IAS 37 - Provisions, Contingent Liabilities and Contingent Assets

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

7 Terms

Provisions

Provisions - a liability of uncertain timing or amount. May be recognized when:

Present obligation (legal or constructive) arising from past event

Probable outflow to settle obligation

Reliable estimate can be made.

Reference: IAS 37.14

Contingent losses (liabilities)

Contingent losses —> NOT recognized:

A possible obligation that arises from past events, whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly in the control of the entity;

A present obligation that arises from past events is not recognised when an outflow of future economic benefits is not probable or the amount of the obligation cannot be measured reliably.

Reference: IAS 37.27-30

Contingent gains (assets)

Contingent gains —> NOT recognized:

possible asset that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

Reference: IAS 37.31-35

Decommissioning Liability - Definition

Obligation for an expected future cost to decommission a tangible asset.

Decommissioning Liability - Recognition

Present obligation (legal or constructive) arising from past event

Probable outflow to settle obligation

Reliable estimate can be made.

Reference: IAS 37.14

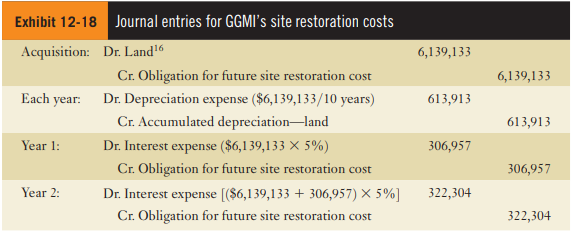

Decommissioning Liability - Initial Measurement

Measured at the best estimate expected to be required to settle.

Present value at pre-tax rate that reflects market risk

Entry is to Dr. Asset and Cr. Decommissioning Provision

Decommissioning Liability - Subsequent Measurement

Liability

Update the liability for changes in the amount and timing of future payments and changes in discount rate. These changes impact the liability and the income statement.

Adjust for time value of money – recognized as interest expense.

Asset:

Depreciate the asset