AP Macroeconomics Vocab: Unit 3- Aggregate Demand and Aggregate Supply

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

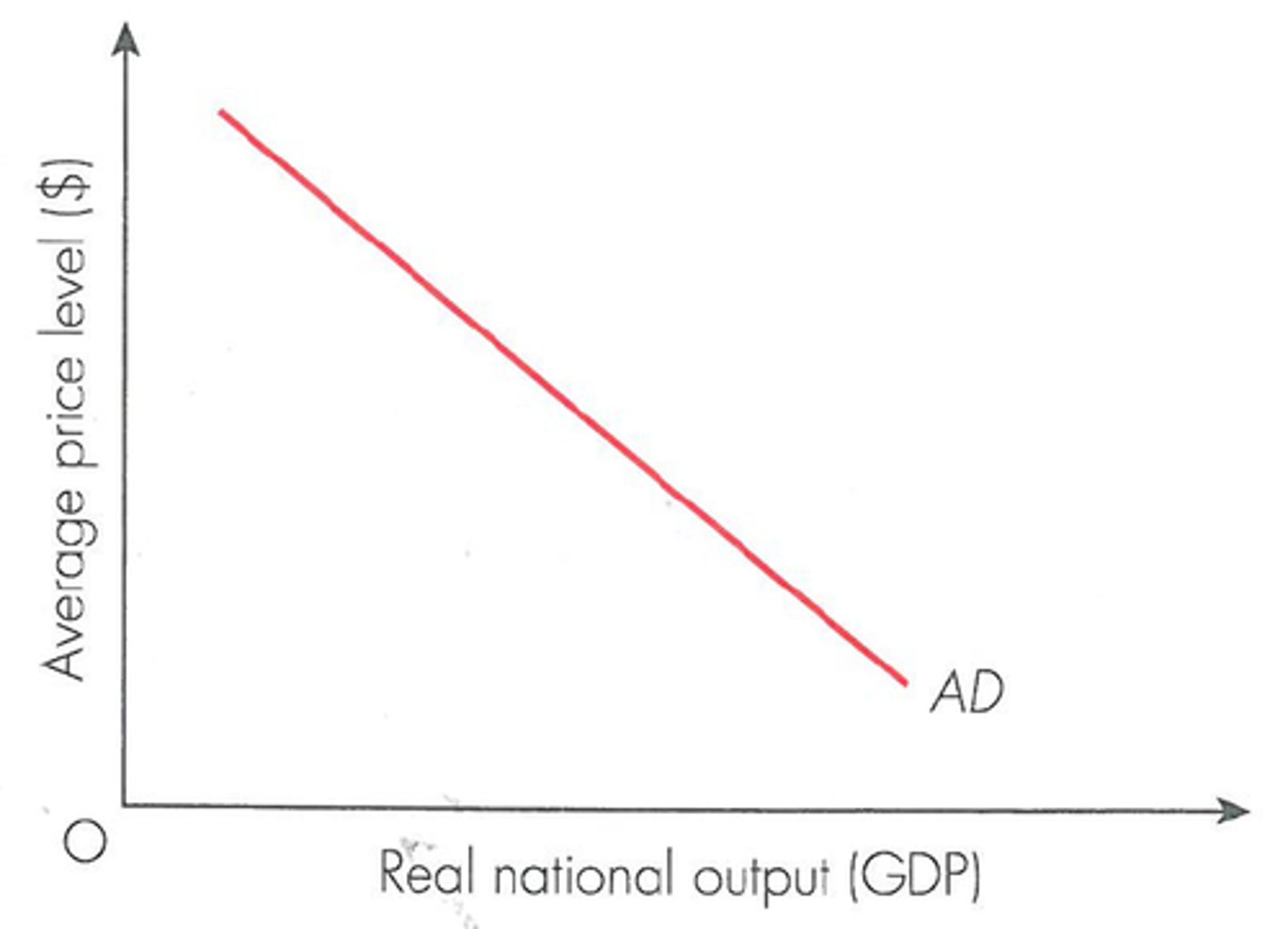

Aggregate Demand

All the goods and services that buyers are willing and able to purchase at different price levels. Same thing as real GDP. There is an inverse relationship between price level (PL) and real GDP (rGDP)

Aggregate

Added all together

Causes the Downward Slope of AD

1. Wealth Effect

2. Interest Rate Effect

3. Foreign Trade Effect

Wealth Effect

Higher price levels reduce the purchasing power of money; lower price levels increase purchasing power and increase expenditures. Example: If the price of something doubles, people will buy less because their purchasing power decreased. As a result, GDP demanded decreases

Interest Rate Effect

When the price level increases, lenders need to charge a higher interest rate to get a real return on their loans.; in short, higher interest rates discourage consumer spending and business investment. Example: If the price of something increases, it will lead to more people taking out loans, which will cause the interest rate to rise so lenders can get a return on their loan

Foreign Trade Effect

When the price level of U.S. goods rises, foreign buyers purchase fewer U.S. goods and Americans buy more foreign goods. Exports fall and imports rise causing real GDP demanded to fall (Xn decreases). Example: If prices in the U.S. triple, Canada will no longer buy as many U.S. goods causing the quantity demanded of U.S. products to fall. As a result, GDP demanded will fall

Shifters of Aggregate Demand

1. Change in Consumer Spending

2. Changes in Investment Spending

3. Change in Government Spending

4. Change in Net Exports

Change in Consumer Spending

Examples include: increase in disposable income, change in consumer expectations, household indebtedness, taxes

Changes in Investment Spending

Examples include: change in real interest rates, future business expectations, productivity, and technology, business taxes

Changes in Government Spending

Example: government expenditures

Changes in Net Exports

Examples include: change in exchange rate (US dollar depreciates compared to euro- shift right) and national income compared to abroad (importer has recession- shift left)

Aggregate Supply

Amount of goods and services (real GDP) that firms will produce in an economy at different price levels; differentiates between short run and long run

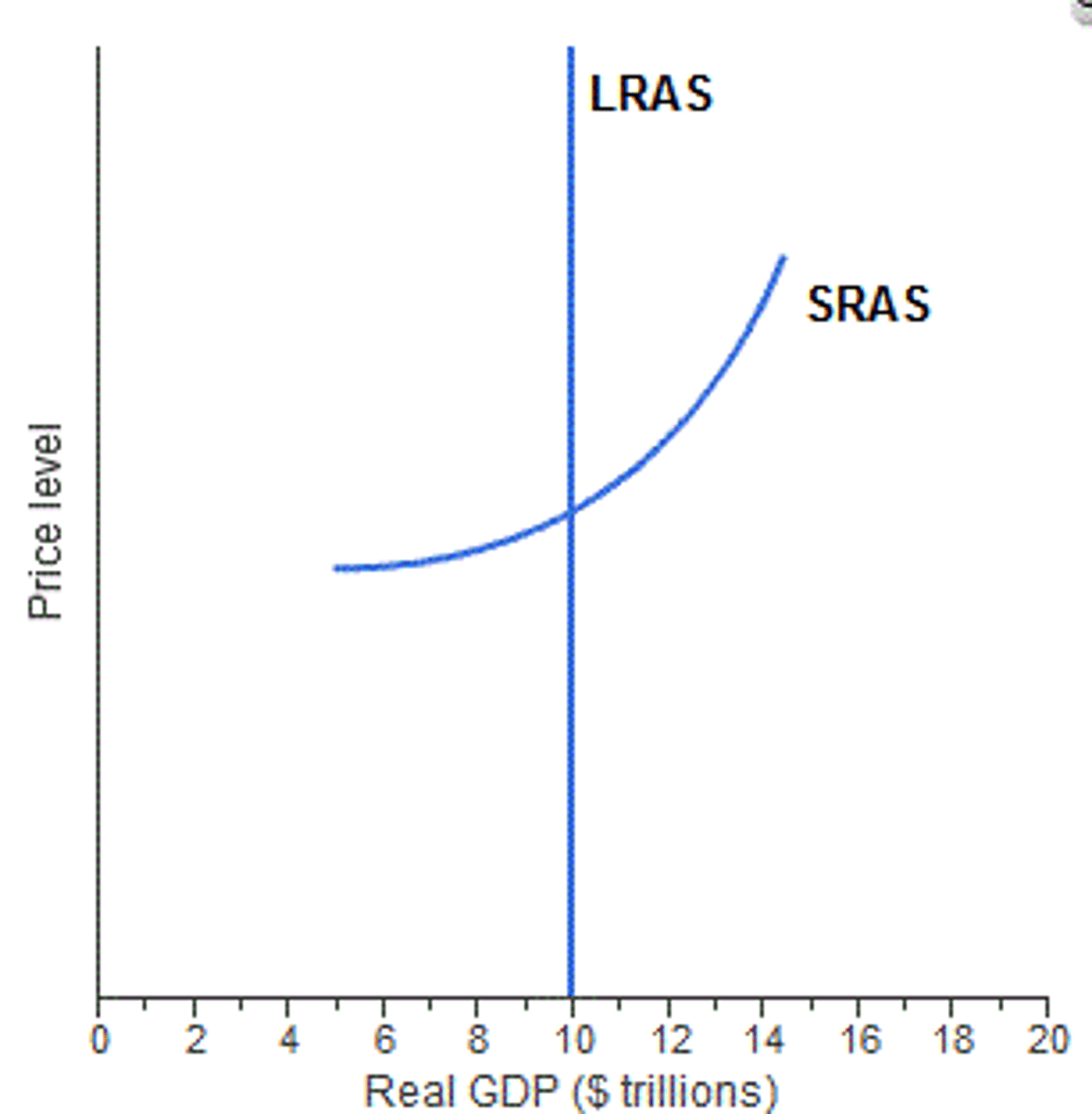

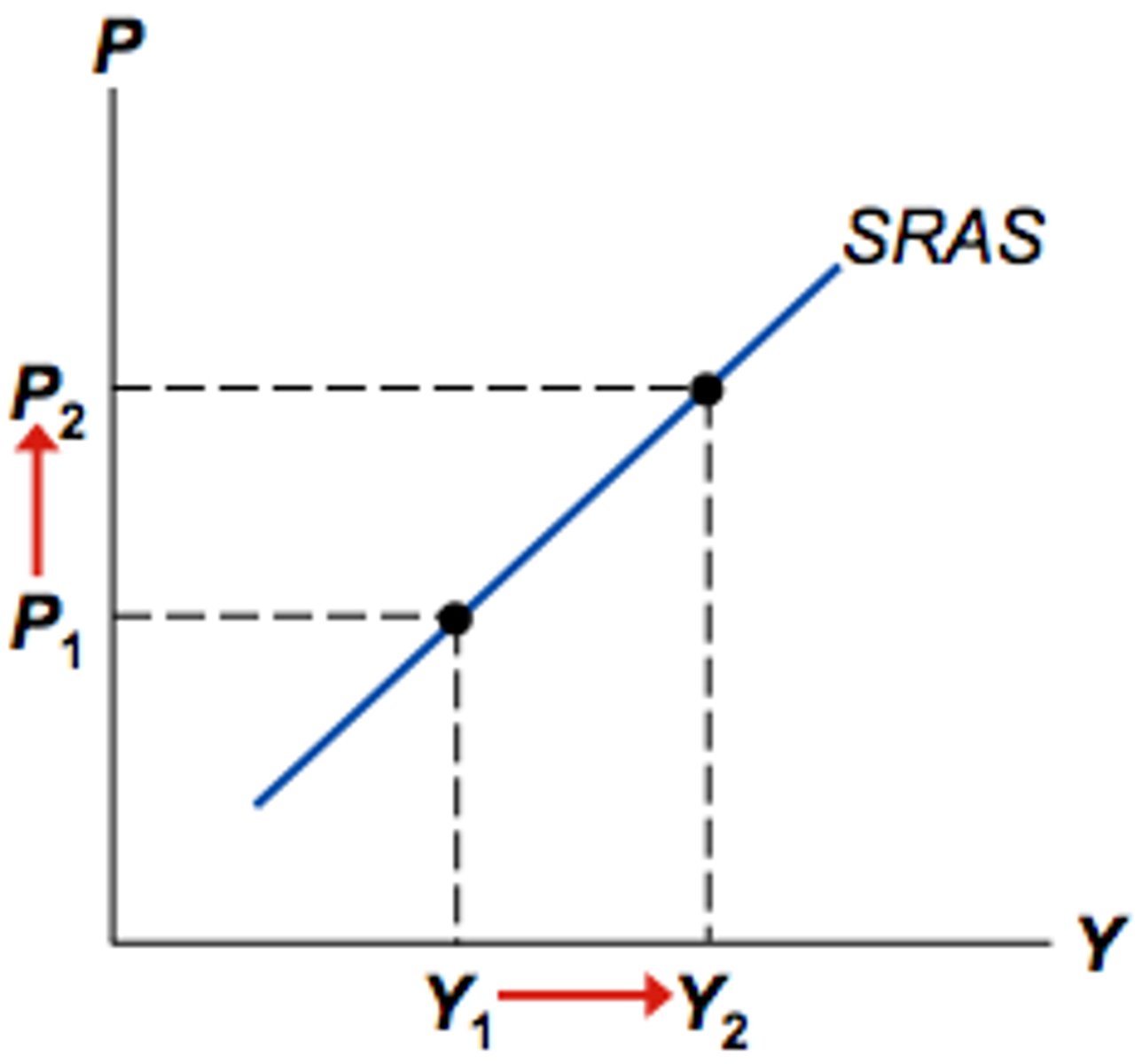

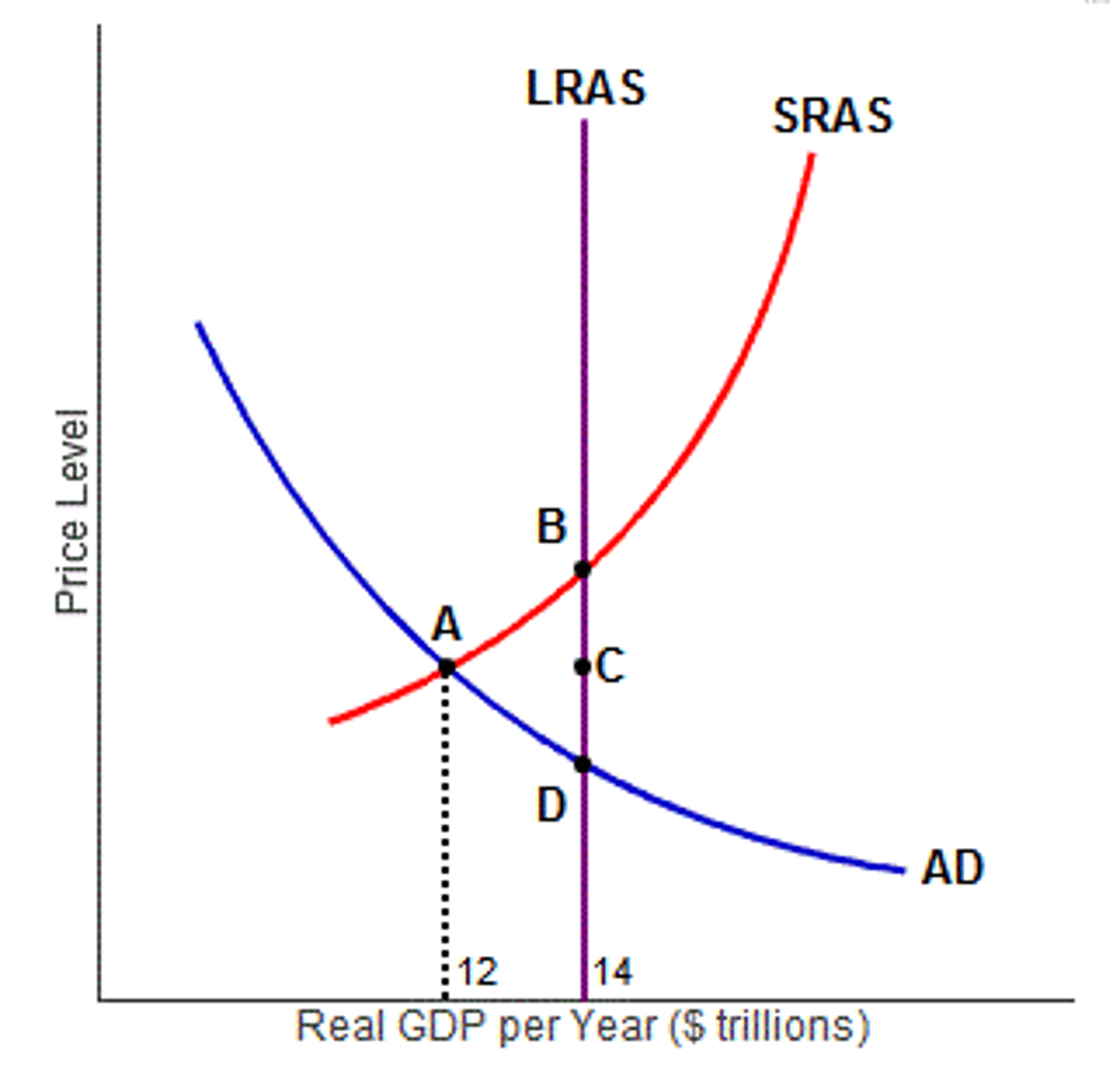

Short Run Aggregate Supply

Wages and resources will not increase as price level increases; with higher profits, a firm has an incentive to increase production. Example: Firm makes 100 units that are sold for $1 each with an $80 cost in labor. Profit is $20. If this price of the unit doubles, the profit will increase to $120

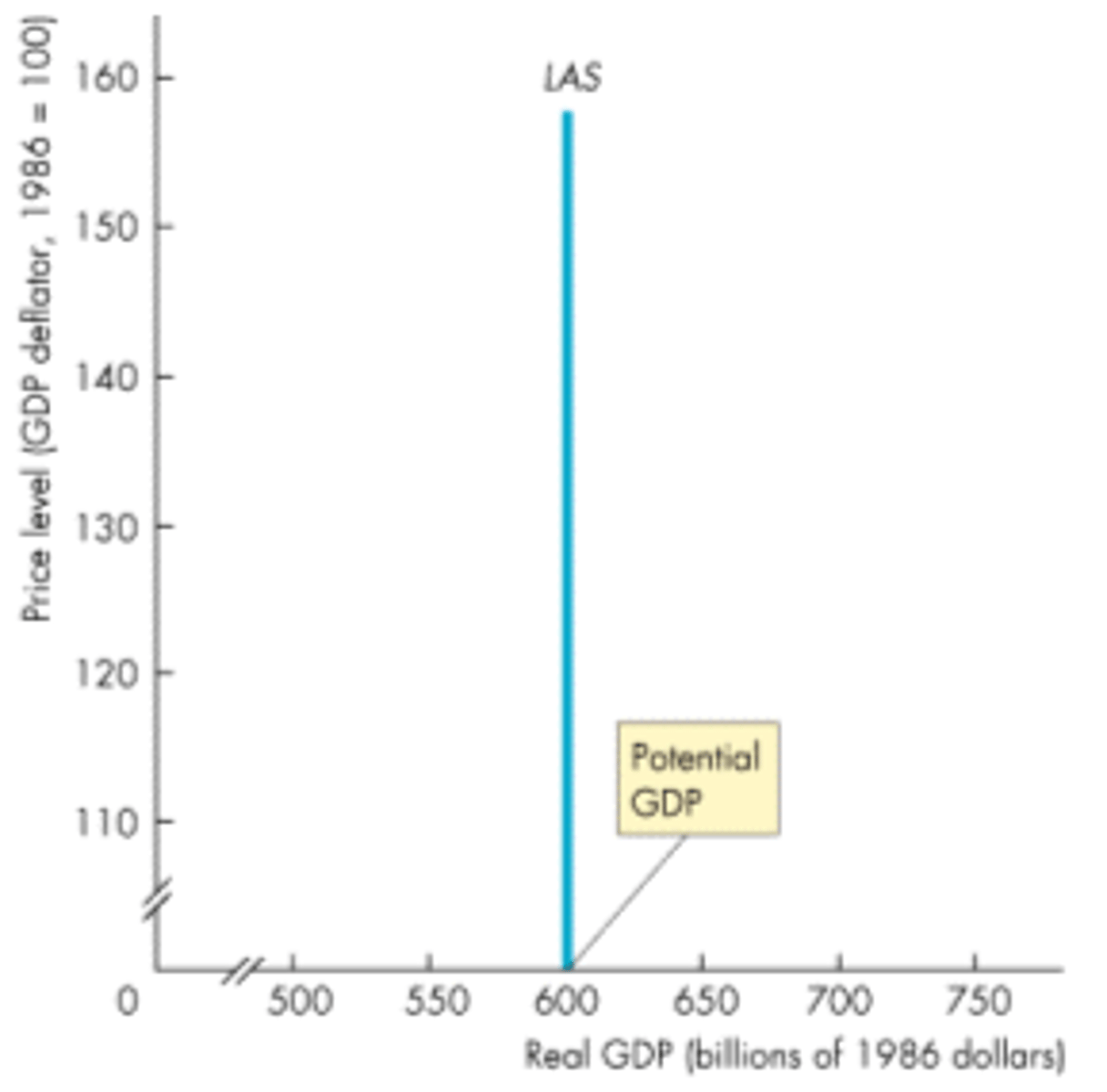

Long Run Aggregate Supply

Wages and resource prices will increase as price levels increase; if real profit doesn't change, firm has no incentive to increase output. A second shift will bring this back to equilibrium

Shifters of Aggregate Supply

1. Change in Resource Prices

2. Actions of Government

3. Change in Productivity

Change in Resource Prices

Examples include: change in cost of factors of production, change in price of domestic and imported resources, supply shocks, and inflationary expectations; if producers expect higher prices in future workers will demand higher wages and costs will increase. This will decrease AS

Actions of Government

Does not include government spending; examples include: taxes on producers, subsidies for domestic products, and government regulations

Change in Productivity

Example: technology increases this; LRAS is only shifted by this

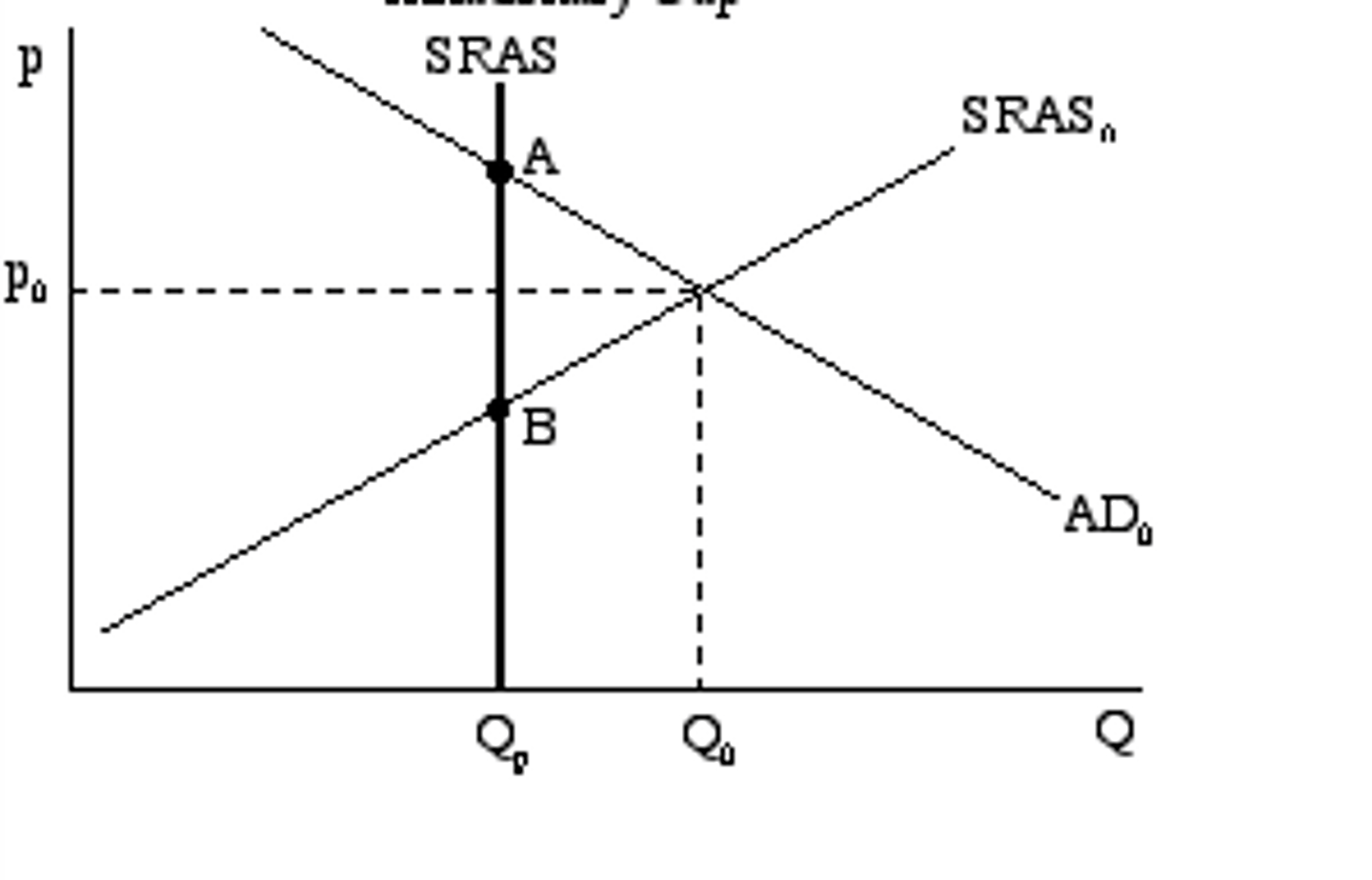

Inflationary Gap

Occurs when equilibrium is to the right of the LRAS; output is high and unemployment is less than NRU; actual GDP is above the potential GDP

Recessionary Gap

Occurs when equilibrium is to the left of the LRAS; output is low and unemployment is more than NRU; actual GDP is below potential GDP

Stagflation

A type of recessionary gap where the price increases and the quantity decreases

Capital Stock

Machinery and tools purchased by businesses that increase their output; when looking at PPC it would shift outward

Economic Growth

Only thing that can cause this is investment since firms are able to increase their capital stock; it doesn't go back to equilibrium it shifts the LRAS

Classical Theory

A change in AD will not change output even in the short run because prices of resources (wages) are very flexible; recessions caused by fall in AD are temporary; price will fall and the economy will fix itself; stresses not government involvement

Keynesian Theory

Wanted government involvement in the economy; believed economists should suggest policies; that could help the economy such as deficit spending; believed that if there is a decrease in AD, it will lead to a persistent recession because prices of resources are NOT flexible- doesn't necessarily cause inflation; believed and increase in AD during the recession doesn't put pressure on prices

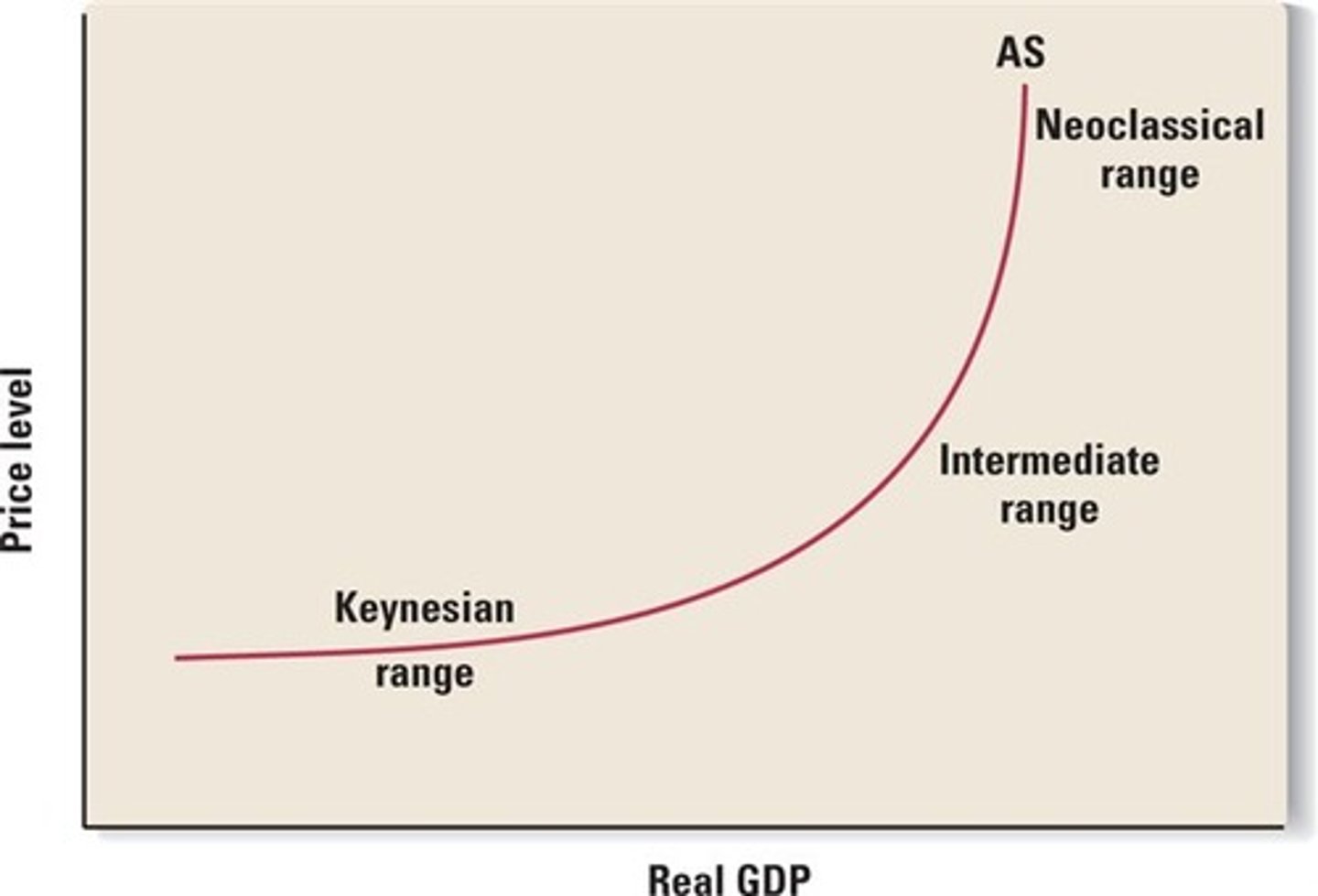

Three Ranges of Aggregate Supply

1. Keynesian: horizontal at low output

2. Intermediate Range: upward sloping

3. Classical Range: vertical at physical capacity