Chapter 22-23: Fiscal and Monetary Policy

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

20 Terms

Public Sector Net Borrowing (PSNB)

governments fund their spending when it exceeds tax revenue by issuing bonds that people and institutions buy, lending money to the government and adding to the national debt

Public Sector Net Cash Requirement (PSNCR)

a more immediate cash-flow focussed measure of government borrowing, accounting for not just planned spending, but also things like loan repayments

fiscal stance

the overall impact of a government’s budget on the economy

automatic stabilisers

built in features of the tax and benefit system which automatically dampen economic swings

fiscal drag

when the economy is recovering but automatic stabilisers pull it back by increasing tax revenue and reducing welfare too quickly, potentially hindering growth

discretionary fiscal policy

when the government actively changes tax rates or spending levels to try and influence the economy

challenges to fiscal policy

timing

magnitude

Keynesian view on crowding out

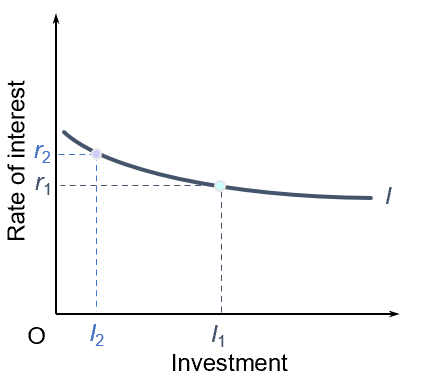

crowding out is minimal, especially during recessions when there is spare capacity in the economy. They argue interest rates won’t rise much and investment isn’t that sensitive to interest rate changes

Monetarist view on Crowding out

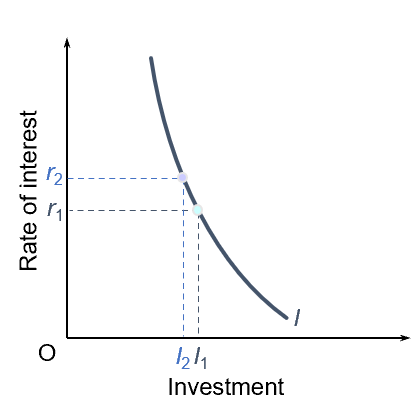

crowding out is a serious concern, they believe government borrowing significantly increases interest rates, which chokes off private investment

central bank tools to influence the money supply

reserve requirements

open market operations

central bank lending

reserve requirements

mandating that banks hold a certain percentage of their deposits as reserves

open market operations

buying or selling government bonds to influence the amount of money in circulation

central bank lending

adjusting the interest rate at which they lend to commercial banks

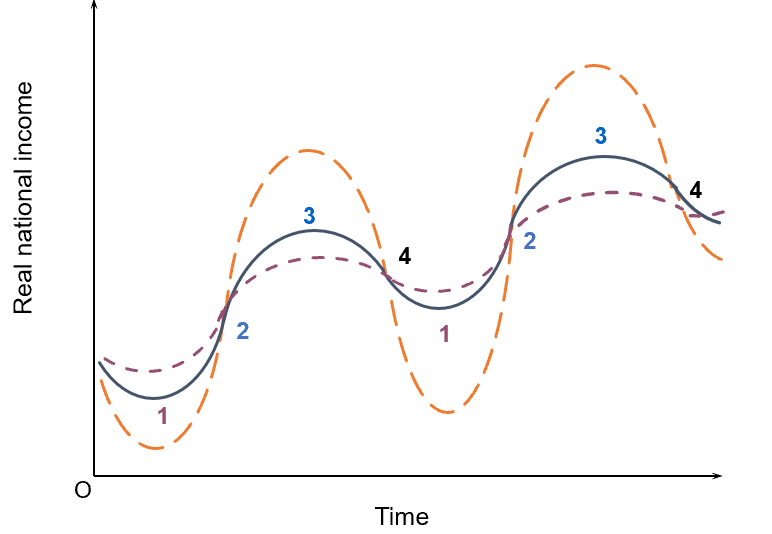

stabilising or destabilising fiscal policy

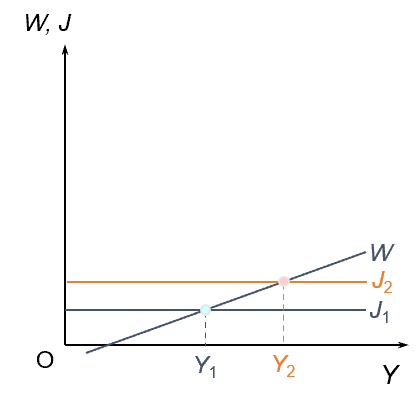

monetary effects of expansionary fiscal policy on the goods market

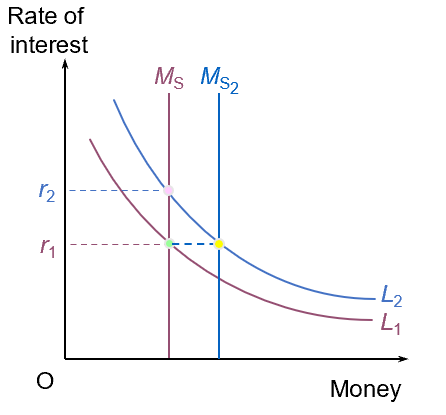

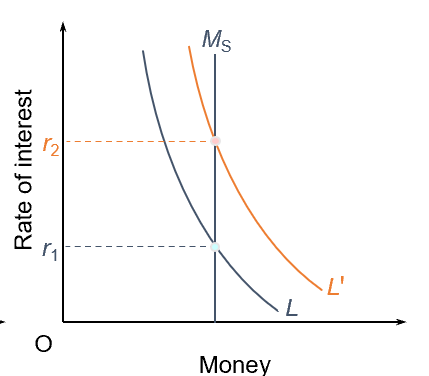

monetary effects of expansionary fiscal policy on the money market

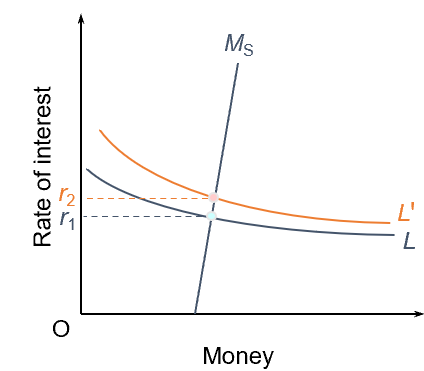

Keynesian view on the demand for money

monetarist view on the demand for money

Keynesian view on the demand for investment

Monetarist view on the demand for investment