FINAL REVIEW FAR

1/105

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

106 Terms

A problem states find the amount “attributable to the parent company” or “total consolidated net income”, what happens?

Attributable to parent company- Parent Income + Subsidiary - any NCI portion if present

Total consolidated net income: Parent income + Subsidiary(NCI is included here)

A problem states “what is the parents equity for consolidation”, what happens?

The subs equity is eliminated

Parents equity + NCI portion = total consolidated

Find net income before dividends for sub

Find the NCI portion for the total stock,

Find the NCI dividends

NCI = NCI stock + NCI Net Income - NCI dividends

Add that to parents equity

A problem mentions to figure out what is considered to be program and support expenses for an NFP, what is not considered, (hint think improvement of fixed asset)

Improvement to fixed assets are not considered to be program expenses or support for NFPS, as they are capitalized because they increase the useful life. When these improvements are depreciated, however, the depreciation is considered to be an expense for a program or support, whichever one it falls into.

Example- renovations to locker rooms is indeed a program expense, but it is capitalized with only the depreciation expense being included over time

A problem mentions “find the current maturities of a lease”, what happens?

Current maturities is the amortization for the next year

its defined as the portion of liability due to be paid within the next year

What are split interest arrangements? What type of donation is it, and what is contribution revenue?

Receiving a donation but also owing a 3rd party

also is sharing the benefits

restricted donation

Contribution revenue : Donation - liability

When are unconditional promises and conditional promises recognized? Whats the journal entry when the pledge is received?

Unconditional- recognized in full when received

Conditional- recognized when conditions are met

When conditions are met

Debit Pledge receivable

Credit contribution revenue

What are accrued vacation 4 conditions and what happens? What happens with vest and accumulation, however? What does vest mean? What happens to sick pay and how does it relate to vest?

Services rendered

Vest or accumulated

Payment is probable

Amount easily estimated

if all 4 are not met, they are disclosed

However, if accrued vacation vests or accumulates, it is accrued regardless if the other conditions are met

Vest- absolute right to payment even if employee leaves

Sick pay= only accrued if vest

A problem gives the investment cost, the total equity of whos being invested in, and the fair market value of assets, what do you do with those?

Find excess of investment |

Total excess = Investment - NBV (Equity * % owned |

Find excess fair value of assets |

FMV of assets- NBV aka the total equity |

Find % of the excess of the FMV and the equity |

Excess goodwill = excess from investment - excess fair value - any intangible assets |

For endowments that use income to fund expenses, if theres a problem that mentions the endowment is for a specific purpose and it buys that purposes, what happens? If the problem mentions it buys some other thing not related to the endowment, what happens?

Related to endowment- grab from the income of endowment and reduce with donor restriction and increase without donor restriction

Not related to endowment- grab and reduce money from without donor restrictions

For SOME of the time problems, they may test you on say a company hires college students, and then is offered by a professional service to do the same job, what happens for contribution revenue?

No contribution revenue is recognized because the job can be done by non professionals, so the task does not require a specialized skill

If a problem mentions for uncollectible allowances theres a debit balance to start, and then you calculate and end up with a credit for the ending allowance, what happens? If it asks for the ending allowance, what is it, and whats the journal entry for credit losses?

You make a T chart and find how much it takes to go from the debit to credit. For example, 50k debit to 90k credit means a 140k adjustment to credit loss expense. If it asks for ending allowance, its 90k

Debit- credit loss expense 140k

Credit- allowance for credit losses 140k

Going from accrual to cash, whats the method to remember, and what is allowance for doubtful accounts considered?

The method is to flip debits and keep credits the same, so an increase in AR means you reduce, while an increase in AP means you add

Allowance for doubtful accounts is a credit account, so an increase you add

When expense is higher in tax or book or when net income is higher, what happens?

Expense higher in taxable income, means net income is higher in book = DTL

Expense higher in book, means net income in tax is higher = DTA

What are exit or disposal costs and when are they recognized?

Exit and disposal

involuntary employee termination

costs to terminate a contract thats not a lease

costs to relocate or consolidate facilities

Liability is recognized

plan communicated to employees

plan committed with no changes

benefits established

employees identified and date

What are change in methods of accounting and example?

Prospective treatment that are change in accounting principle inseperable from a change in estimate. Example is depreciation, amortization, depletion, or demo costs to expensing immediately because its changing expense recognition estimates

For donation of collected items, whats the 3 criteria and what happens if not met? When do you not record it?

Item part of collection for public viewing, education or research

Cared for

Policy to reinvest any proceeds into collection

if not met, record as contribution revenue and as an assets

if all 3 are met, dont record on IS

dont record if no value is known , no alternative use

What is the formula for loss from discontinued operations? When are impairment losses first recorded?

Impairment loss + operating losses for the year

impairment losses are recorded for the year on December 31 if thats when management commits to discontinue.

What is an ARO expense and its formula? Whats the ARO formula? Whats the accretion expense formula? Whats the journal entry for an ARO and accretion expense?

ARO Expense = Beginning ARO for the year + accretion

ARO= The Amount/useful life for straight line depreciation

Accretion expense = Beginning ARO * credit adjusted risk free rate

Debit- ARO Asset X

Credit- ARO Obligation X

Debit- accretion expense X

Credit- ARO liability x

If a problem mentions there are lease hold improvements, what do you do to them?

Capitalize and amortize lease hold improvements over the shorter of lease term/useful life

For more likely than not for taxes, if 50k wont be realized, what happens? And whats the corresponding journal entry? If you’re given a chart, what do you recognize for more likely than not?

50k of DTA wont be realized, so its an increase in the periods income tax expense by 50k

Debit Income tax expense 50k

Credit Deferred tax valuation allowance 50k

If given a chart with % and amount, you recognize the largest amount over 50% as savings/benefit

For taxes, what are the % of dividends that are excluded chart?

0-19% = 50% exclusion of dividends

20-80% = 65% exclusion of dividends

80%-100% = 100% exclusion of dividends

the % of dividends is reduced from total dividend income to get taxable income

Whats the difference between major activities for NFPS and minor activities for NFPS, if a problem mentions it in words?

Major activities- Don’t net contributions and expenses into contribution revenue on statement of activities. Instead, report seperately and record the contribution revenue as just the donation ( this is the gross amount )

Minor activities- You can net them together to obtain the contribution revenue

How should notes receivable be reported on the balance sheet when one note has customary trade terms not exceeding one year and another note has terms exceeding one year?

Notes receivable with customary trade terms not exceeding one year are reported at face value (no discounting required).

Notes receivable with terms exceeding one year must be reported at the present value of the note, discounted at the market interest rate, with the discount amortized over the term of the note.

Hart

Maxx

Face amount of note

10,000

10,000

Interest rate

3%

Annual interest

300

Term of note

5

Interest

1,500

Principal

10,000

Amount due at maturity

11,500

Present value factor

× 0.680

Present value of notes

10,000*

7,820*

*Customary Trade Terms

What is the chart for beneficiary accounting

Recipient has | Recipient Recognizes | Beneficiary Recognizes | ||

Unaffiliated | Variance power | Contribution | Nothing | |

Unaffiliated | No VP | Refundable Advance | Contribution | |

Financially Interrelated | Variance Power | Contribution | Nothing | |

Financially Interrelated | No VP | Contribution | Change in net assets of interest |

When a construction contract is complete, when are gains and losses recognized?

Gains when completed, and losses when they incur in the year in FULL

How are contract billings determined? If contract billings are greater than or less than the billings, what happens?

Costs incurred to date + gross profit

if this is greater than billings = asset

if this is less than billings = liability

How are losses on underwater endowment funds reported and what will be a cue to recognize?

Report accumulated losses together in net assets without donor restrictions

Total endowment balance pre fair value drop

Less fair value

= investment losses

the problem will mention “investment losses will be” if you are looking for this

What are some cash flow operating misc items? What are financing misc items? What are investing misc items?

Operating

dividend income earned

interest payment and earned

gains/losses on trading/AFS/HTM increase/decrease in values

selling trading securities

Financing

dividends paid

buying treasury stock

Investing

cash proceeds from selling the HTM, AFS securities, or long term (non current trading proceeds)

What is the difference between operating items technically in operating activities and supplemental disclosures?

Items

interest paid (2k increase) from 250k

income taxes paid

dividends received

In operating, only the changes to the previous values are shown as a separate line item

In supplemental disclosures

base or original disclosed, such as 250k

non cash transactions

When donated securities restricted for long term use are received, sold, and used, what are they reported as in cash flows?

Received=financing

Sold=investing

Used=investing

For vacation liability and expenses, what is reported?

Liability- what is owed

Vacation expense- what is owed + what has been used

In problems dealing with contribution revenue, what is one thing you must be careful of when asking for like misc sales revenue vs contribution revenue?

Misc sales revenue is what is given up

Contribution revenue is the difference of the gift - misc sales revenue

What are notes payable reported at?

PV of payments to be made using market rate of interest + any costs or down payments afterwards

(PV of payments 6000×2.58)

+4000 +2000 + 3500 costs

What is gross tuition revenue?

Payments + scholarships - refunds

What is net patient service revenue calculated as? What are expenses for patient service revenue as?

Gross patient service revenue - contractual adjustments

Expenses are anything else, such as provision for credit loss + charity care

If an item is disposed of, what must you do before calculating gain or loss? Whats the journal entry?

Calculate depreciation expense on that day of disposal?

Debit- Accumulated depreciation

Debit- loss on transaction

Credit- PPE for the total cost that it was bought for

With type II subsequent events, what is important regarding disclosures? What are some examples?

Disclosures are not require, they are encouraged but not required.

not required for immaterial events, should be, but not required

What is internal service funds and an example to lock it in your mind?

Funds for within, such as car maintenance pool providing support for county vehicles

What is custodial funds and an example to look in your mind?

When the government acts as an agent for temporary funds, such as holding alimony, or taxes, or specifically, a treasurer collecting property taxes, holding them, then distributing to schools. Or collecting and distribution pension funds. KEY IS THE GOVERNMENT IS THE MIDDLE MAN

What is an enterprise fund and example to lock in your mind?

Provides services to public and can be financed by revenue bonds. The construction of UTILITIES is an enterprise

What is capital projects fund and an example to lock in your mind?

Funds for major construction or acquisition of major capital assets. These are financed by general government resources like taxes or general obligation bonds for schools, roads, or buildings.

What is a private purpose trust fund?

Principal and income funds are restricted to private parties

What is one thing you need to lock in for bank recons?

Bank statement

deposits in transit

outstanding checks (not cleared by bank)

errors

Book balance

subtract NSF checks, fees

add fee rebates

add timing differences like rent check

What is the journal entries for a finance lease?

Finance

Initial

ROU ASSET X

Lease Liability X

1st payment without interest

Lease liability X

Cash X

1st payment with interest

Interest Expense X

Lease liability X

Cash X

Amortization (PV of payments/useful or lease)

Amortization Expense X

Accumulated Amortization-ROU Asset X

What is the journal entries for a operating lease? How do you get the lease liability and amortization

Initial

ROU ASSET X

Lease Liability X

1st payment

Lease Expense X (stated payment)

Lease Liability X (

Cash X (stated payment)

Amortization X

Amortization= Lease expense - interest on CV

With additional costs for a lease, whats the initial journal entry?

ROU Asset X

Lease Liability X

Cash X

What does principal on a lease reduce? If it asks for ROU asset value what do you do? If it said the PV payments include a 5000 BPO, what happens? When given a residual value and a chart for PV values, what do you do?

Principal reduces lease liability

Subtract amortization from ROU asset, dont use interest to get ROU carrying value

The 5000 BPO already included, dont add again

PV of payments + PV residual = initial

What is one thing you must do for calculating years such as yan year 5 to dec31 year 10?

This is 6 years

What is the eliminating JE for depreciation for consolidation?

Gain on sale X

Accumulated depreciation X

Depreciation Expense X

Equipment X (credited for how much depreciation has reduced by for the parent)

What is book value per share formula?

(Equity-PS-Dividends in arrear)/CS outstanding

For bonds that are called and retired, what happens? When do you experience gains or losses? Whats the journal entry for a gain or a loss? What do you flip for the JES when its the opposite of what you have? Where is the gain or loss recorded?

Carrying value of bond (Face +- amortized)

Less cash paid to retire bond

= gain or loss

a gain is for a premium if you pay less

a loss for a premium if you pay more

JE Gain

Debit- Bond Payable

Debit- Premium on BP

Credit- Cash

Credit- Gain on Bond retirement

JE Loss

Debit- Bond Payable

Debit- Loss on bond retirement

Credit- Discount on BP

Credit- Cash

flip the loss and gain for bond retirement with the premium/discount when its the other way around (u don’t have that JE here)

gain or loss recorded in continuing operations

What is the restructuring of payables and loss of transfer of assets?

Restructuring of payables

New debt - FV of asset transferred

Loss on transfer

CV of asset - FV of asset

What is the total credit loss expense for a year? A question may ask you “after year end adjustment” or “whats the adjustment” to credit loss expense, what do you do?

Estimated credit losses + adjustment to get to the ending

Adjustment = adjustment to get to ending

After year end adjustment = ending allowance per aging

For pledging receivables, what is disclosure requirements and journal entries? Fill in the bank “ discount a note, ___ a receivable”

Pledging receivables require only note disclosure, with no journal entry for accounts receivable.

factor a receivable

What is the elimination of intercompany notes payable?

Debit- Intercompany Notes payable

Credit- Intercompany notes receivable

When is interest capitalized and expensed for construction? A problem will mention “reported as interest expense” or “capitalized interest” for the answer. What affect do payments have on capitalized interest?

Interest capitalized during construction

Interest is expensed during delays or not during construction

payments don’t affect capitalization, only notes

For loan annual payments, they usually want you to calculate interest expense based on outstanding principal balances before payment, what does this mean? How do you break down a total payment with inerest?

Interest year 1: $3m * 10% = 300k

After paying $1m in principal, new CV is $2m

Interest year 2: $2m * 10% = 200k

Loan: 100k, 8% rate, 3 years

Annual payment (principal + interest) = 39870

Interest = 100k*8% = 8000

Annual payment = 31870 principal

New CV = 100k-31870 = 68130

Repeat for future years

What do costs for land include? What do non costs for land include?

Costs for land- up to excavation to get land ready for use

Non costs for land- debt issuance costs like underwriting fees, legal fees for bonds

What is the improvement/replacement chart?

Expense | Capitalize | Reduce accumulated depreciation | ||

Increase quantity | X | |||

Improvement or replacement increase life | X | |||

Improvement or replacement increase efficiency | X | |||

Ordinary repair | X | |||

Extraordinary repair increase life | X | |||

Extraordinary repair increase efficiency | X | |||

What are examples of increasing efficiency cues in a problem?

Reduces costs, saving time, improving output. This also does not increase market value or the useful life.

What is group/composite depreciation and units of production depreciation?

Group: (Total cost - total salvage)/total depreciation

Unit: (Cost - salvage)/estimated units * numbers produced

Where are impairment losses for held for sale and PPE, and disposed of and held for disposal? Are they reversed?

Held for sale/PPE= income from continuing operations, non reversable

Disposed/held for disposal: discontinued operations, reversable

When 1 loan is tied to construction and another isnt, what happens? What is capitalized interest? What is total interest and interest expense?

Find average expenditures for the year from (expenditures * portion outstanding)

take first loan * interest

Remaining difference of expenditure after first loan is * the other interest rate

Both combined is the capitalized interest

Total interest is both loans combined

Interest expense is remaining interest after capitalized

6m+8m = 7m average

6m*8% = 480k

1000000×09% = 900000

Capitalized interest=570k

Total interest is 6m*8% + 8m*9% = 1.2m

Interest expense is 630k

Whats one thing you have to lock in for accrue and disclose? (hint estimation and loan guarantee)

Reasonably estimted = create liability account

Loan guarantee- exception to disclose but not accrue

When are dividends in arrear and dividends reported and disclosed?

Dividends in arrear= not a liability until disclosed

Declared dividends- liability to dividends payable

What is short term to long term refinancing?

Short term to long term= refinanced and money provided

Short term to long term deal falls through = remains short term liability

When something like a note payable is retired by issuing stock , what happens?

1.5m excluded from current liabilities (stock amount)

250k reported as current liability- remaining loan balance

This is important, for gains and losses on securities, what happens on the statement of cash flows for operating activities?

Gains and losses are not deducted or added to net income under indirect method as net income already includes the gain/loss

In short, dont adjust again

Working from the bottom up for a bonus question, bonus is = 10% of income before tax but after deduction of bonus

tax rate is 40%

Net income after bonus and income tax = 360k

Pre tax income : 360k/60%=600k after deduction for bonuues

Bonus: 600k*10% = 60k

Income before bonus = 660k

For the equity method and stock dividends, cash dividends, and undervalued asset, what are the affects to investment account, income, and JES?

Stock dividend- no affect as no income is recorded.

just adjust unit cost per share, just a note disclosure about more shares. No JE

Cash dividend- reduce investment account by dividend

reduces investment account

doesnt affect investment income

Debit-Cash

Credit- Investment in investee

Undervalued asset

reduces investment account and investment income

Debit- equity in earnings

Credit- investment in investee

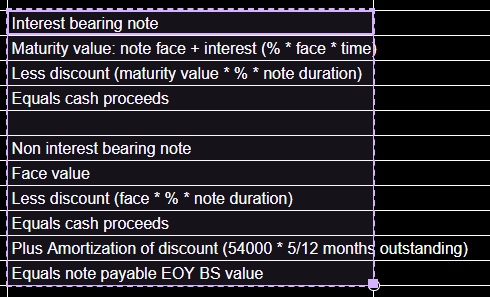

For a interest bearing note and non interest bearing note, what are the formulas?

To find goodwill of a purchase, what are the steps?

Step 1- Look at dates for when equity is given

if equity is given at end of year, you must find beginning of the year for equity, cuz thats when the stock was bought

End of year equity + total dividends paid out - net income = beginning

Step 2- add any fair value in excess of equity to the beginning equity

Step 3- Multiple the total equity + fair value of assets times % ownership to get % of assets purchased

Step 4- subtract Purchase price of stock - FV of assets purchased to get goodwill

For an NFP, what is the residual interest?

Residual interest is what is left of assets - liabilities

For nates payable reporting liabilities and carrying value, what happens at end of year. maturity value, and after?

EOY- 468500 CV and liability reported

Maturity date- full note payable CV and liability reported

After maturity date- 0 because note matured

In looking at problems to find amount from operating or investing etc, they may give carrying amount and cash amount paid, what do you use? Also, do you add cash to operating?

Use cash amount paid no carrying amount. Dont add back cash to operating as at the end of each section its "cash used or received"

For the CECL model, what do you compare? What is ignored for HTM, and what is used for AFS securities and trading?

Historical cost to PV for loss or a gain. Cost > PV = credit loss.For trading, fair value is used for impairment loss, with gains and losses in OCI. For AFS, if FV>COST, no impairment. If COST (500k)>FV(480k)>PV(473k), then 20k credit loss in net income, with 7k loss in OCI. Credit loss is based on Cost to present value. Trading is only looked at with fair value, no credit loss

If asked for BS for equity method, what do you include? What do you include for IS?

Balance sheet = original cost + % of NI, -% of dividends, -% of amortization, -% of writeoffs |

IS= Net income share - % of amortization (FV excess/life), -% of write offs, exclude dividends |

For subsequent events, when the company finds out about a lawsuit, is it relevant? What is?

Its not relevant, should be accrued and disclosed if loss is reasonably estimated and probable

WHat is federal income tax withheld, employee fica tax and employee fica tax?

Federal- liability by employer to gov |

Employee fica- liability by employer |

Employer fica- liability and expense |

If a problem asks for cost of inventory or cost of COGS/selling inventory, what does it mean for calculating?

Cost of inventory- total inventory remaining |

COGS- cost to sell |

In a sim, if it doesnt tell you to put zeroes, what do you do? What are adjustments for a sim?

Leave cells blank if doesnt tell you to put zeroes |

Adjustments for a sim are what should have been, so you put the difference |

If a number shouldnt be recorded, its a negative to reduce it |

In a sim for a lease, if given a BPO and a PV chart, what do you use for the amortization and PV of payments?

Use useful life for amortization for BPO

What is base for equipment? What is accumulated depreciation equal?

Beginning cost of asset |

Plus purchases |

Less cost of equipment sold |

Ending balance\ |

CV= Cost - accumulated |

What is future deductible amount and future taxable amount for DTA and DTL?

DTA is future deductible amount, also means profit in current year |

DTL is future taxable amount, means loss in current year |

In operating and investing, where are gain on sale or loss of fixed assets and proceeds?

Operating- gain or loss on fixed assets |

Investing- proceeds from selling |

What do loans deal with which is opposite of bonds, and how are they calculated?

Loans deal with interest income, same calculation as bonds |

Interest income same calculation to interest expense |

Borrower = expense |

Lender = income |

They also deal with interest receivable which is face * stated |

What is loan amortization table and JES?

Beg Bal | Interest income | Principal repayment | Ending loan bal | |

% * balance | (Pymt-interest) | Balance-principal | ||

Original | ||||

Loan receivable | x | |||

Cash | x | |||

Deferred interest rev | x | |||

Accrued interest | ||||

Interest receivable | X | |||

Deferred interest receivable | X | |||

Interest income | X | |||

PAyment | ||||

Cash | X | |||

Deferred interest receivable | X | |||

Interest income | X | |||

Loan receivable | X |

What must you report discontinued operations as for the gains or losses? Net of tax hint

x * (1-tax)

What do you have to look out for when you receive a chart and are asked to name expenses? What are expenses vs capitalized assets?

The chart will mix in assets that are capitalized

assets short term for current period

capitalized assets for longer period that provides benefits over multiple periods

What must you do when you get dilutive securities(potential)?

Dilutive test

What is impairment loss?

Book value - fair value

Are PUFI Adustments taxed on statement of equity?

Yes, net of tax

Whats a cue for dates?

Watch out for dates issued, if its mid year, quarter, full year

For interim reporting purposes, what do you do with cumulative balances?

Report cumulative balances by adding up previous recorded income

When are exit /disposal activities liability recognized?

Liability recognzed when an event that creates a present obligation or transfer occurs

When you capitalized and expense interest for assets for own use and held for sale?

Own use- capitalize during construction and expense after

For sale- expense all interest

What is a misc item for change in estimate? Whats a misc change for principl change? If given a chart and there’s an item that is supposed to be inseparable from change in estimate, what do you put?

Write offs for estimate and FASB stantdard changes for principle change

put accounting principle

What do you do for AJES?

Record what should be left in the balance

Where can accumulated depreciation be?

As a seperate line item in non current assets