Course 5 - Moral Hazard

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

18 Terms

Principal-Agent Relationship - Moral Hazard

Principal hires agent to perform a task

Agent chooses an effort level a, which affects the output q

Effort = costly for agent, so principal must compensate to encourage them + output-Based Compensation BUT q ≠ perfect indicator

=> leading to some inefficiency

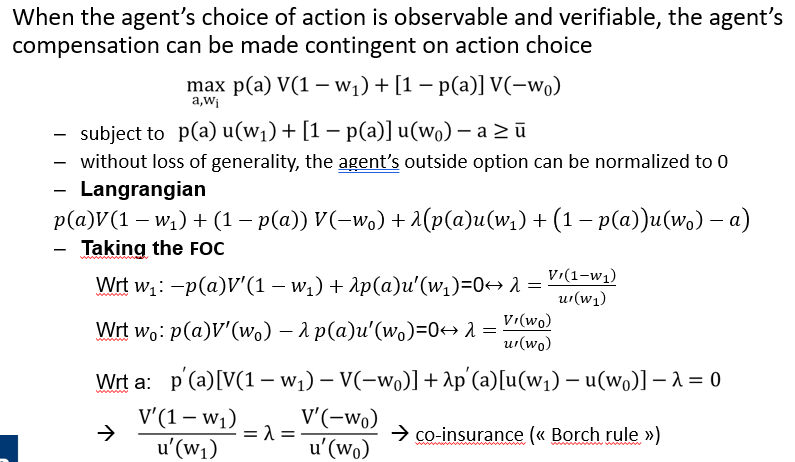

Observable actions

Agent’s effort = observable => principal can directly reward or penalize agent

=> Allows design of an incentive contract that aligns : agent’s actions with principal's goals

Co-Insurance (Borch Rule):

If principal & agent both share some risk, their optimal contract balances how much risk each party bears

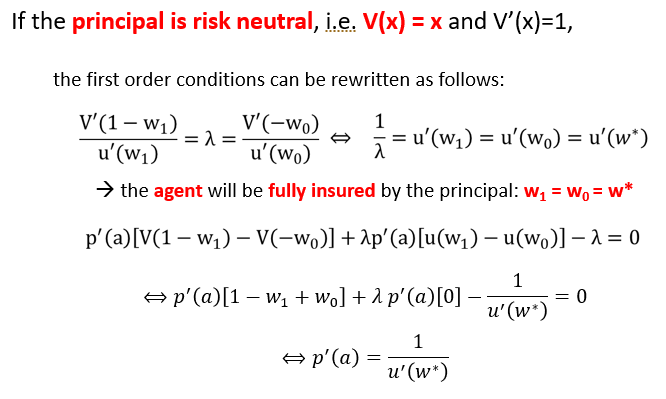

Observable actions - Risk neutral prinicpal

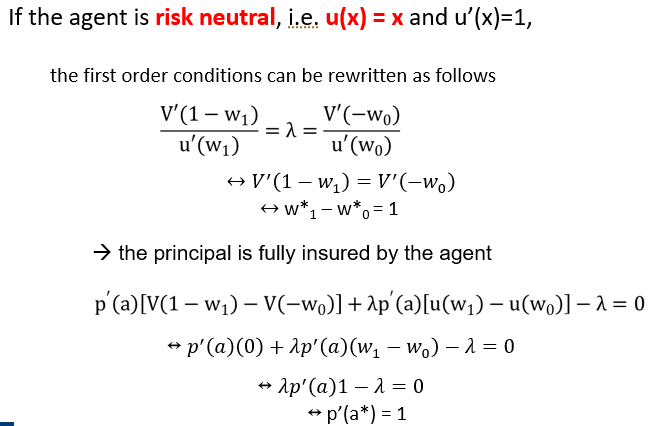

Observable actions - Risk neutral agent

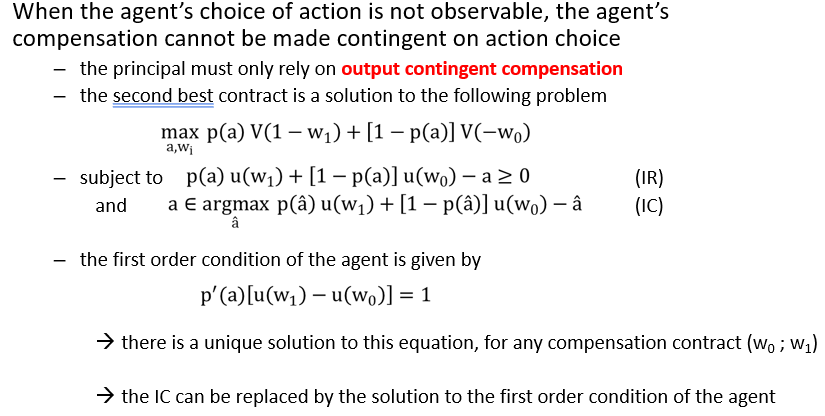

Unobservable Actions

Principal must rely solely on output-based compensation

=> introduces complications, as the agent’s actions cannot be directly tied to the rewards

Agent chooses their effort based on how they expect their actions to influence their compensation

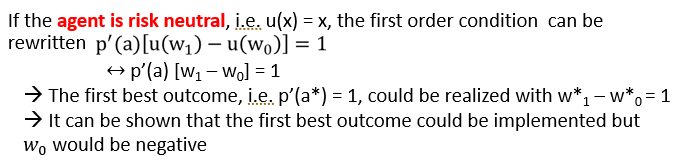

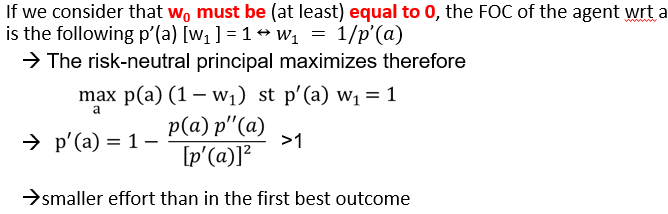

Unobservable Actions - Risk Neutral Agent

Compensation scheme can be adjusted to incentivize the agent to exert a specific effort level

Unobservable Actions - Risk Neutral Principal

They = indifferent to risks of output variability, leading to simpler contracts where agent = fully insured

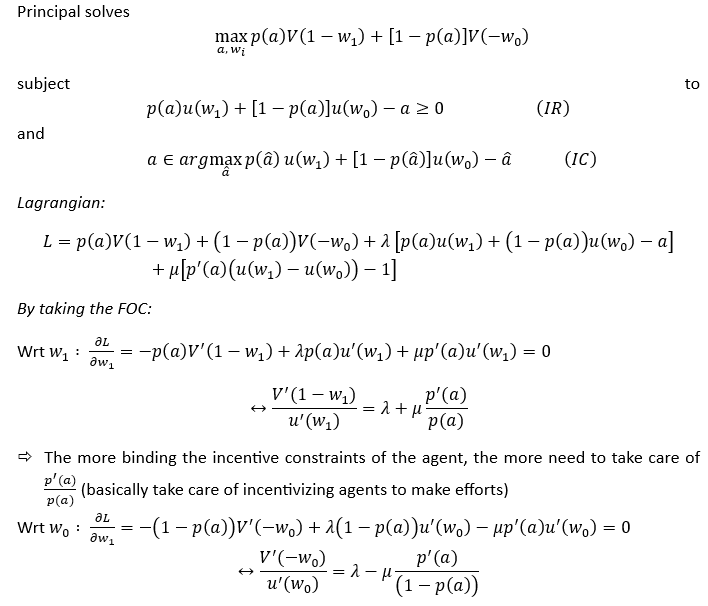

Unobservable Actions - Bilateral Risk Aversion

Both parties = risk-averse, designing optimal incentive contract = more complex

Principal must balance providing incentives with sharing risks, often leading to compensation structures that trade off between motivating effort & providing insurance to agent

Linear Contracts

Contract form: w = t + s ⋅ q

t: Fixed compensation (base salary).

s: Variable compensation (incentive).

q: Observed output or performance

Output equation: q = a + ϵ

a: Effort level chosen by the agent.

ϵ: Random shock, representing uncertainty in outcomes, with ϵ ∼ N(0,σ2)

Output = partly driven by the agent's effort (a) & partly by random factors (ϵ) that the agent cannot control.

Managerial Incentives

= designed to align interests of managers (like CEOs) with those of shareholders

Managerial Incentives - Shareholders vs. Managers

Shareholders (principal) want to :

Maximize the long-term value of the firm

Managers (agent) may have:

Personal goals like job security, minimizing effort, or maximizing their own short-term compensation

Since managers typically control day-to-day decisions, their interests may not always align with those of shareholders => Principal-Agent Problem

Managerial Incentives - Managerial remuneration package

Managerial compensation often includes 3 key components:

Fixed Salary ≠ vary with company's performance

Short-Term Incentives (Bonuses) = based on company's short-term performance

Long-Term Incentives (Stock Options) = incentivizing managers to increase the firm's value over time

Managerial Incentive - Theory vs. Practice

Theory:

Assume that firms offer managers "take-it-/-leave-it" compensation package

Practice:

Managerial Influence:

Managers often draws a compensation package & gets it approved

Rent Extraction:

When managers are able to secure higher compensation through their influence over pay-setting, it is described as rent extraction.

Managerial Incentives - Volatile Stock Prices impact on Compensation

Stock price =highly volatile, manager's compensation through stock options becomes more uncertain

To offset this risk, managers may demand a higher fixed salary or a larger share of profits as compensation for the increased risk

As a result, the proportion of their compensation tied directly to stock price movements might decrease.

Bertrand & Mullainathan (2001):

This study finds that CEO pay is often influenced by "luck," meaning that compensation can increase due to factors beyond the CEO's control (e.g., oil prices for oil companies)

This suggests that in firms with :

weaker governance = compensation may not be as tightly linked to performance

well-governed firms = pay-for-luck =lower, indicating that incentive schemes are more closely tied to actual performance

Gayle & Miller (2009)

This study examines how CEO compensation has evolved over time, noting that :

as firms have grown larger, the cost of aligning incentives between shareholders & managers has increased => leading to higher compensation.

Lazear (2000)

This paper looks at how changing compensation structures (from fixed salaries to performance pay) can significantly boost productivity

But it also highlights a downside:

workers may manipulate poorly designed performance metrics if they are rewarded based on them

Fehr & Falk (2002)

This study explores how financial incentives might crowd out intrinsic motivation, suggesting that :

too much emphasis on performance pay might lead to neglect of other valuable activities not directly tied to incentives