module 5 - price floors and ceilings

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

non-binding price floor

minimum price set by the government that is below the current market equilibrium price (no real effect on the market)

binding price floor

a government imposed minimum price that is set above the market equilibrium price, which does affect the market by preventing prices from falling to the natural equilibrium level

non-binding price ceiling

a max price set by the government that is above the market equilibrium price, so it has no effect on the market

binding price floor

a government imposed max price that is set below the market equilibrium price, meaning it does affect the market by forcing prices down and causing a shortage

unemployment and minimum wage

debated however:

raising the wage increases labor costs, leading to higher unemployment

result in less workers, cutting hours, etc

price control

government laws to regulate prices instead of letting market forces determine prices

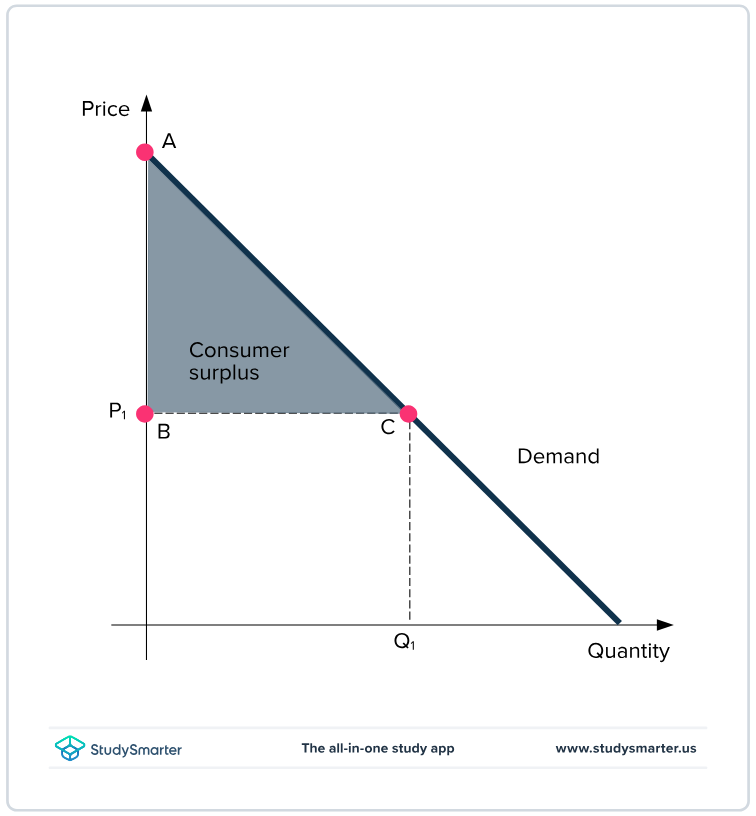

consumer surplus

buyers’ willingness to pay for a good minus amount they actually pay, and it measures the benefit buyer get from participating in a market. can be computed by finding the area below the demand curve and above the the price

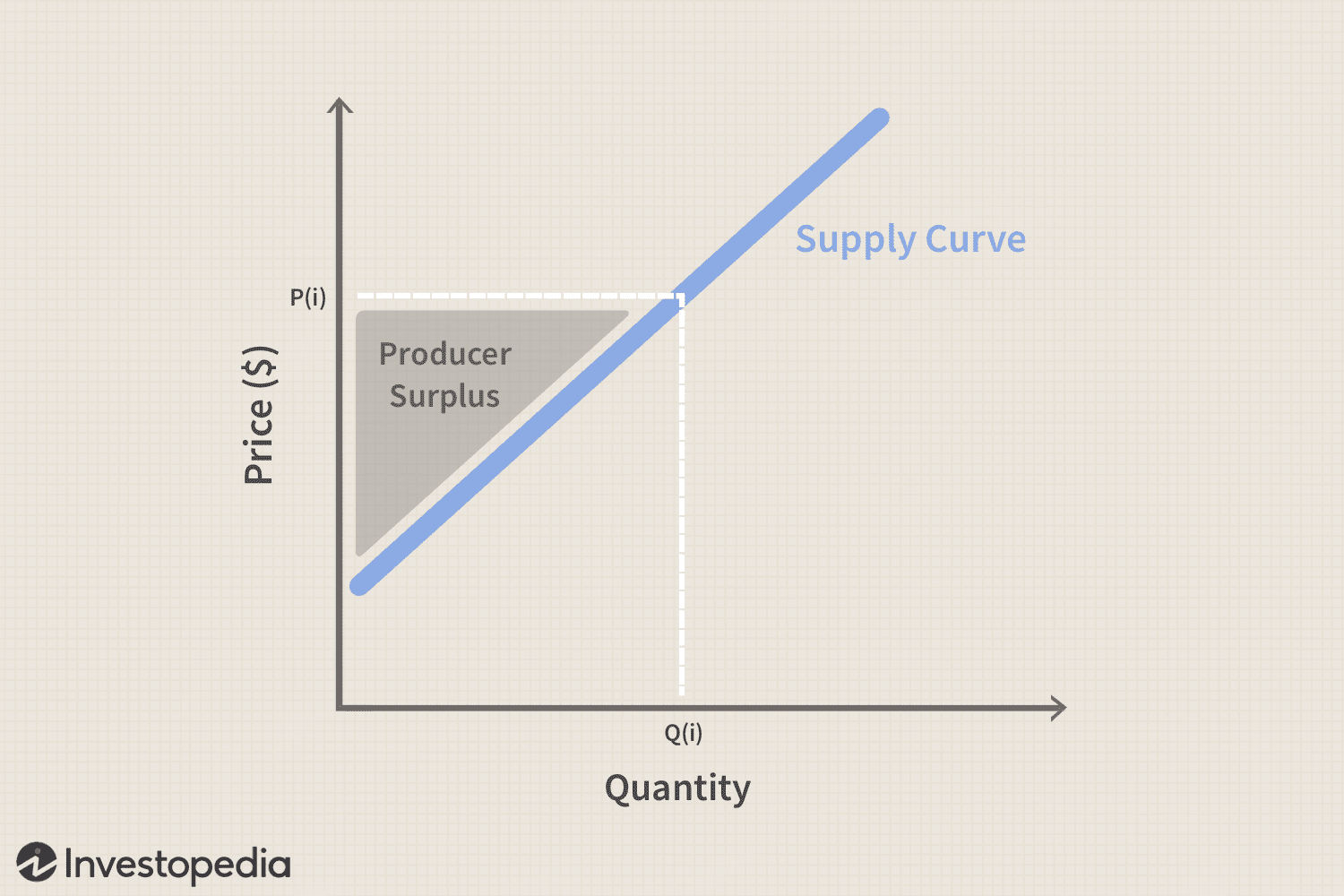

producer surplus

the amount sellers receive for the goods minus their costs of production, and it measures the benefit sellers get from participating in a market. can be computed by finding the area below the price and above the supply curve

allocation of resources

maximizes total surplus (sum of consumer + producer surplus) is efficient

often concerned with efficiency as well as equality

equilibrium of supply and demand

maximizes total surplus

invisible hand in market leads buyers and sellers to allocate resources efficiently

markets and allocation

does not do this efficiently in the presence of failures, such as market power or externalities