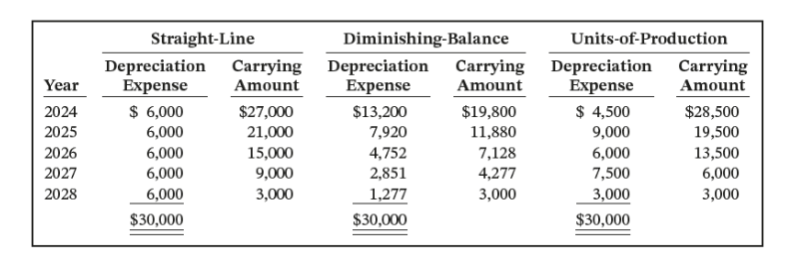

MAIN EXAMPLE

delivery van bought on Jan. 1, 2024

each method will give same total depreciable amount

straight line method

depr. is constant for each year

straight-line rate

100%/# of years in use = rate per year

100%/5 years = 20%/yr

je

dr. depr. expense

cr. acc. depr. - (ppe)

ex.

equipment cost = 143,770

on jan. 1, 2022

resid = 4190

useful life = 5

what is the je for depr. for sept. 30, 2024

cost - resid. = depr. amount

143,770-4190 = 139580

depr. expense = depr. amount/useful life

139,580/5 = 27916

27,916/12 = 2326.33333

jan → sept = 9 months so,

2326.3333×9 = 20,937

dr. depr. expense 20,937

cr. acc depr. - equip 20937

the depr. expense for the next time will be calculated based on the depr. amount of the last time

ex.

if last calc. on dec. 31, 2024 and next one on nov. 30 2025

see how much depr. expense elapsed from last to next by: acc. depr. - last depr. expense = nov 30 depr. expense

to get carrying amount

purchase amount - depr. expense or acc. depr.

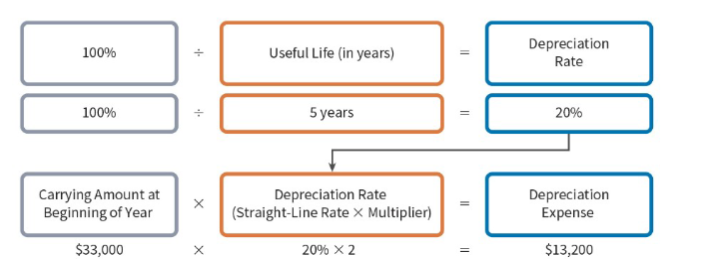

diminishing balance method

annual depr. decreases over the useful life of asset cuz based on carrying amount

declines each yr cuz acc. depr. increases each yr

depr. expense = carrying amount at start of yr* depr. rate

residual value not included

depr. rate = straight-line rate * multiplier

best if most use is in the earlier years of operation

db method ex.

purchased truck jan. 1, 2024 = 104,000

residual = 10,400

useful life = 4 yrs

depr. rate = 2x the straight-line rate

depr. rate = 100%/4 years = 25%

25%*2 = 50%

2024 yr-end

104,000×50% = 52000 depr. expense

104,000-52,000 = 52,000 (new carrying amount) and so on

when you get to the last yr. or when next carrying amount is below residual

do last carrying amount - residual

13,000 - 10,400 = 2,600 depr. expense

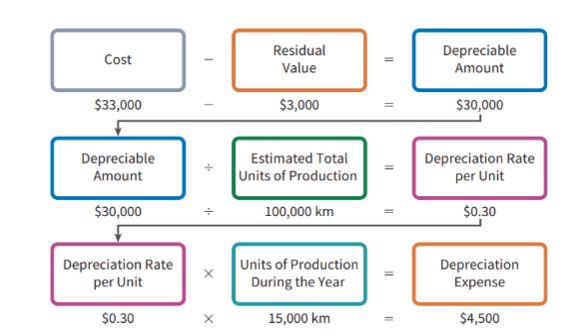

units-of-production method

useful life = total units of production or activity expected from asset

ex.

units produced

hours machine is worked

best way for:

factory machinery

vehicles

airplanes

any asset whose usage changes over time → seasonal

depreciable amount = cost - residual value

depr. rate/unit = depr. amount/est. total units of production

depr. expense = depr rate/unit*units of production in yr

ex.

cost = 35,370

resid. = 520

expected km. to be driven = 348,500

amount driven in 2023 = 104,370

amount driven in 2024 = 115,630

cost-resid = depr. amount

35,370 -520 = 34,850

depr. amount/ expected km. to be driven = depr. rate

34,850/348,500 = 0.1

now get depr exp. for each yr

0.1×104,370 = 10,437 for 2023

0.1×115,630 = 11,563 for 2024

getting carrying amount for UofP depr.

purchase amount - depr. expense

for any year

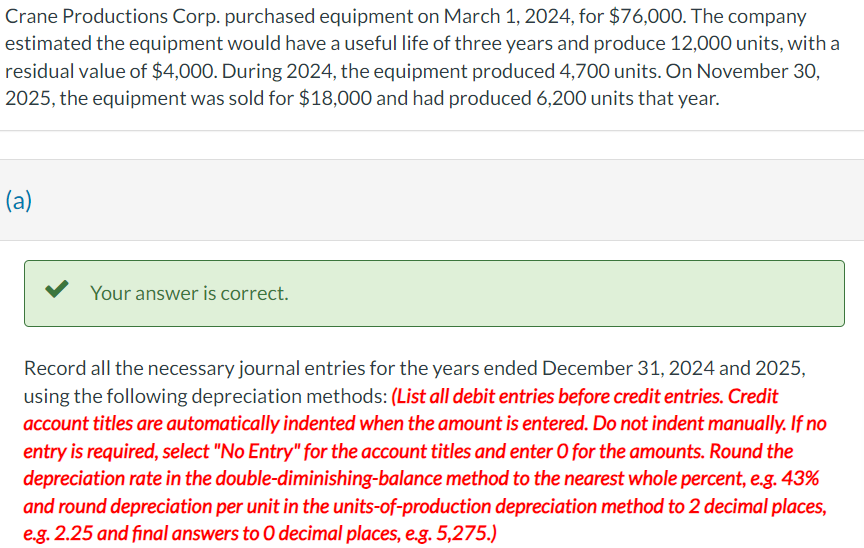

MAIN EX. 2

march 1 entry is always the same

for sale always:

cash = 18,000

equipment = 76,000

only things that change are:

acc. depr.

gain or loss

months between march 1 2024 and dec. 31 2024 = 10 months

months between dec. 31 2024 and nov. 30 2025 = 11 months

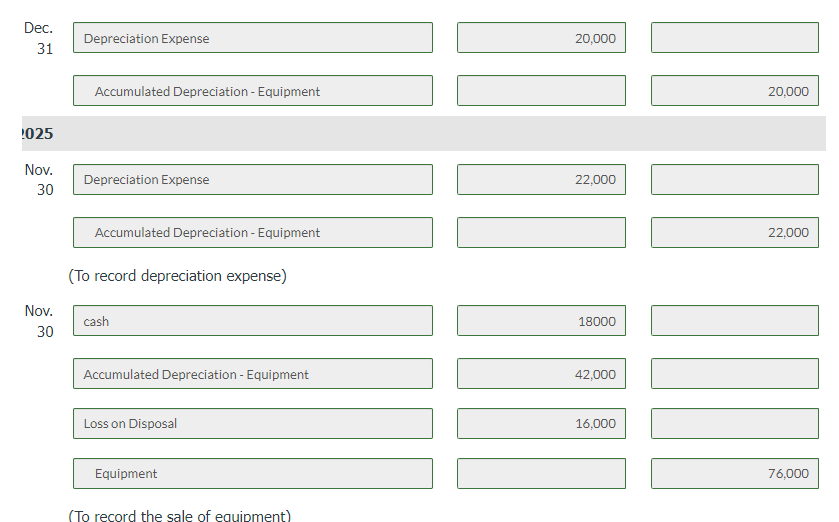

straight line for main ex. 2

dec.31

cost - resid = depr. amount

76,000 - 4,000 = 72,000

/3 = depr. expense per year

72,000/3 = 24,000

/12 = depr. expense per month

24,000/12 = 2,000

march 1 to dec. 31 = 10 months so,

2,000×10 = 20,000

nov. 30

depr. expense

dec. 31 2024 to nov. 30 2025 = 11 months so,

11×2000 = 22,000

sale

acc. depr equip.

20,000+22,000 = 42,000

loss or gain

76,000 -( 18,000 +42,000) = 16,000

positive = loss

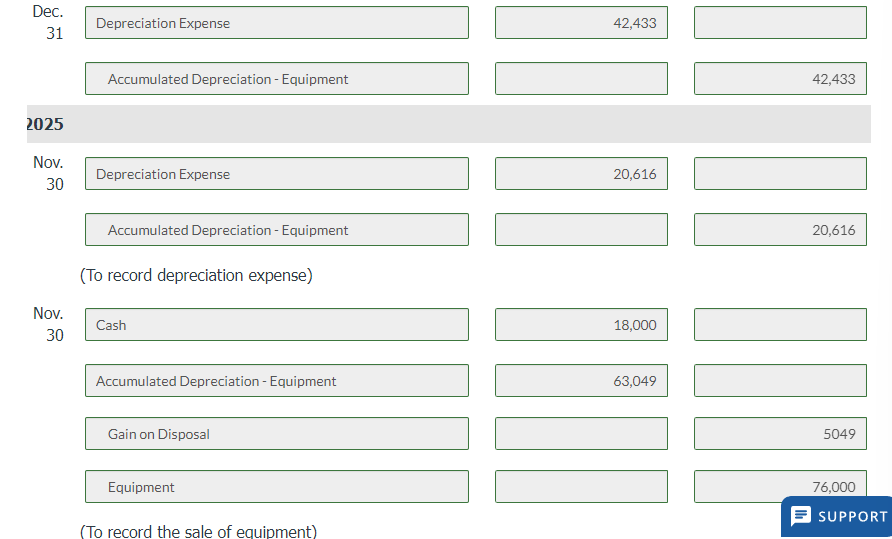

db for main ex. 2

dec. 31

100%/3yrs = 0.33333 depr. rate

“double diminishing” = 0.33333×2 = 0.6666 = 0.67

cost*0.67 = depr. expense per year

76,000×0.67 = 50,920

/12 = depr. expense per month

50,920/12 = 4,243.3333

*10 = depr. expense from march to dec. 31

4,243.3333×10 = 42,433

nov 30

depr. expense

cost - last depr. exp. = new carrying amount

76,000-42,433 = 33,567

*0.67 = depr. exp. per year

33,567×0.67 = 22,489.89

/12 = depr. expense per month

22,489.89/12 = 1,874.1575

*11 = depr. expense

1,874.1575×11 = 20,616

sale

acc. depr = 42,433+20,616 = 63,049

gain or loss

76,000-(18,000+63,049) = -5049

negative =gain

uofp for main ex. 2

for uofp dates do not matter only amount of units

dec. 31

76,000-4,000 = 72,000

/12,000 units = depr. per unit

72,000/12,000 = 6

6*units for 2024

6×4,700 = 28,200

nov. 30

depr. expense

6×6,200 = 37,200

sale

acc. depr = 37,200+28,200 = 65,400

gain or loss

76,000-(18,000+65,400) = -7,400

negative = gain

revising depr.

revision need if:

change in est. useful life or residual value

capital expenditures (additions during useful life

impairment

change in pattern of econ. benefits are consumed

revision is account for as a change in estimate

shown in current and future yrs not previous yrs

to get the changed depreciation expenses after the date of revision:

straight line

latest carrying amount - the revised residual then /revised amount of useful life = depreciation expenses

recording asset impairments

when carrying amount > fair value

diff. = amount of loss recorded

indicators of impair. need to be found on a daily basis

if present → do impair. test

record as:

dr Impairment loss

cr respective Acc. Depr. account

results in a revision of the depr. estimate

accounting for natural resources

consumed physically over time

aka wasting assets

depr. of natural resources is called depletion

depr. method is usually units-of-prod.

cuz production can vary form yr to yr

reserve values = fair value of resource

impairment will occur if: reserve value<carrying amount

significant components

may depr. separately

cost vs. revaluation model

revaluation allowed under IFRS but used on a limited basis

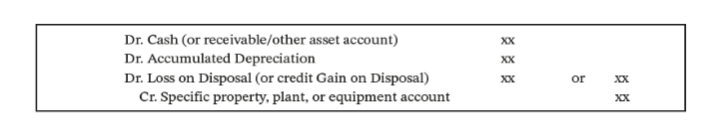

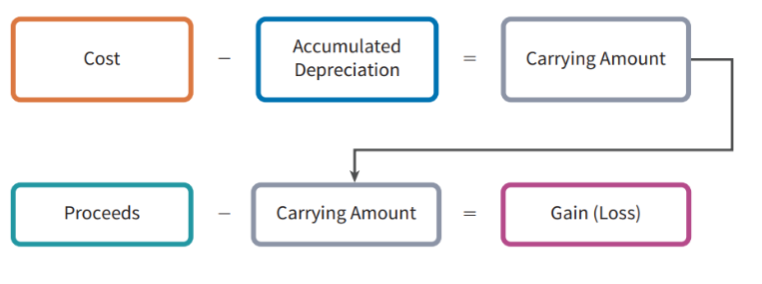

selling PPE

need to record disposal

removal of cost of asset and acc. depr.

records proceeds if any

record gain or loss on disposition if any

retirement of asset

same as disposal except little to no proceed of disposition

ex.

equipment cost = 143,770

on jan. 1, 2022

resid = 4190

useful life = 5

what is the je for selling on sept. 30, 2024

cost - resid. = depr. amount

143,770-4190 = 139580

depr. expense = depr. amount/useful life

139,580/5 = 27916

27,916/12 = 2326.33333

jan → sept = 9 months so,

2326.3333×9 = 20,937

so, acc. depr. is:

acc. depr = 2022, 2023, and 2024 depr.

acc. depr = 27,916+27,916+20,937 = 76,769

use to get loss or gain on disposal

cost - (how much sold for + acc. depr.)

143,770(40,550+76,769) = 26,451

positive = loss

negative = gain

je

dr

cash 40,550

acc. depr.- equip. 76,769

loss on disposal 26,451

cr

equipment 143,770

intangible assets

not physical

they are:

rights

ex.

franchise

license

privileges

competitive advantages

ex.

intellectual property

patents

trademark

needs to be identifiable

can be:

separated from company, sold, licensed or rented

based on contractual or legal rights

how its accounted

recorded at cost + costs to make ready for use

includes:

developmental costs

intangibles finite vs. infinite life

if intangible has a finite life → cost will be allocated over useful life

amortization

depreciation is for tangibles

over est. useful or legal life

whichever is lower

needs to be tested for impairment and write-down when needed

ex.

patents

right to produce for 20 yrs

copyrights

protection for lifetime of creator + 50 yrs

research and develop. costs

all research costs expensed

develop. costs only capitalized if associated w/ a identifiable, feasible product

if intangible had a infinite life

no amortization

ex.

trademarks or trade names

word

phrase

jingle

symbol

franchises

contract to sell products

licenses

grant operating rights

goodwill

represent future benefits from the purchasing of the business

extra cost on top of fair market value of net identifiable assets (assets - liab.)

extra value of business when purchased

only identifiable w/ the business as a whole

not amortized

subjected to annual test of impair.

ex.

market value of assets = 1,100,000

liab. = 600,000

company sold for = 650,000

good will?

market value of assets - liab.

1,100,000-600,000 = 500,000

company sold for-500,000

650,000-500,000 = 150,000 (good will)

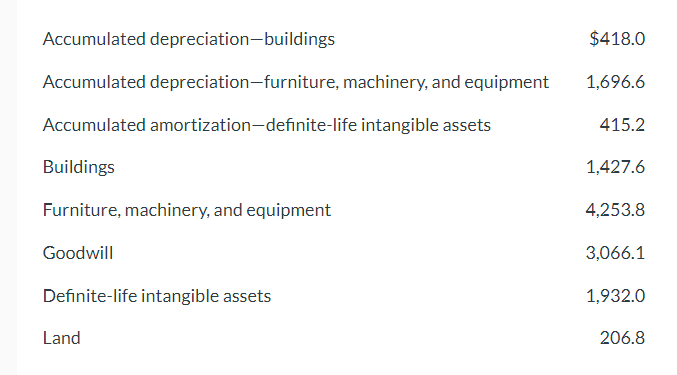

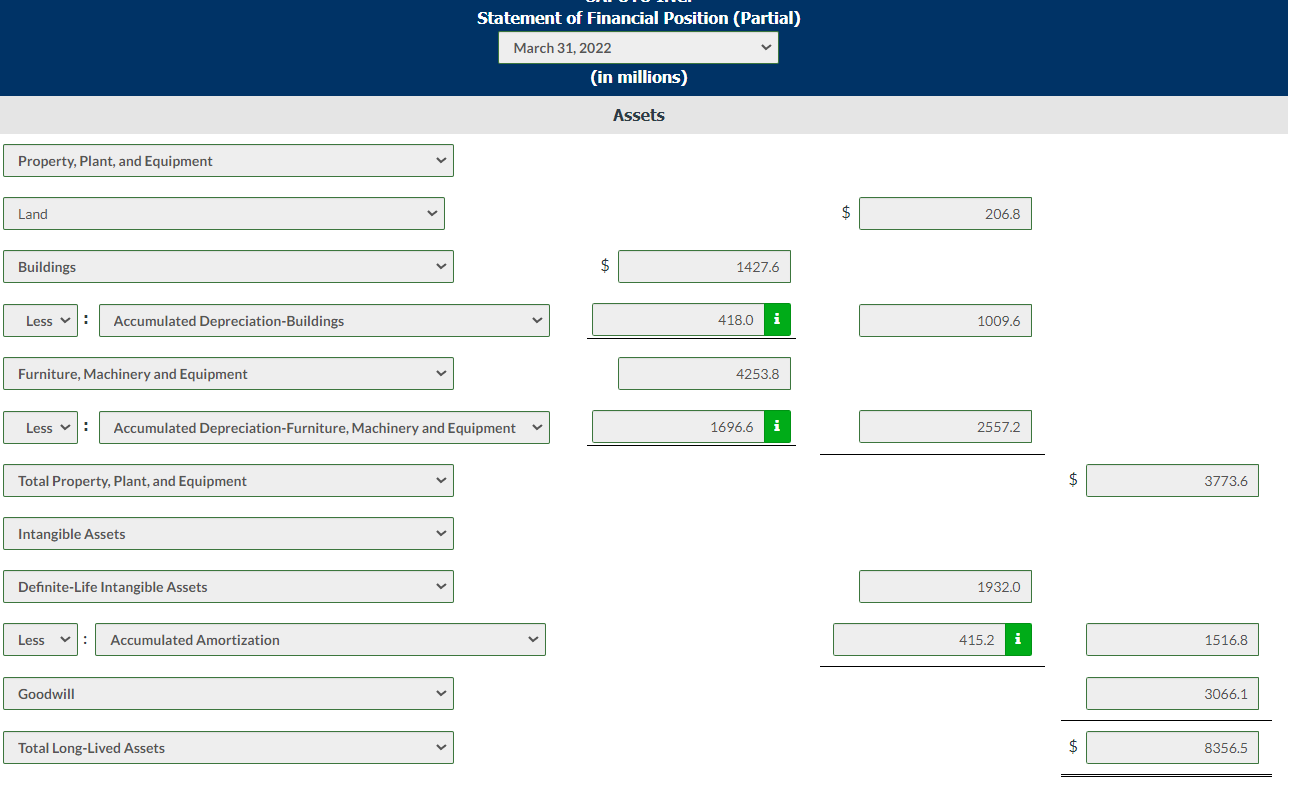

long-lived assets in state. of fp

non-current asset under:

PPE

Intangible assets

Goodwill

shows cost and acc. depr of each

can be in statement or notes

disclose depr./amortization methods and useful lives or rates

more disclosures for IFRS

Long-lived assets in state of inc.

under operating expenses

depr. expense

amortization expense

gains and losses on disposal

impairment losses

repairs and maintenance expense

ex.

vehicle license fee

vehicle expense

buying a new one

painting to advertise the truck

long-lived assets on state. of cash flows

under investing:

cash flows from purchase and sale of long-lived assets

return on assets

measures profitability

return on assets = net income/ avg. total assets

or

profit margin*asset turnover = return on assets

profit margin = gross profit/rev.

profit margin and asset runover explain the return on assets ratio

ex.

A

return on assets = 8.9%

asset turnover = 0.4

B

return on assets = 8.3%

asset turnover = 0.8

gross profit = return on assets/asset turnover

0.0089/0.4 = 22.3%

0.0083/0.8 = 10.4%

higher = better

shows that for every $ invested in assets = more net income

asset turnover

how efficiently assets are being used

asset turnover= sales/ avg. total assets

high = better

shows that for every $ invested into assets → more sales

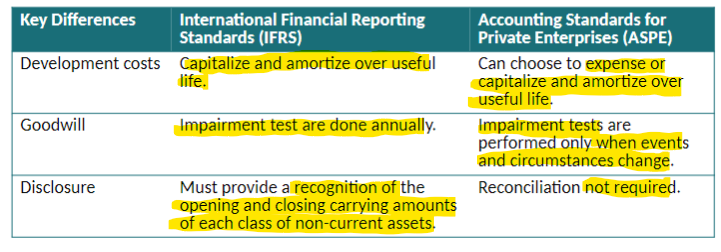

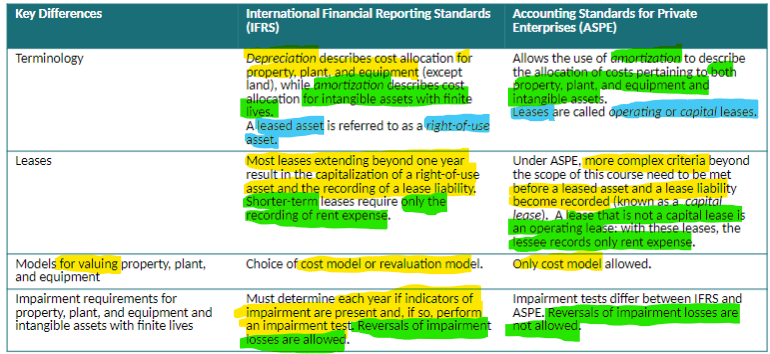

IFRS vs. ASPE