positive externalities, public goods, asymmetric info, inability to achieve equity

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

22 Terms

positive production externalities

external benefits created by producers

eg: R&D efforts that lead to the spreading of productivity improvements

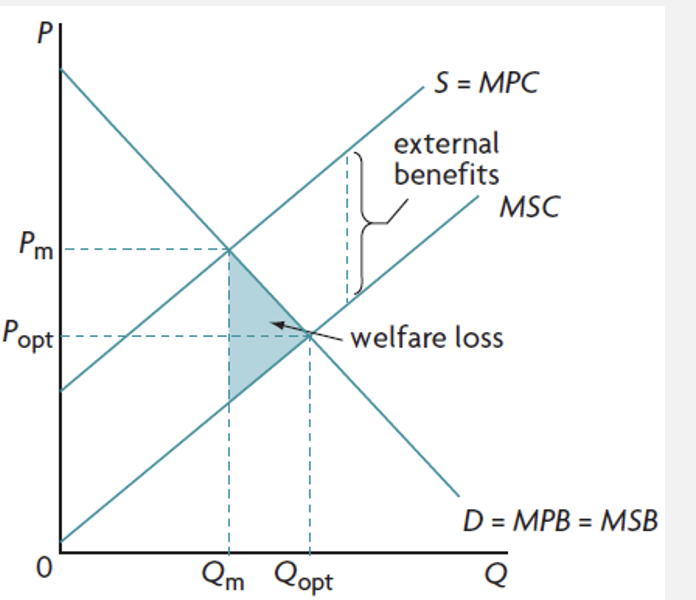

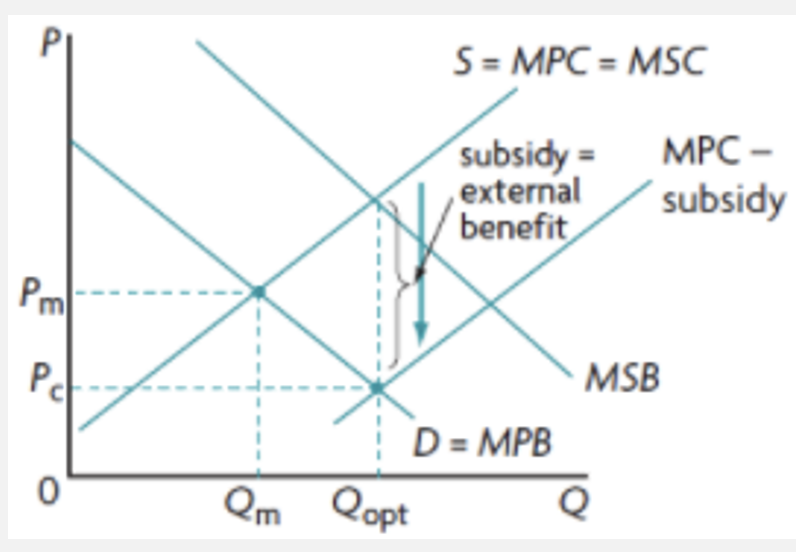

positive production externalities graph

when MSC < MPC

Qm < Qopt and MSB > MSC so the market is under-allocating resources and not enough is being produced

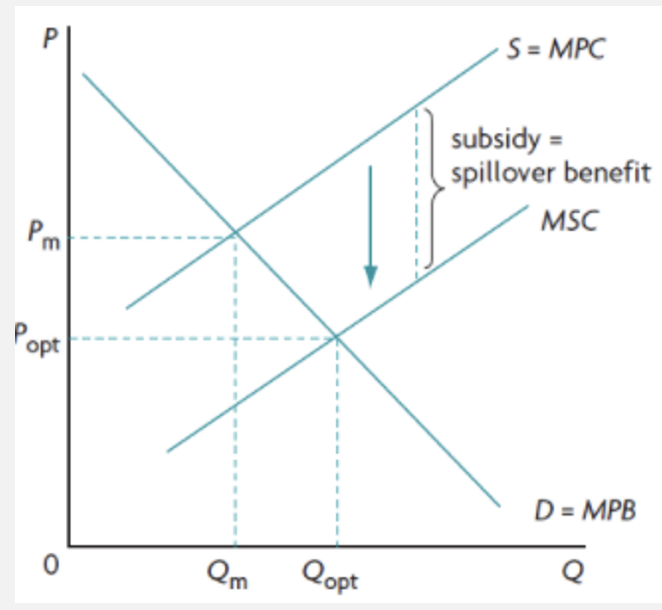

ways to correct PPE

direct govt provision: engaging in R&D or innovation in public companies or offer training to workers. can be done using funds from taxes

subsidies: providing a subsidy equal to the external benefit to reduce costs of production and increase provision

positive consumption externalities

the external benefits created by consumers

eg: consumption of education spills over into society in the form of higher productivity, lower unemployment and higher rate of economic growth.

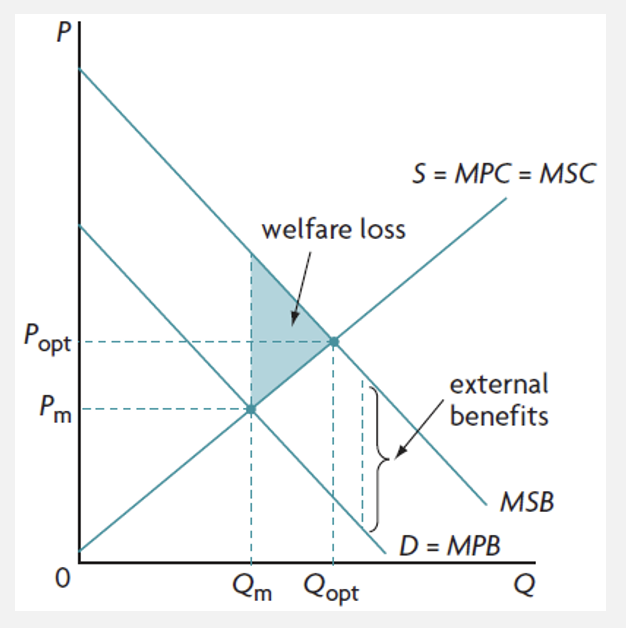

positive consumption externalities graph

when MSB > MPB

Qm < Qopt and MSB > MSC so the market is under-allocating resources and not enough is consumed

ways to correct PCE (increase demand)

govt regulation: make certain services compulsory

education and awareness creation: inform consumers of benefits

nudges: Create incentives to stimulate adoption of goods/services that increase spillover benefits

INCREASE IN PRICE

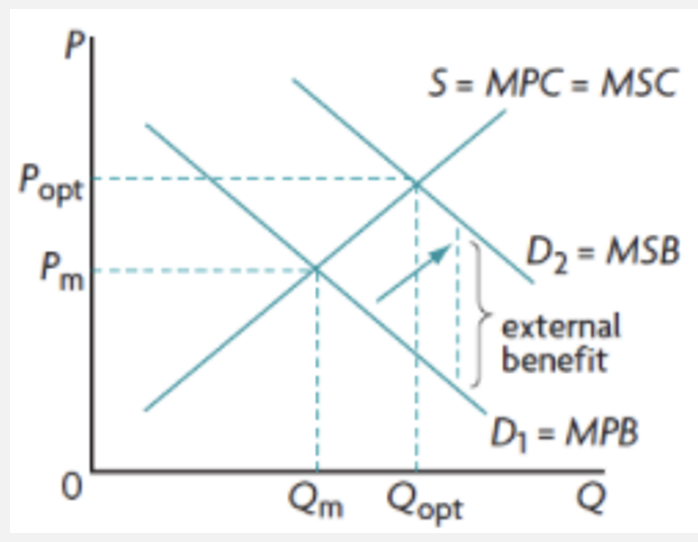

ways to correct PCE (increase supply)

direct govt provision: provide merit goods to increase supply and reduce the amount that is under-allocated

subsidies: increases supply of the good/service, reducing the under allocation

DECREASE IN PRICE

consequences of legislation, education and awareness creation

limitations with regards to calculating the size of the external benefit

increase price for consumers, making some g/s unaffordable

best used in conjunction with direct provision and subsidies

consequences of direct govt provision and subsidies

effective in increasing the quantity of a g/s + lowering price for consumers

opportunity cost

difficult to measure size of external benefit

public goods

goods that are non-excludable and non rivalrous:

non-excludable: not possible to exclude someone from using the good

non-rivalrous: the consumption by one person does not reduce consumption by someone else

the free rider problem

when people can enjoy the use of a good without paying for it.

market failure of public goods

form of market failure because private firms don’t produce them, so are underproduced

market fails to allocate resources to their production

consequences of direct government provision

due to opportunity cost there are issues in determining which and how much of these public goods to provide

Economic criteria should be used but it is difficult to estimate expected benefits- no market price for public goods

Votes, surveys are used instead to estimate the “cost-benefit”. Problem- people will exaggerate the need or value

consequences of contracting out to private sector

competitive tendering- lowest cost provider will be selected

better quality control

access to broader range of skills/technology than the govt

private firm may be more flexible/innovative

govt becomes less accountable

govt loses control

cost may be greater

monitoring adds to costs

asymmetric information

occurs when there is missing information and buyers and sellers don’t have equal access to information

adverse selection (seller knows more)

weary consumers are often aware or skeptical which means they will be more cautious

results in less demand, thus less production (underallocation)

if consumers are unaware and trust the seller there will be overconsumption (overallocation)

government responses to adverse selection

regulation: pass laws that ensure quality standards and safety features that must be maintained

time-consuming

provision of info: govt provides or forces producers to provide info

time-consuming, opportunity cost, info may not be entirely accurate

licensure: govts can require producers to be licensed to practice, sell goods, offer services

private responses to adverse selection

screening: used by the buyer so buyers can get more info on their purchases. information about sellers can be posted online

signalling: used by the sellers so they can convince buyers that the g/s can be trusted. may provide warranties or return policies that increase trust

adverse selection (buyer knows more)

often rises when buying health insurance

results in less supply since the seller is weary of information being withheld so less is offered which makes it more expensive and less people take it up (underallocation).

moral hazard

happen when one party changes their behavior after obtaining an insurance

responses: making the insurance taker pay for part of the costs, regulation and monitoring by the govt

why the free market results in income inequalities

arise from the difference in education, skills and general ownership of assets and wealth.

distribution of factors such as land, capital and entrepreneurial abilities is generally unequal in a society based on a market-determined distribution.

so, income distribution will be unequal and it would be up to the government to redistribute these so that the outcome is fairer

inequality in wealth

refers to the money or things of value that people own. eg: stocks, land, houses, paintings or jewelry.

income- possibility of saving- rise to creation of wealth

high income, low wealth- spend a lot

low income, high wealth- inherited assets