Financial Accounting (Midterm 1 FS)

0.0(0)

Card Sorting

1/87

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

88 Terms

1

New cards

Securities Exchange Commission

An organization created by the Securities Exchange Act in 1934, that is responsible for enforcing the securities industry and protecting investors. It determines the measurement rules for financial statements companies must provide to stakeholders and oversees financial reporting for U.S companies.

2

New cards

Generally Accepted Accounting Principles

The common set of accounting principles, standards, and procedures that companies use to compile their financial statements. These are the principles that the SEC requires publicly traded companies to comply with. Ensures there's an apples to apples comparison between competitors when an investor/ finance person looks into businesses.

3

New cards

True or False: GAAP are only used in the United States

True

4

New cards

External Auditors

Independent people who aren't employees of a company, but are paid by them to ensure that companies are accurately recording and detailing their financial information. Auditors are used because people inside a company might inflate their and financial statements.

5

New cards

PCAOB

Public Company Accounting Oversight Board: a board established after the fall failures of Enron that requires auditors to be independently & externally reviewed and overseen to monitor the quality of their audits. Enron was a company that had a lot of debt and went bankrupt after a scandal caused their stock to plummet along with their reputation.

6

New cards

What organization serves as a check for external auditors?

PCAOB

7

New cards

Balance Sheet

Consists of assets, liabilities, and shareholders' equity: reports a company's financial position at a point in time. It consists of the heading, name of entity, title of the statement, the date, and the unit of measurement. The date is written as "At/As Specific Date," because it's referring to a specific point in time. When looking at liabilities, most helpful to look at short-term significant debt, instead of long term

Equation is A-L=Shareholders' Equity

Equation is A-L=Shareholders' Equity

8

New cards

Income Statement

Consists of revenue, expenses, and profit: measures the accountant's primary measure of economic performance during the accounting period (profitability). The date is written "For The Date"

9

New cards

Gross Profit Margin

Gross Profit/Sales Revenue x 100

10

New cards

Gross Profit Equation

Revenues-Cost of goods sold

11

New cards

Equation for Income Statement

Revenue-Expenses=Net Income

12

New cards

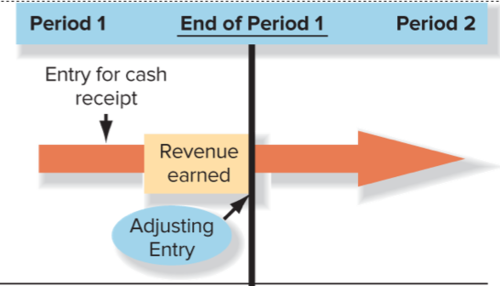

Revenue

Measures the inflow of assets incurred in generating incomes. Formally defined as increases in assets or settlements of liabilities from the major ongoing operations of the business

Examples: Fee/Interest/Rent Revenue

Examples: Fee/Interest/Rent Revenue

13

New cards

Earned Revenue

Revenue that is generated as the result of selling something. Money that actively puts money into a company's pocket

14

New cards

Unearned Revenue

Revenue that has the potential to officially put money in a company's pocket, but either hasn't been delivered yet (to the customer) or hasn't been paid by the customer

15

New cards

Expense

measures the outflow of assets incurred in generating revenues: Cost of goods sold

16

New cards

Expenditure

Any money outflow, used for any purpose

17

New cards

Statement of Stockholders' Equity

Reports additional contributions from or payments to investors and the amount of income the company reinvested for future growth during the accounting period

18

New cards

Equation for Stockholders' Equity

Beginning Retained Earnings+Net Income-Dividends=Ending Retained Earnings

19

New cards

Components of stockholder's equity

(1) contributed capital/ common stock: the value of shareholder's cash contributed to the business in exchange for shares.

(2) earned capital/retained earnings: The amount of profits retained by the business (less any dividends distributed to shareholders)

(2) earned capital/retained earnings: The amount of profits retained by the business (less any dividends distributed to shareholders)

20

New cards

Statement of Cash Flows

Consists of operating, investing, and financing materials: shows a business's ability to generate cash and how it was used during the accounting period

21

New cards

Equation for Cash Flow

+/- Cash Flows from Operating Activities +/- Cash Flows from Investing Activities +/- Financing Cash Flows

22

New cards

Operating Cash Flow

(!)Cash received from customers

(2) Cash expenditures in normal operations (like wages, inventory purchases, taxes, utilities, etc.

*cash expenditures used to provide services to customers & and run properly*

(2) Cash expenditures in normal operations (like wages, inventory purchases, taxes, utilities, etc.

*cash expenditures used to provide services to customers & and run properly*

23

New cards

Investing Cash Flows

(1)Cash received from the sale of PPE, intangibles, and investments

(2) Cash paid for the purchase of PPE, intangibles investments, equipment, etc.

*activities used to acquire long term assets*

(2) Cash paid for the purchase of PPE, intangibles investments, equipment, etc.

*activities used to acquire long term assets*

24

New cards

Financing Cash Flows

(1)Cash received from the issuance of debt and stock (2)Cash expenditures for the repayment of debt, repurchase of stock, and payment of dividends

*activities performed to financially sustain the company and retain its investors*

*activities performed to financially sustain the company and retain its investors*

25

New cards

Assets

An object that has all of the following qualities:

(1) Confers expected future benefits

(2) Must be objectively measured

(3) Must be owned by the company

-On financial statements, they are measured by liquidity

(1) Confers expected future benefits

(2) Must be objectively measured

(3) Must be owned by the company

-On financial statements, they are measured by liquidity

26

New cards

Cash, accounts receivable, investments, and equipment are all examples of what?

Assets

27

New cards

True or False: On financial statements, assets are measured by their amount

False

28

New cards

Current Asset

An asset that is expected be converted to cash, sold, or consumed within a year

29

New cards

What are three examples of current assets?

-Cash

-Accounts receivable

-Prepaid expenses

-Accounts receivable

-Prepaid expenses

30

New cards

Future Assets

An asset that isn't expected to be converted to cash, sold, or consumed within a year

31

New cards

What are three examples of future assets?

-Equipment

-Supplies (when they haven't been used)

-Land

-Supplies (when they haven't been used)

-Land

32

New cards

Liabilities

A term that represents a company's future obligations.

33

New cards

What are some common examples of liabilities? List 3

-Accounts payable

-Wages

-Utilities

-Wages

-Utilities

34

New cards

Current Liabilities

Liabilities that are due within a year

-On financial statements, they are arranged by what you have to pay first

-On financial statements, they are arranged by what you have to pay first

35

New cards

Pervasive Cost Benefit Constraint

The idea that the benefits of providing information should outweigh its cost

36

New cards

Fundamental Qualitative Characteristics Of Useful Information

A set of qualities that specify how financial information should be gathered and presented. These qualities include

*relevance,* meaning that the information given is capable of influencing decisions and allowing investors to assess past activities or predict future activities

*faithful representation:* giving a truthfully accurate depiction of a company's financial standing

-in addition, information should be complete, neutral, and free of error

*relevance,* meaning that the information given is capable of influencing decisions and allowing investors to assess past activities or predict future activities

*faithful representation:* giving a truthfully accurate depiction of a company's financial standing

-in addition, information should be complete, neutral, and free of error

37

New cards

Separate Entity Assumption

Business activités must be accounted for by themselves, and not with the activities of its owners, investors, etc.

38

New cards

Going Concern Assumption

The assumption that the company will continue in operation for the foreseeable future

-If financial statements show that it most likely won't be, however, then its assets and values should be reported as if they were liquidated

-If financial statements show that it most likely won't be, however, then its assets and values should be reported as if they were liquidated

39

New cards

Monetary Time Unit Assumption

The assumption that financial statement values should be reported in the currency/ measurement of its base of operations

40

New cards

External Events

exchanges of assets, goods, or services by one party for assets, services, or promises to pay (liabilities) from one or more other parties

41

New cards

Internal Events

events that directly affect the financial position of the company but don't involve an exchange transaction with another entity

42

New cards

Accounts

A separate detailed record associated with a specific liability, equity, or expense item

43

New cards

Fundamental Accounting model

The equation that states that assets=liabilities+shareholders' equity

44

New cards

Transaction Analysis

The process of studying a transaction to determine its economic effect on the business in terms of the accounting equation A=L+SE

(1) Every transaction affects at least two accounts: correctly identifying them is important

(2) The accounting equation must remain in balance

(1) Every transaction affects at least two accounts: correctly identifying them is important

(2) The accounting equation must remain in balance

45

New cards

Guide To Systematically Analyzing Transactions

1) Identify what was received and what was given

-Goods? Services? Giftards?

2) Identify account affected by each title

3) Classify each account by Asset, Liability, or SE

4) Determine the direction of the effect

5) Ensure accounting equation is in balance

-Goods? Services? Giftards?

2) Identify account affected by each title

3) Classify each account by Asset, Liability, or SE

4) Determine the direction of the effect

5) Ensure accounting equation is in balance

46

New cards

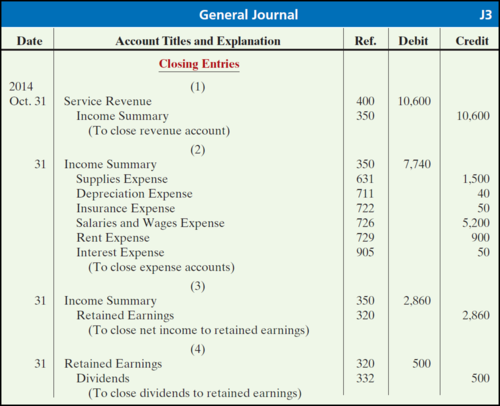

General Journal

-Typically include a date, a short description, a debit account (located on the left) and a credit account (located on the right)

-This is the first place where data is recorded

-This is the first place where data is recorded

47

New cards

General Ledger

A record of a transactions effects and the balances of each account

-a T account is a simplified version of this

-contains a date

-typically track expenses, liabilities, assets, revenues, and capital

-a T account is a simplified version of this

-contains a date

-typically track expenses, liabilities, assets, revenues, and capital

48

New cards

Compound Entry

Any journal entry that affects more than two accounts

49

New cards

Current Ratio

An equation that equals a company's current assets divided by its current liabilities. It's a way to measure a company's ability to pay short term obligations with short term assets.

50

New cards

External Users

People who are not directly involved with the company's interworking

51

New cards

What does the stock market act react the most to?

a. Increased earnings

b. Decreased earnings

c. Unexpected earnings

a. Increased earnings

b. Decreased earnings

c. Unexpected earnings

c

52

New cards

Cash Basis Accounting

A style of accounting typically conducted by small retailers who don't have to report to external users

-A style of accounting that records revenue and expenses when cash is paid, regardless of when revenue/expenses were actually incurred

-A style of accounting that records revenue and expenses when cash is paid, regardless of when revenue/expenses were actually incurred

53

New cards

Accrual Accounting

A style of accounting more useful to external decision makers that records revenues when they are earned (the goods promised to the consumer have been given) and expenses when they are used to generate revenues

54

New cards

Revenue Recognition Principal

A principal of accrual accounting that states that revenue is measured when a company transfers promised goods or services to its customers in the amount it expects to be entitled to receive.

55

New cards

Expense Recognition

Record expenses in the period the related revenue is recognized

-if Chipotle recognizes revenue at the moment food is delivered, then the supplies, the gas, the utilities used to deliver the good are recorded at the same time?

-if Chipotle recognizes revenue at the moment food is delivered, then the supplies, the gas, the utilities used to deliver the good are recorded at the same time?

56

New cards

Accrued Adjustments

Financial adjustments that are unpaid and unrecorded, and will be paid (for) or received in the future

57

New cards

Accrued Expenses

expenses that have been incurred but not yet recorded because cash will be paid after the goods or services are used

58

New cards

Accrued Revenues

Revenues that have been earned but not yet recorded because cash will be received after the services are performed

59

New cards

Deferred Adjustments

Financial adjustments have been paid, received, or recorded, (1) before their services have actually been fulfilled or delivered or (2) before expenses have been incurred

60

New cards

Deferred Expenses

previously recorded assets (Prepaid Rent, Supplies, and Equipment) that must be adjusted for the amount of expense incurred during the period.

61

New cards

Deferred Revenue

A liability created when a business collects cash from customers in advance of completing a service or delivering a product, that must be reduced by the amount of revenue earned during the period

62

New cards

Amounts collected in advance of being recorded are recorded as what three things?

1) Unearned revenue

2) Deferred revenue

3) A liability

2) Deferred revenue

3) A liability

63

New cards

TRUE OR FALSE QUESTIONS RESERVED FOR END

64

New cards

True or False: Unearned revenue is considered a "liability" account?

True

65

New cards

Which of the following are found on the balance sheet?

a)Accrued expenses payable (wages, utilities, etc)

b) Dividends declared

c) Supplies expense

d)Supplies

e) Unearned revenue

a)Accrued expenses payable (wages, utilities, etc)

b) Dividends declared

c) Supplies expense

d)Supplies

e) Unearned revenue

a, d, e,

66

New cards

Under which of the following circumstances would cash basis accounting report higher expenses than accrual basis accounting in the current accounting period?

A) Cash is paid in advance of when services are provided

B) Cash is paid in the following accounting period of when the services were performed

C) Cash is paid in the same period as the services were performed?

A) Cash is paid in advance of when services are provided

B) Cash is paid in the following accounting period of when the services were performed

C) Cash is paid in the same period as the services were performed?

A

67

New cards

trial balance

68

New cards

On the balance sheet, where are the three places where the $ symbol is located?

All subtotals

On the top and bottom of the asset section

On the top and bottom of the liability and SE section

On the top and bottom of the asset section

On the top and bottom of the liability and SE section

69

New cards

Why are adjustments important to the preparation of financial statements?

-They ensure that the balance sheet reports all of the economic resources the company owns and the obligations a company owes

-Unadjusted financial statements could provide a misleading and incomplete picture of a company's financial results

-Adjustments ensure that the revenues earned and expenses incurred during the period are reflected in the income statement

-Unadjusted financial statements could provide a misleading and incomplete picture of a company's financial results

-Adjustments ensure that the revenues earned and expenses incurred during the period are reflected in the income statement

70

New cards

What type of adjustment is this?

Deferred Expense

71

New cards

Contra account

An account that is an offset to, or reduction of the primary account

72

New cards

Net profit margin

net income/Net Sales (Or Operating Revenues)

73

New cards

Total Asset Turnover

(Net Sales or Operating Revenue)/ Average total assets

74

New cards

Closing process

the last step in the accounting cycle that marks the end of the current period and the beginning of the next

75

New cards

Closing Process (for permanent or real accounts)

-Ending balance in period 1 is the beginning balance in period two

-The ending balance of these accounts (assets, liabilities, SE) only equal zero when an account is no longer owed or owned

-The ending balance of these accounts (assets, liabilities, SE) only equal zero when an account is no longer owed or owned

76

New cards

Closing Process (for temporary or nominal accounts)

-The ending balance actually must be equal to zero at the end of the period

-Consists of revenues, expenses, gains, and loss

-Closing entries must be ordered with debits (revenue, because on top and credits on bottom

-Consists of revenues, expenses, gains, and loss

-Closing entries must be ordered with debits (revenue, because on top and credits on bottom

77

New cards

If cash was received and previously recorded, and you're trying to update the entires, what should you do?

Decrease Unearned Revenue (-L) and increase Revenue, which in turn increases SE

78

New cards

Who is the most responsible for making sure that a company is following the SEC's standards?

the CEO and CFO

79

New cards

Board of Directors

People elected by shareholder's that are responsible for maintaining the integrity of a company's financial reports

80

New cards

Institutional Investors

Managers of pension, mutual, endowment, and other funds that invest on the behalf of others.

81

New cards

Private investors

individuals who purchase shares in companies

82

New cards

Lenders/Creditors

People and financial institutions who lend money to companies

83

New cards

Form 10K

An annually audited financial report that consists of (1) Business descriptions of operations and strategy

(6) Select financial data

(7) Management discussion and analysis of financial position

(8) FInancial statements and supplemental data (including auditors report) x

(6) Select financial data

(7) Management discussion and analysis of financial position

(8) FInancial statements and supplemental data (including auditors report) x

84

New cards

Form 10Q

85

New cards

Form 8K

A current event report that reports material important to investors but wasn't previously reported or disclosed

86

New cards

Private Company Annual Report

A report that cons tis of.....

-financial statements

-

Report of independent accountants

-financial statements

-

Report of independent accountants

87

New cards

Historical Cost Principle

The idea that assets should be recorded at the value they were purchased for, regardless of how much they are worth now

88

New cards

True or False: Comparative financial statements include separate columns for more than one's periods results?

True