AP Micro / Trade, Tariffs, Excise Taxes

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

What is a Tariff?

A tax on imports that raises the domestic price of foreign goods.

What is a Quota?

A limit on the quantity of a good that can be imported into a country.

What are the purposes of tariffs and quotas?

To protect domestic producers from foreign competition and to prevent domestic unemployment.

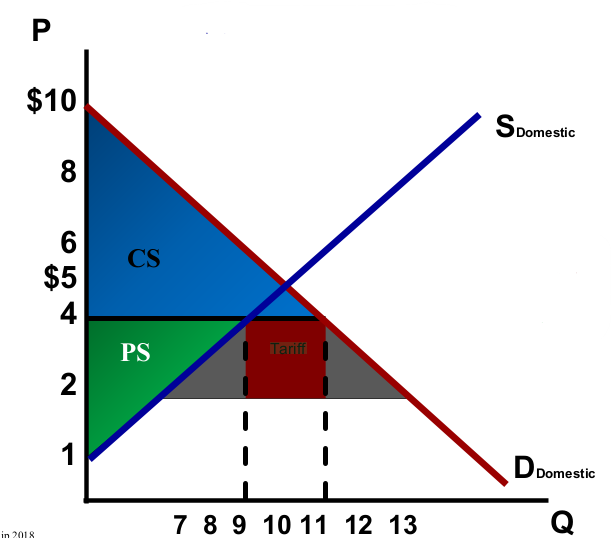

What happens to CS and PS after trade when the world price is lower than domestic equilibrium?

CS generally increases because consumers benefit from lower prices, but producers can’t compete with low prices so PS decreases.

What effect does a tariff have on CS and PS?

Consumer Surplus decreases while Producer Surplus increases due to the higher effective price consumers pay after the tariff.

What is Excise Tax?

A per unit tax on the price of goods that aims to reduce consumer consumption, especially on goods that are harmful.

How does the incidence of a tax depend on elasticity?

(Incidence: Distribution of the burden or impact of a tax between the buyer and the seller in a market. It’s essentially who pays more of the burden of the tax.)

The tax burden falls more on the side of the market (consumers or producers) that is less elastic.

What happens to total tax revenue when demand is inelastic and price increases?

Total tax revenue tends to increase because consumers do not significantly reduce their quantity demanded when the price increases.

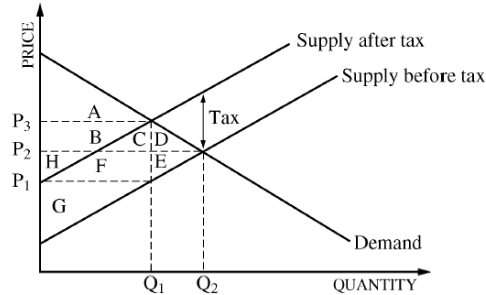

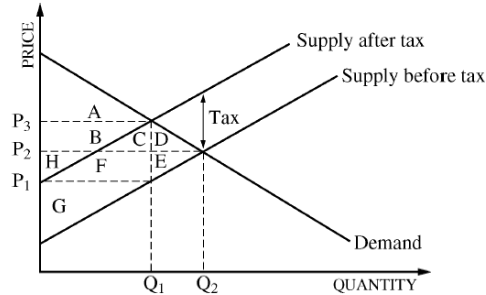

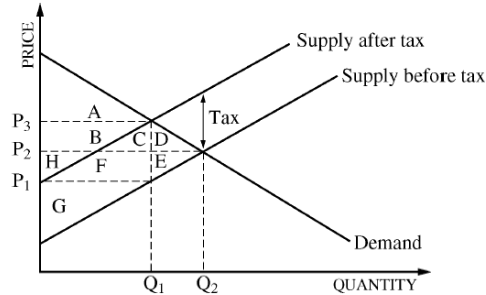

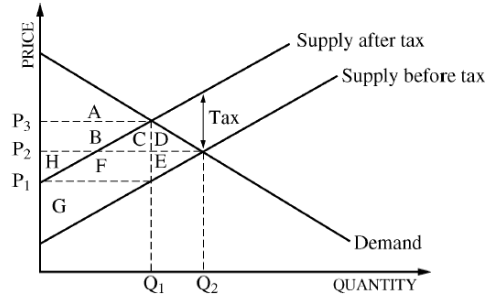

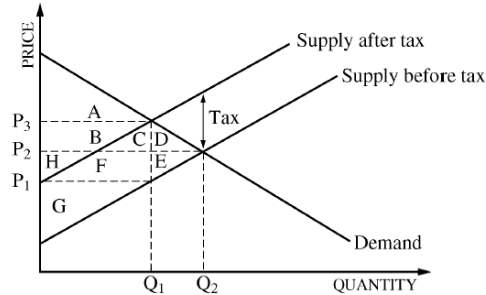

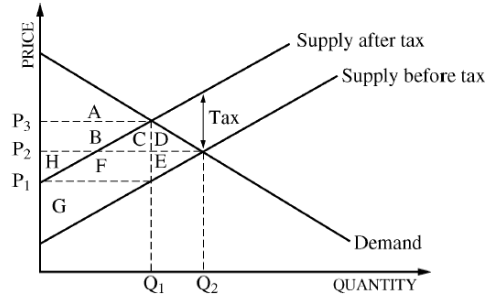

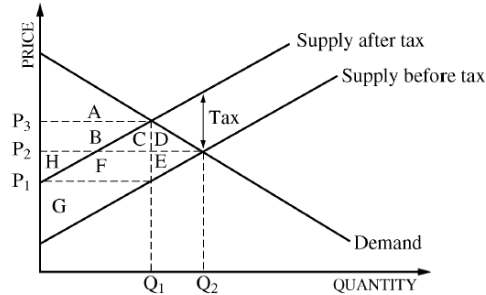

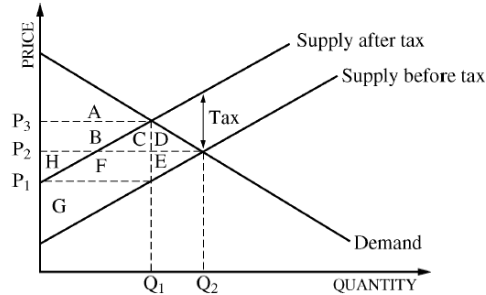

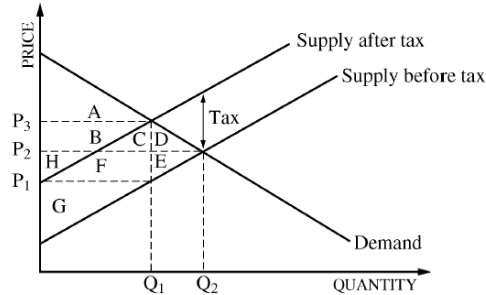

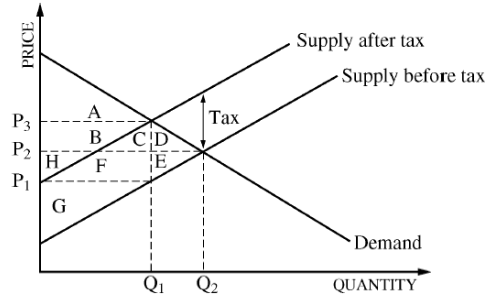

What was the consumer surplus (CS) before the excise tax was imposed?

ABCD.

What was the producer surplus (PS) before the excise tax was imposed?

EFGH

What’s the consumer surplus (CS) after the excise tax was imposed?

A

What’s the producer surplus (PS) after the excise tax was imposed?

G

Why did the producer surplus after excise tax shift down so much?

Because demand decreased due to the increased price from the tariff, producers produce less, shifting down to Q1.

What’s the tax revenue after the excise tax was imposed?

BCFH

What’s the deadweight loss (DWL) after the excise tax was imposed?

DE

What’s the expenditure (total money spent by consumers on the good/service) before the excise tax was imposed?

Q2 * P2

What’s the expenditure (total money spent by consumers on the good/service) after the excise tax was imposed?

Q1 * P3

What’s the total tax paid by consumers after the excise tax was imposed?

BC

What’s the total tax paid by producers after the excise tax was imposed?

HF

What’s the revenue for the business after the excise tax was imposed?

Q1 * P1